Last updated on January 22nd, 2026 at 12:29 pm

If you are confused about whether to do financial Modeling or CFA? Or maybe you are confused if MBA is going to be enough. Then I am going to put these confusions to rest today in this article and explain you exactly how to become a financial analyst in India.

A strong piece of advice is to read the entire article since half knowledge about this can be even more dangerous.

Who is a Financial Analyst?

So, let me be honest with you that I can’t answer that. Lol! Now, the reason why I say that is because the term financial analyst is like saying who a manager is.

Hence, the obvious question that anyone would ask after a person says that I am a manager. Similarly, with financial analysts, the question to ask is, “What do you analyse in Finance”.

- Budget- Do you analyze the budgets of companies?

- Valuation- Do you analyze the financial statements of companies?

- Operations- Do you analyze financial operational regulation?

- Risk- Do you analyze the financial risk status of a company?

So, to conclude, a financial analyst is a generic designation given to a person with different functions related to finance. However, they are responsible for evaluating, recommending, or researching data.

What Does a Financial Analyst Do?

A financial analyst analyzes financial data and turns it into insights that support decisions.

Core responsibilities include:

Analyzing financial statements (income statement, balance sheet, cash flow)

Building financial models and forecasts in Excel

Evaluating investments, projects, or business performance

Preparing reports, dashboards, and presentations for managers or clients

Tracking market, industry, and company trends

In simple terms, a financial analyst answers: Is this decision financially sound?

Types of financial analyst in India

| Role Type | Where They Work | What They Focus On |

| Corporate Financial Analyst | Large companies, MNCs | Budgeting, forecasting, business performance |

| Equity Research Analyst | Brokerages, AMCs, PMS | Company valuation, stock research |

| Investment Banking / Deal Analyst | Banks, PE/VC support | Valuation, M&A analysis |

| FP&A Analyst | Corporates, startups | Financial planning, MIS, variance analysis |

| Risk / Credit Analyst | Banks, NBFCs | Credit risk, loan analysis |

| KPO / Offshore Analyst | Global firms’ India offices | Modeling, reporting, analytics support |

How to become a financial analyst in India?

Let me continue with the same thought,” What do you analyse?”

So, based on your interest, you can have the following career paths and that’s the first step on how to become a financial analyst in India. Following are the roles that you can get into.

- Financial Planning & Analysis Analyst: I call this the investment banker of corporate finance. Also, the analysis doesn’t take place in investment banks but even in the company themselves. A typical job role of an FP&A analyst is to;

- Set budgets for various projects. Set metrics to measure the performance

- Monitor and report performance

- Financial Analyst- Equity Research: So, if you start your career in a stock broking firm researching various stocks, then you would be called an Equity research analyst.

- Financial Analyst- Reconciliation( IB Operations): The analysis is not on stocks but on the process. A typical investment banking firm has to reconcile various trades taken by the company, ensuring that the trade was taken as per plan.

- Financial Analyst- Accounting: Yes, a financial analyst can be present in accounting too. For eg., an analyst who analyses and creates reporting sheets in compliance with LCR, LCD etc.

Financial analyst Roadmap

Being a financial analyst in India might be a little difficult than it looks. Even if candidates have the qualification some still struggle to get a job in finance, also financial analyst is the entry level job in finance. Let’s assume you just have passed your 12th, taking up a degree which is in finance makes 100% sense but if you have passed bachelor’s in non-finance related background. Let’s talk! now that you have passed your bachelor’s its always going to master’s degree. There are two roads after this, take the essential skills needed to get the job opt for internships or take up MBA. Taking up MBA is actually a very relevant decision at this point because companies will ask you your motivation to enter into finance. Companies need a relevant enough answer for the questions.

Roadmap 1:

Taking a gap year to study everything you can about finance, this includes studying for finance qualification like CFA for analyst and CPA, ACCA for accounting you choose. These qualifications need 6-8 month of preparation and also cost money which is equal to a master’s degree. The basic skills and certification you should opt for are Excel and Microsoft office, learn how to make financial models. Make sure to have practical + theory knowledge. Even if you pass the qualifications if you don’t understand practical aspect of finance, you won’t land a job.

