Last updated on November 13th, 2025 at 03:24 pm

Choosing between ACCA (Association of Chartered Certified Accountants) and an MBA (Master of Business Administration) is one of the most debated topics among commerce and business students.

Both are prestigious global qualifications but they serve different career goals..If you are confused with ACCA Vs MBA, then chances are that ACCA came into your purview of confusion, from hearsay. However, at the same time, MBA can’t be a clear choice either, because even that has lot of confusion in itself.

Let’s explore the meaning, scope, salary, and key differences to help you make the right choice.

What is ACCA?

ACCA (Association of Chartered Certified Accountants) is a globally recognized professional accounting qualification based in the United Kingdom.

It focuses on accounting, auditing, taxation, and financial management, preparing students to become Chartered Certified Accountants who can work anywhere in the world.

One of the biggest advantages of ACCA is its exemption system, which allows students to skip certain exam papers based on prior qualifications.

B.Com, BBA, and M.Com graduates typically receive up to 4–5 exemptions, while MBA Finance students may receive up to 9 exemptions, depending on their university.

CA Inter and CA-qualified candidates can get 6–9 exemptions, significantly reducing the number of papers they need to attempt.

These exemptions save time, effort, and cost, allowing students to fast-track the ACCA qualification.

The exact exemptions can be checked through the official ACCA Exemption Calculator, based on your degree and institution.

Key Highlights:

Duration: 2 to 3 years (depending on exemptions & pace).

Structure: 13 papers divided into Applied Knowledge, Applied Skills, and Strategic Professional levels.

Eligibility: 10+2 (Commerce background preferred); Graduates can get paper exemptions.

Governing Body: Association of Chartered Certified Accountants, UK.

Core Focus: Financial Accounting, Reporting, Audit, and Ethics.

Career Roles After ACCA:

1.Financial Analyst

2.Audit Manager

3.Forensic Accountant

4.Tax Consultant

5.Financial Controller

6.CFO (Chief Financial Officer)

Global Presence:

Recognized in 180+ countries, especially in the UK, UAE, Singapore, Canada, Australia, and India.

What is MBA?

MBA (Master of Business Administration) is a postgraduate degree that provides in-depth knowledge of business management, strategy, leadership, and decision-making.

It’s designed for those aiming for managerial, leadership, and entrepreneurial positions.

Key Highlights:

Duration: 1–2 years (Full-time, Online, or Executive MBA).

Specializations: Marketing, Finance, HR, Business Analytics, Operations, International Business, etc.

Eligibility: Bachelor’s degree (any stream) + entrance exams (CAT, GMAT, GRE, NMAT, etc.).

Core Focus: Management, leadership, strategic thinking, and business operations.

Career Roles After MBA:

1.Marketing Manager

2.Business Development Head

3.Product Manager

4.Investment Banker

5.Strategy Consultant

6.Operations Director

7.Entrepreneur

Global Presence:

Highly recognized across USA, UK, Canada, India, Singapore, and Europe with strong industry connections and alumni networks.

ACCA Vs MBA: By the Numbers

If talk purely, on numbers then ACCA candidates in India approximately every year is around 15000, compared to on average 4 Lac students enrolling for MBA programs in India. However, MBA is a degree course which also includes sub standard Tier 2 and Tier 3 colleges.

The increase in numbers of MBA, is for two reasons;

- Existing colleges have been receiving permission to increase their intake

- Also, the introduction of online MBA Programs may have also contributed for the same.

Top 10 MBA College Seats: The Real Legitimate MBA Candidates

Most of the MBA colleges in India, don’t serve their purpose because there is no restriction on any one to start an MBA college itself. However, if we talk about credible MBA colleges, from where students actually get placed then below is the number;

Total Seats in IIM’s is 5000, even if I consider other good colleges then the number would come to around 1896. Which means approximately, around 8000 useful seats in MBA.

