Last updated on August 11th, 2025 at 04:13 pm

CFA Vs ACCA

So, usually this question about comparing cfa Vs ACCA comes about from students. Because both the qualifications have some popularity in the Indian universities. Let me explain this by sharing some numbers with you which make it clear to you.

- During the year 2023 almost 1.1 Lac CFA candidates wrote exams world wide

- While at the same time 1.05 Lac students wrote the ACCA exam worldwide during the same period.

So, its no doubt that both these qualfications are well known in the student community. However, does that mean that you could choose anyone of these? Absolutely not.

On the one hand we have an accounting qualification- ACCA, which also competes with ICAI(CA) in India. While CFA is an investment management qualification.

CFA Vs ACCA – Job opportunities?

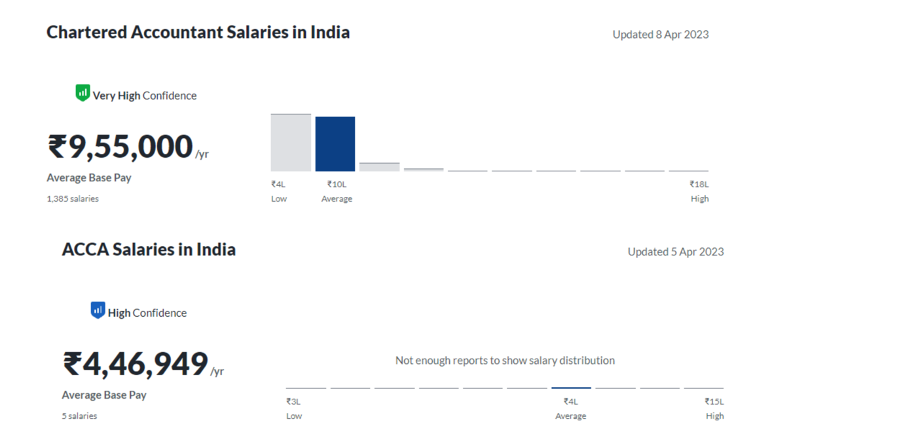

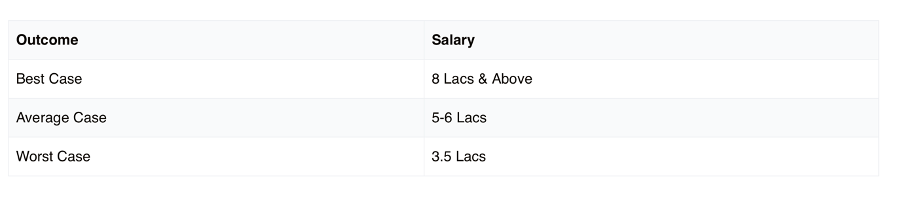

Now, let me discuss a little bit on the scope of job opportinties with CFA vs ACCA. As you know that since ACCA,is an accounting qualification. While the Indian accounting scenario is dominated by chartered accountants, hence salary command for ACCA is not comparable with CA.Below are some salaries which you can get as an ACCA fresher.

On the other hand let me also show you what is the same scenario with CFA candidates. If you see closely then even the worst case scenario with CFA is that you end up at a much higher salary than ACCA.

The Exam Perspective – CFA Vs ACCA

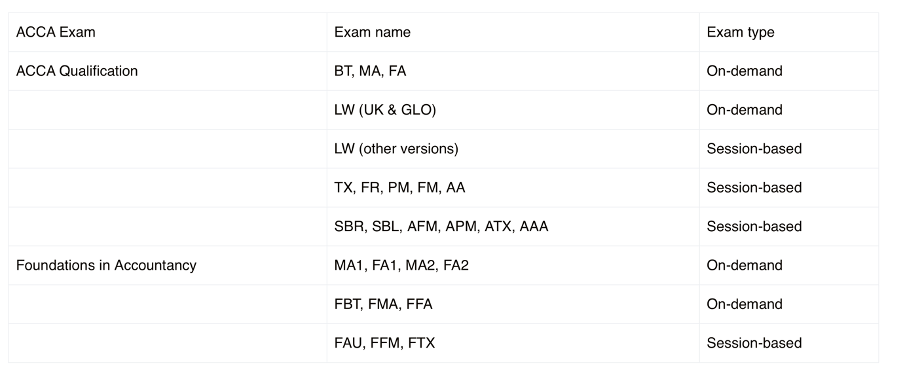

Now, let me compare what is the difference between CFA Vs ACCA in terms of the exam structure. On the one hand CFA is a very simple plain structure of 3 exams i.e Level 1 , Level 2 & Level 3. Whereas, compared to that ACCA has in total 13 papers, and array of exemptions depending upon your previous qualifications.

