Last updated on January 24th, 2026 at 12:29 pm

CRISIL is India’s leading ratings agency. It is also the foremost provider of high-end research to the world’s largest banks and leading corporations. With sustainable competitive advantage arising from their strong brand, unmatched credibility, market leadership across businesses, and large customer base, they deliver analysis, opinions, and solutions that make markets function better. CRISIL global analytical company providing ratings, research, and risk and policy advisory services. In this article we discuss in detail Crisil interview questions.

About Crisil

CRISIL is a leading global analytical company that provides ratings, research, risk assessment, and policy advisory services. It actively supports financial institutions, corporations, and governments by delivering independent analysis and data-driven insights to help them make informed decisions.

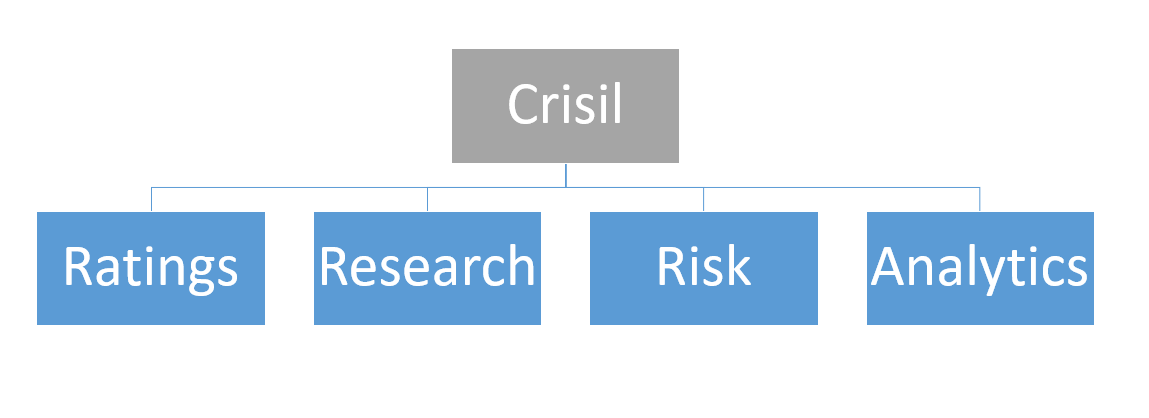

CRISIL and its research verticals

CRISIL Limited is India’s leading credit rating, research, and analytics company, and a subsidiary of S&P Global. Financial institutions, corporates, mutual funds, and regulators widely rely on CRISIL’s opinions to assess credit risk, market risk, and economic trends. For finance students, CRISIL represents a strong entry point into research-driven finance careers.

Key Research Verticals at CRISIL

1. CRISIL Ratings (Credit & Risk Research)

CRISIL Ratings evaluates the creditworthiness of companies, banks, NBFCs, infrastructure projects, and structured finance products.

Analysts here study financial statements, cash flows, leverage, liquidity, and industry risk to assign credit ratings.

Skills tested in interviews:

- Financial statement analysis

- Ratio analysis (liquidity, leverage, coverage)

- Cash flow forecasting

- Understanding of debt instruments

2. CRISIL Research (Industry & Economic Research)

This vertical produces industry reports, economic outlooks, and policy analysis used by corporates, investors, and government bodies.

Analysts track GDP trends, sector growth, cost structures, demand drivers, and regulatory changes.

Skills tested:

- Industry analysis

- Macroeconomic understanding

- Data interpretation

- Report writing & insights

3. CRISIL Global Research & Analytics (GR&A)

GR&A supports global investment banks, asset managers, and private equity firms with offshore research services.

Work includes equity research support, valuation models, credit research, and financial modelling.

Roles students apply for:

- Research Associate

- Credit Analyst

- Financial Modelling Analyst

Skills tested:

- Excel-based financial modelling

- DCF and ratio analysis

- Presentation & client-ready output

4. CRISIL Infrastructure Advisory

This team advises on infrastructure financing, PPP projects, project feasibility, and risk assessment across power, roads, ports, and urban infrastructure.

