Last updated on January 19th, 2026 at 12:49 pm

So, how do you actually become an investment banker in India?Investment Banking is one of the most prestigious and high-paying career paths in the finance world. With India’s economy expanding and global financial institutions deepening their presence, the demand for skilled investment bankers is growing rapidly. But for many students and professionals, the journey into investment banking seems mysterious filled with jargon, elite qualifications, and intense competition.

Whether you’re a commerce student planning your career or a working professional thinking of switching tracks, this guide will walk you through every step from the subjects you should study after Class 12, to the degrees, certifications, skills, and networking strategies you’ll need to break into the industry. We’ll also cover internship tips, salary expectations, job roles, and what top employers are really looking for. You can read more about Investment banking roles and career path

And if you’re feeling overwhelmed by all the technical skills and the competitive landscape don’t worry. There are focused programs, like the Investment Banking Certification by Mentor Me Careers, that offer structured training and even placement assistance to help you stand out.

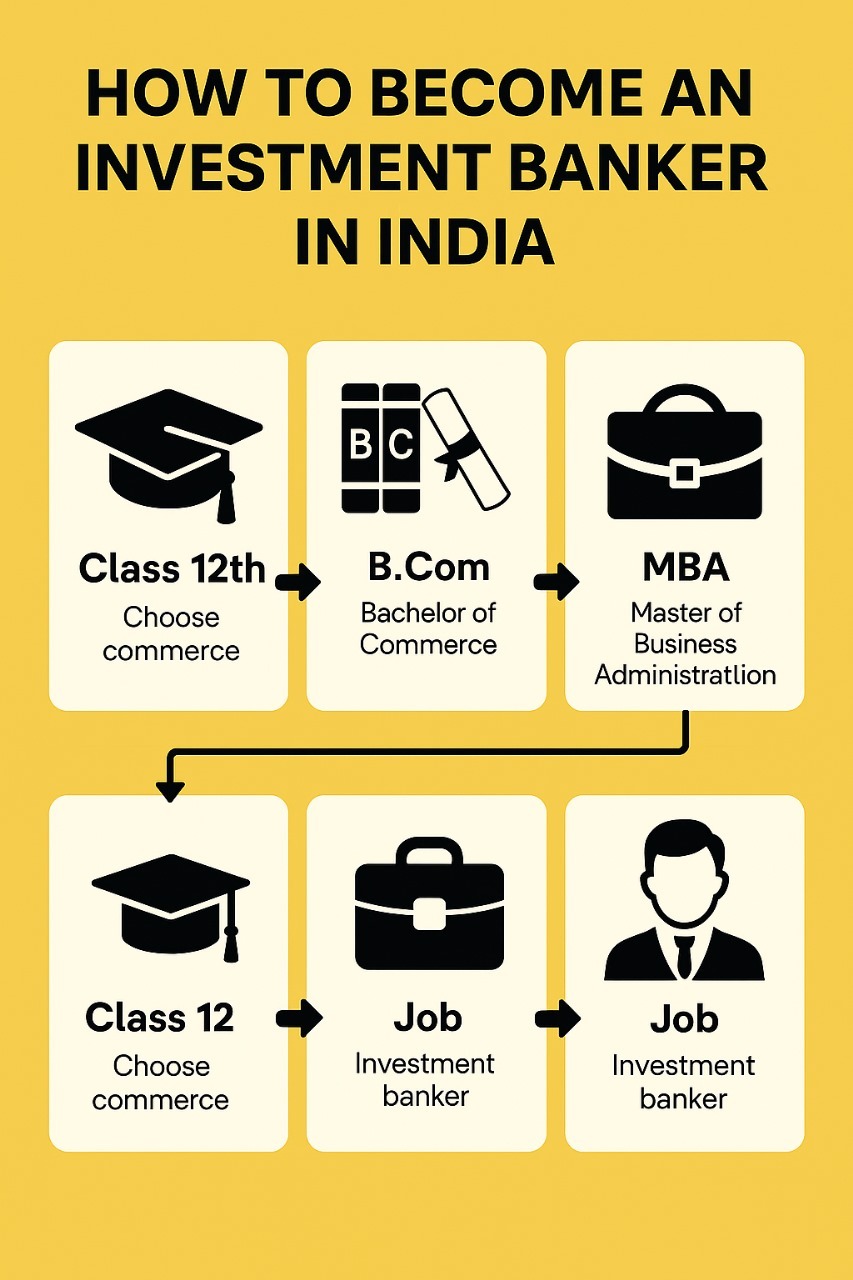

How to become investment banker in India

I will give you exact routes on how to become an investment banker in India, whether you have just completed senior high school, graduate or post graduate.

