Last updated on February 17th, 2026 at 04:10 pm

An AML KYC certification is a professional credential that validates an individual’s practical understanding of Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These certifications confirm that a candidate can identify financial crime risks, perform customer due diligence, monitor transactions, and comply with regulatory requirements.

Having basic AML knowledge is useful, but certified AML skills carry more value. Certification proves that the candidate has been trained using structured frameworks, real-world scenarios, and regulatory guidelines, making them job-ready rather than just theoretically aware.

What is AML KYC?

Remember, the time when opening a bank account was tedious with address verification done manually. And only then you would be even be eligible for opening a bank account. While the world has changed and with the increase in digital transactions, opening a bank account and transacting itself has become very easy.

Which poses the next question? How would you verify and validate people while the volume is so high. That’s where of course in India, AADHAR(UIDAI), has simplified things in at least completing the know your customer process. However, the challenge still remains in making sure that none of these transaction done even by identified individuals falls under the suspicious categories of transactions. Which also will easily explain the AML KYC certification course.

Why AML KYC Certifications Matter in India

AML KYC certifications have become increasingly important in India due to the rise in financial crimes, digital frauds, and stricter regulatory compliance requirements. As banking, fintech, insurance, and digital payment platforms grow rapidly, organizations are investing heavily in strong AML and KYC teams to prevent money laundering and financial misconduct. This has led to consistent hiring demand for AML/KYC professionals across India.

Certifications play a key role in AML/KYC careers because they validate practical knowledge of regulations, transaction monitoring, risk assessment, and compliance processes. Employers prefer certified candidates as they require less training and are better prepared for real-world compliance roles.

AML KYC certification is suitable for students and freshers seeking entry into finance, as well as working professionals looking to upskill or transition into compliance, risk, and financial crime prevention roles.

AML KYC Process & Framework

So, Ill divide this discussion across two parts, one is AML Framework & the next would KYC Framework.So, that you clearly understand if AML KYC certification makes sense or not, or do you need a larger product knowledge to enter this field.

AML Framework

AML (Anti-Money Laundering) and KYC (Know Your Customer) are crucial regulatory frameworks designed to prevent financial crimes, ensure customer identity verification, and maintain the integrity of financial systems. Here’s a brief overview of their frameworks:

AML (Anti-Money Laundering):

- Objective: Prevent the illegal conversion of “dirty” money (obtained through criminal activities) into “clean” money (appearing legitimate).

- Key Focus Areas:

- Identification of Suspicious Activities: Monitoring and detecting transactions that could be indicative of money laundering.

- Customer Due Diligence (CDD): Thoroughly verifying the identities of customers to ensure their legitimacy.

- Risk Assessment: Evaluating the potential risk of money laundering associated with different customers and transactions.

- Reporting: Obligation to report suspicious transactions to relevant authorities.

- Record Keeping: Maintaining records of customer information, transactions, and due diligence efforts.

- Regulatory Bodies: Financial institutions are required to follow AML regulations set by government agencies and international organizations like the Financial Action Task Force (FATF).

KYC Framework

So, following are the kind of activities that are performed in the KYC activity.

- Objective: Verify the identity of customers to prevent fraud, money laundering, and other financial crimes.

- Key Components:

- Customer Identification: Collecting reliable and authentic identification documents to confirm the customer’s identity.

- Customer Verification: Employing verification methods like in-person verification, document cross-checking, and biometric authentication.

- Risk Profiling: Categorizing customers based on their risk levels to determine the extent of due diligence required.

- Ongoing Monitoring: Continuously monitoring customer activities to detect any unusual or suspicious behavior.

- Importance: Helps establish the legitimacy of customers and aids in maintaining the integrity of financial transactions.

- Application: Applicable across various industries, including banking, fintech, cryptocurrency, and more.

How We Ranked These Top 10 AML KYC Certifications

To ensure this list is accurate, unbiased, and useful for career decisions, we ranked the Top 10 AML KYC certifications in India using multiple industry-relevant criteria.

First, we evaluated recognition by regulators and industry, including acceptance by banks, NBFCs, fintech companies, and compliance teams. Certifications aligned with Indian regulatory expectations (RBI, FIU-IND, PMLA) were given higher priority for India relevance.

