Last updated on January 28th, 2026 at 04:37 pm

The horror of having less time for the CFA level 1 exam, is understandable. Even if you have 2 months before the dreaded exam, I have some good news! Yes, it’s possible to be clear if you follow these simple principles that I will be suggesting. So let’s discuss, the CFA level 1 study plan in two months.

CFA level 1 study plan- Framework

At this stage, we must understand that we have very less time to use the traditional method of CFA level 1 exam preparation. Not Possible! Hence we have first to ascertain the effort which is required and then work our way towards execution from there. For this purpose, we must first understand, what is needed.

- 400 Hrs total reading

- 2000 questions practised

- One full-length CFA Mock

- Consistency

Yes! That will be our goal; the reason for 400 Hrs is because although CFA institute recommends 300 Hrs minimum time to master the content.

You can in fact check the June 2019 CFA exam survey to read this detailed report.

So first things first, if I were you, I would need to plan my professional and personal life for the next eight weeks. You need to talk to your superiors at work to get either some unpaid leaves or maybe to get some studying time at the office. Best case, they give you two months off; highly unlikely, though!

Content To Refer -Study Plan for CFA level 1

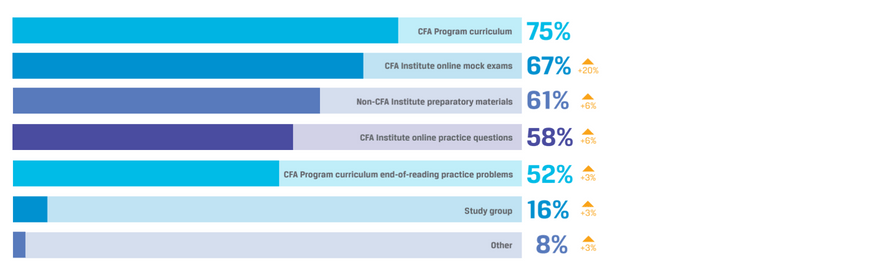

On a typical day, I always recommend people refer to the CFA curriculum, but this is not a normal day

Refer Kaplan Schewezer at any cost but nothing below Kaplan because the quality is not guranteed

Now since you might be thinking that, wait! Should I spend that much money on reference material?

Hence find some second-hand CFA level 1 book. Or find some people who can help you find alternatives.

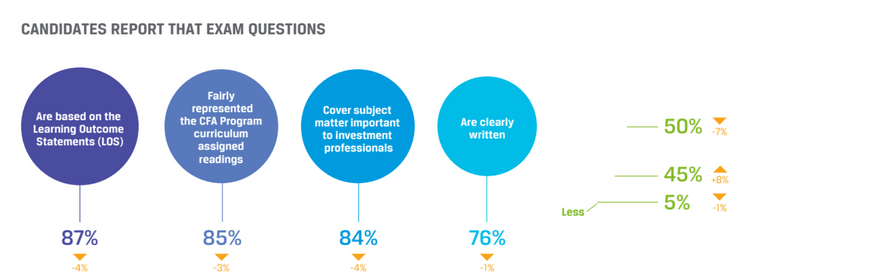

Now, looking at the data above I can clearly prove that students who do use the CFA curriculum have been successful. Now, let me also prove to you, the reason behind that with the following data.

So, the second point is that 85% of the candidates agree that the exam questions were fairly represented in the CFA program curriculum. Which by the way ensures that you are 85% confident of covering everything relevant for the exam.

Practice Strategy

We know now that we need to practice at least 2000 questions, excluding mocks. Practice will be your saviour in this difficult situation, so don’t shy away from practising, even if you might get horrible scores initially.

Why am i saying this?

Well, from experience, I can confidently say that.

Many would have spent the hours of preperation but only 50% of that lot would have practiced enough.

Hence practice is the place where we can beat anyone at this stage.

So How to practice?

The strategy is not to practice from any question bank but rather from mock papers themselves. There are tons of free practice mocks availble. So as you read the content, open the mock exams and solve questions.

The reason why we need at least 2 hrs per day for questions practice is to know the following.

How many minutes per question do we get in the exam day for cfa exam?

The answer is 1.5 minutes. Hence do the maths!