| Criteria | ACCA | MBA |

|---|---|---|

| Full Form | Association of Chartered Certified Accountants | Master of Business Administration |

| Type | Professional Certification | Academic Degree |

| Duration | 2–3 years | 1–2 years |

| Focus Area | Accounting, Finance, Audit, IFRS | Business Strategy, Management, Leadership |

| Eligibility | 10+2 (Commerce) or Graduate | Bachelor’s Degree (Any Stream) |

| Recognition | Global (180+ countries) | Global (depends on B-school reputation) |

| Exam Pattern | 13 papers with global computer-based exams | Semester/Trimester exams + Projects + Internships |

| Career Path | Accounting, Audit, Tax, FP&A, Reporting | Marketing, HR, Strategy, Analytics, Operations, Consulting |

| Skills Gained | Technical, Analytical, IFRS, Reporting | Managerial, Leadership, Strategic Thinking, Communication |

| Average Salary (India) | ₹6 – ₹12 LPA | ₹8 – ₹25 LPA (varies by institute) |

| Career Level | Specialized Finance Professional | Broad Business Leadership Roles |

| Ideal For | Students focused on Finance/Accounting careers | Students aiming for Management/Entrepreneurship |

ACCA vs MBA salaries

Salaries depend on experience, geography, and organization type. Here’s an overview of what ACCA and MBA professionals earn:

| Role | ACCA Salary (Annual) | MBA Salary (Annual) |

| Entry-Level | ₹5 – ₹7 LPA | ₹6 – ₹12 LPA |

| Mid-Level | ₹10 – ₹15 LPA | ₹15 – ₹25 LPA |

| Senior-Level | ₹20 – ₹40 LPA+ | ₹30 – ₹70 LPA+ (Top B-schools) |

| Country | Average ACCA Salary | Average MBA Salary |

| UK | £40,000 – £70,000 | £50,000 – £90,000 |

| UAE | AED 120,000 – 250,000 | AED 180,000 – 350,000 |

| USA | $60,000 – $110,000 | $90,000 – $150,000 |

| Canada | CAD 60,000 – 100,000 | CAD 80,000 – 140,000 |

| India | ₹6 – ₹12 LPA | ₹8 – ₹25 LPA |

ACCA Actual Pass rate

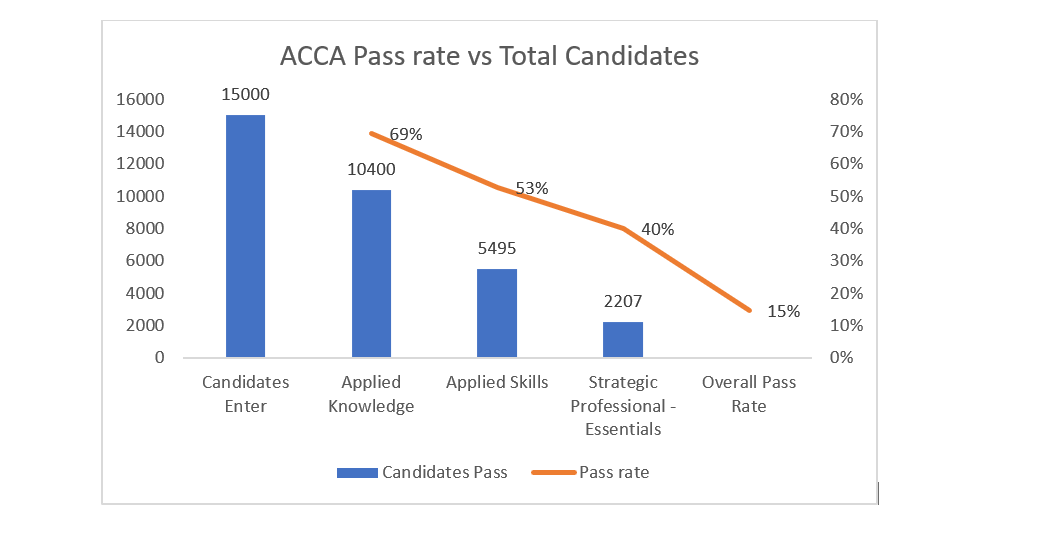

So if we actually compare numbers then looks like ACCA is more popular with 15000 candidates. However, we don’t want to jump into the conclusion so easily. That too, because not all 15000 candidates entered ACCA with the guarantee of finishing. Let’s take some data from the ACCA pass results data itself; So considering this data, the ACCA vs MBA question should not be confused because even the pass rate of ACCA is not low.

| Level | Candidates Pass | Pass rate |

| Candidates Enter | 15000 | |

| Applied Knowledge | 10400 | 69% |

| Applied Skills | 5495 | 53% |

| Strategic Professional – Essentials | 2207 | 40% |

| Overall Pass Rate | 15% |

Data source: ACCA Pass data

So effectively, now it means that 2207 ACCA candidates versus around 8000 MBA candidates who actually end up using the qualification. The only reason why even this comparison of ACCA vs MBA is posted is because, ACCA is projected to be an easier solution which it is not.

