Last updated on January 21st, 2026 at 01:48 pm

Investment banking course fees can vary widely, but choosing the right program matters far more than the price. Mumbai, India’s financial capital, is the ideal place to build a career in investment banking—home to the BSE, RBI, SEBI, and major global banks, and responsible for nearly 70% of the country’s capital market activity.

Whether you’re a fresher entering finance or a professional transitioning into investment banking, the right course in Mumbai can be a career-defining move. Top programs combine hands-on training in financial modeling, valuation, M&A, and capital markets with live instruction, case studies, and strong placement support.

In this article, we break down investment banking courses in Mumbai by fees, curriculum, duration, and placement outcomes. We also cover the practical skills you’ll gain, how to choose the right course based on your experience level, and real salary insights after certification—helping you avoid overpriced programs that promise more than they deliver.

Investment Banking Course Fees

Mumbai, the financial capital of India is the hub of finance services and jobs. In order for you to have a successful careers into this industry, it is essential for you to upgrade your skills. Below is the list of the five courses we recommend that you do not ignore for a capital markets or financial services career.

Investment Banker Course Fees Comparison

Mentor Me Careers

- Excel, Advanced Excel

- Financial Statement Analysis

- Valuation Models, DCF

Imarticus Learning

- Trade Life Cycle, Corporate Actions

- Asset Management, Stock Borrowing

- Risk Management

Wall Street School

- Excel, Feasibility Study

- Valuation, LBO, DCF

- M&A Modeling

IMS Proschool

- Equity and Debt Markets

- Forex, IB Operations

- Risk Management

EduPristine

- Excel, Valuation, M&A

- Financial Analysis

Eligibility Requirements for Investment Banking Courses in Mumbai

Though eligibility requirements for investment banking professionals may vary across institutions or course providers offering programs in investment banking, here are some of the usual conditions that applicants must satisfy:

- Educational Background: Candidates should have successfully completed their high school education (equivalent of 10+2 system).

- Graduation: A bachelor’s degree in commerce-related fields such as B.Com or BBA is often required but not always necessary.

- Interest in Finance: You must be deeply passionate about working within the finance sector especially investment banks.

- Basic Finance Knowledge: Some prior understanding of financial matters would come in handy during your studies towards becoming an investment banker.

The Best investment banking courses in India Comparison

So, let’s explore some of the best investment banking course . I have curated the list basis the review and placement record of the institute.

| Rank | Institute | Investment Banking Course Fees | Duration | Google Ratings |

