Last updated on January 15th, 2026 at 01:05 pm

The research associate salary in India (2025) typically ranges from ₹4 LPA to ₹10 LPA at the entry level, depending on the industry, employer, and skill set. Freshers usually start at the lower end of this range, while candidates with strong analytical skills, domain knowledge, or relevant certifications can command higher pay early on. With experience, salaries grow steadily mid-level research associates (3–6 years) often earn ₹10–18 LPA, and senior professionals in specialized roles can cross ₹20–30 LPA in top firms.

Pay for research associates changes significantly with experience and industry exposure. As professionals move from data collection and basic analysis to owning research projects, building models, and advising stakeholders, compensation rises accordingly. Finance and equity research roles generally pay more due to the need for valuation, financial modeling, and market expertise. Consulting firms offer competitive pay for problem-solving and client-facing research skills. In pharma and life sciences, salaries depend on scientific expertise, clinical research exposure, and regulatory knowledge. Technology companies often blend research with data analytics, AI, or product insights, which can lead to higher pay, especially in major tech hubs. This mix of skills, sector demand, and responsibility explains why research associate salaries vary widely across industries in India.

What does a Research Associate earn in India?

Research Associate salaries in India typically range from ₹2.5–9 LPA, depending on industry, location, and experience. and consulting roles sit at the top end, while academic, pharma, and market-research roles are usually at the lower end. Although all this also differ by location and company size.

Research associate salary by Experience

| Experience Level | Role / Typical Responsibilities | Salary Range (India) |

| 0–1 year (Entry-Level) | Basic research support, data collection, documentation, assisting senior analysts/scientists | ₹2.5 – ₹5 LPA |

| 1–3 years (Early Career) | Independent research tasks, report writing, financial/statistical analysis, industry studies | ₹4 – ₹8 LPA |

| 3–6 years (Mid-Level) | Domain specialization, advanced modelling (Python/SQL/R), leading modules, client/stakeholder coordination | ₹7 – ₹15 LPA |

| 6–10 years (Senior Level) | Senior RA/Lead Analyst, project leadership, mentoring juniors, strategic research contributions | ₹12 – ₹22 LPA |

| 10+ years (Expert/Specialist) | Research Manager/Lead, equity research lead, quant strategist, scientific research head | ₹18 – ₹30 LPA+ |

Research associate salary by Industry

A Research Associate’s career path in India varies by industry (finance, pharma, consulting, tech, academia), but the overall progression follows a structured skill-building journey. Here is the latest, practical, industry-relevant research associate salary in India by industry.

| Industry | Salary Range (LPA) | Comments |

| Equity Research / Investment Banking | ₹6 – 18 LPA | Highest-paying; bonuses common; CFA/CQF preferred |

| Quant Research / FinTech | ₹8 – 20 LPA | Strong pay for Python/ML/Stats skills |

| Management Consulting / Market Intelligence | ₹5 – 15 LPA | High exposure to strategy + client work |

| Pharma / Biotechnology / Clinical Research | ₹3 – 8 LPA | Stable roles; growth with domain specialization |

| Tech Research / Data Science Support | ₹6 – 14 LPA | Higher for SQL/Python/AI-driven roles |

| Market Research Agencies | ₹3 – 6 LPA | Entry-level friendly; mid-range salaries |

| Academic Research / Universities / NGOs | ₹2.5 – 5 LPA | Lower range but good for research-focused careers |

City-wise Salary Comparison

Research Associate salaries in India typically start at ₹2.5-5 LPA for freshers, average ₹4–9 LPA across industries, and can reach ₹12–30 LPA+ for senior specialists in equity research, quant, consulting leadership. Compensation mixes base pay, performance bonuses, project and at startups ESOPs. Mumbai and Bengaluru command the highest packages.

| City | Typical RA Avg (All industries) | Premium vs National Avg | Notes |

| Mumbai | ₹6 – 14 LPA | +15–30% | Finance hub, equity & IB roles pay best. |

| Bengaluru | ₹5.5 – 13 LPA | +10–25% | Tech, product & quant research strong. |

| Delhi-NCR | ₹4.5 – 10 LPA | market avg | Consulting, market research hubs; government research roles. |

| Pune | ₹4.5 – 9 LPA | +5–15% | Pharma R&D and tech centers, pockets of higher pay. |

| Hyderabad | ₹4 – 9 LPA | market avg | Growing tech & pharma clusters. |

| Chennai | ₹3.5 – 8.5 LPA | Slightly below avg | Pharma & academic hubs; lower cost of living. |