Global Scope of ACCA

1.ACCA is accepted in 180+ countries, especially across Europe, Middle East, and Asia-Pacific.

2.You can work with Big 4 firms, multinational corporations, or even become a finance consultant or CFO.

3.Preferred in countries like the UK, Singapore, Dubai, and Canada, where chartered qualifications are highly valued.

4.Ideal for those wanting a career in finance, accounting, audit, or taxation with international mobility.

Global Scope of MBA

1.MBA graduates enjoy multi-industry flexibility, from banking and consulting to tech, FMCG, and entrepreneurship.2.Top global B-schools (Harvard, INSEAD, London Business School, IIMs) create strong networking and leadership opportunities.

3.Offers better roles in strategy, marketing, and operations globally.

4.Best for professionals aiming for executive-level roles or business ownership.

ACCA vs MBA – Skills comparison

ACCA – Skills You Gain

Technical Skills (Primary Focus)

- IFRS & global accounting standards

- Financial reporting & audit

- Taxation (international + local)

- Advanced Excel for finance

- Financial analysis & interpretation

- Risk assessment and compliance

Analytical Skills

- Ratio analysis

- Variance analysis

- Cash flow evaluation

- Interpretation of financial statements

- Decision-making using financial data

Financial Modelling (Essential)

- Building 3-statement models

- Forecasting revenue, cost & cash flows

- Valuation models: DCF, Comps, Sensitivity

MBA – Skills You Gain

Managerial Skills (Primary Focus)

- Business strategy & planning

- Marketing, operations, HR management

- Project management & organizational behavior

- Communication & negotiation

Leadership Skills

- Team management

- Stakeholder communication

- Change management

- Strategic decision-making

Analytical Skills

- Business analytics & data-driven decision-making

- Market and competitor analysis

- Problem-solving frameworks (MECE, SWOT, Porter’s 5 Forces)

Financial Modelling (Required for Finance/Consulting Roles)

- Used in consulting, investment banking & corporate finance

- Often included in MBA Finance majors

MBA career scope (USA, Canada, Singapore)

The USA is the #1 market for MBA jobs globally.

Top Sectors Hiring MBAs:

- Consulting (McKinsey, Bain, BCG)

- Investment Banking (Goldman Sachs, JP Morgan)

- Big Tech & FAANG (Google, Amazon, Meta, Apple)

- Private Equity & Venture Capital

- Fintech & Product Management

Visa Opportunities:

- OPT (3 years for STEM MBAs)

- H-1B sponsorship from tech, finance & consulting firms

- High acceptance for MBAs from Tier-1 US B-schools

Canada is a growing hub for MBA graduates, especially in finance and technology.

Top Sectors:

- Consulting (Deloitte, PwC, KPMG)

- Banking (RBC, TD, Scotiabank)

- Tech (Shopify, Amazon, Microsoft)

- Government & Public Sector

Common Post-MBA Roles:

- Management Consultant

- Financial Manager

- Business Analyst

- Product Manager

Visa Advantages:

- Post-Graduate Work Permit (PGWP) up to 3 years

- Easier PR pathways under Express Entry

- Strong demand for leadership & finance roles

Singapore is Asia’s top business and finance hub, offering high salaries and tax benefits.