| 1 | Mentor Me Careers | 45,999 | 4 Months | 4.9 |

| 2 | Imarticus Learning | 1,40,000 | 6 Months | 4 |

| 3 | Wall Street School | 93,500 | 4 Months | 4.4 |

| 4 | IMS Proschool | 1,20,000 | 9 Months | 4 |

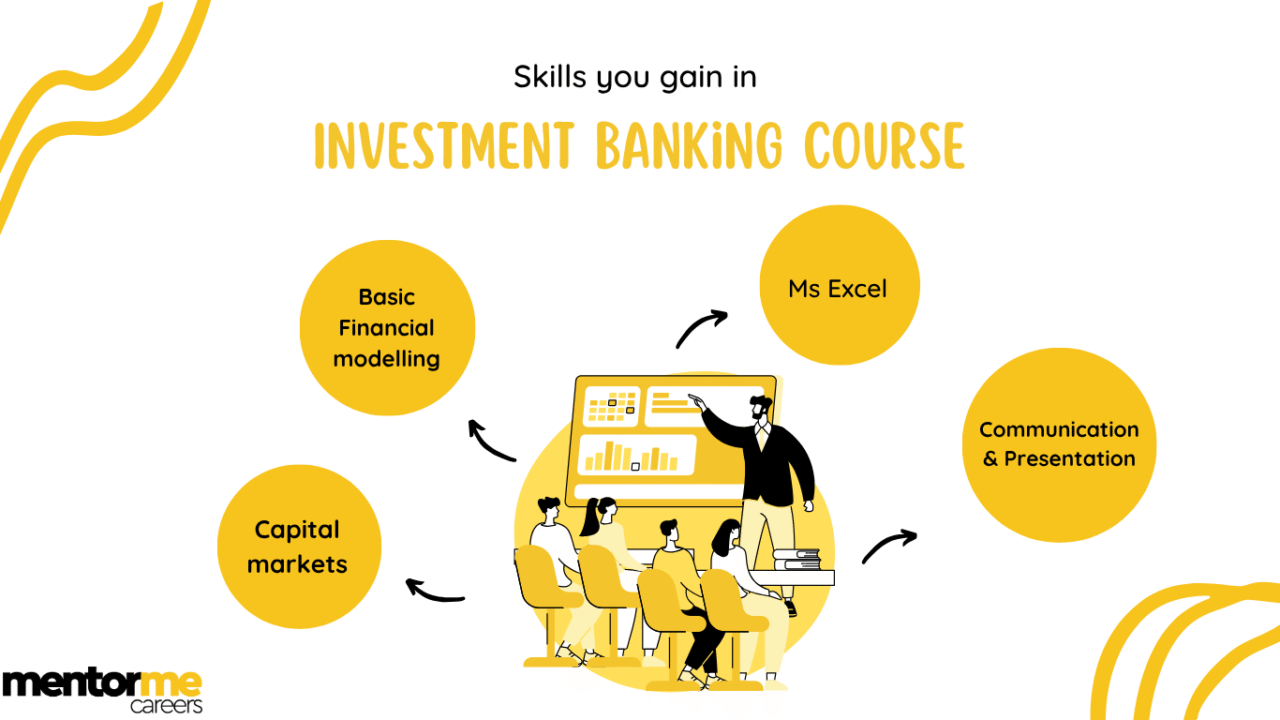

Skills you will master in Investment banking course in Mumbai

In Mumbai’s competitive investment banking sector, excelling means mastering a mix of technical and interpersonal skills.

Financial Modelling & Valuation

You will learn to build basic financial modelling. According to industry-leading programs in Mumbai, this analytical framework empowers candidates to assess investment opportunities and support M&A decisions with confidence. Many courses emphasize case‑studies mirroring real-world scenarios to enhance practical understanding.

Excel & PowerPoint for Pitch Books

Investment banking depends heavily on streamlined Excel skills from advanced formulas and shortcuts to VBA automation plus polished PowerPoint layouts for effective pitch decks. Leading Mumbai courses integrate modules on crafting financial plans in Excel. This combo ensures your output is not just accurate, but investor-ready and visually compelling.

Equity Markets

Understanding how capital markets operate is critical. You’ll learn various deal structures such as equity and debt offerings, LBOs, M&As. This section covers how each instrument functions and its impact on valuation.

Soft Skills: Communication & Interview Preparedness

Strong communication and presentation skills are vital both for internal teamwork and client interaction. You’ll be coached on delivering concise financial insights, structuring persuasive narratives, and mastering typical Investment banking interview scenarios. Courses often feature mock interviews, networking techniques, and feedback loops to ensure you are ready to present yourself and your ideas with clarity and finesse. Investment banking course provided by mentor me careers, here we provide start to end training for interview preparation to make sure students get the job role they have skills for.

By gaining proficiency in technical analysis, modeling tools, market mechanics, and communication strategies, you will emerge from the course better equipped to enter roles like investment banking analyst, M&A associate, equity research analyst, or capital markets consultant with a strong advantage in Mumbai’s vibrant finance market.

Mentor Me Careers’s- Investment Banking Courses Fees in Mumbai

So, Mentor Me Careers is the leading provider of investment banking courses in India. And more over is known for its amazing placement record and recruiter connect. Mentor Me Careers providers two major courses for investment Banking Careers. Both of these investment banking courses is same at 27999, which is affordable and gives high value for money.

