Last updated on February 14th, 2026 at 04:10 pm

In today’s rapidly evolving financial landscape, businesses face increasing risks related to fraud, identity theft, money laundering, and terrorist financing. To fight these threats, organizations across KYC (Know Your Customer) and AML (Anti-Money Laundering) procedures as mandatory compliance practices. These frameworks make sure that financial institutions, fintech companies, NBFCs, banks, and even digital platforms verify customer identities, assess risk levels, and continuously monitor transactions for suspicious activities. Fintech is expanding rapidly and financial frauds are increasing, updated FATF guidelines make strong KYC and AML procedures essential for compliance, risk prevention, and customer safety. Digital payments, online lending, and neobanking platforms are also growing fast, so do threats like identity theft, money laundering, account takeovers etc. Financial Institutions must strengthen verification, monitoring, and reporting to meet global FATF standards, avoid regulatory penalties, and build a secure, transparent ecosystem that protects both customers and businesses.

In this guide, we break down the 7 clear goals of KYC and AML procedures, explain why they matter, and outline practical steps every organization should follow to stay compliant, secure, and future-ready.

AML/KYC Abbreviations

SAR: Suspicious Activity Report

A report filed when a transaction or customer activity appears suspicious.

STR: Suspicious Transaction Report

Official report submitted to FIU-IND/RBI for suspicious financial transactions.

India’s central banking and regulatory authority.

PMLA: Prevention of Money Laundering Act (India)

The primary anti-money-laundering law governing reporting, penalties & compliance.

FATF: Financial Action Task Force

Global body that sets AML/CFT standards and evaluates countries’ compliance.

KPI: Key Performance Indicator

Metrics used to measure how effective AML/KYC programs are.

CDD: Customer Due Diligence

Standard KYC process for verifying and understanding customer identity and risk.

EDD: Enhanced Due Diligence

Stronger, deeper checks for high-risk customers like PEPs, high-risk countries, etc.

SDD: Simplified Due Diligence

Reduced level of KYC checks for low-risk customers or small transactions.

EU: European Union

Regional bloc that issues AML regulations applicable to its member countries.

AMLD: Anti-Money Laundering Directive (EU)

EU’s regulatory framework for AML/CFT compliance (AMLD4, AMLD5, AMLD6, etc.).

What KYC and AML actually aim to do?

KYC (Know Your Customer) and AML (Anti-Money Laundering) procedures aim to protect financial institutions, businesses, and customers from fraud, illegal transactions, and financial crimes. The core purpose is to ensure that companies know who they are dealing with, understand customer risk levels, and prevent criminals from using financial systems for unlawful activities.

What KYC aims to do:

1.Verify customer identity using government-approved documents.

2.Ensure the customer is legitimate and real.

3.Assess customer risk based on occupation, geography, and transaction behavior.

4.Creating a secure onboarding process that prevents identity fraud.

5.Maintain updated customer records through time to time verification.

What AML aims to do:

1.Detect and prevent money laundering activities.

2.Monitor financial transactions to identify unusual or suspicious patterns.

3.Report suspicious transactions to regulatory authorities.

4.Stop terrorist financing and illegal fund movement.

5.Ensure compliance with global regulations such as FATF, EU AMLD, and local laws.

KYC tells you who your customer is, AML ensures what they are doing with money is legal.

7 core objectives of doing kyc and aml procedures is

Verify customer identity

The primary goal of KYC is to ensure that every customer is who they claim to be. By verifying documents (PAN, Aadhaar, Passport, etc.) we can prevent identity theft and fraudulent onboarding.

Example: A digital lending platform onboarded a “synthetic identity” created using stolen Aadhaar data. The fraudster took loans and disappeared.

How Failures Occur:

Using outdated or manual document checks

No biometric or face-match validation

Accepting blurry or tampered documents

Fixes:

Use AI-based OCR and document forensics

Implement facial recognition & liveness detection

Adopt Video-KYC for stronger verification

Assess Customer Risk Profiles Accurately

KYC helps categorize customers into low, medium, and high-risk segments based on their background, location, business activity, and financial behavior. This makes sure that higher-risk customers are monitored more closely, reducing financial crimes.

