Last updated on September 25th, 2025 at 02:55 pm

So, cash ratio is like the strongest measure to to check a company’s liquidity position and is calculated by dividing cash & equivalents like liquid investments to the current liabilities of the company. The higher the ratio, the better the liquidity and low risk.

What is the Cash Ratio?

The cash ratio is a liquidity metric that indicates the company’s obligation to meet its short-term debts with liquid investments equivalents. The cash ratio is stricter compared to other liquidity ratios, such as the current and quick ratios. It has a more conservative measure because only cash and cash equivalents are used in the calculation. The ratio is almost like an indicator of a firm’s value under the worst-case scenario. It indicates the importance of current assets that could quickly be turned into cash and cash equivalents to creditors and analysts. The ratio is beneficial to creditors when they decide how much money they would be willing to loan. The ratio,is more conservative than other liquidity ratios because it only considers a company’s most liquid resources.

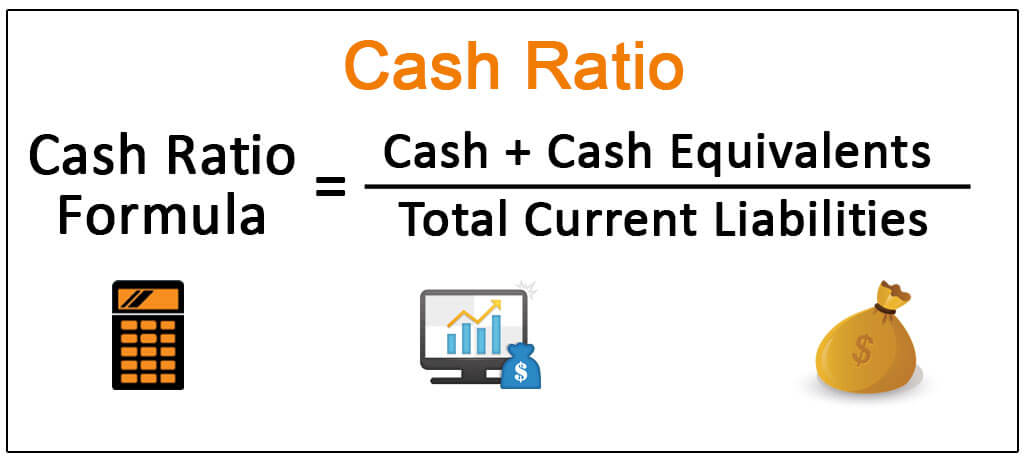

The formula for the Cash ratio

The formula for calculating the ratio is as follows:

Cash Ratio = (Cash + Cash Equivalents) ÷ Current LiabilitiesWhere:

- Cash – Includes legal tender and demand deposits

- Cash equivalents – Assets that can be converted to cash quickly. Cash equivalents are readily convertible and subject to insignificant risk.

- Current liabilities – They are obligations that are due within one year. They include short-term debts, accounts payable, accrued liabilities, etc.

Example

Company A’s balance sheet lists the following items:

- Cash: $10,000

- Cash equivalents: $20,000

- Accounts receivable: $5,000

- Inventory: $30,000

- Property and equipment: $45,000

- Accounts payable: $12,000

- Short term debt: $10,000

- Long term debt: $20,000

The Cash ratio for company A can be calculated as follows:

Cash Ratio =$10,000 + $20,000$12,000 + $10,000 = 1.36

What does the Ratio reveal?

So it is expressed as a numeral greater or less than 1. Upon calculating the ratio, if the result is equal to 1, the company has exactly the same amount of current liabilities as it does with liquid equivalents to pay off those debts.

Less than 1:

If the company has a ratio of less than 1, then there are more current liabilities than liquid equivalents. This means that they have insufficient money on hand to pay off their short-term debts.

Greater than 1:

If the company has a ratio greater than 1, then the company has more cash and cash equivalents than current liabilities. In this situation, the company has the ability to pay off its short-term debts and still have cash remaining.

