Financial Modelling Course in Kolkata

Professional courses, such as Financial Modelling Course in Kolkata, are quite popular in today’s world that is driven by technology. Yes, technology is an integral part of everyone’s life, but then again it has created aspects of competition especially amongst the youths, like never before.

Our Kolkata batches now include cutting-edge topics like, AI in Excel, and Power BI for financial visualization Learn from industry veterans with hands-on experience in global valuations and core financial roles.

Why choose Mentor me careers?

100% Placement Assistance

Full Guidance

Depth in curriculum

Real world case studies

Knowledge that will help in placement

Experience faculties

Mock tests every-week

Interview training

Highlights of Financial modelling Course in Kolkata

Financial Modelling Course fees in Kolkata Fees

Financial Modeling Course

₹39,999 + GST

- 200 Hrs offline training

- Guaranteed Interviews

- 12 Specializations

- Lifetime Portal Access

Financial Modeling Offline Classes

₹45,999 + GST

- 200 Hrs offline training

- Guaranteed Interviews

- 12 Specializations

- Lifetime Portal Access

Financial Modeling Course Testimonials

Service 2026verified by TrustindexTrustindex verifies that the company has a review score above 4.5, based on reviews collected on Google over the past 12 months, qualifying it to receive the Top Rated Certificate.

Overview of Financial Modelling Course in Kolkata

As an institite of role-oriented skilling, we prepare the participants for employment in the field of investment banking and other financial institutions. Our instructors, who are seasoned professionals having worked at leading investment banking firms, deliver quality financial modeling training that encompasses all the latest pertinent material including real case studies and practical discussions in class. Those who do not want to make the full payment right away to reserve a seat can take advantage of a deferred payment scheme of which you pay 40 % fees at the time of enrollment and the remaining 60% upon successful placement with a complete placement assistance package to assist you which also includes contacts of previously placed students. Scheduling can be adapted to your preference, whether you choose to take a full time or a weekend batch.

Learning Journey with Mentor Me Careers’ Financial Modeling Course in Kolkata

The financial modeling course offered by Mentor Me Careers is intended to help individuals progress in their careers. This program is created by veterans of the field, and it aims to teach students how they can apply what they learn in school about finance to real-world situations. The material for this curriculum has been personally designed by retired investment bankers, credit analysts, and fund managers, so you know that everything covered will be relevant if your goal is working as an investment banker or equity researcher. We want each student who completes our comprehensive program either while still in college or already employed full-time elsewhere but looking for new opportunities within the industry itself – not only do we give them practical advice during lectures but also offer hands-on experience through various assignments such as creating models themselves based off different companies’ financial statements; this way nobody leaves without understanding how things actually work!

Syllabus

Our Excel workshop empowers participants with the knowledge needed for finance analyst roles in consulting, equity research or investment banking. The training starts from basic to advanced levels of excel skills so that every possible area is covered.

Key Learning Areas:

• Efficient navigation of excel using keyboard shortcuts

• Advanced techniques for sorting and filtering data

• Better management of data by freezing panes

• Making your presentation more impactful through conditional formatting

• Financial modeling linkages and formula creation

• SUM, PRODUCT, DIVISION, CONCATENATE are essential functions

• VLOOKUP, HLOOKUP and MATCH are functions used to lookup data

• You can combine functions to solve complex problems: VLOOKUP + MATCH; INDEX + MATCH; VLOOKUP + IF.

CAGR IRR EMI are examples of financial calculations.

Table usage and pivot table utilization will also be taught during this session.

Logical/reference functions such as IF SUMIF COUNTIF SUMIFS SUMPRODUCT should not miss out too!

So if you want a strong foundation in Excel or become an expert at it which is crucial for building efficient financial/business models then join us!

Curriculum of Advanced Excel Workshop

Our workshop takes you to the next level after mastering basic skills, focusing on complex formulas and advanced data analysis techniques in Excel. The emphasis is placed on using Excel for fast data analysis and presentation.

