Last updated on December 23rd, 2025 at 04:21 pm

Degree of Financial Leverage, or DFL, basically tells you how much a company’s profit per share or its overall net income can swing up or down when its operating income (EBIT) changes, all because it’s got fixed costs like interest payments on its debt. Think of it this way: DFL shows you how much a company’s profits might move when sales or operating income shifts, depending on how much debt it’s taken on.

Lets explore degree of financial leverage formula, examples and its practice questions so that you can crack next interview!

What is Degree of Financial Leverage?

A Degree of Financial Leverage (DFL) is a leverage ratio that measures the sensitivity of a company’s earnings per share (EPS). The DFL takes into consideration the fluctuations in the company’s operating income caused by the changes in its capital structure. The DFL is used to quantify a company’s financial risk. It measures the percentage change in EPS for a unit charge in operating income, also known as earnings before interest and taxes (EBIT). The higher the Degree of Financial ratio, the more volatile earnings will be. This is good when the operating income is growing, but it can be a problem when operating income is under pressure.

Basically, the Degree of Financial Leverage, or DFL, shows you how much your earnings per share (EPS) are affected by changes in your operating profit (EBIT), all because of things like interest payments on loans. Think of it as a way to see how much your debt financing really bumps up the profits or losses that shareholders see.

So, if your EBIT goes up or down by 1%, DFL will tell you exactly how much your EPS is expected to move.

The formula for Degree of Financial Leverage

The Degree of Financial Leverage (DFL) measures how sensitive a company’s Earnings Per Share (EPS) is to changes in Earnings Before Interest and Taxes (EBIT). It shows the impact of fixed financial costs (interest) on shareholder earnings.

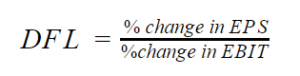

1. Degree of Financial Leverage – Percentage Change Formula

DFL = % change in EPS / % change in EBIT

Explanation:

This formula explains how much EPS will change for a given percentage change in EBIT. A higher DFL indicates higher financial risk and higher earnings volatility.

2. Degree of Financial Leverage – Point Formula

DFL = EBIT / EBIT – Interest

Where,

EBIT = Earnings Before Interest and Taxes

Interest = Fixed interest expense on debt

Assumption:

This formula assumes no preference dividends and ignores taxes for simplicity.

DFL can also be represented by the following equation:

Standard formula (percentage formula)

DFL = % Change in EPS ÷ % Change in EBIT

Point Formula (At a Given Level of EBIT)

DFL = EBIT ÷ (EBIT − Interest)

Mention assumptions (no preferred dividends, ignoring tax for simplicity)

What does Degree of Financial Leverage Tell you?

The higher the DFL, the more volatile earnings per share (EPS) will be. Since interest is a fixed expense, leverage magnifies returns and EPS, which is good when operating income is rising but can be a problem during tough economic times when operating income is under pressure. DFL is very valuable in helping a company assess the amount of debt or financial leverage it should opt for in its capital structure. If operating income is relatively stable, then earnings and EPS would be stable as well, and the company can afford to take on a significant amount of debt. However, if the company operates in a sector where operating income is quite volatile, it may be prudent to limit debt to easily manageable levels.

Degree of Financial Leverage Example (Step-by-Step)

When the DFL is higher, it means your potential profits could be bigger, but you’re also taking on more financial risk. That’s why it’s such a big deal for anyone studying or working in finance.

Given Data

EBIT: ₹10,00,000

Interest: ₹4,00,000

Tax: Ignore for simplicity (common in interview questions)

Step 1: Calculate Earnings Before Tax (EBT)

EBT = EBIT − Interest

= ₹10,00,000 − ₹4,00,000

= ₹6,00,000

Step 2: Calculate DFL

DFL = EBIT / EBIT – Interest

DFL = 10,00,000 / 6,00,000 = 1.67

Step 3: Interpret the DFL

A DFL of 1.67 means:

A 1% increase in EBIT will cause approximately a 1.67% increase in EPS

A 1% decrease in EBIT will cause approximately a 1.67% decrease in EPS

Step 4: EBIT Change Impact (Interview-Style Insight)

If EBIT increases by 10%:

EPS will increase by approximately 16.7%

This shows how financial leverage focuses shareholder returns and risk.

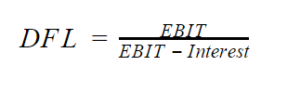

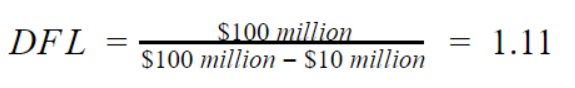

Q. Let’s consider the following example. A Company ABC has operating income or EBIT of $100 million in Year 1 with interest expense of $10 million and has 100 million shares outstanding.