Top Sectors:

- Investment Banking (DBS, Standard Chartered)

- Asset Management & Hedge Funds

- Consulting (BCG, Bain, McKinsey)

- Technology & Fintech (Grab, Stripe, Sea Group)

Common Post-MBA Roles:

- Regional Strategy Manager

- Investment Analyst

- Financial Controller

- Product Lead

Visa/Work Benefits:

- Employment Pass (EP) for skilled MBAs

- Lower corporate taxes (14%–17%)

- High demand for finance & cross-border roles

Below are the top roles MBA graduates typically land in Big Tech, consulting, and fintech:

FAANG / Big Tech

- Product Manager

- Program Manager

- Marketing Strategy Manager

- Business Operations Lead

- Data Analytics Manager

Consulting

- Strategy Consultant

- Management Consultant

- Digital Transformation Consultant

- Project Leader

Fintech

- Risk & Compliance Manager

- Payments Product Manager

- Business Strategy Lead

- Growth Manager

A strong differentiator of MBAs especially from reputed schools is networking power.

MBA programmes offer:

- Large alumni networks across 100+ countries

- Access to exclusive job boards & referral networks

- Peer networking with founders, managers & industry leaders

- Corporate partnerships for internships and placements

- Annual career fairs with top recruiters

Networking often leads to referrals, which dramatically increases hiring chances in companies like Google, Bain, Morgan Stanley, or Deloitte.

ACCA vs MBA – Difficulty level

| Criteria | ACCA | MBA |

|---|---|---|

| Type of Difficulty | Exam Difficulty | Admission Difficulty |

| Pass Rate / Acceptance Rate | 40–50% pass rate per paper | Top Indian MBAs (IIMs/ISB): 1–2% admit rate Mid-tier MBAs: 10–20% admit rate Global MBAs (USA/UK): GMAT 600–740 |

| Exams Required | 13 papers (can get exemptions) | Entrance exams (CAT, GMAT, GRE) + GD/PI + SOP |

| Academic Rigor | High theoretical + practical accounting, finance, IFRS | Varies by college; top MBAs include strategy, analytics, finance, leadership |

| Consistency Required | Continuous preparation for each exam cycle | Short, intense preparation for CAT/GMAT + academic rigor after admission |

| Time Flexibility | Very flexible exam schedule (4 sessions per year) | Fixed academic calendar with classes, internships, and projects |

| Overall Difficulty | Moderate to High (subject-level depth) | High for top B-schools due to competition; moderate for Tier-2/3 colleges |

ACCA and MBA have very different types of difficulty:

1.ACCA is difficult because of subject depth, requiring strong understanding of accounting, auditing, taxation, and IFRS. Each paper has a 40–50% pass rate, making it moderately competitive.

2.MBA is difficult because of competitive admissions, especially for top institutes like IIMs and ISB, where acceptance rates are as low as 1–2%. The academic difficulty after joining varies depending on the school.

ACCA vs MBA – Cost comparison

| Cost Component | ACCA (India) | MBA (India & Abroad) | Notes / Insights |

|---|---|---|---|

| Registration Cost | ₹8,000 – ₹10,000 | ₹10,000 – ₹50,000 (application + exam forms) | ACCA cost is fixed globally; MBA cost varies by institute. |

| Exam Fees | ₹12,000 – ₹15,000 per paper (13 papers) | Included in tuition (semester/trimester system) | ACCA has pay-per-paper cost; MBA is bundled. |

| Total Exam Cost | ₹1.8 – ₹2.5 lakh | Included in total fees | CA-like subsidisation doesn’t exist for MBAs. |

| Coaching / Tuition Fees | ₹1.5 – ₹2.5 lakh | India: ₹8 – ₹25 lakh USA/UK/Singapore: ₹40 – ₹90 lakh | MBA cost varies massively depending on Tier-1 vs Tier-2 colleges. |

| Total Cost (All Inclusive) | ₹3.5 – ₹5 lakh | ₹8 – ₹25 lakh (India) ₹40 – ₹90 lakh (Abroad) | ACCA is 3–10x cheaper than MBA. |

| Other Costs | Annual subscription: ₹12,000 Exemption fees (if any) | Living expenses for full-time MBA (₹6 – ₹15 lakh/year) | MBA has higher opportunity cost due to full-time study. |