Industry-Wide Cash Ratio (Typical Ranges)

| Industry | Typical Cash Ratio Range | Context / Notes |

|---|---|---|

| Technology (Large-cap) | 0.5 – 1.5 | Often hold sizeable cash/marketable securities; strong OCF supports liquidity. |

| Pharma / Biotech | 0.6 – 1.2 | Cash buffers for R&D pipelines and long approval cycles. |

| FMCG / Consumer Packaged Goods | 0.3 – 0.8 | Stable cash flows; moderate cash holdings common. |

| Retail (Non-food) | 0.1 – 0.4 | Cash tied in inventory/working capital; seasonal swings. |

| Manufacturing (Capital-Intensive) | 0.2 – 0.6 | Higher fixed assets; liquidity managed via credit lines. |

| Automobiles & Auto Components | 0.2 – 0.5 | Inventory-heavy cycles; supplier financing relevant. |

| Airlines | 0.05 – 0.30 | High operating leverage; rely on advance sales and financing. |

| Hospitality / Travel | 0.05 – 0.30 | Demand-sensitive; cash cushions vary with seasonality. |

| Utilities | 0.10 – 0.40 | Regulated cash flows; lower cash ratios typical. |

| Telecom | 0.10 – 0.40 | Capex-heavy; liquidity balanced with rolling debt facilities. |

| Real Estate / REITs | 0.05 – 0.30 | Cash managed against lease inflows; focus on LTV and ICR. |

| Banks & Financials | Not comparable | Use regulatory liquidity (LCR, NSFR) rather than cash ratio. |

| Oil & Gas / Energy | 0.15 – 0.50 | Commodity cycle exposure; cash ratios swing with prices. |

| IT Services | 0.4 – 1.0 | Asset-light; healthy cash conversion from receivables. |

Note: Ranges are indicative for education/benchmarking. For investment decisions, compute peer medians from the latest filings (same GAAP/IFRS, fiscal year, and region) and consider seasonality.

Importance of Cash Ratio

Cash ratio is the most stringent version of liquidity ratio, which removes everything in the current assets which doesn’t have absolute liquidity. For example when we take Current ratio, it has inventories, receivables and cash but both are dependent on the type of business. Hence following are the reasons why cash ratio is important

- Creditors to the company or business would be very interested in knowing if their payments will be done on time. Because the company can’t pay using inventories, they need working capital.

- Companies usually track cash ratio during in these scenarios

- Economic downturns

- Before giving more debt

- In capital intensive business’s

- During short term investments

- For credit ratings

Use Cases

Below are the various use cases for cash ratio in practical assessments of any financial decision

- Assessing liquidity risk

- Supporting credit decisions

- Comparing two companies on the level of liquidity

- Early red flags for insolvency

- For Valuation and research

Cash Ratio vs Other Liquidity Ratios

| Ratio | Formula | Includes | Strictness | Key Use |

|---|---|---|---|---|

| Current Ratio | Current Assets ÷ Current Liabilities | Cash + Accounts Receivable + Inventory + Other Current Assets | Least strict | Broad liquidity measure |

| Quick Ratio (Acid Test) | (Cash + Marketable Securities + Accounts Receivable) ÷ Current Liabilities | Excludes Inventory and Other Less-Liquid Current Assets | Moderate | Realistic short-term liquidity |

| Cash Ratio | (Cash + Cash Equivalents) ÷ Current Liabilities | Only Cash & Cash Equivalents | Most strict | Stress test for immediate liquidity |

Case Study: Apple’s Strong Cash Ratio (2023)

How large cash reserves and liquid investments reinforced investor confidence.

Cash & Cash Equivalents

Short-Term Marketable Securities

Current Liabilities

Operating Cash Flow (annual)

Figures shown are approximate for illustrative/educational purposes; update with your preferred source if needed.