Roadmap 2:

Choosing MBA in finance will be the 2nd road. Tier 1 and Tier 2 MBA colleges will give you enough openings for finance if not in core finance but definitely for internships. Colleges does help in this aspect. Get relevant experience in finance let it even be accounting. After 6-9month of internship experience make sure to have some certifications of skills needed in finance world which i did mentioned earlier. With a good experience of internship you will get entry level finance job.

Step-by-Step Roadmap to Become a Financial Analyst in India

1: Build strong basics

Learn accounting, finance fundamentals, and Excel.

2: Learn financial modeling

Practice building simple 3-statement models and forecasts.

3: Do portfolio projects

Create models and reports using real company data.

4: Gain practical exposure

Apply for internships, live projects, or entry-level analyst roles.

5: Add credentials (optional but helpful)

CFA Level 1, FMVA, or short-term finance certifications.

6: Apply smartly

Target roles like junior analyst, research associate, FP&A analyst, or KPO analyst.

Financial Analyst Qualifications: To become a financial analyst in India

So, what exactly do these jobs require in terms of qualifications? Firstly, I need to point out that qualifications matter and don’t matter simultaneously.

Now, let me explain that! So, where does qualification help

- Firstly, in shortlisting resumes because recruiters use it as a probable filter

- Secondly, it can make life easier when understanding.

However, let me also point out how qualifications don’t help

- Firstly, after shortlisting qualifications, leverage drops, and what you can do matters more.

- Secondly, too many qualifications are a two-edged sword. Unnecessary qualifications and certifications can implicate that you are unsure about yourself.

Given the above points in mind, now let me segregate the qualifications as per the roles.

Qualifications by Job category:

- FP&A :

- Advantage: CA/CPA/CFA would be ideal for entering this field

- Minimum: Qualification no bar

- Financial Analyst- Equity Research

- Advantage: CFA or MBA tier 1

- Minimum: Qualification no bar

- Financial Analyst- Reconciliation(IB Operations

- Advantage: Any commerce qualification

- Financial Analyst- Accounting:

- Advantage: ACCA/CPA/CA

- Minimum: Commerce

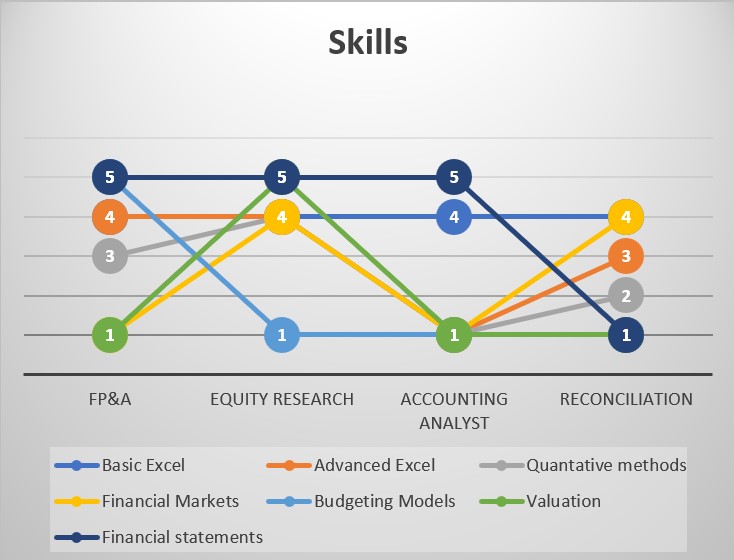

Skills required for becoming a financial analyst in India

Now, unlike qualifications, skills are non-negotiable in these jobs. This is why you can get by having a sub-standard degree, but you can’t get away from proving your skills. Any financial analyst jobs after the initial shortlisting will include a written or case-based test. So, if you have a relevant qualification but can’t crack the case, then it’s curtains down.

Having said that, let me know, and list the skills which are recommended.

Excel

Microsoft Excel is a powerful spreadsheet application used to store, organize and analyze data using cells, formulas and functions. Widely used in business, finance and analytics, Excel enables tasks from simple budgeting to complex financial modelling, pivot-table reporting and data visualization making it a core tool for decision-making. Because of its flexibility and ubiquity, Excel is essential in finance, accounting, operations, marketing and data analytics. Employers in India and worldwide look for Excel skills especially formula fluency, pivot-table mastery and basic VBA/macros as these directly improve productivity and enable data-driven decisions.