Below is the gist of the number of exams in acca.

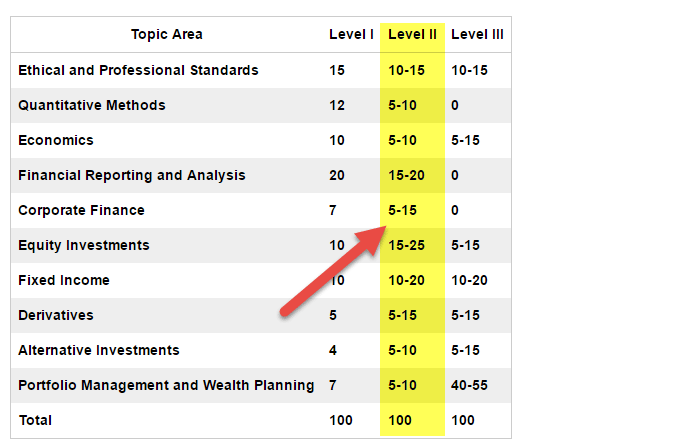

Compared to that below is a gist of the CFA syllabus

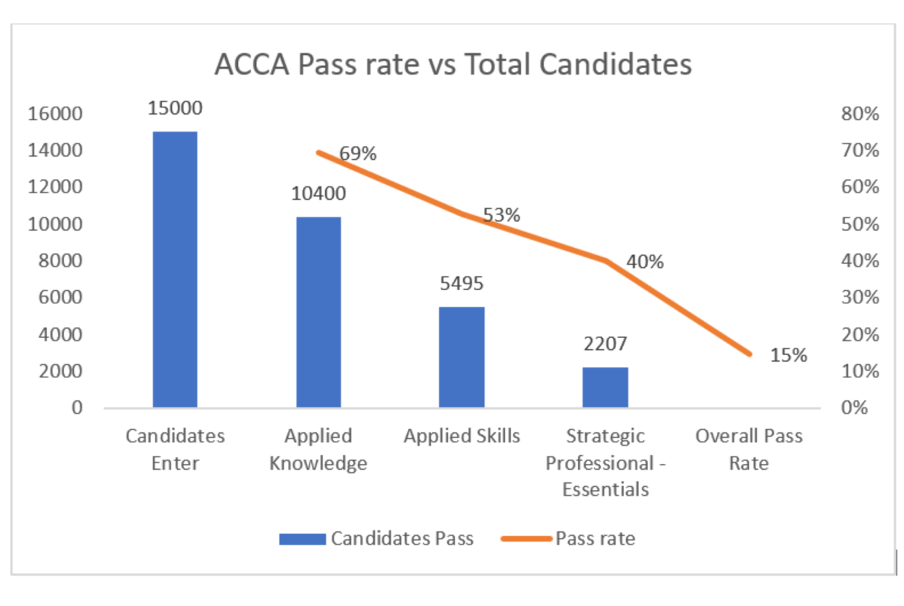

The Pass Rate Comparison

Now if I look at the pass rate comparison CFA Vs ACCA, then we clearly see that the overall pass rate for ACCA is 15%. Which means that if 100 students start the program, you can expect 15 to successfully complete the ACCA program.

So, then what about CFA? So compared to ACCA the pass rates are lower for CFA, because the exam is ofcourse very detailed and comprehensive.

- At level 1 the pass rate is around 40%

- At CFA level 2 the pass rate is at around 46%

- While at Level 3 the pass rate is around 54%

Which means if 100 students start the CFA program at level 1 then, 7-8 students will pass. So the conclusion is that In the CFA vs ACCA comparison, CFA is twice as tough compared to ACCA.

Cost Comparison between ACCA & CFA

Now if I compare these qualifications from a cost perspective then ACCA can be a little more costly, if you start from the foundation level exams. However at a very broad level

- CFA cost around 2.5 Lacs

- While ACCA total pursuing cost will be somewhere around 4.5 Lacs

So if I just look at the cost, obviously then ACCA is more expensive program. However I am assuming that you will not discredit a program just on the basis of its cost. After all its impossible to measure the return on investment on education.