Company & Role Examples

| Company Type | Example Companies | Typical Job Titles | Salary Range (₹ LPA) | Notes / What They Look For |

| Small Boutique Equity Research Firms | Independent Research Houses, Small PMS Firms, Sector-focused boutiques | Junior Research Associate, Equity Research Trainee, Sector Assistant | 3 – 6 LPA | Strong Excel, basic modelling, sector interest. Good entry point for freshers. |

| Mid-Tier Brokerages & Investment Firms | HDFC Securities, ICICI Direct, Kotak Securities, Axis Securities, Motilal Oswal | Research Associate, Junior Analyst, Sector Analyst | 5 – 10 LPA | Balanced modelling + report writing. Strong competition but excellent visibility. |

| Large Domestic Institutions | SBI Caps, IIFL, JM Financial, Edelweiss | Research Associate, Equity Analyst (Junior), Research Specialist | 7 – 14 LPA | Sector expertise required; more structured teams & growth. |

| Global Research Teams (India Offices) | CLSA, Credit Suisse, Deutsche Bank, Morgan Stanley Research, Goldman Sachs (Global Capability Centres) | Research Associate, Associate Analyst, Offshore Analyst | 10 – 20 LPA | High modelling rigor; exposure to global teams; excellent bonus opportunities. |

| Asset Management / PMS / Buy-Side Firms | WhiteOak, Marcellus, ASK PMS, ICICI Pru AMC, Nippon AMC | Buy-Side Research Associate, Investment Analyst, Junior PM Support | 8 – 18 LPA + bonus | Highest learning curve; bonus/AUM-linked payouts; CFA strongly preferred. |

| Market Research & Consulting Firms | Kantar, NielsenIQ, McKinsey Knowledge Center, Deloitte Research | Research Associate, Business Research Analyst | 3 – 8 LPA | Project-based research; not finance-heavy but great analytical exposure. |

| Tech / Data Research Companies | Gartner, Statista, Bain Capability Center, ZS Associates | Data Research Associate, BI Research Associate, Market Analyst | 6 – 15 LPA | SQL, Python, dashboarding and business analysis valued. |

Components of Research Associate Salary

1) Base Salary (Guaranteed pay)

What it is: Fixed annual pay paid in monthly installments. Typical for Research associates in India (2025): ₹2.5–9 LPA on average, with industry and city (finance/quant/consulting higher). Glassdoor and job portals report national averages in the ₹4–6 LPA band for research associate roles, with higher city-specific medians. Source: Glassdoor

Example: An equity research RA in Mumbai may have a base of ₹8 LPA, a pharma lab RA in a smaller city may have ₹3.5 LPA.

2) Bonus / Variable Pay (Performance-linked)

What it is: Annual or quarterly payouts tied to individual, team, or firm performance. In finance and consulting, bonuses can be substantial and make up a sizable % of total CTC.

How it’s set: Benchmarked to KPIs, revenue generation, accuracy of research calls, client wins, project delivery, or company profitability. For finance Research associates, bonuses often depend on the analyst/team’s revenue or the analyst’s contribution to deals.

Example: A research associate with a ₹8 LPA base may receive a performance bonus of 10–30% (₹80k–2.4L) in a typical year, top performers in investment research can get higher payouts.

What it is: In asset/wealth management or some boutique research shops, compensation can include a share of fees or revenue attributable to a portfolio, strategy, or client book (expressed as a % of AUM or revenue). This aligns pay with money managed and revenue generated. Investopedia and CFA commentary explain how asset-based fee models and AUM fees drive recurring revenue in investment management.

How it works (simple formula):

Annual payout = AUM × Management fee% × Revenue share% to team

Example:

1.Manager charges 1% management fee on a ₹100 crore fund – revenue = ₹1 crore.

2.If research team’s revenue share is 5%, the research pool = ₹5 lakh, distributed among contributors according to seniority/performance.

