Last updated on August 8th, 2025 at 04:16 pm

Pursuing a professional certification can open up new job prospects, improve knowledge and abilities, and raise earning potential for financial professionals in India. The Certified Management Accountant (CMA) and the Chartered Financial Analyst (CFA) are two of the most prominent finance credentials. But which certification should you pursue? We’ll look at CMA vs CFA in this blog post to help you make an informed selection depending on your professional objectives and desires.

CMA vs CFA: Summarized Comparison

Understanding CMA

The Institute of Management Accountants (IMA) offers the CMA certification, which is intended to authenticate management accountants’ skills in planning, analysis, control, and decision-making. Candidates must have a bachelor’s degree from a recognised university and two years of relevant work experience to be eligible for the CMA certification in India.

Eligibility & Requirements

So, the eligibility just like any other professional qualification is simple:

- Graduate from accredited university or college in any discipline

- However, if you are from India, then your university marksheets will have to be sent for verification

- You need to first apply for membership with IMA before actually registering for the exam

Note: If you are pursuing graduation then CMA can be pursued under the CMA student scholarship that allows you to pursue CMA before you becoming a graduate.

Experience Requirements

You will have to show case 2 years of relevant experience in management accounting filed. Which can either be before you start preparing for CMA exams or post completion of CMA exams.

Revant Roles for example include designations like FP&A, Capital budgeting, Cost accounting etc.

Exam Structure

The CMA test is divided into two sections, each with 100 multiple-choice questions and two essay questions. Financial planning, performance, and control; cost management; internal controls; and ethics are all included in the test. Each section has a passing score of 360 out of 500.

- Part 1 Financial planning Performance and analytics

- Part 2: Strategic Financial Management

- Compliance and ethical standards is a common module and also you need to abide by all their principles

CMA certification provides Indian financial professionals with more credibility, job progression chances, and higher pay. CMA professionals can work in various fields such as healthcare, technology, industry, and government.

Career Opportunties

So, post completion of CMA, let me discuss the directly relevant roles you could be targeting in India & Middle East.

Career Opportunities & SalaryAfter CMA in India

| Career Role | Description | Industries | Salary Range |

|---|---|---|---|

| Financial Analyst | Analyze financial data and support decision-making processes. | Banking, IT, Manufacturing | ₹7-10 LPA |

| Cost Accountant | Evaluate cost structures and optimize resources. | Manufacturing, FMCG, Pharma | ₹6-9 LPA |

| Management Accountant | Focus on financial planning, budgeting, and strategy. | Corporate Finance, Real Estate | ₹8-12 LPA |

| Finance Manager | Oversee financial activities and ensure compliance. | IT Services, Telecom, Consulting | ₹10-15 LPA |

| Internal Auditor | Evaluate internal controls and compliance with regulations. | Banking, Insurance, E-commerce | ₹6-10 LPA |

| Business Consultant | Provide insights for business performance improvement. | Consulting Firms, Advisory Firms | ₹10-18 LPA |

| Risk Manager | Identify and mitigate financial risks for organizations. | Banking, Investment Firms, NBFCs | ₹9-14 LPA |

| Chief Financial Officer (CFO) | Lead financial strategy and planning at an executive level. | Multinationals, Conglomerates | ₹25-50 LPA |

| Budget Analyst | Prepare budgets and improve cost efficiency. | Government, Corporates | ₹6-9 LPA |

| Investment Analyst | Analyze investment opportunities and financial markets. | Investment Banking, Asset Management | ₹8-12 LPA |

Total Cost of Pursuing CMA

| Cost Component | Approximate Cost (USD) | Approximate Cost (INR) |

|---|---|---|

| IMA Membership Fee (Professional) | $135 annually | ₹11,205 annually |

| IMA Membership Fee (Student) | $45 annually | ₹3,735 annually |

| CMA Entrance Fee (Professional) | $280 one-time | ₹23,240 one-time |

| CMA Entrance Fee (Student) | $210 one-time | ₹17,430 one-time |

| Exam Fee (Per Part, Professional) | $460 | ₹38,180 |

| Exam Fee (Per Part, Student) | $345 | ₹28,635 |

| Study Materials (Optional) | $500–$1,500 | ₹41,500–₹1,24,500 |

Total Estimated Cost:

