Last updated on January 16th, 2026 at 04:00 pm

Considering financial modelling course with placement or have completed a financial modelling course, knowing the salary trends in India is essential for setting goals and expectations. Financial modelling skills is used in every industry now especially in credit analysis, consulting and even startups. Financial Modelling Salary in India (2026) typically ranges from ₹5–8 LPA for freshers and can grow to ₹20–40 LPA+ for experienced professionals, with roles spanning investment banking, corporate finance, private equity, consulting, and fintech. Pay increases faster with strong modeling skills (Excel, valuation, Python) and deal exposure than with years of experience alone.

In this article let’s explore Financial Modelling jobs like Financial Analyst and their salary by experience level, certification impact, whether you are a fresher or experience professional financial modelling course is a short term certification in finance. Let us dive deep and get a clear picture where you stand and how much you can earn. In this article we discuss the financial modelling salary in India, with examples and real job descriptions.

Factors Affecting Financial Modeling Salaries

There is no benchmark or blanket compensation that is common across companies. So let me give you two different ways of looking at how the financial modelling salaries are affected;

Two Factors that dictate the compensation

So, we know the basics of what this job is all about and what are the various requirements. Now, it’s time to get into the real question, what are the financial modelling salary ranges?

Accordingly let me first classify the financial modelling salary for freshers basis the industry and Tier of companies. This means the salary also depends on the size of the company that you are in.

Financial modelling salary in India by company tier

| Salary Ranges | Tier 1 | Tier 2 | Tier 3 |

| Equity Research | 6 -7 LPA | 4-5 LPA | 2 -3.5 LPA |

| Private Equity | 10 -12 LPA | 5-6 LPA | |

| Project Finance | 7-8 LPA | 5-6 LPA | |

| Investment Banking | 10 -12 LPA | 5-6 LPA | 2 -3.5 LPA |

| Wealth Management | 5-6 LPA | 4-5 LPA | |

| Risk Management | 12-15 LPA |

Experience: The biggest deciding factor is experience. In this industry experience is like gold. The more you have it, the better opportunities.

Company type: Whether the company is the likes of Goldman Sachs, Crisil, Evalue serve or are they tier 2 companies which are smaller in size.

Jobs That Demand Financial Modelling Skill

What many still overlook is that no matter which academic background you come from, financial modelling skill is the baseline requirement.

Let me give some examples of roles which require this skill:

- Financial Analyst

- Business Analyst

- Corporate Finance

- Credit Analyst

- Merger and Acquisition Associate

- Investment Banking Analyst or Associate

- Financial Planning and Analysis

- Equity Research Analyst or Associate

Use this calculator to estimate realistic monthly and annual salary based on role, experience, and location. Actual offers vary based on modeling depth and Excel proficiency.

The salaries for candidates pursuing FM could very much depend on factors like experience, industry, size of the company, job role, and location.

Type of Financial Modeling Skills Used in Various Roles

As shown below I have created a table, various areas of the broader financial modeling skill which gets used for different roles.

| Role | Three-Statement Modeling | Discounted Cash Flow (DCF) | Sensitivity Analysis | Scenario Analysis | Valuation Techniques | M&A Modeling | Risk Analysis | Budgeting/Forecasting | Data Analysis | Reporting |

|---|---|---|---|---|---|---|---|---|---|---|

| Financial Analyst | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | |

| Business Analyst | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | |||

| Corporate Finance | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | |

| Credit Analyst | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | |

| Merger and Acquisition Associate | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Investment Banking Analyst/Associate | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Financial Planning and Analysis | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ||

| Equity Research Analyst/Associate | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

Financial Modeling Salary Calculator

Based on salary survey reports conducted by recruitment agencies in India, we have designed this salary calculator. Which should give you a good estimate of financial modeling salary per month.