This component is more common in boutique asset managers, PMS teams, or quant shops, and less common in academia or pharma.

4) Stock / ESOPs (Equity compensation)

What it is: Startups and some tech/analytics firms grant ESOPs or stock options to retain talent and provide upside if the company grows/IPO’s. These are usually subject to vesting (e.g. 4 years with 1-year cliff). Investopedia explains ESOs, SEBI maintains rules and guidance on ESOPs in India.

Value drivers: Company valuation, liquidity event (acquisition/IPO), vesting schedule, and strike price.

Example: 1,000 options @ ₹10 strike, vesting over 4 years. If company IPOs and share price = ₹200, theoretical gain = (200 − 10) × 1,000 = ₹190,000 (pre-tax).

Understanding base salary, bonus structures, AUM/revenue-share models, and ESOPs is important when analyzing a Research Associate offer in India. Compensation mixes vary sharply by industry – finance roles pay more variable and revenue-linked bonuses. Ask for a clear breakdown, verify payout formulas, and weigh immediate cash vs long-term equity upside before you accept.

What is a research Associate?

Research Associate Less Than 1 Year of Experience

So, in general a research associate with less than a year of experience will spend most of its time on;

- Collecting Data

- Organizing the template for research

- Research on secondary sources

Research Associate more than 1 Year of experience

This is when the associate has some acclimatization with the investment industry. Hence, beyond this there are chances that a research associate might start assisting in the following activities