Advanced Formulas and Analysis:

Combining multiple functions (VLOOKUP + MATCH, INDEX + MATCH, VLOOKUP + IF)

Applying the OFFSET function

Techniques for Sensitivity Analysis

Application of Scenario Manager

Management of iterative calculations

Statistical Analysis (Correlation, Regression, Variance)

Summarizing data with INDIRECT function

Charting and Visualization:

Making appropriate charts (bar, pie etc.)

Using dynamic charts and Name Manager

Advanced chart types (Waterfall, Thermometer)

Charts with Sensitivity analysis

Charts with Form Controls that are interactive

Practical Application:

Building dashboards using advanced formulas, conditional formatting and charting techniques

PowerPoint Training: Creating impactful slides through data representation including effective charting as well as visual appeal.

Key Learning Outcomes:

Efficiently analyzing data with advanced excel functions

Professional charting & Data Visualization

Creation of comprehensive dashboards

Effective PowerPoint presentations fit for corporate standards.

This workshop equips you with practical skills needed for a finance analyst role where complex data analysis becomes simple yet impactful when presented.

No one can become a financial analyst without knowing accounting and financial statement analysis required for investment finance field for analysing the financial performance. The investment banking course offered by Mentor Me will teach you financial accounting , analysis, various line items from the basics.

Introduction to financial Analysis Framework– Annual report reading, Con Call reports, Quarterly reports, statement of change in equity, Supplementary information

Financial statement linkages and creating financial statement in excel

Income statement– Revenue recognition principles, Expense recognition principles, Diluted EPS, EPS, LIFO, FIFIO,AVCO

Balance Sheet– Format of balance sheet, current assets, current liabilities, Fixed assets, Non current liabilities

Cash flow statement– Format of cash flow statement, Direct method , Indirect method, FCFF, FCFEE

Ratio analysis– Solvency Ratios, Profitability ratios, Activity Ratios.

Ratio Analysis Case Study- Analyse persistent systems annual report

How to Read an annual Report step by step

Franchisee Business Model Valuation- NPV , IRR, Sensitivity analysis

Minority Interest, Impairment, Good will analysis

Once the finance fundamentals are set now its time to dig into creating financial models in practice. We will start applying all the concepts learnt into practical real life financial decision making. Check a project finance class here.

Start-Up Model Travel agency Business

You will learn how to think of the template of the business model. How a three statement financial model is made . Also you will learn how small business assumptions can make the decision making difficult

Manufacturing Plant Business Modeling

In this financial model you will learn how funding complications affect the model. Interest capitalisation, Construction phasing , Soft cost and hard cost of projects will be taught in this section

Tax Modeling

Tax is an important part of investment decision making calculation. Taxation is much more complicated than calculating 30% of the PBT. Here you will learn tax loss carry forwards, Carry forward loss set off, Minimum alternate tax, MAT Credits, MAT Set off,Deffered tax liability & Deffered Tax Asset. All of this practically using excel

Manufacturing Plant Set Up Model

This is a real model of the industry made from scratch using real world assumptions and calculations. You will learn what it means to work in a industry level financial model from zero. All the complications thrown into one project finance case. You also learn how to create deb schedule with various interest rate calculations.

Real estate valuation model

Trading Comps Valuation Technique

Investment bankers and finance professionals widely use the trading comps valuation method, which compares a company with other similar companies to find its market value. In this course you will learn:

Building Trading Comps: From choosing peers to analyzing final output.

Understanding Multiples: How they are compared and used, the reasons for their differences, and how to deal with them.

Detailed Analysis:

Constructing analyses (enterprise value, latest twelve months, cleaning financials, calculating multiples)

Convertible securities impact, leases, R&D expenses

Different multiples in same sector and why they vary

IPO valuation multiples

Regression analysis on multiples

Industry relevant multiple

High growth vs low multiple scenarios

Differences among industry multiples and their drivers

Peer selection when there are no similar listed companies available

By taking this comprehensive approach you will be able to use trading comps effectively for accurate company valuation.

