Last updated on October 23rd, 2024 at 02:38 pm

As the name suggests deferred annuity plan means a delayed income for some form of recurring contribution today. Now theoretically this helps in planning for some financial goals like retirement. In this article we will discover and explore details how it works, what are the types of plans available and Pros & Cons of it.

Working of a Deferred Annuity Plan

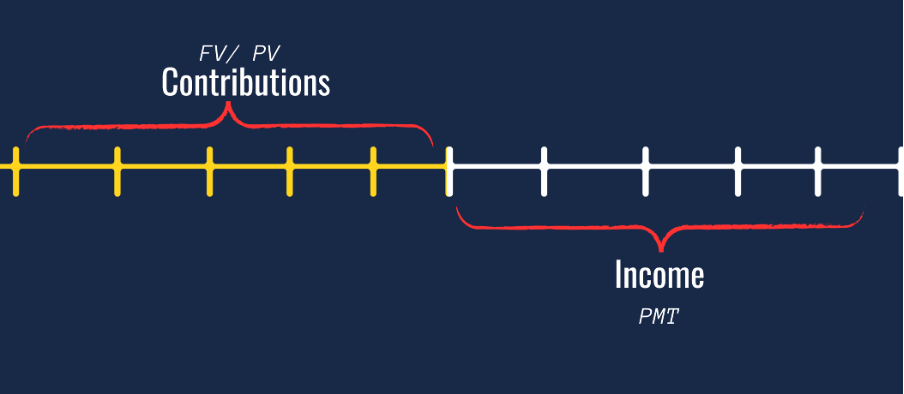

- So, the whole simple logic to a deferred annuity plan is that, initially you contribute certain amounts in regular intervals.

- The investment management then invests this amount into assets to generate returns until a point and beyond

- Then the lump sum is distributed monthly to the investor on a regular basis in the form of an annuity.

The catch here for the investment management firm is that any excess return generated is income or profit for it.

Types of Deferred Annuity

Now since there can be so many variables to time, how you pay or for how long you pay. Hence these permutations and combinations create the scope for many types of deffered annuity plans. Let me discuss a few basic structures;

Deferred Annuity Types by Underlying Assets

A lot depends on what is the underlying asset. For example will it be stocks or will it be bonds.

Variable Deferred Annuities

As the name suggests in case of variable deferred annuity plan, the returns and payouts are variable. Hence, there is no fixed annuity which can be guaranteed. The major reasons for this is that the underlying is stocks majorly with bonds and money market instruments in lower proportions.

Now, the underperformance or over performance of variable deferred annuities depends on how well the asset management company invests the underlying assets.

Fixed Deferred Annuities

Now, compared to the variable deferred annuity plan, fixed deferred annuity plans tend to invest in less volatile assets. For example certificate of deposit, where the returns are lower but are more predictable. Hence, the advantages of this type of a plan is that the returns are more predictable but the risk is that your investments might not be able beat the inflation itself.

Types of Annuity By The Term

Term Deferred Annuity Plan

Usually this is a kind of a insurance contract that eventually turns your contribution into annuity payments for certain time period. Hence, on the event that the insured dies then the payments continue to their heirs.

Lifetime Deferred Annuity Plan

The whole catch here is that as opposed to a term plan, where the term of payments is decided. However in case of a life time, the plan ensures that you don’t out live your deferred annuity plans. This is especially useful now, since the life expectancy has been increasing year on year and more and more advancements is happening in improvement of health.

Single Contribution Plans

Now, the insurance company could also offered you a slightly different structure where the contribution instead of it being staggered is collected all at once. For the insurance company the benefits is that they get the money today. While the advantage to you is that you don’t have the hassle of payments every period.

Taxation with Deferred Annuity Plans

First let me discuss the taxation benefits of deferred annuity plan

- Every deferred annuity plan is tax deductible under sec 80 c of the income tax act 1961. However be aware that the total deduction under 80 c is capped at 1.5 Lacs INR. Which means that if you already have home loan deductions then the benefits might be reduced to the amount left below 1.5 Lacs

- However leaving the contribution, the withdrawals are taxable at normal slabs that is applicable to you.

4 Things To Remember While purchasing Deferred Annuity Plan

It’s common for many customers to have remorse later after the purchase of an insurance contract like this. Hence I am listing out 4 important things to remember while purchasing such plans

- Ask about the amount of the contribution that gets invested. This is important because it might happen that only 60% to 70% of the funds actually get invested in the fund while the rest is held back.

- Pay close attention to the commissions charged to you. Remember that it’s an insurance contract so there is a good chance that the commissions in such contract might be deductible at the entry phase itself

- IRR. Ask about the total IRR generated in the contract. While finally tells you how much return. If its below 10%. You will be better off just investing in fixed deposits.

Conclusion

Deferred annuity plans are notorious for mis selling specially in India because of its complex structure. Customers fall prey to such complex plans because half of things are not explained by the sales agent. And since legally the customer is expected to do his own research, often fall with their life savings to such plan with no recourse.