- Professional Candidates: ₹1,52,305 – ₹2,35,305

- Student Candidates: ₹1,19,635 – ₹2,03,635

Understanding CFA

The CFA Institute offers the CFA certification, which is meant to provide financial professionals with the knowledge as well as skills necessary to thrive in investment analysis, portfolio management, and wealth management. Candidates in India must have a bachelor’s degree from a recognised university or four years of relevant work experience to be eligible for the CFA certification.

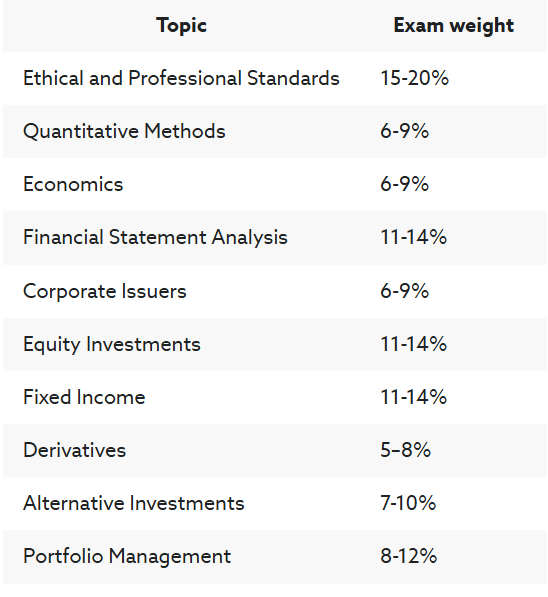

Each level of the CFA test covers topics like ethics, mathematical techniques, economics, financial reporting and analysis, corporate finance, portfolio management, and derivatives. The CFA test has a famously poor success rate, with just about 25% of students clearing all three levels.

Global recognition, specialized expertise, and access to a network of finance specialists are all advantages of CFA certification for Indian financial professionals. Moreover, CFAs can work in various fields, including investment banking, asset management, private equity, and hedge funds.