- Initiating Fundamental Analysis

- Collecting actional research data based on the model

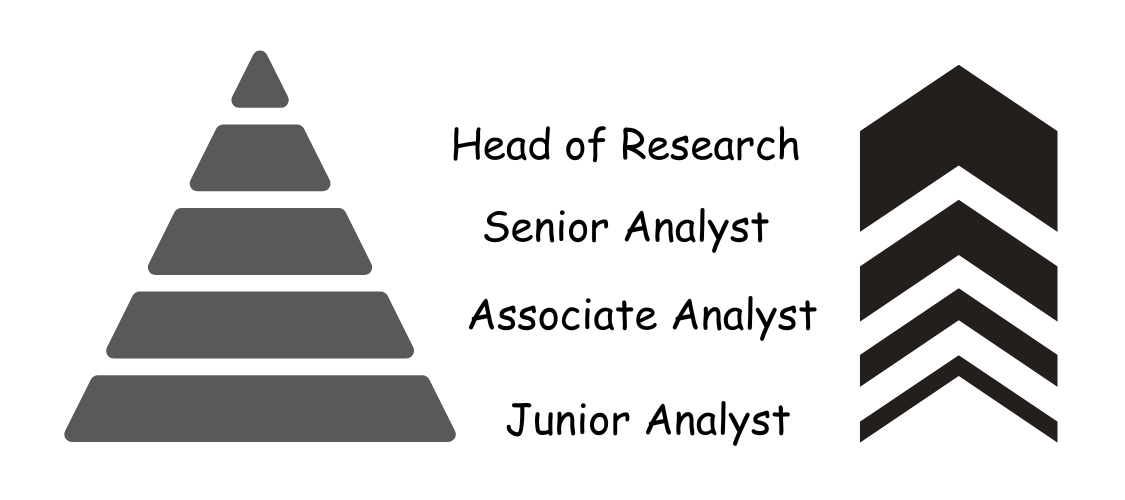

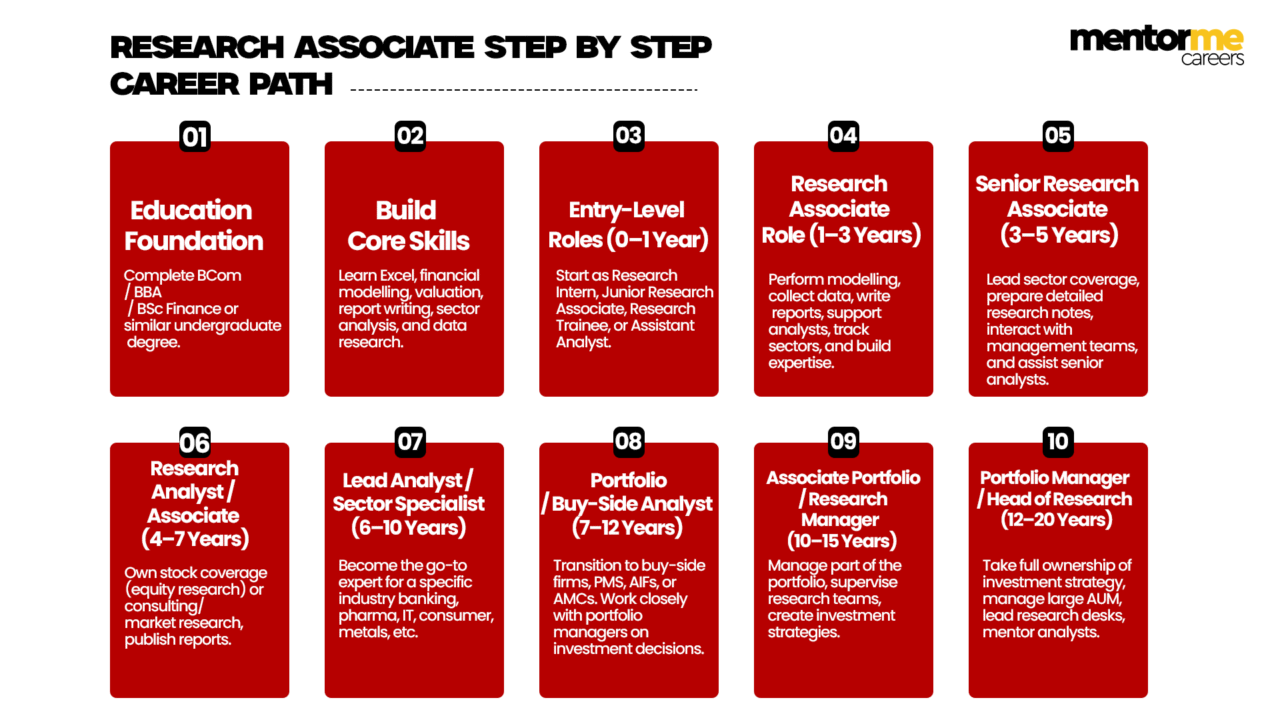

Career Path Of Research Associate

So in general and under ideal conditions and performance following could be the career path of a research associate;

- Minimum 2 years as research associate

- Progress into Senior Research associate or research analyst

- Lateral shift to front office, marketing role

In conclusion what matters is really the experience and expertise gathered by you. The more core experience you get, the better roles and options are wide open.