Now let me briefly cover the coverage of these courses.

The Best Investment banking Course in Mumbai

Exceptional training & Placements provided from beginning to the end. Although I had done my investment banking course from another institute in Mumbai, but they didn’t give placements. So finally I joined Mentor Me Careers and got placed in Morgan Stanley Mumbai.

CA Laxmikanth Bansal, Morgan Stanley

Financial Modelling and valuations Course

Financial modelling is the most basic skill required in the world of investment banking. Moroever, it is tested as a part of the investment banking profile interview.

So, this investment banking fee at INR 38999 & it covers all the major aspects of front office skills. The course covers;

- Excel

- Advance Excel

- Financial statement analysis

- Valuation with 12 models

Moreover, this course also comes with life time validity on learning portal access. Also, it provides unlimited interviews.

You can check the placements of this course here: Investment banking placements.

Top Finance Professional Courses in India

Features & Highlights

The investment banking certification courses provided by MentorMeCareers have the following features:

- Lifetime validity on learning portal access

- Unlimited interviews

- BSE Certification

Check the placements of this course here: Investment banking placements

Course Duration & Fees

The course on average takes three to four months to complete from enrolment to placements.

| Course Variant | Price (INR) |

|---|---|

| Self-Paced Financial Modelling | 10,999 |

| Live Basic Financial Modelling | 16,499 |

| Live with Placements Financial Modelling | 32,999 |

Certified Investment Banking Operations Course Fees- CIBO

Now, if you want to make a career in Middle office and back office operations. Then even the CIBO – investment banking fee is around 27999. Which makes it the lowest fee for any investment banking course in India.

Course Coverage & Syllabus

The broad coverage of this investment banking course is; you can check a detailed syllabus recommended for investment banking.

Investment Banking Course Syllabus

Investment Banking Foundation

- Financial system and trading terminologies

- Various methods of exchange

- Recording trade details with case studies

- Financial services and actual trade order case study

- Structure, functions, and roles of investment banks

Equity & Market Structure I

- Classification of capital markets

- Types of securities and financial intermediaries

- Long and short positions, leverage ratio

- Execution and clearing instructions

- Security market indices

Equity & Market Structure II

- Index construction methods and types

- Rebalancing and reconstitution

- Fixed income indices and alternative investment indices

- Overview of financial markets

Derivatives Instruments I

- Concept of arbitrage

- Forward and future contracts

- Forward rate agreements and swap contracts

- Valuation of options (in-the-money, out-of-money)

Derivatives Instruments II

- Exchange-traded vs. over-the-counter instruments

- Forward claims and contingent claims

- Value at expiration calculations

- Purpose of derivative markets

Fixed Income Securities I

- Classification of global fixed income markets

- Interbank rates and bond markets

- Primary vs. secondary markets for bonds

- Types of bonds: sovereign, corporate

- Short-term funding for banks and money markets

Fixed Income Securities II

- Bond features: coupon, rate, yield curve

- Bond covenants and regulatory considerations

- Fixed income cash flow structures

- Contingency provisions

Asset Management

- Portfolio approach to investing

- Steps in portfolio management process

- Types of investors and investment plans

- Aspects of asset management and mutual funds

Corporate Governance & Corporate Finance

- Stakeholder groups and conflicts

- Board of directors: roles and risks

- ESG considerations in governance

Course Details Summary

Investment Banking Course Details

Features & Highlights

- 1500 financial institutions for placements

- The best placement assistance program

- Practical training using case studies

Fees & Duration

The program has variants according to your needs:

| Program Variant | Price (INR) |

|---|---|

| Live with Placements | 32,999 |

| Self-Paced – CIBOP | 10,999 |

| Live Basic – CIBOP | 16,499 |

Testimonials

I got placed in GAA Advisory Mumbai after completion of financial modeling course in Mumbai provided by MentorMeCareers.

