Last updated on February 10th, 2026 at 11:33 am

So, there are many situations where you can think of in our daily lives where you make a payment in advance. However what if the service provider doesn’t deliver? Or defaults on the promises made. That’s where we discuss the concept of advance payment guarantee.

Advance Payment Guarantee mechanics

So, think of advance payment guarantee as safety deposit in return of the work provided. Which means that the contractor or the service provider receives an advance payment and the client gets a bond. Which the client can use in case there is any default on the contractual obligations.

However, it must be a natural question that arises that how is this different than a regular contract or agreement? And the answer is that in case of a regular contract or agreement, there is no third party gurrantor who ensures the execution. Which in case of advance payment guarantee, ensures that both the parties are insured of any defaults.

Industry Use Cases of Advance Payment Guarantee.

Now, you cannot take the pain of using this method of contracting for regular work, because ofcourse there are costs involved. So, you will usually see advance payment gurantee bonds being executed in large contracts like;

- Purchase of large stock of raw materials

- Supply of heavy duty machines

- Bulk order purchases

- Import orders

Benefits of Advance Payment Guarantee

So naturally there are several advantages of advance payment guarantee that arises for a contractor and client. Let me illustrate some of the benefits below;

- Protects the contract of payment risk

- Ensures the client is protected

- Helps ensure there is no fraud

- Gives Easy legal recourse in case of default

Advance Payment Guarantee Vs Performance Bond- The difference

Firstly, before you think this is overly complicated, let me clarify the difference in one sentence. The difference between advance payment guarantee and performance bonds, is that the former gurantees only the advance payment. However, the performance bonds are used to ensure the full contract including any contractual breach that might arise.

Which means, that beyond the intial advance payment protection for the contractor and the client, there is no coverage of anything that might happen in the performance. Hence, that is where performance bonds might be used if both the parties want to ensure the functioning of the entire contract.

Types of Bank Guarantees

There are many types of bank guarantees depending on the need of the business transaction. Let me discuss in brief some of the types of advance bank gurantee

- Financial Bank Guarantee: This ensures the buyer that if the project is not completed in its entirety then the whole amount or losses will be made whole.

- Deferred Payment Bank Guarantee: This is a type of bank guarantee where the bank pays the beneficiary in installments

- Contract Execution Bank Guarantee: This type of bank guarantee assures timely delivery of goods or performance of services according to a contract. Monetary compensation is made by the bank in case of any delay in performance of services.

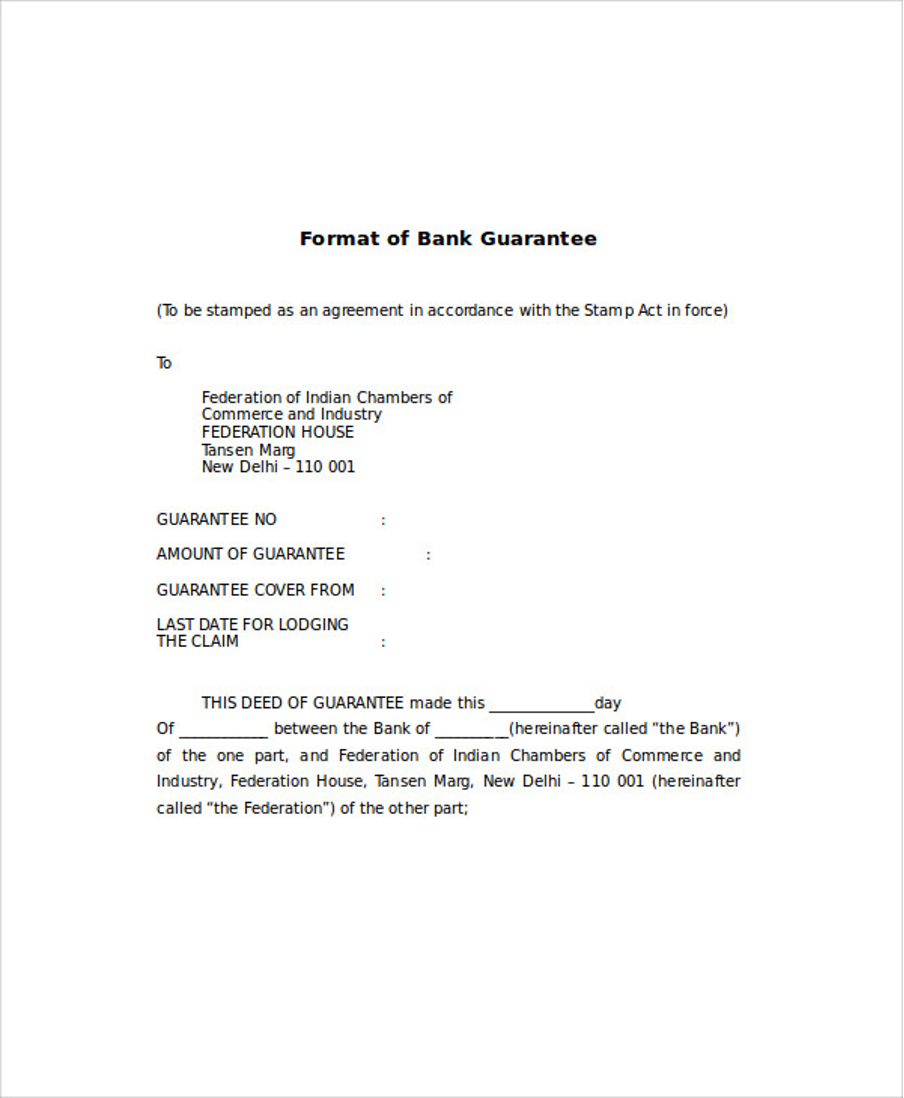

Advance Payment Guarantee Template

Frequently Asked Questions

Which party can issue advance payment gurantee?

Usually banks and insurance companies are the backing party to such advance payment guarantee. Something similar to letters of credit issue by banks on behalf of the purchaser.

What is advance payment guarantee insurance?

As, the word suggests here the buyer is basically taking an insurance against the performance of the contractor. And there is no involvement of the contractor in this contractor. If the contract defaults then the insurance company makes good on the losses.

What are objectives of a bank advance payment guarantee?

The main purposes of an advance payment guarantee are as follows

- Acts as a collateral

- A lot of business practices require advance payment so it protects the buyers

- It ensures a smooth functioning of the contract.