Example: A high-risk customer from a flagged jurisdiction opened an account with minimal checks. Later, multiple suspicious transfers were traced to offshore shell companies.

How Failures Occur:

Incomplete customer profiling

No PEP/sanction list screening

Ignoring high-risk indicators (crypto dealings, cash-heavy business)

Fixes:

Run automated screening against OFAC, UN, EU, and PEP lists

Use risk-scoring algorithms

Conduct enhanced due diligence (EDD) for high-risk profiles

Prevent Money Laundering and Illegal Fund activities

AML procedures aim to stop criminals from using financial systems to hide or move illegal money. Through monitoring, pattern analysis, and red-flag detection, institutions can prevent suspicious transactions before harm occurs.

Example: A customer made multiple ₹49,000 cash deposits across different branches of classic structuring to avoid reporting requirements.

How Failures Occur:

No transaction monitoring system (TMS)

Threshold-based monitoring only (not pattern-based)

Lack of cross-account behaviour analysis

Fixes:

Deploy rule-based & AI-driven transaction monitoring

Identify patterns like structuring, round-tripping, mule behavior

Periodic reviews of high-value cash activity

Detect and Report Suspicious Transactions Timely

Financial institutions must identify transactions that appear unusual or linked to criminal behavior. These are then reported as STRs/SARs to regulators.

Real Example:

A bank failed to report ₹1.2 crore in repeated same-day transfers across multiple new accounts later traced to a phishing scam.

How Failures Occur:

Delayed review of alerts

Compliance analysts handling large backlogs

Lack of clear escalation workflow

Fixes:

Automated STR/SAR generation triggers

Internal SLA (24–72 hrs) for alert investigation

Dedicated compliance team + case management system

Ensure Compliance With Local and Global Regulations

KYC and AML frameworks ensure organizations comply with laws such as:1.FATF Recommendations

2.RBI KYC Master Directions

3.PMLA (India)

4.EU AMLD regulations

Compliance prevents legal penalties, regulatory actions, and reputational damage.

Real Example:

A global bank was fined millions for failing to update risk models to FATF’s revised guidelines.

How Failures Occur:

Outdated compliance policies

No regulator-driven change management

Lack of periodic internal audits

Fixes:

Regular policy updates based on FATF/RBI circulars

Conduct quarterly internal compliance audits

Maintain exhaustive customer & transaction logs

Strengthen System Security and Build Customer Trust

By verifying customers and preventing illegal activities, a safer and more transparent ecosystem is build.This enhances customer confidence, reduces fraud, and supports long-term business growth.

Example: A payment wallet faced mass fraud when attackers created fake KYC profiles, leading to customer losses and public distrust.

How Failures Occur:

Weak authentication at login/onboarding

Misuse of pre-verified accounts

Poor fraud monitoring

Fixes:

Implement multi-factor authentication (MFA)

Continuous monitoring of unusual login/device patterns

Educate customers on fraud red flags

Protect the Financial System From Terrorist Financing

AML procedures help detect and block transactions linked to terrorist groups and politically exposed persons (PEPs). This helps knowing that the financial channels are not misused for funding terrorism or illegal organizations.

Example: A charity account was used to funnel micro-payments internationally to fund extremist activities largely unnoticed due to low-value transfers.

How Failures Occur:

No cross-border transaction monitoring

Failing to screen beneficiaries/payees

Ignoring micro-transaction clustering

Fixes:

Screen senders & receivers against sanction lists

Monitor micro-transactions that form suspicious clusters

Apply EDD for NGOs, money service businesses, and foreign accounts

Summary

Objective | What It Means | Purpose |

| 1. Verify Customer Identity | Collect and authenticate customer documents (KYC data). | Prevent identity fraud, impersonation, and fake accounts. |

| 2. Assess Customer Risk Profiles | Classify customers as low, medium, or high-risk based on background and activity. | Apply appropriate due diligence and prevent high-risk exposure. |

| 3. Prevent Money Laundering | Track and analyze financial behavior to detect illegal fund movement. | Stop criminals from converting black money into legitimate funds. |

| 4. Detect & Report Suspicious Transactions | Identify unusual transaction patterns and file STR/SAR reports. | Alert regulators and support early crime prevention. |

| 5. Maintain Regulatory Compliance | Follow rules from FATF, RBI, PMLA, etc. | Avoid penalties, legal action, and regulatory violations. |

| 6. Build Security & Customer Trust | Secure onboarding + strong monitoring systems. | Create a transparent, safe environment that boosts customer confidence. |

| 7. Prevent Terrorist Financing & Sanction Violations | Screen customers against PEP, sanction, and watchlists. | Block high-risk entities and stop illegal funding networks. |

Practical steps to meet the objectives

Below are steps businesses must follow to successfully meet the 7 objectives of KYC and AML procedures. These steps apply to banks, NBFCs, fintechs, insurance companies and any regulated entity.

Verify Customer Identity

1.Collect government-approved ID documents

2.Use OCR/AI-based document verification tools to check authenticity.

3.Match customer image with document photo using facial recognition.

4.Validate mobile number and email through OTP verification.

5.Conduct Video KYC when applicable to establish physical presence.

Practical Steps to Assess Customer Risk Profiles

Create customer risk scoring based on:

a. Country of residence

b. Nature of business

c. Transaction pattern

d. Employment type

e. Source of income

1.Screen customers

2.Apply enhanced due diligence (EDD)

3.Update risk score periodically based on behavior and transaction history.

Prevent Money Laundering

1.Implement transaction monitoring systems (TMS) powered by analytics.

2.Set threshold triggers

3.Track activities such as:

a. Sudden high-value deposits

b. Round-tripping

c. Structuring/smurfing

d. Frequent international transfers

4. Review red flag activities daily or in real time.

Detect & Report Suspicious Transactions

1.Conduct automated screening of transactions against AML rules.

2.Train staff to identify behavioral red flags.

3.Investigate red flagged events.

4.File STR (Suspicious Transaction Reports) or SAR (Suspicious Activity Reports) to regulators.

5.Maintain secure documentation for audits and regulatory inspections.

Maintain Regulatory Compliance

1.Follow guidelines from:

a.FATF

b.RBI KYC Master Directions

c.PMLA 2002

d.SEBI and IRDAI rules

2.Conduct periodic audits and gap assessments.

3.Maintain up-to-date compliance policies and SOPs.

4.Keep complete KYC documentation and logs.

5.Implement automated compliance dashboards.

Build Security & Customer Trust

1.Use encrypted systems for storing customer data.

2.Maintain transparency with customers about data usage and privacy.

3.Provide safe digital onboarding experiences with minimal friction.

4.Monitor for internal fraud or unauthorized access.

5.Resolve customer queries related to KYC or account restrictions quickly.

Prevent Terrorist Financing & Sanction Violations

1.Screen all customers and transactions against global databases such as:

a. OFAC

b. UN Sanctions List

c. EU Sanctions List

d. PEP databases

2.Block onboarding immediately if a match is found.

3.Apply EDD on politically exposed persons (PEPs).

4.Monitor cross-border transactions strictly.

5.Maintain ongoing screening throughout the customer lifecycle, not just at onboarding.

Real world example (short case study)

Case Study: HSBC UK – Major Failures in KYC and AML Controls

Between March 2010 and March 2018, HSBC’s UK division experienced compliance breakdown in the banking industry. The case exposed serious weaknesses in the bank’s KYC (Know Your Customer) and AML (Anti-Money Laundering) frameworks, leading to regulatory penalties and global scrutiny. This real-world example demonstrates why strong KYC and AML procedures are essential for financial institutions.

What Went Wrong?

1. Failure to Detect Unusual High-Value Transactions

A customer declared an annual income of ~Rs.72,84,739, yet received five separate payments of nearly Rs. 8,90,000 each in a single day.