Investment bankers use the precedent transaction method or deal comps as a vital valuation technique to supplement trading comps and DCF valuation. To find out what a deal is worth, this method looks at past deals that have been done under similar circumstances.

Key Points:

Building Transaction Comps: Involves calculating transaction multiples, cleaning up financials, benchmarking multiples among others.

Comparative Study: The distinction between transaction and trading comps.

Controlling Premium: Its effect on multiples and how to measure it.

Right Situations: When to apply transaction comp multiples for accurate valuation.

Market behavior is better understood through this approach which also assists in valuing firms based on historical transactions data.

Check out our demo class of financial modeling valuation .

This is the final section before the specialization kicks in. In this section we will take a publicly listed company from NSE stock exchange and create a DCF Valuation Model and Relative /Comparable analysis financial model. This is one of the other applications of financial modeling in decision making. This model is specifically useful for people who want to pursue to join equity research and Investment banking

Valuation Basics- DCF, Gordon growth, WACC, Cost of equity , Levered, Un levered Beta, Terminal Value

Creating a model template

Data collection and data feeding in financial model

Revenue Driver- breaking the business into Price and quantity metrics, so that you can forecast those metrics

Cost Driver

Debt Schedule , Asset schedule Forecast

Free Cash flow calculation

DCF Valuation Calculation

Sensitivity Analysis

Report Writing

This is our major success metric at Mentor Me, your placement. With over a decade of experience in this field, we have developed resources and process which will make you polished for the interview and job in investment banking and research. This module will include

Employability quizzes for each skill tested in the interview

Case studies practice for interview

Written test question bank

Mock Interviews- Face to face

Stress Interviews

CV Edits and recommendation

Soft Questions practice for HR Rounds

More and more finance Jobs require candidates to know the basics of python. In the Financial modeling course with placement in the weekday program we cover

- Python basics

- Data Sets

- Data visualisation using matplotlib and seaborn

- Linear and logistic Regression machine learning models using python.

Case study for finance on python.

Module 1: Power BI Set up

Learn the basic set up requirements of Microsoft Power BI & Overview of the major functionalities.

Module 2: EDA Using Power BI

Learn how to use the easy to use power BI Functionalities, to explore the data. Before beginning any analysis further

Module 3: Data Visualization with Reports Learn how to create beautiful charts and data presentation using Power BI

Module 4: Dashboards using Power BI

Learn how to create powerful interactive dashboards to summarize the data analysis in Power B

- Sql introduction

- SqL Operators

- Data tables in SQL

- Major Sql functions

- SQL Data base

- 4 Technical Mocks

- Interview cases role wise

- Face to face advice questions in finance

- General Market Questions

- Practice Questions

- Vocabulary Training

- Role Play

- Non Verbal Communication

- Difficult HR Questions

Financial servies industry, asset management industry basiscs, overview of portfolio management

Resume Building & LinkedIn Optimization Workshops

Soft Skills Training – Communication, Pitching & Interview

Sector-specific Financial Statement Forecasting

Recorded Sessions for Flexibility

Internship Opportunities during the Course (Kolkata only)

12 Comprehensive Specialisations

Mergers models are A+B=C or A+B= A. The purpose of this kind of a model is to actually find the synergies and cost benefits.

M&A Merger Model Explained

A merger model predicts how much money shareholders of the new company will make in the future. It indicates whether a deal is beneficial or harmful to shareholders’ earnings.

Important Features:

• Building The Model: Making an integrated merger model that can evaluate transaction effects.

• Deal Structure Impact: How stock deals or cash deals affect future earnings.

• Synergies: Pro forma earnings should include anticipated synergies.

• Debt Refinancing: Existing debt in the target company needs to be accounted for when adjusting.

More Things You Can Learn:

• Complete overview of M&A process

• PowerPoint basics for presentations

• Drafting Letters Of Interest and Intent

• Fundamental Merger Model concepts

• Access to model files and detailed M&A notes

This method helps us understand financial implications during mergers and acquisitions completely.