Financial Modeling Salary Calculator

Now, look at how well a fresher level employee gets compensated for risk management positions at Company like Credit Suisse

Financial Modeling Average Fresher Salary by Qualification

| Qualification | Average Salary (₹ Lakhs per annum) | Explanation |

|---|---|---|

| Undergraduate Degree (B.Com, BBA, etc.) | 3 – 6 | Fresh graduates with a bachelor’s degree typically start in entry-level roles such as analysts or junior analysts. |

| Postgraduate Degree (MBA, M.Com, etc.) | 7 – 12 | Postgraduates, particularly those with an MBA in finance from a reputed institution, usually command higher starting salaries due to advanced knowledge. |

| Professional Certifications (CFA, CA, etc.) | 8 – 15 | Candidates with professional certifications like CFA or CA are preferred for specialized roles and can expect higher starting salaries due to focused expertise. |

| Engineering Graduates with Finance Specialization | 5 – 9 | Engineering graduates with finance electives or certifications can find opportunities in financial modeling or quantitative analysis roles in investment banking. |

| International Degrees (e.g., MS in Finance, MBA from international institutions) | 12 – 20 | Candidates with international degrees from well-known institutions can secure higher starting salaries due to global exposure and advanced skill set. |

Financial Modeling Salary for Freshers in India

| Company Name | Salary Range (₹ Lakhs/Year) | Average Salary (₹ Lakhs/Year) |

|---|---|---|

| Goldman Sachs | 20 – 30 | 23.7 |

| JPMorgan Chase & Co. | 20 – 30 | 22.2 |

| HSBC Group | 10 – 20 | 17.7 |

| Barclays | 10 – 20 | 13.9 |

| Crisil | 0 – 5 | 10.3 |

| FactSet | 5 – 10 | 12.2 |

| Morningstar | 5 – 10 | 13.3 |

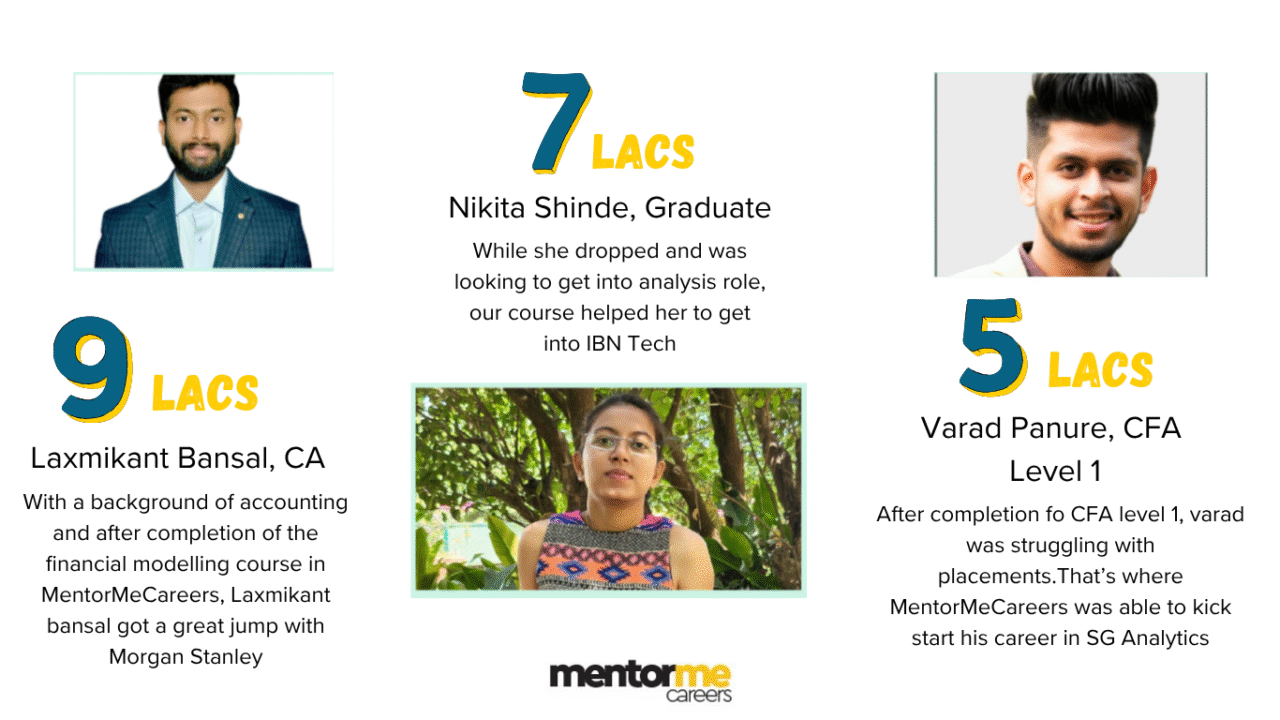

Success Story – Mentor Me Careers

Shivang Garg

Meet Shivang Garg whose dedication and logical career choices led him to a core finance position in MITCON consultancy realising importance of practical skill to entry financial sector.

Shivang has engineering background, after completing his engineering he got a job as a manager where he worked for 3 years also side by side preparing for competitive exam. Not getting any success in the current position and in exams Shivang wanted change, he enrolled in Mentor Me Career in 2022.

With the help of Financial modelling course he gained hands on experience in:

Building financial models, Conduct valuation analyses, Interpreting complex financial data. These enhanced his technical skills and also jumped his confidence to take challenging roles in finance sector. Leveraging his skill set, Shivang secured a role as a Project Consultant at MITCON Consultancy and Engineering Services Ltd where he was responsible for: advising clients on finances, developing and analysing financial models, collaborating with teams for project success. His progression from an aspiring engineer and trying competitive exams to finance core project consultant serves as an inspiration for many finance professionals.