HSBC’s monitoring system failed to detect or flag this as suspicious, even though it clearly exceeded normal customer activity patterns.

2. High-Risk Transaction Patterns Ignored

In another case, a customer with an annual income of ~Rs. 35,60,000 received ~Rs.1,06,80,000 across eight payments in one day. Again, no alerts, escalations or reviews were triggered, revealing major gaps in AML monitoring tools and processes.

3. Lack of Enhanced Due Diligence (EDD) for High-Risk Customers

The bank did not apply Enhanced Due Diligence (EDD) or appropriately monitor high-risk customers. Its systems failed to analyze transaction velocity, volume.

Lessons learned?

1. Regulatory Fine of Rs. 69.3 lakhs

The UK Financial Conduct Authority (FCA) imposed a Rs, 69.3 Lakhs fine, penalizing HSBC for failing to maintain robust AML and KYC controls.

2. Weak KYC and AML Controls Allow illegal Transactions to Slip Through

The case showed how ineffective onboarding, poor verification, and outdated monitoring systems can create opportunities for money laundering and financial crime.

3. Importance of Continuous Monitoring

This incident shows that compliance is not a one-time task. Banks must continuously monitor customer behavior, detect red flags, and escalate suspicious activity immediately.

Key Takeaways Connected to the 7 KYC & AML Objectives

1. Failure to Verify and Authenticate Customer Identity

2. Failure to Assess Customer Risk Profiles Accurately

3. Failure in Transaction Monitoring and AML Surveillance

4. Failure to Detect and Report Suspicious Transactions

This case shows how weak KYC verification, poor AML monitoring, and lack of due diligence can result in significant financial penalties and reputational damage. It highlights the critical importance of risk profiling, transaction monitoring, and continuous compliance in preventing money laundering activities.