Skills tested:

- Project finance models

- Long-term cash flow analysis

- Debt service coverage ratios (DSCR)

- Structure questions into Accounting, Valuation, Industry, Behavioural

For better clarity I will divide the answer into three sections :

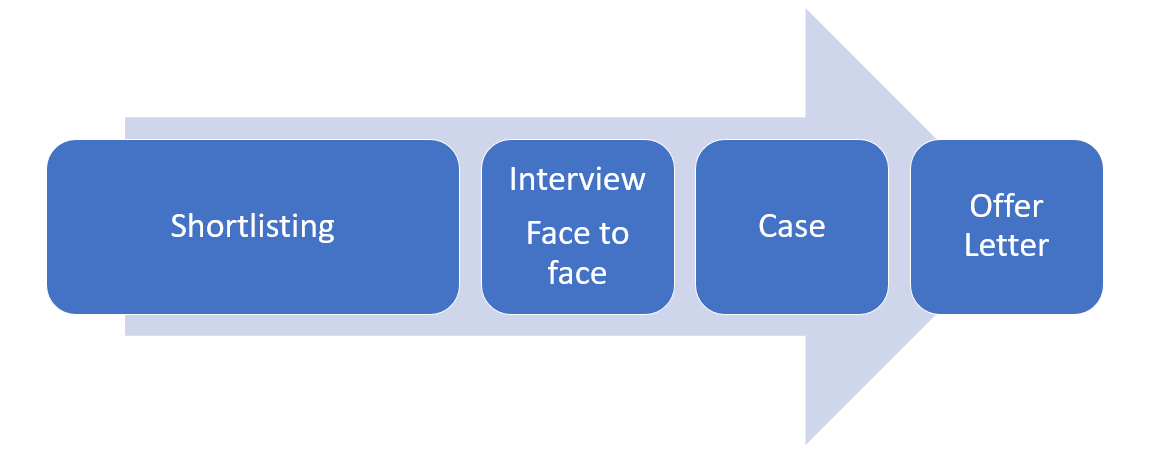

Crisil Interview Question Types

Technical Crisil Interview Questions

As mentioned earlier knowledge of finance is vital. How does a particular transaction flow through the three statements and how do we value a stock also what is the kind of security that interests us most (fixed income, equity etc.); what are the hedging techniques; selection criteria for stocks; financial ratios; types of analysis: fundamental/technical. Questions on crisil interview questions will, majorly flow on these lines.

Crisil interview questions like tell me something about yourself; about strengths/weaknesses; interests; career plans. The important thing to remember here is that you must have a sound reason for everything you speak. Every adjective that you use to describe yourself should be backed by instances.

Aptitude-Related Crisil Interview Questions

CRISIL includes aptitude-related questions in its interview process to assess a candidate’s analytical ability, numerical accuracy, logical reasoning, and problem-solving skills. These questions help evaluate how effectively candidates can analyze data, interpret numbers, and apply logical thinking in real-world financial and business scenarios.

What CRISIL Looks for in Research Analysts

CRISIL interviewers focus less on “high-level banking jargon” and more on:

- Strong fundamental finance concepts

- Ability to analyze numbers logically

- Clear explanation of assumptions

- Comfort with research-oriented roles

- Accuracy, discipline, and structured thinking

They value quality of analysis, not speed or deal.

Detailed Technical Crisil Interview Questions

Here are some Crisil interview questions questions you can face, and their probable answers:

Question 1. What are the credit factors would you look if you have to rate a company for credit worthiness?

Try to use the keywords as much as possible. Know everything that you speak, because the next Crisil interview questions might be from what you just said.

Answer: Several factors such as financial statements, type and level of debt, lending and borrowing history, debt repayment ability, past credit repayment behaviour, etc. are taken into consideration before assigning a rating to a particular entity.

Question 2. Describe cash flow statement.?

Instead of using exactly a booking language, tell them something more. The concept always remains the same, but what makes you a selected candidate is how you explain and the examples you give while explaining.

Answer : A cash flow statement is a financial statement that provides aggregate data regarding all cash inflows that a company receives from its ongoing operations and external investment sources. It also includes all cash outflows that pay for business activities and investments during a given period.

A company’s financial statements offer investors and analysts a portrait of all the transactions that go through the business, where every transaction contributes to its success. The cash flow statement is believed to be the most intuitive of all the financial statements because it follows the cash made by the business in three main ways: through operations, investment, and financing and so, the sum of these three segments is called net cash flow.

Question 3. Explain the best method to calculate return required for equity.

Again a very basic crisil interview questions which frequently turns up in the interview.

The required rate of return (RRR) is the minimum return an investor will accept for owning a company’s stock, as compensation for a given level of risk associated with holding the stock.

There are a couple of ways to calculate the required rate of return either using the dividend discount model (DDM), or the capital asset pricing model (CAPM). The choice of model used to calculate the RRR depends on the situation for which it is being used.

- The dividend-discount model calculates the RRR for equity of a dividend-paying stock by utilizing the current stock price, the dividend payment per share, and the forecasted dividend growth rate. The formula is as follows:

RRR = (Expected dividend payment / Share Price) + Forecasted dividend growth rate

To calculate RRR using the dividend discount model:

- Take the expected dividend payment and divide it by the current stock price.