A Leveraged Buyout (LBO) is when a company buys another company primarily with external debt.

Valuation: The target company’s worth is analyzed.

Transaction Assumptions: Major presumptions for the purchase.

Debt Assumptions: Conditions of the borrowed money.

Goodwill Calculation: Establishing intangible value.

Closing Balance Sheet: Financial standing after acquisition.

Income Statement: Expected revenues and costs.

Balance Sheet: Overall fiscal condition after LBO completion.

Cash Flow Statement (CFS): Money movements in and out.

Key Metrics: Success measurement for LBOs

LBO Files: All-inclusive modeling files for review

This framework guarantees an exhaustive comprehension of leveraged buyouts and their monetary consequences.

One of the favorites of the industry, because of its large contribution to India’s GDP. A very engaging model to make and easily understandable

Learn about the renewable energy project finance case on solar business. Learn its challenges, accounting assumptions and return potential

Aviation is more than just tickets. The major complication of making a aviation Model is the lease calculations and forecasting of it in the future

Education industry has changed over the years and is one of the most sought after business for investment banks. Learn how to model and value such business

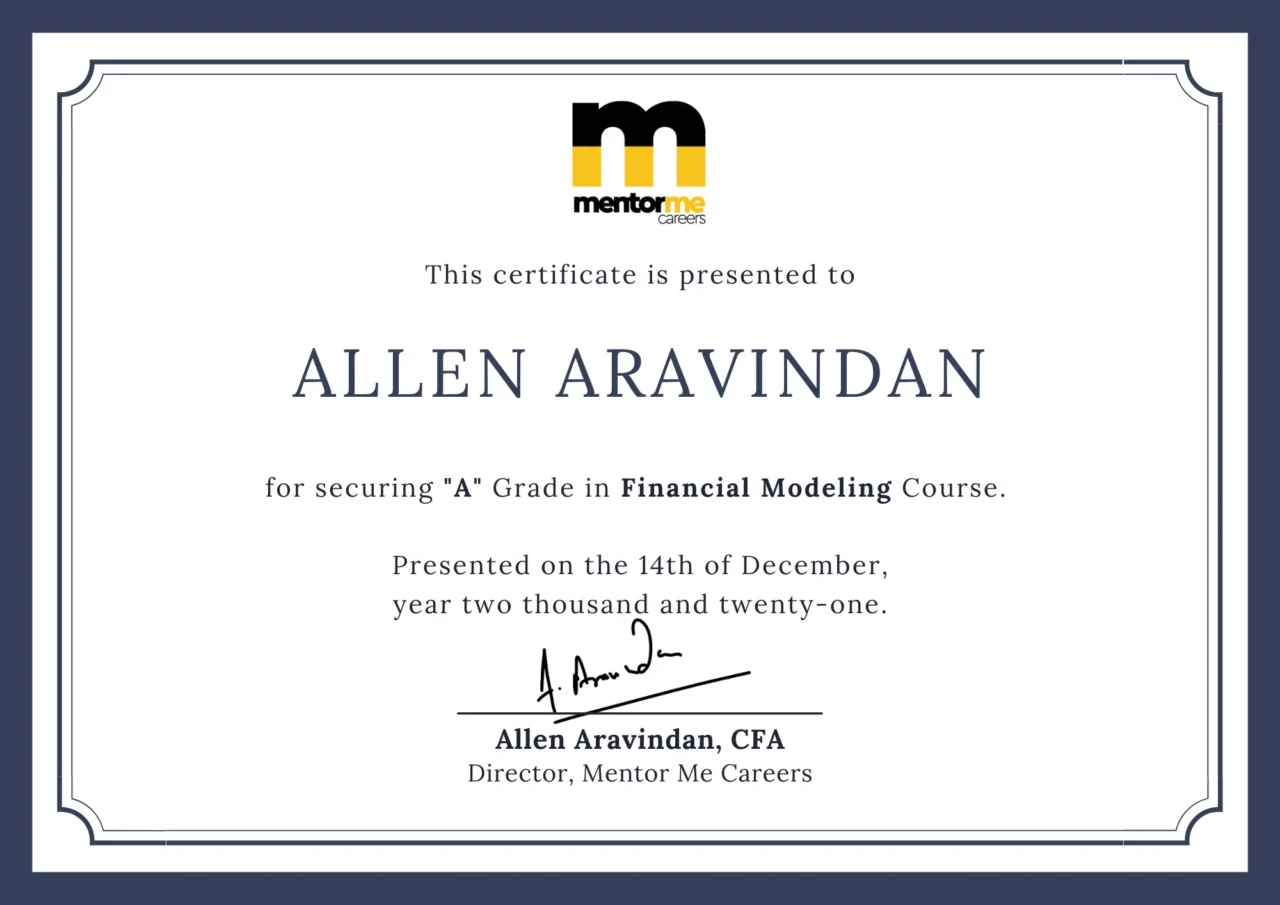

Industry Recognised Certification Mentor Me Careers

Mentor Me Career's financial modelling course in Kolkata comes with a built in Industry recognized certification

Expert Faculties

Nikhil Jain, CFA

Expertise: Credit Analysis, Financial Statement Analysis, Risk Management

Our trainers are seasoned experts from buy-side and sell-side firms with experience in credit underwriting portfolio management, and valuation across real estate, retail, and technology sectors

Finance Recruiters in Kolkata

ICRA Ratings 17th Floor, Plot – G, Infinity Benchmark, 1, GP Block, Sector V, Kolkata, West Bengal 700091

Crisil:57, Chowringee Rd, Gokhel Road, Elgin, Kolkata, West Bengal 700071

Price water house:

SBI capital markets:kolkata. 1, Middleton Street, Jeevandeep Building, 9th floor, Kolkata – 700 071.

The Best Placements Process:Financial Modelling Course in Kolkata

We follow a success-based placement fee model you get guranteed interviews with the placement course. Our partnerships across Kolkata’s investment banking and consulting ecosystem also open doors for internship opportunities during the course.