Cash Ratio Formula & Calculation

Plug-in (Apple, 2023):

This is a conservative view that ignores longer-term marketable securities which are highly liquid for Apple.

Interpretation

- On a strict basis, Apple could cover about 39% of current liabilities using only cash & near-cash.

- However, Apple also holds substantial long-term marketable securities (> $100 bn) and generates strong, recurring operating cash flows, which materially strengthen practical liquidity beyond the cash ratio alone.

- Conclusion: the headline cash ratio looks modest, but effective liquidity remains exceptionally strong.

Why It Boosted Investor Confidence

- Absolute cash firepower: Tens of billions in cash on hand is a powerful cushion in volatile markets.

- Resilient cash generation: > $100 bn operating cash flow supports ongoing liquidity and investment needs.

- Balanced capital allocation: Apple sustained dividends and buybacks while funding R&D and strategic moves.

- Credit strength signal: Strong liquidity profile supports high credit ratings and favorable financing terms.

Analyst Takeaway

- Never interpret the cash ratio in isolation; pair it with marketable securities, cash flow trends, and capital policy.

- A firm like Apple can operate effectively with a lower strict cash ratio due to its exceptional liquidity ecosystem (liquid investments + cash generation).

- Use the cash ratio as a stress-test, then layer in broader liquidity resources to assess true resilience.

Quick Comparison (Context Matters)

| Metric | Strict View | Contextual View |

|---|---|---|

| Cash Ratio | 0.39 | Looks modest in isolation |

| Liquid Investments | Short-term: $21 bn | Long-term marketable securities > $100 bn (highly liquid) |

| Cash Flow Engine | — | > $100 bn OCF sustains liquidity and returns |

| Investor Signal | Cautious | Strong overall liquidity & consistent capital returns |

Conclusion

👉 Want to master ratio analysis and financial modeling? Explore MentorMeCareers’ Financial Modeling Course and learn how analysts use ratios like Cash Ratio in real-world company valuations.

Frequently Asked Questions (Cash Ratio)

How do you calculate the cash ratio?

The cash ratio is calculated as (Cash + Cash Equivalents) ÷ Current Liabilities. This shows the proportion of short-term obligations that can be covered using only cash and near-cash items.

What is a good cash ratio?

A ratio between 0.5 and 1.0 is generally considered good. It indicates the company can meet at least half to all of its short-term liabilities using cash reserves, though benchmarks differ by industry.

Is a cash ratio of 0.2 good?

A cash ratio of 0.2 means only 20% of current liabilities can be covered with cash. This is low for most industries, but may still be acceptable in sectors with stable cash flows or easy access to credit.

Cash ratio formula

Cash Ratio = (Cash + Cash Equivalents) ÷ Current Liabilities. Cash equivalents include treasury bills, commercial paper, and money market instruments.

Quick ratio

The Quick Ratio (Acid-Test) is (Cash + Marketable Securities + Accounts Receivable) ÷ Current Liabilities. It excludes inventory but is less strict than the cash ratio.

Cash ratio vs quick ratio

The quick ratio includes receivables and marketable securities, while the cash ratio only considers cash and cash equivalents. The cash ratio is the more conservative measure.

Cash ratio vs current ratio

The current ratio uses all current assets, including inventory and receivables, making it the broadest measure. The cash ratio is the strictest, and the quick ratio sits in between.

Cash ratio example

If a company has ₹50,000 cash, ₹25,000 equivalents, and ₹1,00,000 liabilities: Cash Ratio = (50,000 + 25,000) ÷ 1,00,000 = 0.75. This means the firm can cover 75% of liabilities immediately with cash.

How to calculate Cash Ratio from balance sheet

From the balance sheet, take line items under Cash & Cash Equivalents in current assets and divide by total Current Liabilities. This gives the cash ratio directly.

Cash ratio interpretation less than 1

If the cash ratio is less than 1, the company cannot fully cover liabilities with cash alone. This is common in many industries, but persistent low ratios may signal liquidity concerns.