- Add the result to the forecasted dividend growth rate.

- The CAPM model of calculating RRR uses the beta of an asset. Beta is the risk coefficient of the holding. In other words, beta attempts to measure the riskiness of a stock or investment over time. Stocks with betas greater than 1 are considered riskier than the overall market (often represented by a benchmark equity index, such as the S&P 500 in the U.S., or the TSX Composite in Canada), whereas stocks with betas less than 1 are considered less risky than the overall market.

RRR = Risk-free rate of return + Beta X (Market rate of return – Risk-free rate of return)

To calculate RRR using the CAPM:

- Subtract the risk-free rate of return from the market rate of return.

- Multiply the above figure by the beta of the security.

- Add this result to the risk-free rate to determine the required rate of return.

Question 4. Explain Stochastic calculus.

Stochastic calculus is a branch of mathematics that operates on stochastic processes. It allows a consistent theory of integration to be defined for integrals of stochastic processes with respect to stochastic processes. This field was created and started by the Japanese mathematician Kiyoshi Itô during World War II.

Question 5 What is credit rating?

The most basic crisil interview questions of all. They might ask you this, just to get a hold of your intelligence. Are you able to connect the dots and link your answer to tell them that you have studied about their company well?

Answer: A credit rating is an evaluation of the credit risk of a prospective debtor, predicting their ability to pay back the debt, and an implicit forecast of the likelihood of the debtor defaulting.

CRISIL was a pioneer in India in this field. In 1987, CRISIL was incorporated by ICICI and UTI. These two institutions additionally acted as the promoters of CRISIL.

Since then it has given valuable and reliable ratings which can be trusted by all.

Question 5. Difference between cash flow and fund flow.

Answer : The cash flow will record a company’s inflow and outflow of actual cash (cash and cash equivalents). The fund flow records the movement of cash in and out of the company. Both help provide investors and the market with a snapshot of how the company is doing on a periodic basis.

Again a very basic crisil interview questions. Do remember to point out all the differences with the right keywords!

Preference Share Capital is the funds that a company has generated by issuing preference shares.

Equity Share Capital is the funds that a company has generated by issuing Equity shares.

- Dividend Rate-

The Dividend Rate in the case of Preference Share Capital is not changeable.

The Dividend Rate is changeable or fluctuating in the case of Equity Share Capital.

- Voting Rights-

Preference Shareholders do not have any voting rights in the selection of the management.

Equity Shareholders have voting rights in the selection of the management.

- Participation in Management-

Preference Shareholders do not have the right to participate in the management decisions.

Equity Shareholders holders have the right to participate in the management decisions.

- Claim to assets of the company-

Preference Shareholders have a right to claim over the company’s assets whenever they decide to wind up their operations.

Equity Shareholders do not have any right to claim their assets whenever they decide to wind up their operations.

- Preference in paying dividend-

Preference shareholders get the first preference when the company pays a dividend.

Equity shareholders get second preference when the company pays a dividend.

- Types of Shares-

The different types of Preference Shares are as follows:

Cumulative Preference Shares,Participating Preference Shares,Redeemable Preference Shares,Convertible Preference Shares

Non-Cumulative Preference Shares

Non-Participating Preference Shares

Non-Redeemable Preference Shares

Non-Convertible Preference Shares

The different types of Equity Shares are as follows:

Authorised Share Capital,Issued Share Capital,Subscribed Share Capital,Paid-up,Share Capital,Rights Share,Bonus Share,Sweat Equity, Share

Arrears of Dividend

- Preference Shareholders are eligible to get arrears of unpaid dividends from previous years. They can get it along with the dividend of the current year, except for non-cumulative preference shares.

- Equity Shareholders are not eligible to get arrears of unpaid dividends from previous years.

- Convertibility-

Preference Shares are eligible to get converted into Equity Shares.

Equity Shares can never be eligible to get converted into Preference Shares.

- Risk-

Preference Shareholders are at a lower risk compared to Equity Shareholders.

Equity Shareholders are at a higher risk compared to Preference Shareholders.

Question 7. Why do companies take Foreign Currency Loan?

A more logical crisil interview questions that is testing whether you understand the basic understanding of business dynamics.

Answer: Advantages of Foreign Currency Funding-

- Exposure to a variety of debt instruments.

- Suits to hedge your international trade.

- No extra hedging cost.

- You can hedge against your business income/expenses.

Question 8. What is terminal value?