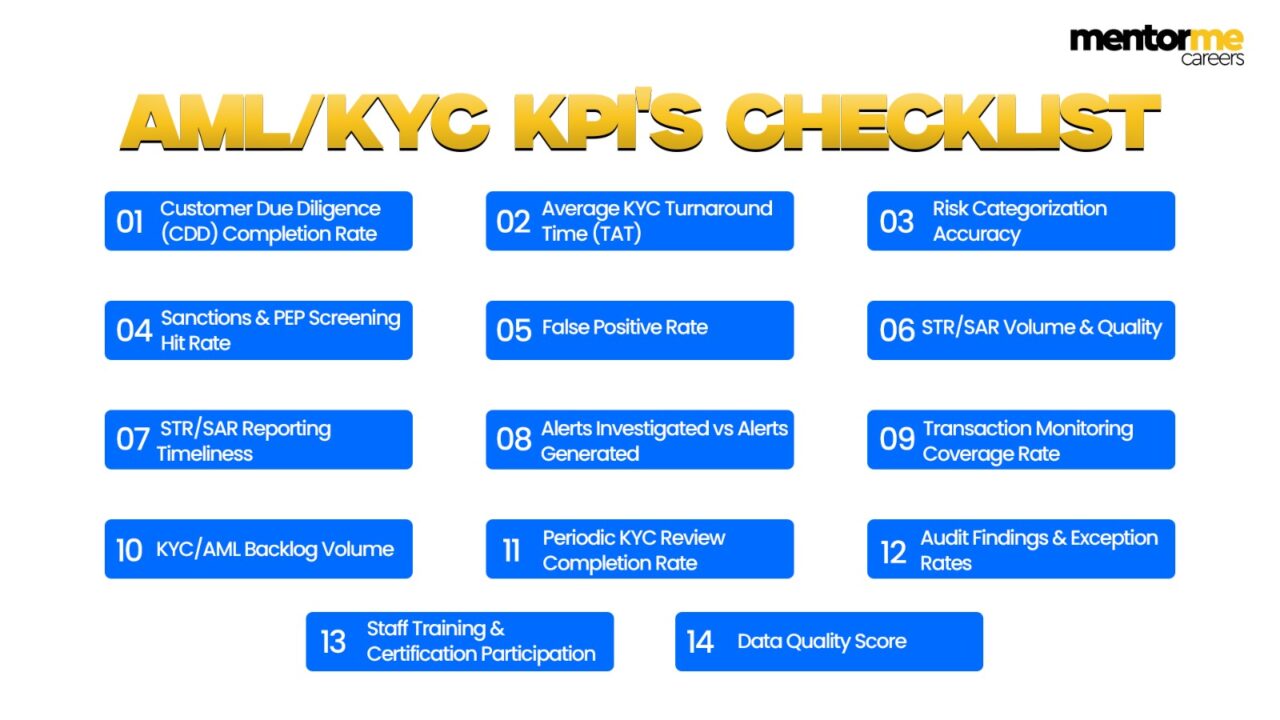

List of KPI’s to show AML/KYC program is effective

1. Customer Due Diligence (CDD) Completion Rate

Measures the percentage of customers whose KYC onboarding is fully completed and verified.

Higher rate = better compliance discipline and onboarding accuracy.

Formula:

CDD Completion Rate = (Completed CDD Profiles ÷ Total Customers Onboarded) × 100

Why It Matters:

Shows how effectively the institution verifies customer identity and documentation. Low CDD compliance increases onboarding risk, fraud exposure, and regulatory penalties. 95–100% for regulated institutions and 100% required for high-risk customers.

2. Average KYC Turnaround Time (TAT)

Tracks how long it takes to complete customer verification from start to finish.

Low TAT = efficient processes without compromising compliance.

Formula:

TAT = Total Time Taken to Complete KYC ÷ Number of Customers Processed

Why It Matters:

Shorter KYC TAT improves customer experience and operational efficiency, while still maintaining compliance accuracy. Digital KYC: 2–5 minutes, video KYC: 5–12 minutes, manual KYC: Within 24–48 hours

3. Percentage of High-Risk Customers Identified Correctly

Evaluates how effectively the system flags customers who fall into high-risk categories (PEPs, high-risk geographies, unusual occupations).

Shows the accuracy of risk profiling models.

Formula:

High-Risk Identification Rate = (Correctly Flagged High-Risk Customers ÷ Actual High-Risk Customers Identified Later) × 100

Why It Matters:

Shows the accuracy of your risk-scoring engine and how well you detect PEPs, risky geographies, suspicious occupations, and business categories.

85–95% accuracy with strong risk models

4. Sanctions & PEP Screening Hit Rate

Measures how many potential matches appear during sanctions screening, PEP screening, or adverse media checks.

A healthy hit rate indicates proper screening rules and controls.

Formula:

Screening Hit Rate = (Number of Screening Hits ÷ Total Customers Screened) × 100

Why It Matters:

Indicates whether your screening filters are calibrated correctly. Too few hits = weak filtering; too many = poor configuration and high false positives. Varies by region, but 0.1–2% hits is typical. Mid–high hit rate shows robust screening rules

5. False Positive Rate in Screening

Shows how many alerts are incorrectly flagged as suspicious.

Low false positives = efficient AML screening + reduced compliance workload.

Formula:

False Positive Rate = (False Alerts ÷ Total Screening Alerts) × 100

< 2–5% in optimized systems

> 15% indicates poor tuning

Why It Matters:

High false positives waste analyst time, delay reviews, and cause alert backlogs. Low false positives mean efficient, accurate AML screening.

6. Suspicious Transaction Reporting (STR/SAR) Volume

Tracks the number of STRs/SARs filed during a period.

An effective AML program should detect and escalate genuine suspicious activity.

Formula:

STR/SAR Filing Volume = Number of STRs Filed in a Period

No fixed number depends on customer demographics

Focus is on quality, not quantity

Why It Matters:

A healthy STR/SAR filing pattern shows the institution can detect real suspicious activity and escalate accurately per regulatory mandates.

7. Time Taken to File STR/SAR Reports

Monitors the speed of investigation and reporting after a suspicious activity is identified.

Shorter time = strong internal alert-handling processes.

