Last updated on September 5th, 2025 at 02:30 pm

The Association of Chartered Certified Accountants (ACCA) is a globally recognized professional accounting body that offers a qualification highly regarded in the field of Accounting and Finance. One crucial aspect of the ACCA journey is selecting the right exam center in India. Therefore, in this comprehensive guide, we will provide valuable insights and factual information about ACCA exam centres in India, helping students make informed decisions.

Overview of ACCA Exams

ACCA offers a comprehensive qualification that consists of different levels, including Applied Knowledge, Applied Skills, and Strategic Professional. Moreover, each level comprises multiple exams designed to test candidates’ knowledge and practical skills. Completing the ACCA qualification opens up a world of opportunities, with recognition in over 180 countries as well as a diverse range of career options in Finance, Accounting, and beyond.

Benefits of Taking ACCA Exams in India

India has emerged as a preferred destination for ACCA exams due to several advantages it offers to students:

- Affordability: Firstly, compared to some other countries, the cost of pursuing the ACCA qualification in India is relatively affordable, making it an attractive option for students with budget constraints.

- Availability of Resources: Secondly, India has a robust infrastructure in terms of study materials, coaching centres, and online resources to support ACCA students. Therefore, a wide range of textbooks, study guides, and mock exams are readily available to aid preparation.

- Accessible Exam Centers: Moreover, with ACCA exam centres spread across various cities in India, students have greater flexibility in selecting a location convenient for them. As a result, this accessibility reduces travel and accommodation expenses for candidates.