Answer: Terminal value (TV) is the value of an asset, business, or project beyond the forecasted period when future cash flows can be estimated. Terminal value assumes a business will grow at a set growth rate forever after the forecast period. Terminal value often comprises a large percentage of the total assessed value.

Question 9. What is CRR?

Answer: The CRR (Cash Reserve Ratio) often comes up in the RBI monetary policies. It ensures consumers financial security.

Economies are usually volatile. They fluctuate depending on several internal and external factors. Banks and their ability to lend money are especially susceptible to these factors. Proper regulation and financial management can help avoid bumps in banking operations and maintain enough liquidity. The Reserve Bank of India (RBI) uses Cash Reserve Ratio (CRR) to eliminate such risks and regulate the money supply in the market. CRR impacts banks and financial institutions in how they offer loans and other credit products.

Question 10. How is the income statement linked to the balance sheet?

Answer: There is a connection between the balance sheet and income statement when double-entry accounting is used. In essence, increases in revenue and gains as reported on the income statement cause stockholders’ equity to increase on the balance sheet. Also, In addition, increases in expenses and losses as reported on the income statement cause stockholders’ equity to decrease on the income statement. In addition, the write-down of an asset on the balance sheet causes a loss to appear on the income statement.

So, these were the important questions in today’s list. Do share with us your interview experience so we can add more questions!

Short case-study based questions

Credit Risk Case

Case: A mid-sized manufacturing company shows stable profits, but operating cash flow has declined for two years.

Answer:

I would analyze working capital trends, receivables collection, inventory buildup, and capex intensity. Declining operating cash flow despite stable profits may indicate weak collections, aggressive revenue recognition, or rising input costs, which increase credit risk.

Financial Statement Analysis Case

Case: Revenue grows at 15% CAGR, but ROE keeps falling.

Answer:

ROE can decline due to margin compression, rising debt levels, increasing interest costs, equity dilution, or inefficient asset utilization. I would break ROE into profit margin, asset turnover, and leverage using the DuPont framework.

Liquidity Assessment Case

Case: Current ratio is 2.5, yet the company struggles to pay short-term obligations.

Answer:

A high current ratio may mask poor liquidity if current assets are tied up in slow-moving inventory or doubtful receivables. I would assess the quality of current assets and review cash conversion cycle and operating cash flows.

Debt Sustainability Case

Case: A company plans to raise more debt despite high leverage.

Answer:

I would review interest coverage ratio, debt service coverage ratio (DSCR), cash flow stability, and future earnings visibility. If incremental debt weakens coverage metrics or increases refinancing risk, the credit profile may deteriorate.

Sector Risk Case

Case: A power company operates in a highly regulated sector.

Answer:

Regulatory risks can affect tariffs, cash flows, and project viability. I would assess regulatory stability, payment security mechanisms, counterparty risk, and government support before forming a credit view.

Rating Outlook Case

Case: Two companies have similar financials, but one operates in a cyclical industry.

Answer:

The company in a cyclical industry faces higher earnings volatility during downturns, increasing business risk. I would assign a more cautious outlook due to lower cash flow predictability.

Working Capital Case

Case: Inventory levels rise while sales remain flat.

Answer:

This suggests weak demand, poor inventory management, or obsolete stock risk. It increases working capital pressure and may lead to cash flow stress, negatively impacting credit quality.

Stress Scenario Case

Case: Interest rates rise sharply; the company is highly leveraged.

Answer:

Higher interest rates increase borrowing costs, reducing interest coverage and free cash flows. I would stress-test cash flows to assess whether the company can meet debt obligations under adverse conditions.

Business Model Risk Case

Case: A company earns 60% of revenue from one customer.

Answer:

High customer concentration increases revenue risk and bargaining power risk. Loss of the key customer could significantly impair cash flows, warranting a weaker credit assessment.

Governance & Management Quality Case

Case: Management frequently misses financial projections.

Answer:

Consistent forecast inaccuracies raise concerns about planning quality, internal controls, and governance. I would factor this negatively into the qualitative assessment of management credibility.

How to Prepare for CRISIL Research Interviews

Practice ratio analysis and cash flow interpretation

Be ready to explain credit risk vs equity risk

Understand CRISIL’s role vs investment banks

Prepare simple financial models, not complex LBOs

Read recent CRISIL industry reports before interviews

Conclusion Crisil Interview Questions

In addition Crisil is a place which takes the best, not in terms of the fancy qualifications you hold. However, definitely in terms of the quality of knowledge. Hence, if you want to crack the Crisil interview questions, then you should focus on the basics of financial statements, valuation, genuine business knowledge and the correct attitude to learn. Learn financial modeling in a structured approach with our financial modeling course.