Are you ready to drive your own success story? Join Mentor Me Career’s Financial Modelling Program to stay relevant in finance industry.

Placements after Financial Modelling – Mentor Me Careers

Real Life Testimonies by Analysts

Equity Research

“Salaries are proportionate to experience with regards to finance industry. Generally speaking a good career should value each year for INR 2.5 Lacs. So if you are at 10 years experience then the financial modelling salary should be somewhere around 24 Lacs”

Shashank Yadav, CFA, AVP, Kroll

Risk Management

In my experience salaries are dictated by a persons initiative and interest to learn in an organisation. Qualification gives you the platform and knowledge to back it up

Sandeep Aggarwal, CFA, FRM

Credit Research

I worked in credit but was initially into sales but later with the sales experience and knowledge of CFA plus the skills of financial modelling I was able to grow

Nikhil Jain, Ex AVP, Crisil

Conclusion

Financial modelling is an ever green skill in finance and will remain so in the future too. A single word of advice for every candidate aspiring to progress in finance to learn this skill and practice continuously. In the longer run the perspective will get build and you wont regret learning this skill. Financial modelling course is a short term finance certification course which gives new opportunities, skills to enter finance sector. Searching jobs in finance sector without any certification course guidance will confuse you more.

Related Articles

Frequently Asked Questions- FAQ’s

Financial Modelers can earn different salaries based on their experience and background but a fresh financial modeler with graduation can start his career with around 4-5 Lacs INR P.A

If the MBA is from Tier 1 business schools then you can start from anywhere between 12 -15 Lacs P.A

Although Hyderabad is low on core finance financial modeling jobs but still at a fresher level, one could expect around 4.5 Lacs to begin with.

The Financial modelling salary per month for freshers with undergraduate degree should be around INR 30,000 to INR 35000.

Any jobs related to using financial modeling as a skill, would fall under high cognitive application based jobs. And this directly means that these jobs are more likely to survive compared to process based job careers.

Simply put if you already have MBA, or any equivalent qualifications then you dont need CFA. But on the flipside, whether you are an MBA, CFA, CPA, B.COM, CA etc, you still need to learn financial modeling to firstly crack the interview and secondly to execute your day to day tasks.

Not really, because its entirely practical and even if you are from a non commerce background it still possible to learn it with ease.