ACCA Vs MBA Jobs: Data

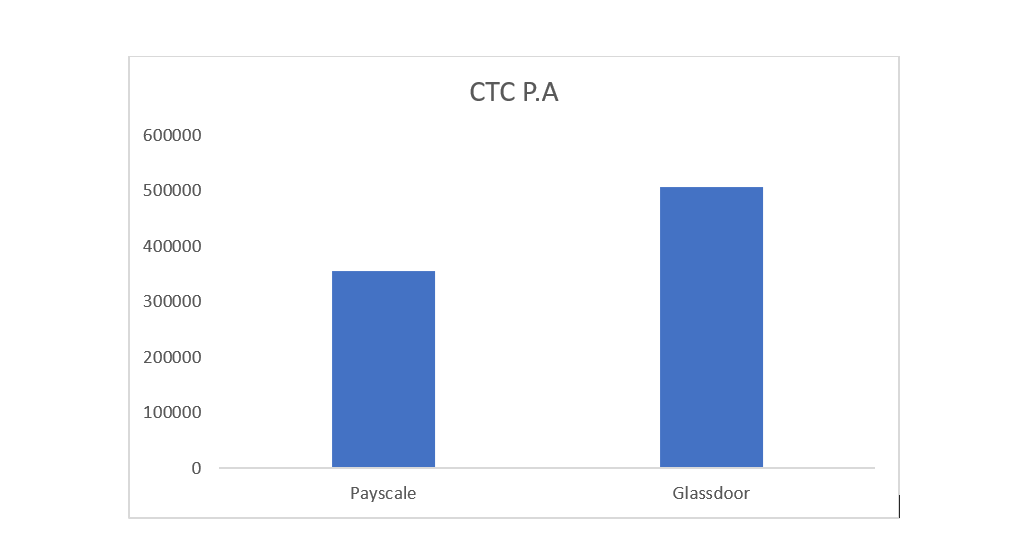

So, apart from the heavily exaggerated numbers given by various education institutes propagating lets look at salary data of ACCA from two sources. Similar conclusions can be made here, ACCA salaries don’t match the kind of effort it requires. So in terms of salary, ACCA vs MBA, the latter is a straightforward choice.