Focussing on Difficult Subjects

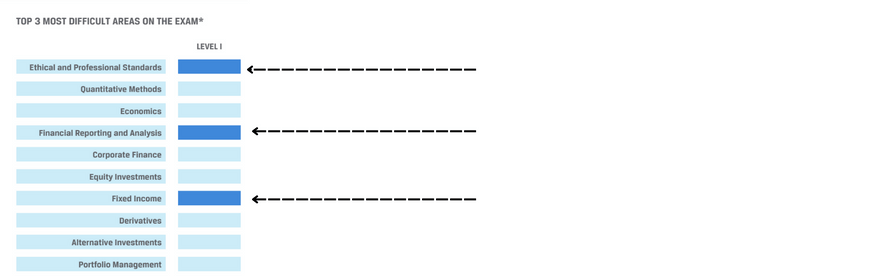

While getting the number of hours, referring to the current content and practising is good, but not without a clear strategy. Firstly, not all subjects are equally difficult, hence preparation requires you to keep these points in mind.

Let me explain this from two perspectives

- Firstly difficulty by Volume

- Secondly, difficulty in perspective.

- Finally difficult by boredom

Now, Financial statement analysis is difficult due to the volume itself. So, as you start reading FSA, you realise the subject almost takes two months of your preparation time. Next, fixed income is difficult just because most of us have never purchased a bond in our life. Hence fixed income becomes difficult because of perspective. Finally, ethics is just boring at the thought of studying it. Also, i can’t blame anyone for not liking ethics. Hence, no one actually prepares ethics from the start, rather keeping it as an adopted son in terms of priority.

So, if you want to keep your chances high, make sure you divide your time and also consider the difficulty of the subject based on your background.

Revision Strategy

You don’t have the luxury of reading through the entire content and revising.

Hence the revision strategy is

- Reading the LOS list and asking yourself- Do i know this?

If you don’t know, then you open the material and read.

- Practising 10 questions on subjects that are completed and analysing the following

Which LOS is weak? Identify it and fix it. That’s how the revision should take place till the end.

All that we are trying to do in this crash preperation, is do the same things we would have done in case of a usual preperation.

The difference is that we are doing all of it once.

CFA Study Planner Level 1 Sheet

My strong recommendation is to use this study planner, to calculate your basic planning and then keep tracking it as you go.

The best thing you could do at this juncture is to know where you stand against where you should by sticking to study schedule.

Best of luck and please reach us out for any assistance and guidance.

My Recommended Study Plan for CFA level 1

So my strong recommendation is to follow the below schedule for optimum preparation for the CFA level 1 exam

- First, Start with FRA and Quants at the same time

Now, the main reason is that these two subjects have the maximum foundation for other topic areas like fixed income and equity

- Night Time Novel: Ethics and Professional Standards

So, make this your bedtime reading material. However, make sure that it doesn’t mean that you just flip one page and doze off.

- After FRA- Start with Fixed Income & Corporate Finance

Corporate finance should be fairly easy to complete and is easy. Also, if you have completed quants already then corporate finance will be done faster

- Fixed Income> Equity> Alternative> PM >Economics

Once you have completed the FRA, Corporate finance, Ethics and Quant, then follow the above order of content preparation.

Economics, I have kept it at the end because personally, I find it extremely boring and can hamper my motivation to sustain the preparation. In fact, just for economics, I wouldn’t mind switching to Schweizer.

FAQ

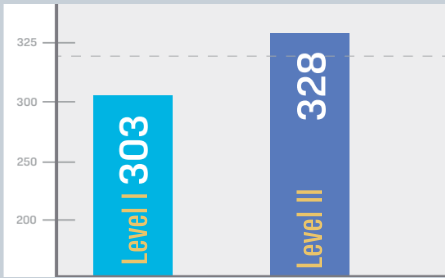

Which level is the toughest?

Level 2 is the toughest.

Is CFA level 3 easier than 1?

Yes compared to 1 CFA level 3 is easier. Level 3 is last one to crack and as candidates know the pattern etc about the exam. It is easier to crack CFA.

Is CFA level 2 tougher than level 1?

The concepts in level 2 are more complex to understand. Also the questions asked on the concepts that take time to understand and solve.