Last updated on February 14th, 2026 at 04:55 pm

CFA is highly valued for its rigorous curriculum, practical skills and ethical standards. CFA open doors for more specialized jobs in Finance sector. Chartered financial analyst is awarded by CFA Institute (USA). Focuses portfolio management, ethical standards and advanced financial knowledge. Program consists of three exam levels which is practically oriented in the real world finance. Employers value the focus on ethics and technical competence which is emphasized by CFA. In this blog let us explore salary you should be expecting after CFA level 1 and advance also the opportunities you will gain when you complete Chartered financial analyst. Let’s dive in!

CFA salary in India Overview

Entry level (level 1): 3-6 lakh per annum, junior analyst or research associate

Level 2: 6-12 lakh per annum analyst position

Level 3: 12+ lakh per annum obviously because you have completed all 3 levels of CFA. Knowledge and practical real-world scenarios you have gained will get you higher paying job in finance sector.

Charterholders: After 3 years of work experience you will earn your charterholder before that you are just passing all CFA levels.

Average across charterholders: 28.9 Lakh per year based on recent CFA Institute survey.

CFA Salary in India- by Levels

| CFA Stage | Average Salary (INR per annum) | Notes |

| Level I | ₹4 – ₹6 LPA (freshers, entry roles) ~₹9.8 LPA (survey average) | Entry-level jobs: Equity Research Analyst, Financial Analyst, Credit Analyst. Salaries vary: fresh grads on lower end; candidates with prior exp at ~₹9–10L. |

| Level II | ₹6 – ₹9 LPA (general avg) ₹13.5 LPA (survey point) | Opens mid-tier roles: Senior Analyst, Associate, Risk roles. Better opportunities with some work experience. |

| Level III (passed) | ₹10 – ₹14 LPA (fresh charter-pending) ~₹20.7 LPA (survey point) | Candidates close to charter; land roles like Portfolio Manager Assistant, Senior Analyst. Higher pay especially in metros. |

| CFA Charterholder | ₹28.6 LPA (new charterholder, 6 yrs exp) Up to ₹44.4 LPA (charterholder avg across seniorities) | Official CFA Institute data. Senior charterholders in top roles (CIO, CFO, VP) can earn ₹50 LPA – ₹1 Cr+. |

2025 highlights the strong earning potential and growth trajectory for CFA charterholders across all experience and job roles.

Influencing factors:

Location (Mumbai, Bangalore and Delhi pay more)

Industry type (Investment Banking, asset managers etc)

Experience and level of CFA

Senior CFAs especially have more opportunities in leadership roles with packages comparable to global standards.

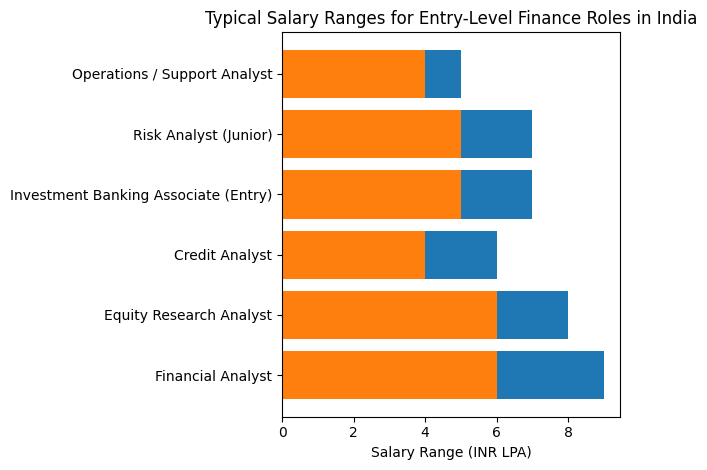

CFA Salary in India by Job function

| Role / Function | Typical Salary Range (INR LPA) | Notes |

| Financial Analyst | ₹6 – ₹9 LPA | Common first role for CFA Level 1; involves financial modeling, reporting, and valuation. |

| Equity Research Analyst | ₹6 – ₹8 LPA | Popular fresher role; focuses on stock/sector research and preparing reports. |

| Credit Analyst | ₹4 – ₹6 LPA | Often in banks/NBFCs; assesses creditworthiness of clients/borrowers. |

| Investment Banking Associate (Entry) | ₹5 – ₹7 LPA | Usually in support/middle-office at global IBs; higher end (₹8–10LPA) in Mumbai/Bangalore. |

| Risk Analyst (Junior) | ₹5 – ₹7 LPA | Entry positions in risk teams of banks/fintechs; growth potential into Risk Manager roles. |

| Operations/Support Analyst | ₹4 – ₹5 LPA | Some CFAs start here before moving into core investment functions. |

Average CFA Salaries (Level I vs Charter holder)

CFA salaries in India range from 6 LPA to 30 LPA. There are alot of factors which matter in getting this range of package. CFA institute say in their survey the average package of a CFA is 28.6 LPA. This Package is of 6 years of experience or less. For you to get the package you are dreaming by doing CFA. Make sure that after CFA level 1 you gain relevant experience in the finance field.

CFA Salary in India- What Our Students Got Paid?

So, let’s also check what students who studied with mentormecareers, got as salaries as CFA candidates.

Fresher CFA Level 1: Real Example

So Abhishek Aggarwal a recent pass out of CFA Level 1 exam, recently got in touch with us since he was looking for placements. We were able get him trained and placed at INR 4.2 LPA as a fresher.