We also assessed global acceptance, as many professionals aim for international AML roles. Certifications with recognition in global banks and consulting firms ranked higher.

Another key factor was career value and job outcomes, including employability, salary impact, and role suitability. Difficulty level and eligibility were considered to ensure the list is helpful for both freshers and experienced professionals. Finally, we compared cost vs return on investment (ROI), focusing on certifications that deliver strong career benefits relative to time and fees.

This methodology ensures the rankings reflect real hiring trends and career outcomes, not just popularity.

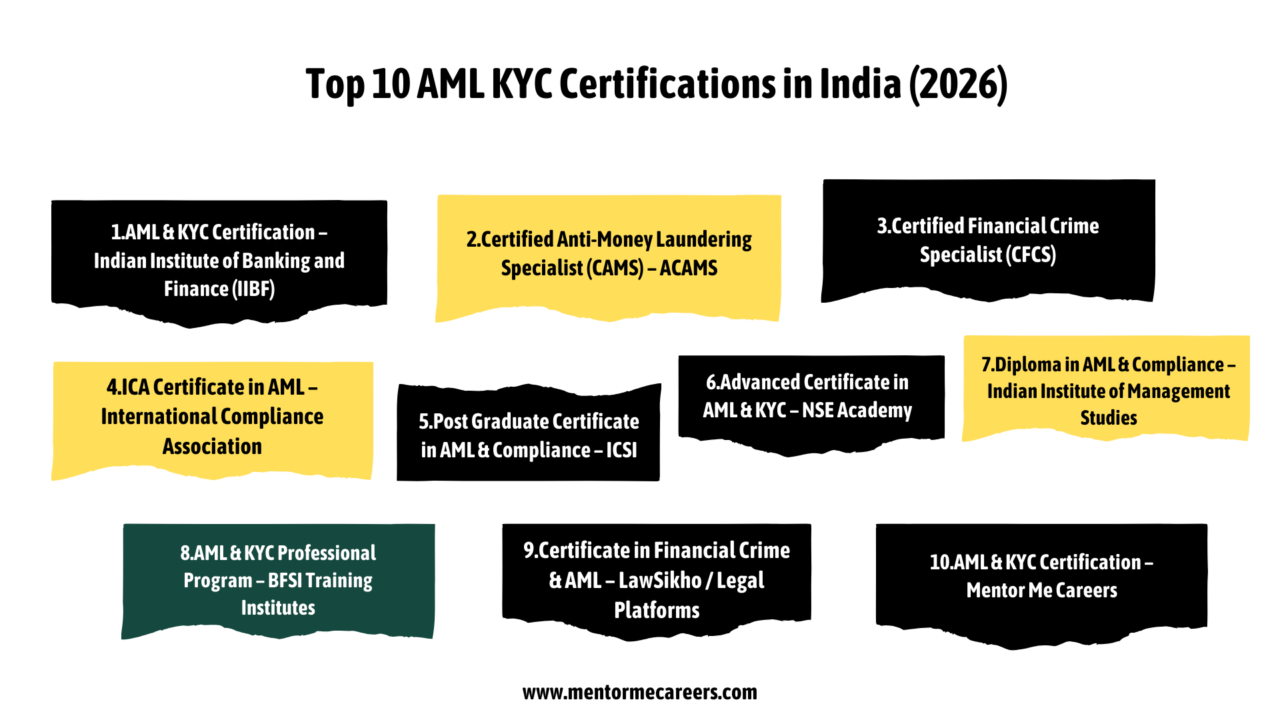

Top 10 AML KYC Certifications in India

1.AML & KYC Certification – Indian Institute of Banking and Finance (IIBF)

Issuing Organization: Indian Institute of Banking and Finance

Level: Beginner

Who Should Take It: Students, freshers, entry-level professionals

Key Topics Covered: AML laws, KYC norms, PMLA, CTR/STR reporting

Mode: Online (exam-based)

Duration: 2–4 weeks

Career Value in India: Very high (preferred by Indian banks & NBFCs)