Formula:

STR Filing Time = Time from Suspicious Alert → STR Submission

1–3 days for critical STRs

Up to 7 days for medium-level alerts

Why It Matters:

Regulators expect fast reporting. Delays create compliance gaps and increase the risk of financial crimes continuing unchecked.

8. Alerts Investigated vs. Alerts Generated

Measures how many AML alerts generated by the system are actually reviewed by analysts.

High ratio = better monitoring and no backlog.

Formula:

Alert Clearance Rate = (Alerts Investigated ÷ Alerts Generated) × 100

95–100% clearance rate

Backlogs should be eliminated daily

Why It Matters:

Shows your AML operations efficiency. Low clearance rate indicates understaffing, outdated tools, or alert overload.

9. Transaction Monitoring Coverage Rate

Shows the percentage of total transactions that pass through AML monitoring engines.

Close to 100% = strong AML surveillance.

Formula:

Monitoring Coverage = (Transactions Monitored ÷ Total Transactions) × 100

99–100% coverage required for regulated entities

Why It Matters:

Ensures that no transaction bypasses AML controls. Low coverage exposes institutions to undetected laundering schemes.

10. Number of AML/KYC Backlog Cases

Tracks pending alerts, reviews, or KYC files.

Low backlog = healthy compliance operations.

Formula:

Backlog Volume = Total Pending Alerts + Pending KYC Files

0–2 days max backlog

Zero backlog for high-risk alerts

Why It Matters:

Backlogs indicate operational inefficiency, staffing issues, or tuning problems. Persistent backlogs increase regulatory and reputational risk.

An effective AML/KYC program is measured using KPIs such as CDD completion rate, screening accuracy, STR filing efficiency, monitoring coverage, risk profiling accuracy, backlog levels, audit findings, and staff training participation. These KPIs ensure that compliance teams detect risks early, maintain up-to-date customer data, reduce false positives, and protect the financial system from money laundering and fraud.

Conclusion

Effective KYC and AML procedures are no longer just regulatory requirements, they are essential safeguards that protect financial institutions from fraud, money laundering, identity theft, and terrorist financing. By understanding the core objectives, following well-structured practical steps, and tracking the right KPIs, organizations can build a compliance framework that is proactive, reliable, and resilient.

The real-world case study, like the HSBC UK incident, proves how costly and damaging weak KYC and AML controls can be. When businesses invest in strong verification systems, continuous monitoring, accurate risk profiling, and timely reporting, they not only meet compliance guidelines but also create a secure, transparent, and trustworthy financial ecosystem for their customers.

Want to become job ready in AML KYC?

Get hands-on training + case studies + mock interviews + placement assistance from Mentor Me Careers.

FAQ

The main objectives are to prevent money laundering and terrorist financing, verify customer identity, assess customer risk, monitor transactions for suspicious activity.

They make sure banks do not become a way for illegal money movement, help meet regulatory obligations, reduce penalties, safeguard reputation and build safer customer relationships.

KYC involves identifying and verifying customers, evaluating their risk profile, performing due diligence, and monitoring their activity throughout the business relationship.

KYC is the identity and verification part of compliance, while AML is the framework that includes KYC, transaction monitoring, suspicious activity reporting, risk assessment, and internal controls which businesses maintain the control.

AML procedures target:

1.Placement : introducing illegal funds into the system

2.Layering: assessing the money trail

3.Integration: reintroducing funds as legitimate income

CDD is the process of collecting customer information, verifying it, understanding their financial behavior, and assigning a risk rating to determine monitoring levels.

EDD is required for high-risk customers, including politically exposed persons (PEPs), cross-border transactions, unusual patterns or customers from high-risk jurisdictions.

KYC is updated on a risk-based schedule:

1.High-risk customers: more frequent reviews

2.Moderate-risk: periodic reviews

3.Low-risk: less frequent or event-driven updates

Related Articles

- AML KYC interview questions

- AML analyst career path

- What is AML in banking?

- AML KYC certification

- What is CFT under AML KYC regulations