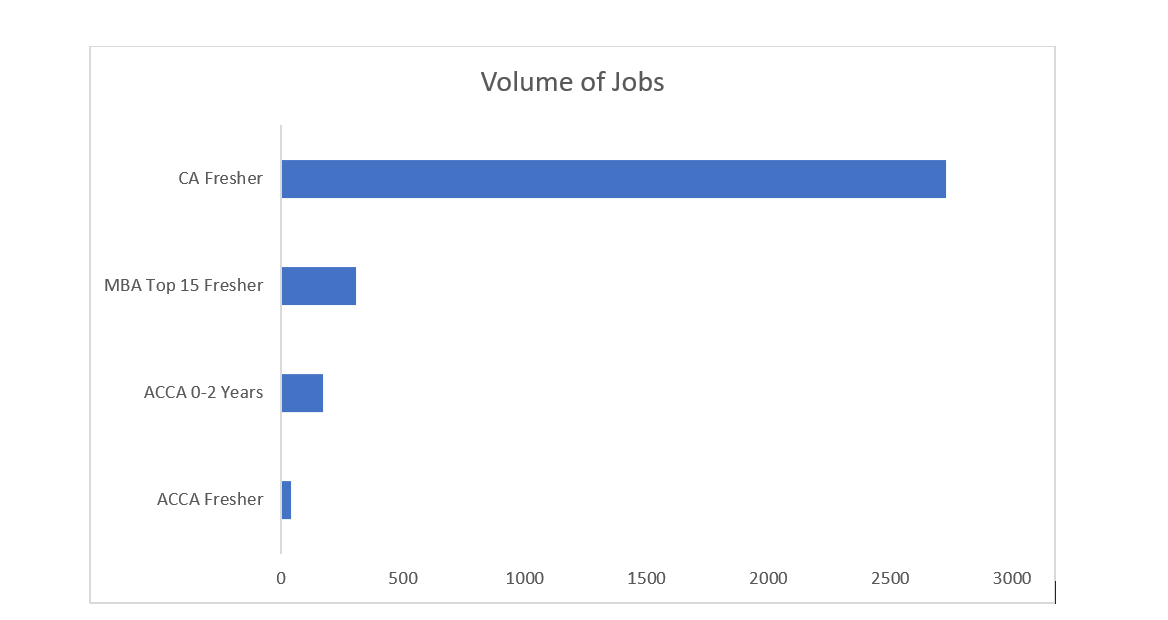

ACCA Vs MBA :Volume of Jobs

However, we also should look at the volume of opportunities that an ACCA candidate gets after putting these kinds of efforts to clear the exam. So, it is pretty clear that in the volume of opportunities as well ACCA is far behind. With CA being the most preferred qualification in accounting. In fact, also in terms of salary the qualification doesn’t add much value as per the data presented. Now, again the same conclusion on volume of jobs realted to ACCA Vs MBA, very few jobs.

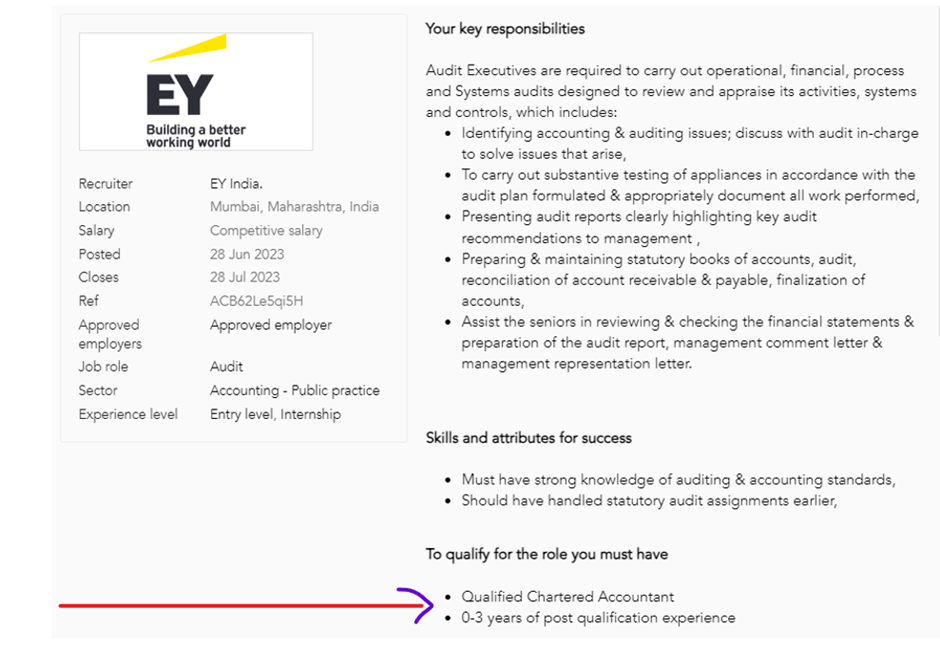

ACCA’s Career Page: Insights

On further investigating the jobs provided by ACCA itself, on their website with the relevant filters of experience and location. But, the results aren’t encouraging. Here are the findings;

- Most of the jobs for freshers are not jobs but internships

- The jobs themselves don’t require ACCA itself.

In fact in one of the jobs, which is mentioned as an ACCA approved employer, the requirement is actually of a chartered accountant and not ACCA. So even the ACCA career page itself concludes the ACCA Vs MBA question.

ACCA Reviews by Members

Now, obviolsy when you type this keyword on google “ Is ACCA worth it?”, you are sure to get a lot of definitive answers. However, most of those answers are either intended to market their own courses, or just may be an ego massage.

However, when you look at some anonymus answers, you find some insights like these below.

ACCA Exemptions

One of the biggest advantages of ACCA is its exemption system, which allows students to skip certain papers based on their previous qualifications. This significantly reduces time, effort, and total cost of completing ACCA.

Below are the most searched exemption paths in India:

ACCA Exemptions After B.Com

Students who have completed a Bachelor of Commerce (BCom) typically receive:

4–5 exemptions

These exemptions are usually for:

- Business & Technology (BT)

- Management Accounting (MA)

- Financial Accounting (FA)

- Corporate & Business Law (LW) (depending on university)

This reduces the ACCA duration by 6–12 months.