Examples of Research: Morgan Stanley

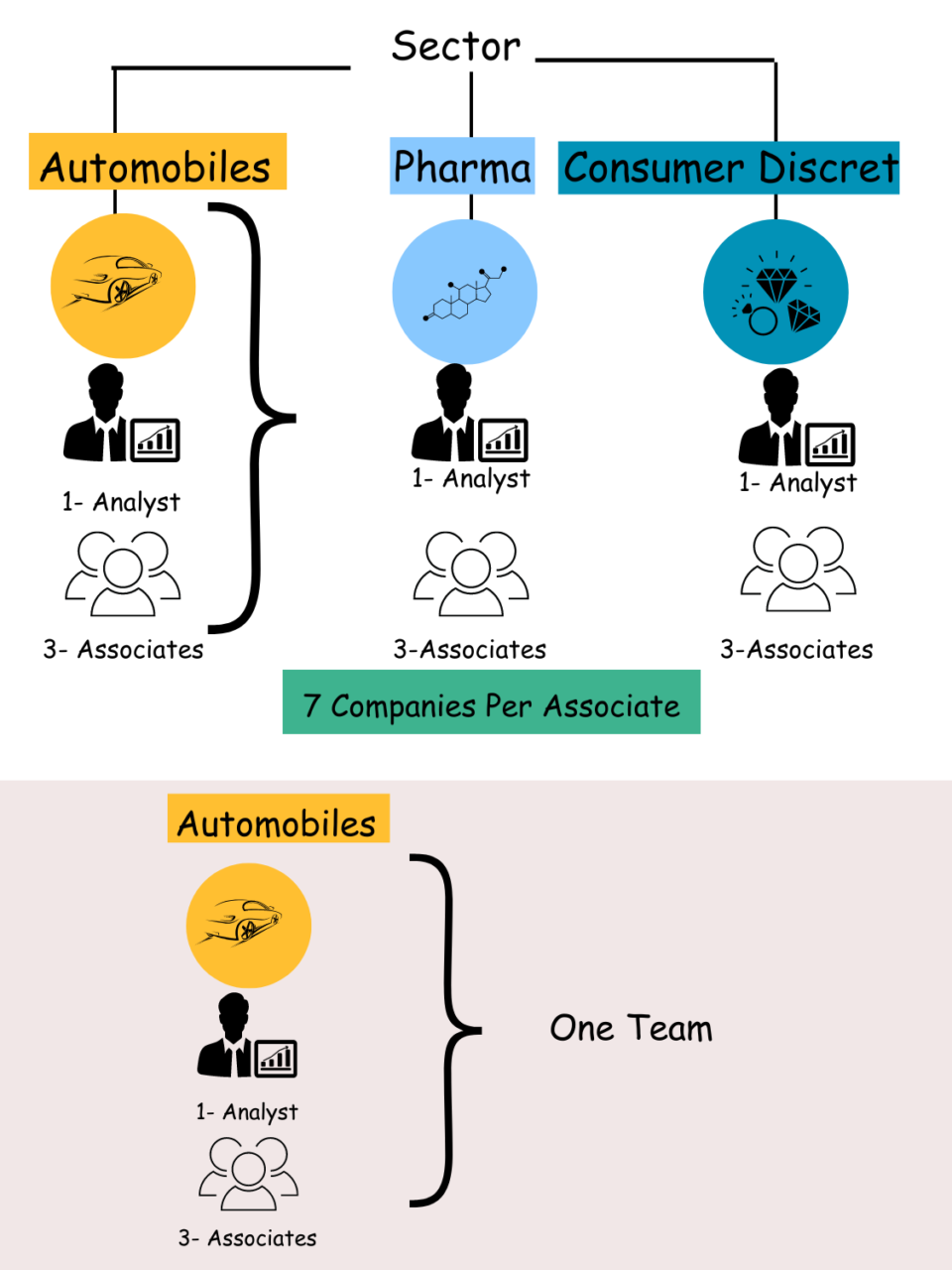

Team structure in Research

So, now I am beginning a little deeper display of the reality of how the team looks like in research. So generally, a team for research is structured as;

- One Analyst + 3 Research Associates

- Each research associate is expected to cover 7 companies.

- Also these teams are divided based on the sector expertise of specific analyst and research associates.

Just to depict this visually, I have created an infographic below for your reference.

Types of Research Analysts

Now, analyst doesn’t mean that he or she has to be necessarily only senior. In fact below are the type of analysts based on the seniority level;

- VP Level analysts

- MD Level analysts

- Senior Analysts

Bonus Criteria’s For Research Associate

Now let me take you through some criteria’s which decide the kind of bonus you make in the research associate salary.

- Analyst rankings such as the Institutional Investor Poll (II) Greenwich Poll; 2)

- the performance of Buy/Hold/Sell calls;

- And revenue indirectly generated via trading commissions and investment banking fees (e.g. from companies going public or public companies issuing follow-on offerings through the bank).

However, please understand that these bonus will be applicable only when you are directly working with an investment bank. Not really with a KPO.

Research Associate vs Research Analyst vs Senior Researcher

1. Research Associate (Entry to Early Career)

Who they are:

Research Associates are typically entry-level or early-career professionals who support research projects, data collection, report building, modelling, and analysis. They usually work under senior analysts or researchers.

Typical Duties:

1.Collect and clean data

2.Build basic research reports

3.Support financial models / lab experiments

4.Prepare summaries, charts, and presentations

5.Assist lead analysts in daily tasks

Salary Range (India, 2025):

₹2.5–5 LPA (Entry-Level)

₹4–9 LPA (1–3 years experience)

Who hires them:

Banks, fintechs, pharma companies, universities, market research firms, consulting firms, equity research houses.

Skill Expectations:

Excel, data analysis, statistics, strong research writing, basic modelling (finance) or lab skills (pharma/biotech).

