Last updated on October 23rd, 2024 at 04:55 pm

A corporate guarantee is a legally binding commitment made by a company on behalf of another party, usually a subsidiary or affiliate company, to assume responsibility for the debt or other financial obligations of that party.

You are free to use this image on your site, template etc. Just provide us the attribution link

What is a Corporate Guarantee?

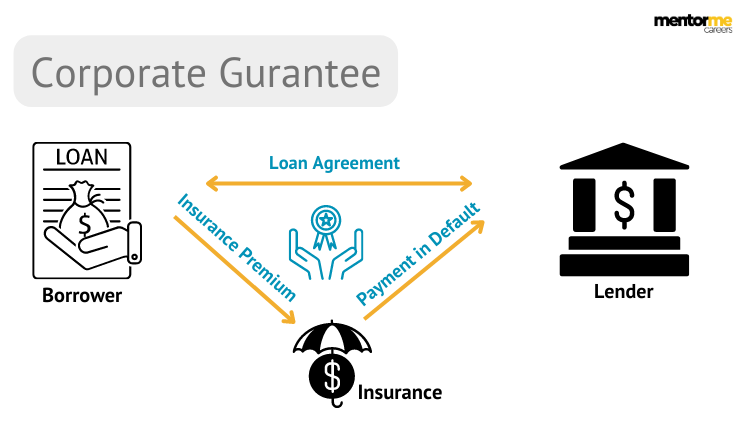

A corporate guarantee is a legal agreement between a borrower, lender, and guarantor, in which an external insurance company takes full responsibility for the debt repayment of the borrower provided it faces bankruptcy. This guarantee will show how much of a loan will be given and who will take the responsibility if the debtor defaults on the loan. A personal guarantee is a similar document. Here, the guarantor is an individual who takes responsibility of handling the loan repayment. A corporate guarantee can be either limited or unlimited.

Understanding Corporate Guarantees

There are 3 parties that are involved in a corporate guarantee. They are:

- Lender: The entity lending the money

- Debtor: The entity that is borrowing the money

- Guarantor: The individual/insurance company that agrees to be liable for the loan repayment if the debtor fails to do so.

Some data should be clearly stated in the corporate guarantee. This data is mandatory. The data is as follows:

- Name of the Debtor

- Details regarding the guarantor such as name, contact information, address, etc.

- Information of the lender such as name, address, etc.

- Statement of any limits to the guarantee such as the maximum amount being repaid by the guarantor

- Signature of a witness. This person should not be involved in the argument.

Types of Corporate Guarantee

Corporate guarantees can be limited as well as unlimited. A limited guarantee means that a guarantor will be liable for the debt of the borrower only to a certain extent. For example, if there is a limit of $1,000,000 to be paid to the lender by the guarantor if the debtor goes bankrupt despite that $5,000,000 was borrowed initially.

For an unlimited corporate guarantee, the guarantor is not limited by a particular amount of money to be repaid. So, in the case of an unlimited corporate guarantee, in the above example, the guarantor must pay the entire amount of $5,000,000.