Best For: Freshers entering AML/KYC roles

2.Certified Anti-Money Laundering Specialist (CAMS) – ACAMS

Issuing Organization: ACAMS

Level: Advanced

Who Should Take It: Working professionals, senior analysts

Key Topics Covered: Global AML standards, FATF, investigations, sanctions

Mode: Online

Duration: 2–3 months

Career Value in India: High (global MNCs, consulting firms)

Best For: Experienced professionals aiming for global roles

3.Certified Financial Crime Specialist (CFCS)

Issuing Organization: ACFCS

Level: Intermediate to Advanced

Who Should Take It: AML, fraud, and compliance professionals

Key Topics Covered: AML, fraud, cybercrime, investigations

Mode: Online

Duration: 1–2 months

Career Value in India: High (banks, fintech, consulting)

Best For: Working professionals

4.ICA Certificate in AML – International Compliance Association

Issuing Organization: International Compliance Association (ICA)

Level: Intermediate ICA certification

Who Should Take It: Compliance and risk professionals

Key Topics Covered: AML framework, risk-based approach, governance

Mode: Online / Classroom

Duration: 3–6 months

Career Value in India: High (MNC banks, global compliance roles)

Best For: Professionals seeking international exposure

5.Post Graduate Certificate in AML & Compliance – ICSI

Issuing Organization: Institute of Company Secretaries of India

Level: Intermediate

Who Should Take It: Law, finance, CS students

Key Topics Covered: AML, corporate compliance, regulatory laws

Mode: Online / Hybrid

Duration: 6 months

Career Value in India: Moderate to High

Best For: Law and compliance-oriented candidates

6.Advanced Certificate in AML & KYC – NSE Academy

Issuing Organization: NSE Academy

Level: Beginner to Intermediate

Who Should Take It: Freshers and finance students

Key Topics Covered: AML basics, KYC, transaction monitoring

Mode: Online

Duration: 1–3 months

Career Value in India: Good (capital markets & BFSI)

Best For: Freshers

7.Diploma in AML & Compliance – Indian Institute of Management Studies

Issuing Organization: IIMS

Level: Intermediate

Who Should Take It: Finance and banking aspirants

Key Topics Covered: AML, compliance operations, audit readiness

Mode: Online

Duration: 3–6 months

Career Value in India: Moderate

Best For: Career switchers

8.AML & KYC Professional Program – BFSI Training Institutes

Issuing Organization: Private BFSI institutes

Level: Beginner

Who Should Take It: Students and non-finance graduates

Key Topics Covered: KYC process, AML operations, documentation

Mode: Online / Classroom

Duration: 1–2 months

Career Value in India: Entry-level focused

Best For: Freshers

9.Certificate in Financial Crime & AML – LawSikho / Legal Platforms

Issuing Organization: Legal & compliance training platforms

Level: Intermediate

Who Should Take It: Law graduates, compliance officers

Key Topics Covered: AML laws, investigations, enforcement

Mode: Online

Duration: 2–3 months

Career Value in India: Niche but valuable

Best For: Law & regulatory roles

10.AML & KYC Certification – Mentor Me Careers

Issuing Organization: Mentor Me Careers

Level: Beginner to Intermediate

Who Should Take It: Students, freshers, career switchers

Key Topics Covered: AML, KYC, transaction monitoring, case studies

Mode: Online (mentor-led)

Duration: ~1.5 months

Career Value in India: High (job-oriented & practical)

Best For: Freshers & early professionals seeking placement support

AML KYC Certifications Accepted by Banks & Regulators in India

In India, AML KYC certifications are valued most when they are aligned with regulatory expectations set by authorities such as the Reserve Bank of India (RBI) and the Financial Intelligence Unit – India (FIU-IND). These regulators mandate strict KYC, transaction monitoring, and suspicious transaction reporting norms for banks, NBFCs, fintechs, and insurance companies. Certifications that cover PMLA provisions, RBI KYC Master Directions, CTR/STR reporting, and risk-based compliance frameworks are therefore highly preferred.