Solution:

EPS for ABC in Year 1 would be:

Using this, the DFL can be calculated as follows:

Interpretation of Degree of Financial Leverage

High DFL

1.Indicates high debt usage

2.EPS is highly sensitive to EBIT changes

3.Higher return potential but higher financial risk

Low DFL

1.Indicates low reliance on debt

2.More stable earnings

3.Lower risk but limited return amplification

Ideal DFL

1.Moderate range (around 1.2–2.0 for many industries)

2.Balances growth and risk efficiently

Risky DFL

1.Very high values (above 3.0)

2.Small profit declines can severely impact EPS

3.Signals potential solvency stress

Degree of Financial vs Operating vs Combined leverage

DOL focuses on business risk. DFL focuses on financial risk. DCL captures total risk exposure

| Basis of Comparison | Degree of Operating Leverage (DOL) | Degree of Financial Leverage (DFL) | Degree of Combined Leverage (DCL) |

| Meaning | Measures impact of change in sales on EBIT | Measures impact of change in EBIT on EPS | Measures impact of change in sales on EPS |

| Type of Risk Measured | Business (operating) risk | Financial risk | Total risk (operating + financial) |

| Focus Area | Cost structure (fixed vs variable costs) | Capital structure (debt vs equity) | Overall earnings sensitivity |

| Key Formula | DOL = %Δ EBIT ÷ %Δ Sales | DFL = %Δ EPS ÷ %Δ EBIT | DCL = DOL × DFL |

| Point Formula | Contribution ÷ EBIT | EBIT ÷ (EBIT − Interest) | Contribution ÷ (EBIT − Interest) |

| Cause of Leverage | High fixed operating costs | Fixed interest expense | Fixed operating + fixed financial costs |

| Impact on Earnings | Amplifies operating profit | Amplifies shareholder earnings | Amplifies total earnings volatility |

| High Value Indicates | High operating risk | High financial risk | High total risk |

| Used By | Cost & pricing analysts | Finance managers & investors | Strategic & risk analysts |

| Example | Manufacturing firms | Debt-heavy firms | Capital-intensive companies |

Real-Life Applications of Financial Leverage

The Degree of Financial Leverage (DFL) explains how debt impacts earnings volatility. A higher DFL amplifies EPS changes when EBIT fluctuates, increasing both return potential and financial risk. Understanding DFL is essential for financial analysis, capital structure decisions, and investment evaluation.

Manufacturing Companies

Manufacturers often use debt to finance plants and machinery. DFL helps management assess whether fixed interest obligations are sustainable during demand fluctuations.

Capital-Intensive Industries

Industries like infrastructure, power, telecom, and airlines rely heavily on debt. High DFL is common, making earnings highly sensitive to revenue cycles.

Startups vs Mature Firms

1.Startups: Prefer low or zero DFL due to unpredictable cash flows.

2.Mature firms: Use higher DFL strategically to enhance shareholder returns.

Cyclical Businesses

Sectors like steel, cement, automobiles face demand cycles. High DFL during downturns can severely impact EPS, making leverage decisions critical.

Practice Questions on Degree of Financial Leverage

Question 1

A company has an EBIT of ₹10,00,000 and interest expense of ₹2,00,000.

Calculate the Degree of Financial Leverage (DFL).

Solution:

DFL = EBIT / (EBIT − Interest)

DFL = 10,00,000 / (10,00,000 − 2,00,000)

DFL = 10,00,000 / 8,00,000 = 1.25

Answer: DFL = 1.25

Interpretation: A 1% change in EBIT leads to a 1.25% change in EPS.

Question 2

A firm reports an EBIT of ₹5,00,000 and interest of ₹5,00,000.

What is the DFL?

Solution:

DFL = EBIT / (EBIT − Interest)

DFL = 5,00,000 / (5,00,000 − 5,00,000)

DFL = 5,00,000 / 0 = Undefined

Answer: DFL is not applicable / infinite

Interpretation: The company is at break-even at EBIT level; EPS becomes extremely sensitive to EBIT changes.

Question 3

A company has EBIT of ₹8,00,000 and interest of ₹10,00,000.

Calculate DFL and comment.

Solution:

DFL = EBIT / (EBIT − Interest)

DFL = 8,00,000 / (8,00,000 − 10,00,000)

DFL = 8,00,000 / (−2,00,000) = −4

Answer: DFL = −4

Interpretation: Negative DFL indicates EBIT is insufficient to cover interest, leading to losses and high financial risk.

Conclusion

In real-world finance, DFL plays a crucial role in capital structure decisions, risk assessment, valuation, and investment analysis. Whether evaluating manufacturing firms, capital-intensive industries, startups, or cyclical businesses, understanding DFL allows smarter decision-making. For finance students and professionals, mastering financial leverage concepts is essential for interviews, financial modeling, and real-life corporate finance roles.

FAQ

The degree of financial leverage (DFL) measures how sensitive a company’s earnings per share (EPS) are to changes in operating profit (EBIT) due to fixed financial costs like interest.

DFL = EBIT / (EBIT − Interest)

This formula shows the impact of interest costs on shareholders earnings.

DFL is not applicable when a firm has no fixed financial charges, such as interest or preference dividends, because there is no financial leverage involved.

DFL measures risk from financial costs (interest), while operating leverage measures risk from fixed operating costs. DFL affects EPS, operating leverage affects EBIT.

High financial leverage amplifies shareholder returns in good times but increases risk and losses during downturns due to mandatory interest payments.

Yes, DFL can be negative when EBIT is less than interest expense, indicating losses and high financial risk for equity shareholders.