Goal Setting

Baselining

Profile Building

Job Applications

Mock Interviews

Success

FAQ's :Financial Modelling Course in Kolkata

A Financial Modeling and Valuation course teaches you how to develop professional financial models and perform valuation analyses. It covers crucial topics such as discounted cash flow (DCF) valuation, comparative company analysis, and advanced Excel functions to enhance your financial decision-making skills.

To register for our live program, simply contact our counselors who will guide you through the registration process and provide all necessary details to get started.

Yes, having a basic understanding of accounting is necessary. MentorMeCareers provides pre-lecture study material to ensure that students have a strong foundation before attending the course, making the in-class experience more fruitful

This course is designed for finance professionals, analysts, investment bankers, corporate finance managers, and anyone interested in mastering the art of financial modeling and valuation techniques.

Graduates can explore career paths in investment banking, equity research, financial consulting, corporate finance, and asset management. The skills gained through the course are also valuable for entrepreneurs and other finance-related roles.

For the live course, you will attend 80 sessions of 3 hours each, totaling 240 hours of training. The recorded version of the course offers around 150 hours of high-quality content.

While there is no job guarantee, we provide robust placement support with numerous opportunities for core finance roles. Your success in securing a job will depend on a range of factors, including your performance and market conditions.

Upon completing this course, you can target finance roles such as Valuation Analyst, Investment Banker, Portfolio Manager, and other core finance positions.

Yes, select students from each batch are shortlisted for internship roles with our partner companies based in Kolkata across investment banking, equity research, and credit advisory domains.

Absolutely! We offer <strong>recorded sessions in addition to live classes so you can learn at your own speed, revisit concepts, and never miss a lesson.

Know More About Financial Modeling

Financial Modeling Videos

14:42

8:05