Last updated on July 20th, 2024 at 03:48 pm

Often when you see the balance sheet of a company, you will notice a line item showing “Goodwill”. In this article we will discuss on how to calculate goodwill using Capitalisation of average profit method formula.

What is Capitalisation of average profit method formula?

The capitalization of average profit method formula is as follows;

Goodwill= Capitalised average profits – Actual Capital Employed

- Where capitalized average profits= Average profits X 100/ Normal rate of return.

- Also actual capital employed = Total Assets(Excluding goodwill)- Outside Liabilities

Capitalisation of Average Profit Method Formula- Example

Let’s try to understand this using an example;

Let’s say Steve and Sam are working as business partners and both in total have a credit amount of 200,000 in the company’s capital account. Also they have 20,000 each in their current account. The general normal return of business is 10% and the average profit is 100,000. Find the goodwill using the Capitalisation of average profit method formula?

Answer: So, now let me calculate this using the same formula given above.

Here the capitalized average profit= 100,000 x 100/10= 1 Million. Now, the total capital employed is 200,000+ 40000( Current account)= 240,000

Hence, the good will be= 1000000-240000= 760,000.

Understanding Goodwill: Super Profit and Weighted Average Profit

Goodwill valuation often involves different methods, including the calculation of super profit and weighted average profit. The goodwill super profit method assesses the excess of actual profits over normal profits. To use this method, you first need to calculate the super profit, which is determined by subtracting the normal profit from the actual profit. The normal profit itself is derived from the average profit, which is calculated by multiplying the average profit by the normal rate of return. This approach helps in understanding the premium value a business commands over its net assets.

On the other hand, the goodwill weighted average profit method considers the varying profitability of a business over time. Instead of using a simple average, this method gives more weight to higher profits and less weight to lower ones, providing a more nuanced view of the company’s value. The formula for calculating goodwill in this case is the weighted average profit multiplied by the number of years of purchase. This method can be particularly useful for businesses with fluctuating profit levels.

Other Methods for Valuation of Good will

So, there can be many types of methods of calculating good will. So, let me just enumerate the various methods that can be used briefly

- First is the average profits method

- Simple Average: In this method the total good will is just basically calculated using average profits x number of years of purchase

- Weighted Average: Compared to that, in case of this method more weightage is given to higher profits and lower weightage to lower profits. So the formula becomes= Weighted average profit x Number of years of purchase

- Second Super Profits Method

The super profit method of valuation of good will covers the excess over normal profits. The formula for which is Super profit x no of years of purchase. Also in this formula ( super profit= average/Actual profit – Normal profit). And normal profit =(capital employed x Normal rate of return/100).

Disadvantages of Capitalisation of average profit method formula

Now, every method obviously have some shortcomings because any formula carries certain assumptions with it.

- The capitalization of average profits method formula assumes the calculation of average profits which can either be an underestimation for a growing business and over estimation for a mature company

- Another big disadvantage of problem with the formula is that the formula needs the assumption of normal rate of return. Which again requires an assumption. A normal rate of return might fluctuate basis the business conditions. For example post covid era the normal rate of return fluctuated between the year 2019 and 2023.

- Also the formula has one more issue that it does not capture intangible issues of business’s like management quality, the quality of products etc.

FAQ’s

What is meant by the valuation of the good will?

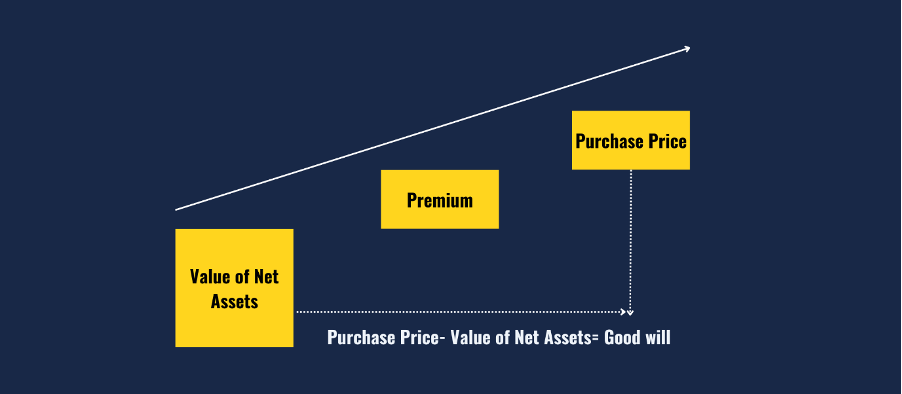

Goodwill is an intangible assets that is created when a company gets purchased over its net assets. The premium is nothing but good will. Hence its basically created during the acquisition of a company.

What are the approaches to calculate good will?

Ther are multiple approaches to goodwill calculation and there are certain controversies related to it because it requires you to take certain assumptions.

What is the Impairment of good will?

Good will impairment basically happens when the the acquired company, for which the excess prices given falls in value. Which leads to goodwill impairment. Which results in the decrease of good will in the balance sheet and an impairment loss is recognized in the income statement.

What are the limitations of good will?

Since it should be clear to you that good will just an accounting treatment of the excess purchase price. Hence if the company is acquired for less than its net fair value of assets then the good will will turn negative.