How to become investment banker in India after Class XII

If you’re asking, “Can I become an investment banker after 12th?” the answer is yes, but it requires smart planning from the start. Your journey begins with selecting the right stream and preparing for the entrance exams that will shape your academic path.

Best Stream After 12th for Investment Banking in India

While investment banking is open to graduates from various fields, choosing the Commerce stream after Class 10 is the most aligned with this career. Subjects like Economics, Accountancy, Mathematics, and Business Studies build a strong foundation in financial concepts.

However, Science and Arts students can also pursue investment banking with the right degrees and certifications later on. What’s important is developing core competencies in finance, data analysis, and business strategy all of which can be learned through structured education and upskilling.

Key Entrance Exams to Prepare For

To enter top colleges and finance-focused programs, here are the key entrance exams you may need:

CUET (Common University Entrance Test): Required for admission to many central universities for B.Com, BBA, and BA Economics.

IPMAT: For five-year integrated management programs at IIM Indore and IIM Rohtak a great early path toward IB.

CET (Common Entrance Test): For state-level business and commerce colleges.

CAT, SNAP, XAT: These are MBA entrance exams to plan for after graduation if you’re aiming for IIMs or top B-schools common route into investment banking in India.

Choosing the right stream and preparing early for entrance exams sets the stage for a successful finance career. If you’re unsure where to begin, structured guidance like that from Mentor Me Careers can help you map your roadmap from Class 12 to a top IB role.

How to Become Investment Banker in India After Graduation?

After completing your 12th grade, choosing the right bachelor’s degree is a crucial step toward becoming an investment banker in India. While investment banking firms hire from various academic backgrounds, certain degrees provide a stronger foundation in finance, economics, and business.

Top Bachelor’s Degrees for Investment Banking

- B.Com (Bachelor of Commerce):

A popular and affordable choice, B.Com covers accounting, taxation, economics, and business law all essential for a finance career. Consider pairing it with certifications like CFA or financial modeling courses to stand out. - BBA (Bachelor of Business Administration):

Ideal for those who want an early introduction to business management, finance, and marketing. Many BBA programs now include internships and case studies, which can help with investment banking exposure. - BA in Economics:

A great option for students who enjoy data analysis and macroeconomic thinking. Economics majors are often hired for roles in equity research and financial planning. - CA (Chartered Accountancy):

Although not a degree, many investment bankers in India come from a CA background. CA pass-outs with exposure to mergers, valuations, and auditing often transition well into IB roles.

How to Become Investment Banker in India After Engineering (Especially from IITs/NITs):

Many investment banks actively recruit engineering graduates from top institutes like IITs and NITs, especially those who later pursue an MBA in Finance. Analytical thinking and problem-solving skills make engineers highly adaptable to IB roles.

Top Colleges in India That Open Doors to Investment Banking

- Shri Ram College of Commerce (SRCC), Delhi University

- St. Xavier’s College, Mumbai

- NMIMS, Mumbai

- Christ University, Bangalore

- IITs & NITs (for engineers targeting MBA+IB)

- IIM-Indore & IIM-Rohtak (via IPM programs)

CA Institutes and Top Commerce Colleges

Whichever degree you choose, supplementing your education with practical finance skills such as Excel, valuation, and financial modeling is key. Programs like Mentor Me Careers’ Investment Banking Course can bridge the gap between theory and the real-world skills investment banks demand.

How to Become Investment Banker After Post Graduation

While it’s possible to enter investment banking with just a bachelor’s degree, pursuing a Postgraduate Program in Finance, especially an MBA or PGDM, significantly boosts your chances of landing top roles at leading investment banks.