Experienced CFA Level 2 : Experience Not in Finance

Priya Mishra came to us after completion of CFA Level 2, however she has experience in sales. However, she was able to get a CTC above 7 LPA irrespective of a non finance experience background.

Why CFA Matters for Your Finance Career

CFA is considered golden standard for investment professionals offering credibility and enhanced career prospects. Chartered financial analyst qualification and designation highly respected by finance firms including the Big 4 consulting firms. CFA is recognized in over 160 countries, meaning it provides more career mobility for professional in finance. Membership in the global community provides exclusive networking opportunities, industry events also ongoing learning. Chartered financial analyst focuses on real world investment decision-making and advanced financial theory. CFA charterholders negotiate higher salaries and compensation salaries this is because employers value advanced financial knowledge and ethics.

Roles That Pay High Salary for CFA Candidates

Chartered financial analyst demand is broad and continues to expand with increased demand for skilled finance professionals. The growth of India’s financial sector more global investments contribute to rise in CFA opportunities.

Top CFA career areas include:

- Investment Banking

- Portfolio & Asset Management

- Equity Research & Analysis

- Risk Management

- Corporate Finance

- Private Equity & Venture Capital

CFA Job Opportunities

CFA charterholders are actively recruited by major global and Indian firms:

- Investment Banks: JP Morgan, Goldman Sachs, Morgan Stanley, Citibank, HSBC

- Asset Management Firms: BlackRock, Franklin Templeton, HDFC AMC, ICICI Prudential AMC, SBI Mutual Fund

- Big Four Consulting: Deloitte, PwC, EY, KPMG

- Financial services: HDFC Bank, ICICI Bank, Axis Bank, Kotak Mahindra Bank, Bajaj Finserv

- Private equity & VC: Sequoia Capital, Blackstone, Temasek

Key job titles and functions include:

- Investment Banker

- Portfolio Manager

- Equity Research Analyst

- Risk Analyst

- Financial Analyst

- Wealth Manager

- Credit Analyst

- Senior Business Analyst

High-Demand Roles for CFAs in India

| Role | Core Responsibilities / Why in Demand |

| Portfolio Manager | Managing assets and funds; growing mutual fund & wealth industries |

| Investment Banker | M&A, capital raising, financial modelling |

| Equity Research / Investment Analyst | Stock and sector analysis, entry-level to mid-level positions |

| Risk Manager | Managing financial risks in evolving markets and fintech |

| Credit Analyst | Evaluating creditworthiness banks & rating agencies |

| Wealth Manager | Serving HNI clients, wealth planning, personalized strategies |

| Quant/Trading Analyst | Derivatives and algo trading; hiring surge from global firms |

| CFO / CIO / VP Roles | Strategic leadership finance, investments, and corporate oversight |

| ESG / FinTech / Private Markets Specialist | Growing niche areas aligning with evolving financial industry trends |

| Consulting / Advisory | Valuation, M&A, due diligence roles at consulting and Big 4 firms |

Top Employers and Industries Hiring CFAs

Hiring for CFA charterholders in India mostly belong to sectors like banking, consulting, asset management and more.

Top employers Hiring CFA’s

Investment banks like Goldman Sachs, Morgan Stanley also Citibank and HSBC are the key recruiters for the roles. Blackrock for asset management also HDFC AMC. SBI mutual fund employ CFA’s as portfolio manager and analyst.

Commercial Banks: HDFC bank, ICICI bank also Axis bank and kotak banks are some commercial banks who hire CFA’s for Credit analysis, risk management and corporate banking.

Talking in consulting we have the big four: EY, PwC, KPMG and Deloitte engage CFA in advisory and financial consulting roles. Fintech companies: Emerging firms focused on digital management and financial analytics.

Key Industries hiring CFA’s:

Investment Management: Mutual funds, hedge funds and wealth management firms.

Banking and Financial Services: Retail banking and specialized financial institutions.

Corporate Finance: Large corporates, financial planning and strategy

Consulting and advisory: Financial advisory, Management consulting

Fintech and Technology-Driven Finance: Digital Investments and blockchain based financial services.

Conclusion

CFA qualification is hard to crack the passing of CFA every year is 45%, less than half of the students pass. This is what makes the qualification very important to earn, you will included in their exclusive CFA community. This community will provide you a lot of benefits. Make sure to study enough meaning study more than 300+ Hours. Suggested 300 Hours is not enough to crack CFA. Its not just about the qualification, it is about what knowledge it is providing you which will get you a good job in finance sector.

FAQ

Yes, you can earn 1 Cr with a CFA. After experience of almost 10+ Years you can hit that milestone. If you stick with a company and passion enough you will definitely get a position where you will be getting 1 Cr package.

Starting salary of CFA level 1 is 5-7 LPA as a fresher with no Finance experience before which is a really good milestone you see in finance. Getting a internship in finance is hard.

You have to manage study with your job, time management is the key here. Most of the CFA pursuing candidates are working because for you to be Charterholder you need experience of minimum 3 years. Check our students who got placed after completing CFA Level 1 training.

There is no age limit in CFA. The only eligibility is education where candidate should be in the last year of their college.

Big 4 hire CFA’s in India. Global Investments Banks like Goldman Sachs, JP Morgan, Morgan Stanley also hire in India.