Career Growth:

RA → Research Analyst → Senior Researcher / Lead Analyst

2. Research Analyst (Mid-Level Professional)

Who they are:

Research Analysts are mid-level specialists responsible for deeper analysis, forecasting, modelling, and generating insights. They own research modules and contribute to strategic decisions.

Typical Duties:

1.Build advanced financial/statistical models

2.Analyze large datasets (SQL/Python/R)

3.Conduct competitor/industry analysis

4.Write detailed investment, market, or sector reports

5.Give insights to leadership/clients

Salary Range (India, 2025):

₹6–12 LPA (General RA roles)

₹10–18 LPA (Equity / Finance / Consulting)

₹8–15 LPA (Pharma / Scientific research)

Who hires them:

Investment banks, equity research firms, consulting firms, Big 4, pharma R&D labs, tech companies (data/market intelligence teams).

Skill Expectations:

Financial modelling, Python/R/SQL, valuation, forecasting, lab expertise, domain specialization, excellent writing/presentation skills.

Career Growth:

Research Analyst → Senior Analyst → Lead Researcher / Manager

You can learn financial modeling course with placement with mentor me careers for placements in India.

3. Senior Researcher (Expert-Level Professional)

Who they are:

Senior Researchers are experienced professionals (5–12+ years) who lead research projects, manage teams, publish insights, and contribute directly to high-value decisions.

Typical Duties:

1.Lead complex research projects

2.Manage junior researchers

3.Present insights to CXOs/clients

4.Write high-impact whitepapers/industry reports

5.Build advanced quant, financial, or scientific models

6.Drive strategic recommendations

Salary Range (India, 2025):

₹12–22 LPA (General industries)

₹18–35 LPA (Finance, consulting, tech, quant research)

₹15–28 LPA (Pharma, biotech, health sciences)

Who hires them:

Top consulting firms, investment banks, quant funds, MNC pharma companies, global capability centers, think tanks, and research-driven tech companies.

Skill Expectations:

Domain mastery, leadership, advanced modelling, publications/patents, deep analytics, strong stakeholder management, project leadership.

Career Growth:

Senior Researcher → Research Manager / Head of Research → Director / Principal Researcher → VP / Chief Research Officer

Source: Indeed

Skill & Requirement

So, research is a intellectual job which requires the candidate to have a diverse knowledge of a specific industry.

- For e.g, If you follow the consumer discretionary industry, then the market size, market share, the effect of inflation etc.

- Have a sound knowledge of looking at financial statements

- Finally possess the financial modeling skill to bring this altogether.

Other softer skill requirements include

- Excellent communication

- Excel

- Presentation skills

- Comfort with data bases like Bloomberg, Reuters etc.

Conclusion

Well, I think in a nutshell research associate salary finally depends on the kind of investment bank you work with. Whether it is a boutique investment bank, or is it a full scale investment bank. However the above discussion should be pretty near to the reality of mostly all the research associate roles.

FAQ

Average pay typically ranges ₹4–9 LPA, depending on industry, location, and experience, finance/quant roles sit at the higher end, academic or market-research roles at the lower end.

Entry-level RAs usually earn ₹2.5–5 LPA in India; top internships-to-job conversions in finance or tech can start higher (₹5–8 LPA).

Highest pay is usually in investment banking / equity research / quant trading / management consulting / tech data teams. Pharma/academic research and market-research firms generally pay less.

Comp packages commonly include base salary + performance bonus, plus benefits (health insurance, PF), occasional variable pay/incentives, and mainly in startups or tech, stock options/ESOPs.

Fastest levers: upskill (financial modelling, Python/SQL, domain expertise), earn certifications (CFA/FRM), deliver measurable impact, take lateral moves to higher-paying sectors (IB/tech), or negotiate/job-hop after 12–18 months with a strong track record.

Yes, generally. Equity research (finance) typically pays more than pharma/academic research at comparable experience levels, due to higher bonuses and revenue-linked pay in finance.

Bonuses: common (performance-linked).

Stock options/ESOPs: possible mainly in startups/tech firms or some boutique shops, rare in academic or many pharma roles.

Related articles

- Who is a research analyst?

- Top 4 equity research analyst jobs to start in Mumbai

- Equity research companies in India

- SEBI research analysts exam