Why an MBA/PGDM is Valuable for Investment Banking

An MBA in Finance from a reputed institute not only provides advanced knowledge in valuation, corporate finance, and M&A but also connects you with alumni networks and top recruiters. Most investment banks in India hire Analysts and Associates directly from IIMs and top B-schools during campus placements.

For those who don’t pursue a full-time MBA, PGDM programs or executive finance diplomas can also serve as viable alternatives. Additionally, pairing a PGDM with a specialized course like Mentor Me Careers’ Investment Banking Certification can make your profile placement-ready.

Recommended-Certifications & Specialised Training

To succeed in the competitive world of investment banking in India, having the right certifications alongside your degree can set you apart. While academic qualifications lay the foundation, specialized training equips you with practical skills investment banks actively seek.

Top Professional qualifications for Investment Banking Career in India

CFA (Chartered Financial Analyst):

Highly regarded worldwide, the CFA program focuses on investment analysis, portfolio management, and ethical standards. It’s especially valuable for roles in equity research, M&A, and asset management. Even completing Level 1 gives you a strong edge when applying for analyst roles. Read More about CFA

CA (Chartered Accountant):Can a CA become an investment banker?

Chartered Accountants have a deep understanding of financial reporting, auditing, and taxation. Many CAs transition into investment banking, especially in roles like due diligence, valuations, and corporate finance advisory. If you’re a CA looking to break into IB, pairing it with an IB course can help bridge practical gaps.

FRM (Financial Risk Manager):

Offered by GARP, FRM is ideal for those aiming to specialize in risk management, credit analysis, or structured finance within investment banks. While less common than CFA, it’s valuable in risk-heavy roles.

| Professional Qualification | Duration | Focus Area | Financial Modeling Training | Placement Edge |

| CFA | 1.5–4 years (3 levels) | Investment analysis, portfolio management | Basic (self-learned, not hands-on) | Globally recognized; useful for equity & research roles |

| CA | 4–5 years | Accounting, auditing, taxation | Minimal (focus is on audit & compliance) | Strong for valuations, M&A, corporate finance |

| FRM | 1–2 years (2 parts) | Risk management, credit, market risk | Not covered | Best for careers in risk management, credit analysis |

| CIBOP by Mentor Me Careers | 2–3 months (flexible) | Practical investment banking skills | Hands-on financial modeling with Excel, DCF, M&A | Includes resume prep, interview training, and placement support |