Regulatory relevance is important because employers want candidates who can apply rules correctly from day one, reducing compliance risk and training costs. Indian banks and financial institutions commonly prefer certifications such as IIBF AML/KYC, along with globally recognized programs like CAMS and ICA certifications for senior or international-facing roles. Choosing a regulator-aligned certification improves credibility, shortlisting chances, and long-term career stability in India’s compliance-driven financial sector.

Career Opportunities After AML KYC Certification

Completing an AML KYC certification opens doors to a wide range of compliance and financial crime prevention roles across banking, fintech, insurance, and consulting sectors. One of the most common roles is AML Analyst, where professionals monitor transactions, investigate alerts, and file suspicious transaction reports. Another popular entry role is KYC Analyst, focused on customer onboarding, identity verification, and due diligence.

With experience, professionals can move into Transaction Monitoring Analyst roles, handling complex transaction patterns and escalations. Compliance Officer positions involve overseeing regulatory adherence, audits, and internal controls, while Risk Analyst roles focus on identifying and mitigating financial and operational risks. These roles are in consistent demand due to increasing regulatory scrutiny and digital financial activity. An AML KYC certification significantly improves employability by validating practical compliance skills required for these positions.

How to Choose the Right AML KYC Certification for You

Choosing the right AML KYC certification depends on your background, experience level, and career goals. Candidates from a finance, commerce, or law background may adapt quickly to advanced certifications, while those from non-finance backgrounds should start with beginner-level, India-focused programs that explain concepts clearly from the ground up.

Experience also matters. Students and freshers benefit most from entry-level certifications that build foundational AML and KYC knowledge and improve job readiness. Working professionals should look for intermediate or advanced certifications that deepen expertise and offer global recognition. Career goals are equally important if you aim for banking or NBFC roles in India, regulator-aligned certifications work best, while fintech, consulting, or global roles benefit from internationally recognized credentials like CAMS or ICA. Selecting a certification aligned with your profile ensures better ROI and faster career growth.

Common Mistakes to Avoid While Choosing AML KYC Certifications

One of the most common mistakes is choosing unrecognized or low-credibility courses that lack industry or regulatory acceptance. Such certifications may add little value to resumes and can limit job opportunities. Another frequent error is ignoring practical exposure. AML roles are application-driven, and certifications without case studies, transaction analysis, or reporting practice fail to prepare candidates for real-world work.

Many learners also make the mistake of focusing only on certificates rather than skills. Employers prioritize candidates who can analyze alerts, understand regulations, and write clear reports, not just those with certificates. Avoid selecting programs based solely on low cost or quick completion. Instead, choose certifications that combine regulatory relevance, practical training, and career support. Making informed choices helps ensure that your AML KYC certification genuinely strengthens your career prospects rather than becoming just another credential.

Final Conclusion: Which AML KYC Certification Is Best in 2026?

There is no single AML KYC certification that is best for everyone in 2026 the right choice depends on your career stage, background, and goals. For students and freshers in India, beginner-friendly and regulator-aligned certifications such as IIBF AML/KYC or job-oriented programs with practical exposure are ideal for building a strong foundation. Working professionals looking to grow in compliance or move into senior roles should consider globally recognized certifications like CAMS or ICA, which offer higher career mobility and international acceptance.

The most effective AML KYC certification is one that combines regulatory relevance, practical skills, and clear career outcomes, not just a certificate.

If you’re unsure which certification fits your profile, get expert guidance before enrolling. Choosing the right path early can save time and significantly boost your career growth.

Enquire now, get personalized guidance, or talk to an AML expert to start your compliance career with confidence in mentor me careers.

FAQ

There is no single “best” certification for everyone. IIBF AML/KYC is widely preferred for beginners in India, while CAMS (ACAMS) is best for global and senior AML roles.

No, AML KYC certification is not mandatory, but it is highly preferred. Certification significantly improves shortlisting chances, especially for freshers and career switchers.

Yes. Freshers can easily pursue AML KYC certification, even without prior finance or banking experience. Many entry-level AML roles are open to certified freshers.

Some AML certifications are globally recognized, such as CAMS. Others, like IIBF AML/KYC, are primarily recognized in India but are valuable for domestic roles.

Most AML certifications take 2–8 weeks to complete, depending on the course level, learning format, and exam schedule.