ACCA Exemptions After CA Intermediate

Candidates who have completed CA Inter (both groups) usually receive: 6 exemptions

These exemptions include most Applied Knowledge & Applied Skills level papers.

This allows CA Inter students to directly enter higher-level ACCA papers.

ACCA Exemptions for CA Qualified

Fully qualified CAs receive the highest number of exemptions: Up to 9 exemptions

They need to attempt only the final Strategic Professional papers such as:

- Strategic Business Leader (SBL)

- Strategic Business Reporting (SBR)

- One Optional Paper (AFM/AAA/APM/ATX)

CA-qualified professionals can complete ACCA in as little as 6–12 months.

- BCom → 4–5 ACCA exemptions

- CA Inter → 6 ACCA exemptions

- CA Qualified → up to 9 ACCA exemptions

This makes ACCA a fast-track global qualification for commerce graduates and CA professionals in India.

What Should You Do? MBA or ACCA

Well, now that I have presented you the data on both the qualifications, there is conclusion to be made. Furthermore, I don’t teach ACCA, neither am I an MBA so this opinion is purely for the benefit of the students.

1.Firstly,If you are seriously not sure on your exact career path, whether it is accounting or finance then I would suggest to stay away from ACCA. In my opinion ACCA can be a supplemental qualification, if the need arise however cannot be the primary background for a career in accounting and finance.

2.Secondly, MBA needs to be done from top 15-20 colleges only, else it as good as ACCA because neither will give you any advantage in the industry either from a salary angle or opportunity.

3.On the contrary, if you are just thinking about MBA because after completing UG, you need to do PG then that’s a wrong move again. As per the structural shifts in every industry, those notions no more hold true.

4.Finally, if you are serious about accounting then hands down the choice has to be ICAI’s Chartered accountant qualification. While, it is hard and torturous, but that’s the only thing that actually works.

5.In fact, CA- inters have more jobs than ACCA qualified candidates, majorly because of the credibility of its slog process it makes its candidates go through.

| Career Goal | Choose ACCA | Choose MBA |

| Want global accounting role | Yes | |

| Want leadership & management | Yes | |

| Want Big 4 finance role | Yes | Yes |

| Want to start a business | Yes | |

| Want international job in audit | Yes |

FAQ

Not necessarily. ACCA is better for those targeting finance and accounting careers, while an MBA offers a broader business management scope. If you want a specialized global accounting role, choose ACCA. if you want leadership and cross-functional growth, choose MBA.

Generally, MBA graduates from top-tier business schools earn higher starting salaries, often ₹20–₹30 LPA. However, experienced ACCA professionals working internationally can also earn ₹25–₹40 LPA or more. So, salary depends on industry, location, and experience.

Yes! In fact, it’s a powerful combination.

An ACCA + MBA professional has both technical finance expertise and strategic business acumen, making them highly valuable for CFO and leadership roles in global firms.

ACCA is academically more rigorous due to 13 professional exams with a global standard.

MBA, on the other hand, is management-focused and involves projects, teamwork, and case studies.

In short:

1.ACCA = Technical Difficulty

2.MBA = Strategic and Conceptual Challenge

After ACCA, you can work in roles such as Auditor, Financial Analyst, Tax Consultant, and Risk Manager in top firms like PwC, Deloitte, EY, and KPMG.

Global demand for ACCAs is especially strong in the UK, UAE, Singapore, Canada, and Europe.

No. ACCA is a professional qualification, while MBA is an academic postgraduate degree.

However, both are internationally recognized and can complement each other. ACCA focuses on finance expertise, while MBA focuses on management leadership.

Yes, ACCA is recognized in the USA, but it is not a licensed CPA qualification.

After an MBA, ACCA can still help you with working in multinational companies, Big 4 firms, shared service centers, and internal audit

No, an MBA is not necessary after ACCA.

It depends on the type of finance job you want:

Choose ACCA if you want:

Accounting & auditing roles

Financial reporting

IFRS-based jobs

Big 4 roles (audit, tax, advisory)

FP&A and controllership roles

Global accounting careers

Choose MBA if you want:

Investment banking

Consulting (McKinsey, Bain, BCG)

Product management

Strategy roles

Corporate leadership

Fintech & startup management