Last updated on October 23rd, 2024 at 02:21 pm

So the equivalent annual cost is an important metric used in corporate finance used by finance managers to make asset purchase decisions. Hence what it entails is to calculate the NPV of the benefits of using the asset of over time including the maintenance cost of theasset. This can be and is one of the important tool in deciding leasing verus purchase decision.

Key Takeaways of EAC

- EAC is the annual cost of owning, operating and maintaining an asset over its entire life.

- Secondly it is used for capital budgeting decisions to compare the lease versus purchase decision

Equivalent Annual Cost

Very simply put, the implication of this is the calculation of cost per year of owning, operating and maintaining an asset over the course of its entire life span. Now this is important becase the calculation gives you a method to decide. Whether its better to lease an asset or purchase an asset.

What is Equivalent Annual cost

In order to simply understand what is EAC, you need to understand the problem at hand. For example; if I say you could purchase a $5000 machine or lease out the the same machine for $100 per month. So, this is important because, the decision is not just done on the basis of the intial cost. While the same machine also requires maintenance and cost of capital.

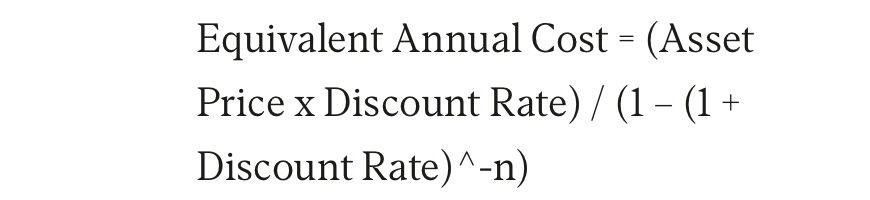

Formula for Equivalent Annual Cost

So the formula for Equivalent annual cost can be a little confusing. However let me explain what exactly is going on here. Asset price is the cost of the project or asset to be purchased. Similary the discount rate is nothing but the cost of capital to purchase the asset. You are dividing by the present value of the discount rate itself today. Which is done by taking an inverse of the 1+discount rate .

Example of Equivalent Annual Cost

So let’s say company ABC is choosing between two competing projects. Project one has assets with intial investment of $100000 and life span of 5 years and annual maintenance of $4000. Compared to the Project 2 has an intial investment of $1450000 and life span of 8 years along side maintenance expenses of $2500.

Now let me assume the cost of capital to be 5%. So we could calculate the annuity factor as

Project 1:1-(1/(1+0.05)^5/0.05) or 4.33

Project 2:1-(1/(1+0.05)^8/0.05)= 6.46

Now let’s calculate the Equivalent annual cost as;

Project 1: 100,000/4.33+4000= $27094.69

Project 2: 145000/6.46+2500= $24945.82

Hence, its preety clear that owning the second asset is preffered since it has a lower cost of owning it compared to asset 1.

Assumptions and Problems

- One of the biggest problems with any forecasting model and the equivalent cost model in capital budgeting decision is the discount rate. Which is leaving aside every assumption, how confident are you about the discount rate for calculation.

- Another problem with EAC is that it excludes or doesn’t consider the impact of taxes

- When comparing assets, the asset needs to be similar which is always not the case.

- The EAC calculation also ignores the impact of inflation which is again a realistic problem

Equivalent Annual Cost Vs Whole Life cost

So in short the whole life cost is just the total cost of owning and asset for its life span. Which includes costs like purchase, installation, design , operating cost etc. Compared to that the equivalent annual cost measures the annual cost of owning, operating and maintain the assets.

Frequently Asked Questions

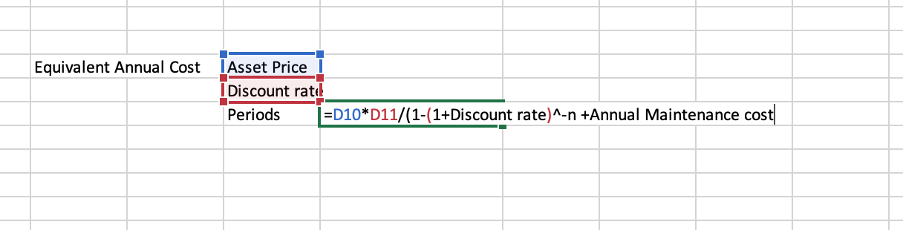

How to calculate Equivalent annual cost in excel?

Open a spread sheet and first enter all the details required for EAC and use the below method to calculate the equivalent annual cost in excel spreadsheet.

When should you use equivalent annual cost?

The Equivalent annual cost method can be used in the following scenarios

- Leasing verus purchase decision

- Replacement of assets

- Comparing projects or assets

- Long term budget planning