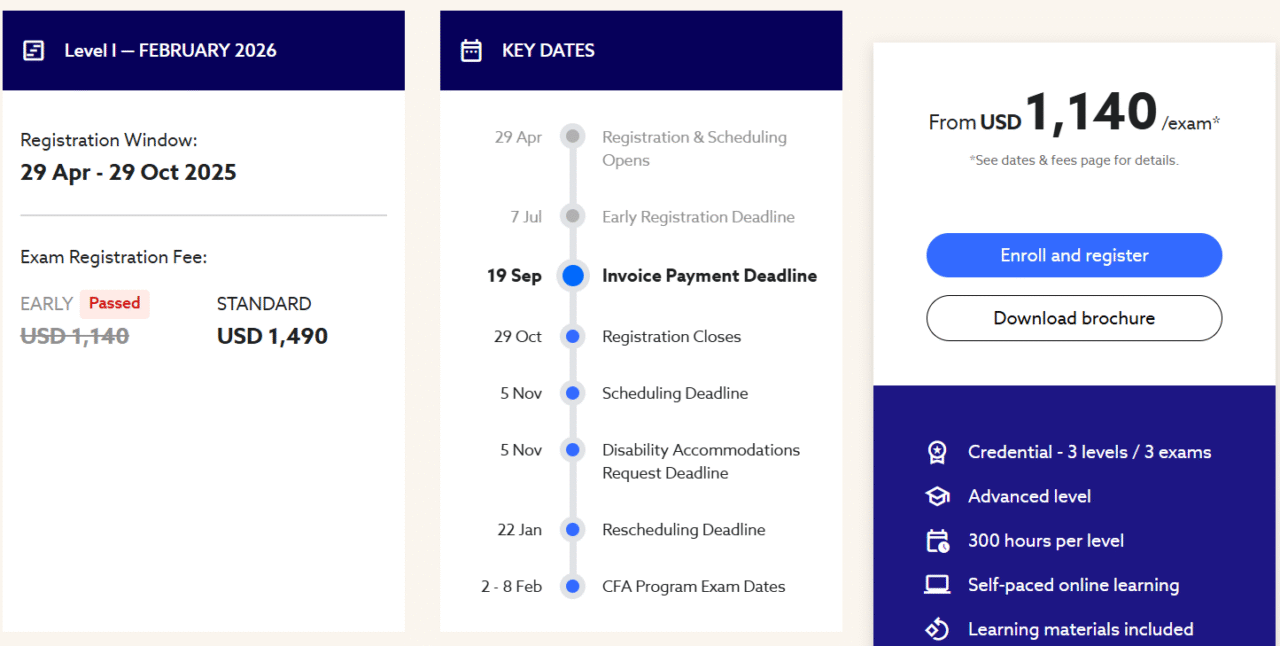

CFA Fees and Exam Date

CFA Curriculum

CMA Vs CFA: A Detailed Comparison

Now that we’ve reviewed the fundamentals of CMA vs CFA, let’s compare the two certificates in depth.

Exam Format, Content, And Difficulty Level

They divide the CMA exam into two sections, each containing 100 multiple-choice questions and two essay questions.

The CFA test divides into three levels, each with its format and material.

People generally consider the CFA test more challenging than the CMA exam because it covers a broader range of topics and has a lower passing rate.

Career Opportunities and Earning Potential

CMA professionals can work in various fields such as healthcare, technology, industry, and government.

The finance and investing industries commonly employ CFA professionals.

CMA professionals in India earn an average income of INR 8.5 lakhs per year, according to an IMA poll, whereas CFA professionals in India may earn up to INR 20 lakhs per year.

Time And Cost Required to Obtain Each Certification

The CMA (Certified Management Accountant) qualification normally takes a 6–12-month time commitment.

Obtaining the CFA (Chartered Financial Analyst) designation, on the other hand, is a far more difficult procedure. Candidates typically take 3-4 years to fulfil all of the criteria for this certification.

In general, the CMA certification is less expensive than the CFA certification. The cost of earning the CMA certification in India is roughly INR 50,000, which includes study materials, test costs, and membership fees.

In India, however, the cost of acquiring the CFA certification can reach INR 4 lakhs, which includes the cost of study materials, exam fees, and exam travel expenditures.

Relevance To Your Career Goals

It is critical to examine your professional aims and goals while deciding between the CMA and CFA certificates. The CMA certification may be more helpful if you are interested in management accounting and financial planning. The CFA certification, on the other hand, might be a better fit if you’re interested in investment analysis, portfolio management, and wealth management. Therefore, it is essential to understand the differences between CMA and CFA and choose the certification that aligns with your career aspirations.

Career Opportunities: CMA vs CFA

CMA and CFA certifications may both lead to a plethora of employment options in India for financial professionals.

CMA specialists can work in a variety of sectors as Financial Analysts, Cost Accountants, Internal Auditors, and Finance Managers.

CFA experts, on the other hand, can operate in the financial and investment industries as

- Investment Analysts,

- Portfolio Managers,

- Research Analysts,

- Risk Managers.

Exam Preparation Tips: CMA vs CFA

The CMA or CFA test might be difficult to prepare for. However, with the correct strategy, you can improve your chances of success. Here are some points to help you study for the exams:

- Make and stick to a study plan.

- Make use of study tools and resources such as books, study guides, online courses, and practice exams.

- Join a study group or locate a study partner to help you stay motivated and accountable.

- Use online forums and communities to interact with other test takers and benefit from their experiences.

- During the exam period, practice time management, exam strategy, and stress management.

CMA vs CFA: Success Stories from India

After earning the CMA or CFA certification, several Indian financial professionals have found significant success.

For example, CMA professional Jagan Mohan Reddy founded the YSR Congress Party. Additionally, he also served as the Chief Minister of Andhra Pradesh.