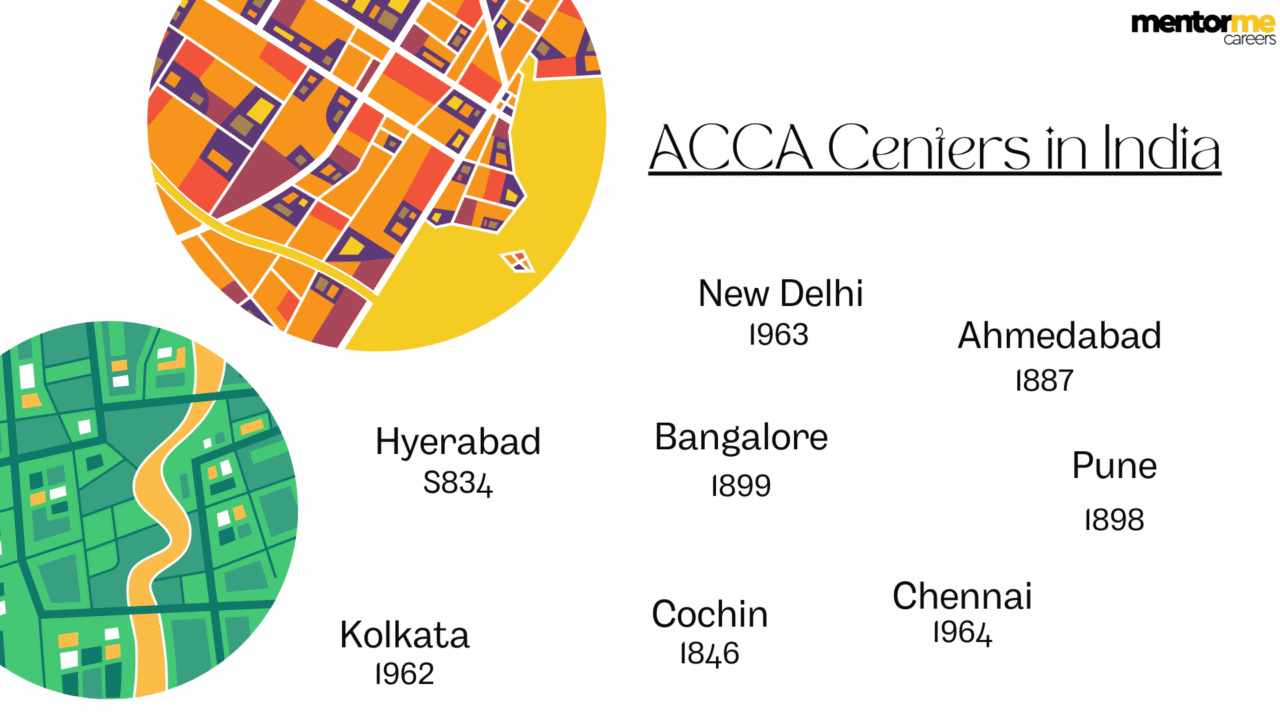

ACCA Exam Centres in India

ACCA exam centres in India are strategically located across different regions. They offer 14 examination centres in India where students may take their examinations. Let’s explore the major cities where exam centres are available:

ACCA Regular Exam Centers in India

| City | Center Code | Address |

|---|---|---|

| Ahmedabad | I887 | ABC Center, Near XYZ Road, Ahmedabad, Gujarat |

| Bangalore | I899 | DEF Institute, MG Road, Bangalore, Karnataka |

| Chennai | I964 | GHI Center, Anna Salai, Chennai, Tamil Nadu |

| Cochin | I846 | JKL Complex, Near Marine Drive, Cochin, Kerala |

| Hyderabad | I715 | MNO Institute, Banjara Hills, Hyderabad, Telangana |

| Kolkata | I962 | STU Academy, Park Street, Kolkata, West Bengal |

| Mumbai | I961 | VWX Center, Andheri East, Mumbai, Maharashtra |

| New Delhi | I963 | XYZ Institute, Connaught Place, New Delhi |

| Pune | I898 | ABC Training Center, FC Road, Pune, Maharashtra |

Each ACCA exam centre in India is equipped with the necessary facilities, including comfortable seating arrangements, examination rooms adhering to international standards as well as professional invigilators to ensure a smooth examination experience.

ACCA On Demand Exam Centers in India

Academy for CBE

5th Floor, 43, Chevalier Sivaji Ganesan Road, T Nagar, Chennai 600017

Email: [email protected]

GlobalFTI – Chennai

No 8 Basement, Arihant VTN Square, 104 G N Chetty Road, T. Nagar, Chennai 600017

Email: [email protected]

Anu Agrawal Classes

No. 506 Swapna Siddhi, 5th Floor, Akurli Road, Kandivali East, Mumbai 400101

Email: [email protected]

EduPristine

702, Raaj Chambers, 115, R.K Paramhans Marg, Old Nagardas Road, Andheri East, Mumbai 400069

Email: [email protected]

ArivuPro Academy

1st Floor, SAI PREMA, Christ Lane, No 39, Krishnanagar, Hosur Road, Bengaluru 560029

Email: [email protected]

Globalfti Private Limited

806 “Souravya”, 10th A Main, Indiranagar, Bengaluru 560038

Email: [email protected]

AK’s Training Academy

2, Samarth, 1018, Near Deep Bangla Chowk, Above Dharap Children’s Clinic, Shivajinagar, Pune 411016

Email: [email protected]

ACCA Curriculum & Fees

The ACCA Exam has three levels: Knowledge Level, Skill Level and Professional Level.

Knowledge Level:

- Accountant in Business (AB)

- Management Accounting (MA)

- Financial Accounting (FA)

Knowledge level examinations are completely objective, computer-based online tests. You have two hours to complete a 100-mark question paper. Moreover, exams are available all year through on-demand Computer Based Exams.

Skill Level:

- Corporate and Business Law (LW)

- Performance Management (PM)

- Taxation (TX)

- Financial Reporting (FR)

- Audit & Assurance (AA)

- Financial Management (FM

In a written format, Skills Level examinations are 60% descriptive and 40% objective. You have 3 hours to complete a 100-mark question paper. Exams are administered in March, June, September, and December.