Common uses (who uses Excel and why)

- Finance & Accounting: budgets, P&L, cashflow, valuations, modelling.

- Data Analysis: cleaning, joining and summarising data sets.

- Reporting & Dashboards: KPI tracking and monthly management reports.

- Operations & Inventory: tracking stock, orders and logistics.

- Sales & Marketing: lead lists, campaign performance, ROI calculations.

- Personal Productivity: expense trackers, timetables, checklists.

Financial Statements

Financial statements are formal records that summarize a company’s financial performance and position typically the Balance Sheet, Income Statement (Profit & Loss), Cash Flow Statement, and Statement of Changes in Equity, plus.

Who uses financial statements and why?

- Investors & analysts: Assess profitability, growth and valuation.

- Lenders & banks: Evaluate creditworthiness and repayment capacity.

- Management: Make operational and strategic decisions.

- Regulators & tax authorities: Ensure compliance and calculate taxes.

- Employees & suppliers: Gauge company stability.

Quantitative Finance calculations

Quantitative finance calculations refer to the set of mathematical, statistical and computational procedures finance professionals use to model markets, price securities, assess risk and make data-driven trading or investment decisions. These calculations translate economic assumptions and market inputs (prices, volatilities, rates) into numeric outputs such as fair values, risk exposures, hedging parameters, and optimal asset allocations. They are central to trading, risk management, portfolio construction, derivatives pricing, and credit modelling.

Where these calculations are used (real-world roles)

- Buy-side: portfolio managers, quant analysts, risk managers.

- Sell-side: derivatives traders, structurers, quant researchers.

- Banks & FinTechs: credit modelling, risk capital, algorithmic trading.

- Corporate finance: valuation, treasury risk management, project appraisal.

Reddit post

Best thing to set yourself up for a finance job postgraduate is an internship and pertinent skills.

Finance internship recruiting for this summer is pretty much over for most big companies. You might be able to network yourself or get lucky with a small gig internship but that’s going to be tough.

I would say work on building your core finance skills (i.e. understanding fundamental financial concepts, Excel, etc) and try to get a finance related position within a business (preferred) or non-business (still okay) club or organization. Kudos if you’re already in the club/organization as the coveted positions go to those who have a longer tenure.

The kind of titles you’re shooting for are VP of Finance, Treasurer, or any position where you might be working with numbers (fundraising, event coordination/budgeting)

From there, apply to a metric fuck ton of internships. (Make sure you build a well rounded resume) And by that I mean spend at least an hour applying to jobs everyday and take every interview as if it were the last interview you’ll ever have. Record your interviews and look back on how you can improve yourself for next time.

After that, it’s just a waiting game. In the meantime after you apply, you can try networking with people who have internships you want to get their experience on LinkedIn and putting yourself out there.

Also GPA is very important, esp when you’re applying for your first internship so make sure you prioritize that as well. Since your experience is limited, the rest of your resume will speak for you.

Overall, you’re not in the worst scenario since you caught yourself early, just grind these next 2 years out and you’ll be fine postgrad. Hope this helps.

Portfolio Projects You Must Build

To stand out without experience, build visible proof of skills:

Financial analysis of a listed Indian company

3-statement financial model with assumptions

Budget vs actual analysis (FP&A style)

Investment comparison of two companies

Simple valuation (DCF + comparables)

Upload projects on Google Drive or GitHub and link them on your resume and LinkedIn.

Financial analyst salary in India for freshers

| Level | Typical Salary Range |

| Entry-level / Fresher | ₹4–7 LPA |

| 2–4 years experience | ₹7–12 LPA |

| 5+ years experience | ₹12–20 LPA+ |

Firstly, let me explain what I mean by these tiers.

- Tier 1 means companies that pay salaries more significant than 6 Lacs P.A for freshers

- Similarly, Tier 2 means companies that pay in the range of 4.5 but less than 6 LPA.

- Finally, Tier 3 companies are low paymasters ranging between 2.4 LPA to 3.5 LPA

Now let me show this to you with proof, which will put this question to rest.