Global Recognition CFA Vs ACCA

Now, let me also touch upon the overall recognition of these two programs worldwide. And No! I am not going to just talk about how many countries they are recognized in. Because that kind of data is really not helpful in deciding. However, what I will do certainly is to see how these qualifications have progressed world wide in terms of competitive qualifications. Or May be employability.

- ACCA qualification does not have any signing authority except in Dubai, which is the primary requirement to assess a programs application.

- Whereas if I compare the same statistic with CPA, CPA’s have signing authority across most of the countries world wide.

- Compare that to CFA, but we aren’t really going to compare the signing authority because they don’t sign. However if you see in the investment management industry, CFA qualification has been officially recognized in a country like India as equivalent to a tier 1 post graduate program.

- Which also means that no more will CFA candidates have to negotiate their salaries on the basis of graduation.

Conclusion

Overall in my opinion CFA is a much better option for graduates if they are seeking a career in finance and investments. However if this is not the case then I would still recommend candidates to pursue the standard CA qualification. While the main reason for recommending it is because, even if you do not clear the entire CA program. You are still better placed in terms of job opportunities in finance. Check out our CFA Classes in Pune.

FAQ

Which is tougher ACCA or CFA ?

ACCA covers a broader range of accounting and finance topics, has more exams with relatively higher pass rates as compared to CFA. CFA is tougher taking the 45% passing rate also CFA has broader syllabus which demands more study time also for Chartered Financial Analyst case studies are more important.

Which is more expensive ACCA or CFA?

CFA total cost in India is approximately ₹3.1 lakhs for early registration and can go up to ₹4 lakhs or more if registering late, covering enrollment fees and exam fees for all three levels. ACCA total cost typically ranges between ₹2.7 lakhs to ₹4 lakhs, including registration, exam fees, annual subscriptions, and study materials. Both take almost same amount this number can vary by coaching and training you take and also if you apply late you will have to pay more as late fee.

Will ACCA provide me better package or CFA?

As a fresher the package you get as a CFA level 1 candidate and ACCA candidate gets is the same which ranges from 5LPA to 8LPA. When you enter into the market as a fresher the skill matters but the salary range is standard after you have gained experience your growth is exponential.

Should i pursue ACCA or CFA?

ACCA is for accounting as it says on their website ACCA is number one choice for accountancy students. If auditing, accounting also taxation is something you feel passionate about you should go for ACCA. CFA focuses on core finance side which includes analyst position and portfolio management also wealth management.

Is there any major update in ACCA or CFA?

The major update is ACCA and CFA are implementing more sustainability into Finance and also more real world case studies will be emphasized.

Read More

How to Build a Financial Model: A Practical Step‑by‑Step Guide

Learning how to build a financial model isn’t just about entering numbers into Excel — it’s about structuring information so you can make better business and investment decisions.A financial model turns business drivers and assumptions into a logical framework that helps you forecast outcomes and evaluate choices. Whether you’re an investor, entrepreneur, or finance professional, this guide…

Top Investment Banking Skills for Aspiring Students & Professionals

Investment banking skills are the foundation of a successful career in one of the most competitive fields in finance. These skills decide how fast you grow, how well you perform under pressure, and how much value you bring to clients. They matter for students, fresh graduates, and even career switchers who want to break into…

Investment Banking Subjects: What You’ll Learn & Why It Matters

Last updated on January 16th, 2026 at 01:35 pmInvestment banking is a specialized field of finance that focuses on helping companies, governments, and institutions raise capital, make strategic decisions, and execute complex financial transactions. The subjects related to investment banking combine accounting, finance, economics, and business strategy to build a strong understanding of how companies…

What Is an Investment Banking Course? Syllabus, Skills & Career

Last updated on January 16th, 2026 at 01:13 pmInvestment banking is one of the most sought-after careers in finance, attracting both fresh graduates and professionals looking to switch into core finance roles. But where do you begin, and what skills or training actually matter?In this guide, we break down what an investment banking course really…

Top 5 high paying CFA level 1 Jobs in India – Guide

Cracked CFA Level 1 and wondering what’s next? You’re not alone. Thousands of finance students and professionals in India clear Level 1 of the CFA Program each year but the big question remains: “Can I get a good job after CFA Level 1?” The short answer? Yes, but with the right expectations. While Level 1…

Importance of corporate finance – Why it matters

In today’s dynamic business world, every financial decision big or small has a ripple effect. Whether it’s funding a new project, managing day-to-day cash flows, or planning for long-term growth, corporate finance lies at the heart of it all. It’s the engine that keeps businesses running efficiently, strategically, and profitably. But why exactly is corporate…