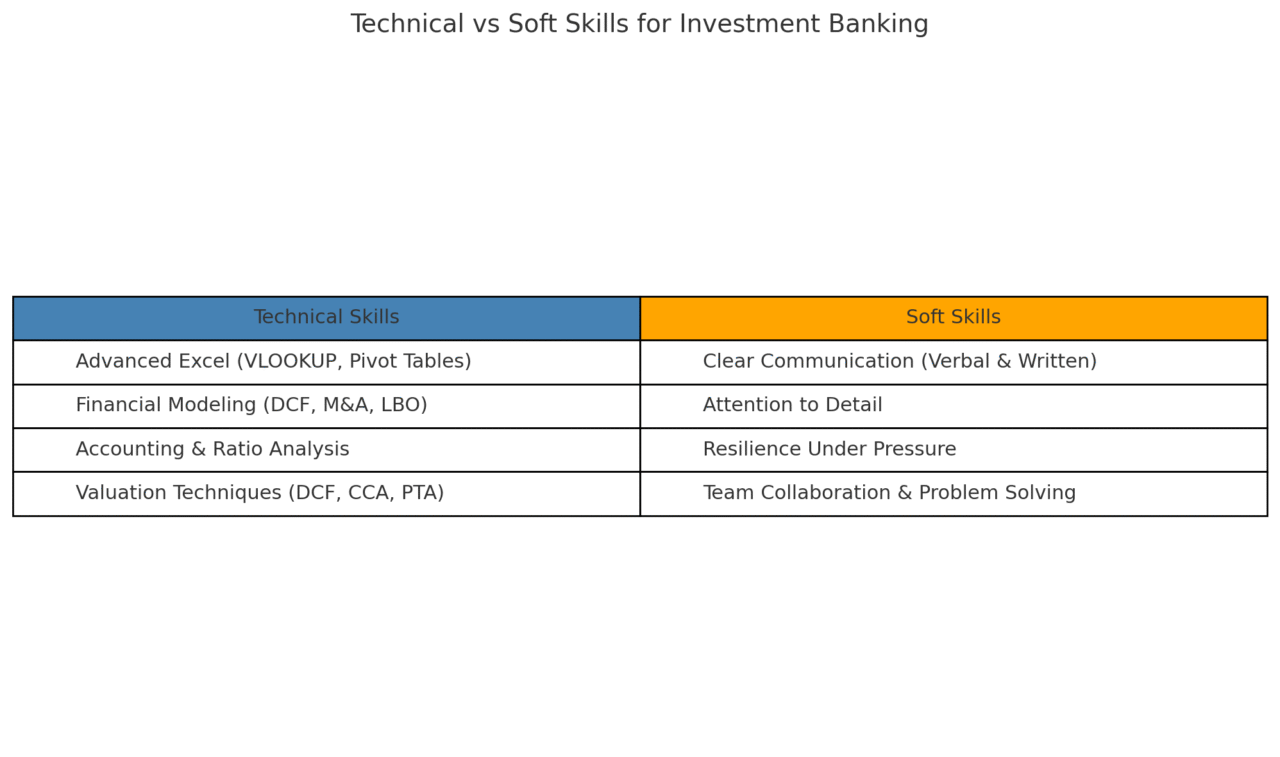

Key Skills for Becoming an Investment Banker in India

Investment banking is a fast-paced, high-stakes profession that demands a combination of sharp technical knowledge and polished interpersonal abilities. Whether you’re applying for an analyst role or preparing for an internship, building the right skill set is crucial for success in the field.

Mastering these core finance skills will make your profile stand out:

- Financial Modeling in Excel: The ability to build 3-statement models, DCFs (Discounted Cash Flow), and M&A models is fundamental. Recruiters expect strong Excel proficiency and hands-on modeling experience.

- Accounting & Financial Statement Analysis: Understanding income statements, balance sheets, and cash flow statements is essential for evaluating businesses.

- Valuation Techniques: Knowing how to apply DCF, Comparable Company Analysis (CCA), and Precedent Transaction methods is key to analyzing investment opportunities.

- MS Excel Shortcuts & Tools: Excel is the language of investment banking. Efficiency with formulas, pivot tables, and scenario analysis can set you apart.

- PowerPoint/Presentation Skills: Bankers often present reports to clients and management; clean, impactful decks are a valuable asset.

- Soft Skills Investment Bankers Need

- Communication: Explaining complex financial insights in simple terms is a daily requirement. Both written and verbal communication matter.

- Attention to Detail: Even a minor error in a model or presentation can be costly. Precision is critical.

- Resilience & Stress Management: Long hours and tight deadlines are common. The ability to handle pressure gracefully is a must.

- Team Collaboration: Investment banking is highly team-oriented. Working well across departments (legal, compliance, research) is essential.

- Problem-Solving & Critical Thinking: IB professionals are expected to analyze large volumes of data and develop actionable recommendations quickly.

Additional Recommendations : Internships & Networking

Breaking into investment banking isn’t just about degrees and certifications real-world experience and professional connections make a major difference. Internships and strategic networking can dramatically increase your chances of landing full-time IB roles in India.

Why Internships Matter in Investment Banking

Internships are often the first step into the IB world. They give you hands-on exposure to financial modeling, pitchbooks, research tasks, and client interactions. Most major investment banks in India like Goldman Sachs, JP Morgan, and ICICI Securities use summer internships as pipelines for full-time analyst positions.

Internship Tips for Investment Banking Aspirants

- Start Early: Apply in your second or third year of graduation, especially for summer analyst programs.

- Build Your Profile: Learn financial modeling, Excel, and valuation through online courses or certifications.

- Target Boutique Firms: Smaller investment banks and advisory firms offer more hands-on exposure and are often more open to beginners.

- Tailor Your Resume: Highlight finance projects, certifications (like CIBOP), and Excel skills clearly.

- Be Interview-Ready: Expect technical interview questions (e.g. DCF, EBITDA) and behavioral questions (teamwork, pressure handling).