As you can see, companies like Tres vista have premium clients with premium needs and hence pay higher entry-level salaries. Mostly, the reason is, for obvious reasons, higher quality applicants.

On the other hand, eclerx can be a good start for a student who is improving his skill sets and employability but not the final destination.

Another point to note is that even Tier III companies may pay higher salaries for mid-level executives, exactly opposite to the trend at fresher levels.

Financial Analyst Jobs In India

Now, I’ll take you through the financial analyst jobs in India. Also, I’ll bifurcate according to the career paths, which are, FP&A, Equity Research, Accounting & Operations -Investment banking.

Equity Research:

Company: Sutherland

Job Description

Sutherland is seeking a passionate and self-motivated person to join us as a Professional – Equity Research. We are a group of driven and hard-working individuals. If you are looking to build a fulfilling career and are confident you have the skills and experience to help us succeed, we want to work with you! Professionals in this role get to: Be the Expert: join dedicated client teams providing valuable ideas, penetrating insights, and sector-focused analysis. Build, value and update the company’s financial models using both absolute (Discounting Cash Flow) and relative models. Analyze financial information to produce forecasts of business, industry, and economic conditions for use in making investment decisions. Formulate the research framework to analyze industries and companies in consultation with clients and project managers. Impact the Bottom Line: Carry out industry/company research and prepare reports outlining the investment recommendation. Write in detail Initiating.

Qualifications

Analyze financial information to produce forecasts of business, industry, and economic conditions for investment decisions. Formulate the research framework to analyze industries and companies in consultation with clients and project managers. Impact the Bottom Line: Carry out industry/company research and prepare reports outlining the investment recommendation. Write in detail Initiating.

JP Morgan Global Commodities Research

Analyst

J.P. Morgan’s Global Research Center (GRC) was set up in Mumbai in August 2003 as an extension of the firm’s global equity research teams worldwide. GRC has grown steadily, and the team of analysts has expanded to provide coverage for the key sectors globally. Besides working with J.P. Morgan’s equity research teams, GRC Analysts are now engaged with other areas of public side research, including fixed-income research, strategy, derivatives, commodities, quant and indices.

To support the continuing growth of the Global Research Center, we are seeking to hire a Junior Commodity Analyst. This Analyst will be aligned with J.P Morgan’s Global Commodity Research Team and will work with colleagues in the UK and USA, on markets including agriculture, biofuels and carbon but with opportunities to expand into other areas of commodity coverage.

The Junior Analyst’s Main Responsibilities Will Include

- Gathering and analysing data from various sources, including Bloomberg, government and company reports, the internet, online databases, market consultancies, weather bureaus and J.P. Morgan proprietary content. Summarizing conclusions from data analysis for research colleagues will be critical to this role.

- Building, maintaining and analysing models of commodity markets; generating regular and one-off reports, graphs and datasets from these models using a standard JPMorgan model format.

- Updating text, tables, and charts in presentations, as well as writing research for reports covering market developments and prospects.

- Maintaining regular contact with colleagues in the global research team, taking part in conference calls and responding to project requests (often client-generated). Establishing a collaborative, team-focused approach is critical to the role’s success.

Essential Skills

- Keen interest in agricultural, commodity and financial markets

- Strong quantitative, statistical and coding/VBA skills

- Analytical aptitude and ability to learn commodity and financial market concepts

- Good knowledge of Excel, use of the internet and standard Office suite

- Good communication and team skills in a multi-location set-up

- Close attention to detail and ability to work to very high standards

- A strong motivation to learn and manage projects independently

- Passion for and interest in commodity market analysis

Research Analyst- Equity Research- Mumbai – Indian Market (1-3 years)

A Research Analyst / Senior Research Analyst is responsible for executing research of a designated sector/geography for a leading sell-side research firm

- Build and update the company and industry models

- Create and maintain databases using data from different sources

- Work on regular research publications – earnings previews, reviews, event updates, flash notes etc.

- Contribute meaningful research ideas for thematic publications

- Carry out sector analysis and come up with investment themes /ideas

- Keep track of the latest developments in the companies under coverage and the sector and incorporate these into the research publications etc.