Professional Level:

- Strategic Business Leader (Essential) (SBL)

- Strategic Business Reporting (Essential) (SBR)

- Advanced Financial Management (AFM)

- Advanced Performance Management (APM)

- Advanced Taxation (ATX) Advance Audit and assurance in professional level (AAA)

Professional Level examinations are written exams that are 100% descriptive and case study based. You have one hour to complete a 100-mark question paper. Exams are administered in March, June, September, and December.

Exam Fees:

The fee for a standard knowledge level test range from Rs. 10,000 to Rs. 20,000 for a professional-level exam.

Tips for Choosing the Right ACCA Exam Centre

- Proximity: Select an exam centre located conveniently to minimize travel time and expenses. Moreover, consider the distance from your residence or educational institution.

- Infrastructure: Look for exam centres with well-equipped facilities, including spacious examination rooms, comfortable seating arrangements as well as appropriate lighting and ventilation.

- Past Experiences: Seek insights from fellow ACCA students who have appeared for exams at different centres. Their experiences can provide valuable information about the quality of facilities, invigilation, and overall ambience.

- Center Capacity: Consider the number of students accommodated in each exam centre. Opting for a centre with a moderate number of candidates might ensure a more focused and peaceful environment.

Preparing for ACCA Exams in India

Preparing for ACCA exams requires dedicated effort and effective strategies. Henceforth, we have listed some tips to enhance your preparation:

- Study Techniques: Explore different study techniques such as note-taking, mind mapping, or creating flashcards to reinforce your understanding of key concepts.

- Time Management: Secondly, create a study schedule that allocates sufficient time for each exam paper. Moreover, prioritize topics based on their weightage and your proficiency level.

- Mock Exams: Practice mock exams under timed conditions to simulate the actual exam environment. Additionally, analyze your performance to identify areas for improvement.

- Join Study Groups: Collaborate with other ACCA students by joining study groups or forums. Group discussions allow for knowledge sharing as well as clarifying doubts.

- Seek Professional Guidance: Equally, consider enrolling in coaching classes or online tutorials provided by reputed ACCA training providers. Expert guidance can undeniably, enhance your understanding and boost your confidence.

Conclusion

In short, choosing the right ACCA exam centre in India is a crucial step in your ACCA journey. Consider factors such as proximity, infrastructure, availability of resources, and past experiences when making your decision. Moreover, plan your exam schedule in advance and follow the registration process diligently. With thorough preparation and the right exam centre, as a result, you can enhance your chances of success in ACCA exams. Remember, perseverance, dedication, as well as effective study techniques, will pave the way for a rewarding career in the accounting and finance industry.

Frequently Asked Questions (FAQs)

Yes, you can request an exam centre change before the specified deadline, subject to availability and payment of any applicable charges.

Carry your ACCA DipIFR registration card, ACCA exam docket, valid identification proof, stationery as well as any other materials permitted by ACCA. Refer to the ACCA guidelines for a comprehensive list of allowed items.

Yes, ACCA provides reasonable accommodations for candidates with disabilities. Contact ACCA no later than 30 March for the June examination session and 30 September for the December examination session, and provide the necessary documentation to request special arrangements.

No, you need to choose a single exam centre for each exam session. Therefore, ensure you select the same centre for all papers within a session

Yes you can give acca exams at home as well, however there are strict rules that need to be followed. For example; only desktops can be used, or full size laptops except MAC. Use of dual monitors is not allowed. No one should enter the room during the exam time. The internet connection should be stable.

So as per my analysis of the pass rates of ACCA: following are the toughest papers

1. Knowledge Level: Management Accounting (MA)

2. Skill Level: Performance Management (PM)

3. Strategic Professional Level: Advanced Audit and Assurance (AAA)

1. Knowledge Level: Business and Technology (BT)

2. Skill Level: Taxation (TX)

3. Strategic Professional Level: Strategic Business Leader (SBL)