Last updated on October 23rd, 2024 at 04:55 pm

Introduction

The one thing that attracts interest among researchers is the separation between management and ownership. As the board of directors is the key element of corporate governance, it is clear that its composition must be responsive to the basic functions. Some of them would be supervising, monitoring, avoiding opportunistic behaviour on the part of executives, and providing advice to decision-makers to improve the management of the business. Let us look deeper into this.

What are the Board of Directors?

A Board of Directors is a committee that supervises the activities of an organization or entity, which can be either a profit or non-profit organisation such as a business, NGO, or government agency [1]. The board meets at regular intervals to set corporate management and oversight various policies. Every public company must have a board of directors. The board is responsible for protecting shareholders’ interests, establishing policies for management, oversight of the corporation or organization, and making decisions about important issues a company or organization faces.

The function of the Board of Directors

Boards guide the success or failure of accompany by steering the overall corporate direction, setting policies, choosing executives, and ensuring the major decision that is essential, ethical, and prudent. The board also has other responsibilities like [2]:

- Creating dividend policies

- Creating options policies

- The hiring of the senior executives (especially the CEO)

- Establishing compensation for executives

- Supporting executives and their teams

- Maintaining company resources

- Setting general goals for the company

- Making sure that the company is equipped with all the well-managed resources for its smooth functioning

The board of directors should represent both the management and shareholders interests and they must include external and internal members. The insider member has the knowledge of significant shareholders, officers, and employees whose experience within the company adds value. The insider member is usually a C-level executive, major shareholder such as a union representative.

Outside directors are not involved in the day-to-day workings of the company. These board members are reimbursed and usually receive additional pay for attending meetings. An outside director brings an objective, independent view to goal setting, and settling any company disputes.

Basic Structure of Board of Directors

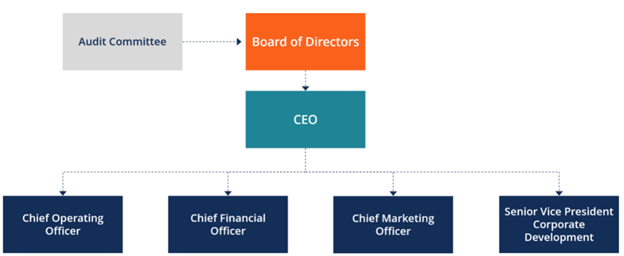

The responsibilities, structure and powers are determined by the bylaws of the company. The bylaws generally determine how many board members there are, how the members are elected, and how frequently the board members meet. There’s not a set number or structuring for a board of directors; it depends largely on the company or organization, the industry in which the company or organization operates, and the shareholders. The following image shows the basic structure of the Board of Directors [2]:

Let us look at some designations and positions common to a Board of Directors in public corporations [3].

- Chief Executive Officer:

- A CEO, which stands for Chief Executive Officer (CEO), is the highest-ranking individual in a company or organization. The CEO is responsible for the overall success of a business entity or other organization and for making top-level managerial decisions.

- Chairman:

- A chairman leads the board and thus heads the committee and board meetings. The Board of directors votes and elects the chairperson. Usually, the company’s chief executive officer is the chairman.

- Chief Operating Officer:

- The Chief Operating Officer (COO) is a senior executive who oversees the day-to-day administrative and operational functions of a business. The COO typically reports directly to the CEO and is considered to be second in the chain of command.

- Chief Financial Officer:

- The Chief Financial Officer (CFO) is an officer whose main responsibility is to look over and manage the finances of the company including financial planning, managing financial risks, record-keeping, and financial reporting.

- Chief Marketing Officer:

- A chief marketing officer is a corporate executive who is tasked with overseeing the marketing activities of an organization. The main function of a chief marketing officer is to help the company increase its revenues by creating a marketing plan that gives the company a competitive advantage.

Non- Executive Director:

- A non-executive director doesn’t belong to the organization but is a part of the board. External directors present an objective and third-person perspective. They give voice to stakeholders outside a firm.

Conclusion

Boards legally fulfil the requirements of incorporation, thus helping companies maintain corporate status. They also provide support and guidance to management while providing shareholders with a voice in the company’s major decisions. Like any group of people, however, boards can work harmoniously or with great tension. Some do not provide the expertise required of them and act merely as a prop to uphold the corporate charter. Boards may also be too micromanaging, making it impossible for the CEOs to lead effectively.