- Conduct independent company-specific, economic, or trend analysis

- Publish written articles and research reports that summarize analysis & findings

- Develop and publish own industry forecasts, subject to review by senior team member

- Write and publish analytical articles with minimal supervision and requiring little editing or input from senior team members

- Respond to client inquiries concerning designated coverage areas

- Deepen research skills to prepare investment thesis and generated differentiated research ideas

- Get an opportunity to travel onsite and work closely with the onshore team and understand/experience the investment decision-making process

What we are looking for?

- MBA (Finance) or Chartered Accountant with one to five years of prior experience

- Pursuing or clearing the CFA certification

- Prior experience in Equity Research is preferred but not mandatory

Financial Planning & Analysis Jobs in India

Job description-Qualification CA

- Coordinating variance analysis with BU finance controller.

- Margin variation analysis for BU-wise, customer-wise, and product-wise.

- Quarterly presentation to auditors for any variations.

- Reporting Monthly, Quarterly, and Annual Financial results and analysis, including preparing Flash reports and Variance commentary based on General Ledger Analysis.

- Adherence to Group Accounting policies and updating and maintaining SOP

- Automation and process improvement of legacy reports using BI

- Analyzing monthly, quarterly, and yearly SG&A expenses and comparing them with Plan, forecast, and PY.

- Responsibilities included but were not limited to detailed data collection, analyzing and modelling. Identifying key value drivers and deal breakers. Calculation of normalized EBIDTA, Working capital and cash flows. Revenue analysis, Contract reviews, and quality of earning accounting.

- Computing & reporting the Currency impact on Revenue & EBIDTA

Executive – Financial Planning and Analysis – IT

This role is for a leading MNC IT organization for their office in Bangalore.

Key Responsibilities

- Support plan and estimate processes for different teams covering financial modelling, revenue projections, reporting, engagement tracking and cost estimates and preparation of related presentations

- Evaluating engagement pricing and its implications on financials.

- Keeping track of estimated engagement position for large projects to avoid surprises on any overruns/premium adjustment

- Supporting the monthly Management Reporting to the leadership team and various other related analyses

- Providing business finance support in the areas of decision support, analysis, planning and reporting

Experience

- CA (1st or 2nd attempt) or MBA Finance (top colleges only)

- 1-2 years of relevant work experience in financial analysis, budgeting and planning

- Strong analytical skills, with an ability to navigate details

- Ability to operate effectively in a virtual team

Investment Banking Operations Job

Associate Investment Banking- Accenture

Roles And Responsibilities: Accenture Post Trade Processing (APTP)

In this role, you must solve routine problems, mainly through precedent and referral to general guidelines. Your expected interactions are within your team and direct supervisor. You will be provided detailed to a moderate level of instruction on daily work tasks and detailed instruction on new assignments and the decisions that you make that would impact your work. Will need to be well versed with basic statistics and terms involved in the day-to-day business and use them while discussing with stakeholders. Required to help in the overall team’s workload by managing your deliverables and assisting the team when needed. You will be an individual contributor as a part of a team with a predetermined focused scope of work. Please note this role may require you to work in rotational shifts.

Need more help? Contact us for personalized counselling!

Conclusion:

So, with all that information, its time to summarize. Firstly, becoming a financial analyst is not difficult if you know the absolute truth behind preparation. Secondly, qualifications are not necessary. So stop that serial certificate hunter; it ain’t working. Finally, you need to find your interest and seal it consistently in the industry.

FAQ

Financial analyst usually have a finance related degree or a master’s degree like MBA in finance. Make sure you have finance related skills.

You can become a financial analyst without experience by learning financial modeling and valuation, building Excel-based projects, completing internships, and earning entry-level certifications like CFA Level 1 or FMVA. Strong practical skills matter more than prior jobs.

Excel is the most important skill in finance. Through excel learn financial modelling which will help you become a financial analyst.

Yes there is high demand for financial analyst in India, everyday there are new opening for financial analyst. The requirements differ by position and company.

After BCom, start by strengthening accounting and corporate finance basics, learn financial modeling in Excel, and apply for junior analyst or research associate roles. Certifications like CFA, FRM, or short-term finance courses improve job chances.