- Follow Up: After applying, send polite LinkedIn messages to analysts or HR for visibility.

Networking Tips to Land Investment Banking Roles

- Use LinkedIn Strategically: Connect with alumni, analysts, and associates in IB roles. Send short, respectful messages requesting advice or insights.

- Attend Finance Events & Webinars: Join CFA Society events, financial conferences, or placement cell webinars focused on IB careers.

- Join Finance Clubs: If you’re a student, be active in finance or investment clubs these often lead to referrals and internship leads.

- Give Value First: When networking, avoid asking for jobs immediately. Instead, ask thoughtful questions, share your learning journey, or comment on industry insights.

- Stay Consistent: Set weekly networking goals (e.g., 3 new contacts, 1 informational chat) to stay on track.

Top Employers in India for Investment Banking

India’s investment banking sector is growing rapidly, with both global giants and homegrown firms hiring aggressively for analyst and associate roles. Whether you’re aiming to work in M&A, equity research, or capital markets, it helps to know which firms lead the pack.

| Company Name | Location(s) | Average CTC (Entry Level) | Common Entry Roles |

| Goldman Sachs | Bangalore, Mumbai | ₹18–25 LPA | Analyst, Summer Analyst |

| JP Morgan Chase | Mumbai, Bangalore | ₹14–22 LPA | Investment Banking Analyst |

| Morgan Stanley | Mumbai | ₹16–24 LPA | Analyst, Associate |

| Citi (Citigroup) | Mumbai | ₹14–20 LPA | Analyst, Capital Markets Analyst |

| ICICI Securities | Mumbai, Delhi | ₹10–16 LPA | Analyst, Equity Research |

| Kotak Investment Bank | Mumbai, Hyderabad | ₹12–18 LPA | Analyst, Corporate Finance |

| Avendus Capital | Mumbai, Bangalore | ₹12–20 LPA | Analyst, M&A Associate |

| Axis Capital | Mumbai | ₹10–15 LPA | Analyst, Deal Execution Team |

| Spark Capital | Chennai, Mumbai | ₹10–14 LPA | Analyst, Junior Associate |

| Unitus Capital | Bangalore | ₹9–13 LPA | Impact Investment Analyst |

Common Job Roles in Investment Banking

- Investment Banking Analyst – Entry-level role focusing on financial modeling, research, and pitchbooks.

- Associate – Manages transactions, leads junior teams, and interfaces with clients.

- Equity Research Analyst – Analyzes stock performance and publishes investment reports.

- Capital Markets Analyst – Works on IPOs, debt instruments, and market intelligence.

- M&A Analyst – Specialises in mergers, acquisitions, and corporate restructuring deals.

FAQ

Yes. Many investment bankers start with a B.Com or BBA, followed by an MBA or specialised certifications like CFA or a financial modeling course.

No, it’s not mandatory, but the CFA charter is highly valued. It boosts your credibility in finance and can improve your chances of landing IB interviews.

Absolutely. Many investment bankers have engineering degrees, especially from IITs. An MBA in finance or certification in financial modeling helps bridge the gap.

Not always. You can enter via internships, analyst programs, or certifications like the one offered by Mentor Me Careers. However, an MBA from a top-tier institute can accelerate your path.

Key skills include financial modeling, Excel, valuation techniques, accounting, communication, and networking.

Entry-level analysts earn ₹10–15 LPA, mid-level associates ₹20–35 LPA, and senior VPs or MDs can earn ₹50L+ annually, including bonuses. You can read more about investment banking salaries here

Apply early through campus placements, LinkedIn, and networking. Having basic finance knowledge and Excel skills helps. Some training programs include internship assistance.

Top options include CFA, CA, FRM, and specialized investment banking courses like the one by Mentor Me Careers, which includes practical training and placement support.

Goldman Sachs, JP Morgan, Morgan Stanley, ICICI Securities, Kotak Investment Banking, and Avendus Capital are among the top recruiters.

Yes, it can be demanding with long hours and tight deadlines, but it’s also high-paying and prestigious. Proper training and time management help.

Related Articles

- Investment banking interview preparation

- Investment Banker Salary in India

- Investment Banking Roles in India

- Interview Guide for Investment Banking