Navneet Munot, on the other hand, is the Chief Investment Officer of SBI Funds Management. People consider him one of India’s most significant finance experts.

Future Outlook in India: CMA vs CFA

The demand for experienced financial professionals with specialised expertise and qualifications is likely to rise as India’s finance industry continues to expand and evolve. In the next few years, certifications like CMA and CFA will continue to be relevant and significant. This will provide opportunities for career growth and professional development.

Conclusion: CMA Vs CFA

In conclusion, while looking at CMA vs CFA certifications, both are beneficial to financial and accounting professionals seeking to improve their knowledge, abilities, and credibility in their fields. People in management accounting and financial management jobs pursue the CMA certification, while those in investment analysis, portfolio management, and other fields of finance pursue the CFA certification.

While you can earn the CMA certification quickly and at a reasonable cost, the CFA certification needs more time and a larger expenditure. The CFA certification, on the other hand, is more well-known and regarded in the financial world. All in all, your professional goals, experience, and personal preferences will determine the certification you choose

It’s critical to think about the time and money it takes to get each certification, as well as the educational and professional experience requirements. Pursuing both certificates is also a possibility if your career objectives and resources allow it. Overall, both the CMA and CFA certifications may assist people in the financial and accounting industries in advancing their careers and achieving their professional goals.

ROI Calculator: CFA & CMA

FAQs on CMA vs CFA

Q: What is the difference between the CMA and CFA certifications?

The CMA (Certified Management Accountant) certification is intended for individuals in management accounting and financial management positions. The CFA (Chartered Financial Analyst) certification is intended for individuals working in investment analysis, portfolio management, and other finance-related fields.

Q: Which certification is more valuable?

Your professional objectives and the sector in which you work determine the worth of any qualification. Both certificates are useful for financial and accounting professionals, but the CFA is more well-known and regarded in the investment industry.

Q: How long does it take to obtain each certification?

The CMA certification normally takes 6-12 months to complete, but the CFA qualification often takes 3-4 years.

Q: How much does each certification cost?

Acquiring the CMA certification is often less expensive than earning the CFA certification. In India, for example, the CMA certification costs roughly INR 50,000. However, the CFA certification may cost up to INR 4 lakhs.

Q: Do I need to have specific education or work experience to obtain these certifications?

Yes, both certificates need particular education and professional experience. For example, applicants for the CMA must have a bachelor’s degree from an approved university, as well as at least two years of professional experience in management accounting or financial management. Candidates for the CFA must have a bachelor’s degree and at least four years of professional experience in the investment industry.

Q: Which certification is more difficult to obtain?

People often see the CFA certification as more difficult to obtain than the CMA certification because it requires a lengthier time commitment and covers a broader scope of topics.

Q: Can I pursue both certifications?

Yes, if you fulfil the qualifying requirements and have the time and money, you can seek both certificates. Depending on your professional goals and the area of work, you may not be required or practicable to earn both credentials.

Helpful Links

Here are some helpful government links related to finance and accounting certifications:

- Institute of Management Accountants (IMA) - This is the professional association for accountants and financial professionals in the business. They offer the CMA certification along with resources for professionals looking to enhance their skills in management accounting and financial management. Link: https://www.imanet.org/

- CFA Institute - This is the global association for investment professionals. They offer the CFA certification and provide resources for professionals looking to enhance their skills in investment analysis, portfolio management, and other areas of finance. Link: https://www.cfainstitute.org/

- National Association of State Boards of Accountancy (NASBA) - This is the organization that administers the Uniform CPA Exam and provides resources for CPA candidates and licensed CPAs. Link: https://www.nasba.org/

- Securities and Exchange Board of India (SEBI) - This is the regulatory body for the securities market in India. They provide information on the regulations and requirements for professionals working in the investment industry. Link: https://www.sebi.gov.in/

- Ministry of Corporate Affairs (MCA) - This is the regulatory body for companies in India. They provide information on the regulations and requirements for professionals working in corporate finance and accounting. Link: http://www.mca.gov.in/