Valuation Associate, GAA Advisory Mumbai

List of Investment Banking Courses in Mumbai

Imarticus Learning- Investment investment Banking Classes in Mumbai

Imarticus learning is also another institute for investment banking courses and their investment banking fee is around 1.4 Lacs. Which under this category is the most expensive investment banking course fee.

User Reviews:

Rohan Patil Ex Imarticus Student

I want to tell my story of doing the data analysis and machine learning course at Imarticus so that you can be careful. The program and job support weren’t what I had been led to expect, even though their advertising was very persuasive.

To start with the content of the course was old-fashioned; there were a lot of things missing. No window functions, stored procedures or Common Table Expressions (CTEs) were taught, among other vital topics. These gaps could put candidates at a disadvantage during interviews because most technical job interviews touch on these areas.

Another thing is that I felt like 100% job guarantee promised by Imarticus was more marketing strategy than anything else. Advertising for help in finding jobs does not mean that they will find you one too. They only scheduled two interviews for me after I finished studying with them despite assuring over and over again that this would happen without fail. I passed one interview but lost it because there was reorganization within the company where had succeeded being selected through their platform which frustrated me since it costed me Ksh 180k.

It should also be noted that they have changed their group settings such that now messages are restricted to admin posts only – this raises questions about how transparently their recruitment process is run given this move which may also affect visibility into what happens behind scenes regarding their “job guarantees”.

Now, let me take you briefly throught the coverage of this investment banking course;

Course Coverage

The certificate in investment banking operations program by imarticus covers very similar content as of mentor me careers. However, still let me give you a brief overview;

- Trade life cycle

- Introduction to financial markets

- Reference data management

- Corporate actions

- Asset management

- Stock borrowing and lending

- Collateral management

User Experiences with Imarticus

What our customers say

Source: Quora

I joined imarticus to get better compensation which was promised by their counsellor that they will not provide good package. But however this did not happening and also the grading structure has been designed in such a way and had been advised the teaching staff how good the student perform the score is just 3 which is passing marks as out of 5 on the basis of this they are providing the package. I have performed well and passed with good grades but no job opportunity is provided.

Rohan Patil

Source: Quora

CIBOP certification course is definitely a worthwhile course at imarticus I’m not bluffing I was a part of this program back in December 2018 and also I got placed at Societe Generale corporate and investment banking in Bengaluru trainers were supportive and did a fabulous job in training 30 us from classes to attending interviews I had just graduated from my college and was looking to join an investment bank to kick start my career and Imarticus learning in Bengaluru helped me in making this a reality. And now I’m currently working at Northern trust Hedge fund services where again the training helped me in cracking my technical and HR interview because the questions asked in my previous organization was almost similar and I could answer in a much professional manner.I still have those notes that I had written down during my training classes with me for reference.

Hope this helps

Bharat SV

Source: Quora

I did my invesment banking course at imarticus. When i joined they clearly mentioned they wont give any guarantee in getting a job but they will assist you for sure. I got my job through imarticus. They will concentrate both on technical and softskills. I gained immense knowledge on the technical side. Faculties are strong in technical knowledge and they are easily approachable. If you want to get into a invesment bank then imarticus will be ur right choice.

Pros:

Faculties are friendly and easily approachable.

Can gain immense knowledge in invesment banking.

They have better facilities.

Cons:

They wont guarantee for ur job they will only give assistance.

They need some improvements in softskills training.

Diwakar Nagarajan

The Wall street school-Investment Banking Courses Fees

TWSS, as popularly known runs its financial modeling course which qualifies as one of the investment banking courses that we will cover. However, let me first take you throught the investment banking fee of TWSS. Which is around 99000/-( 24000 for the training and 75000 for placements).

In my opinion charging 75000 for placements is a huge ask, especially since the course’s main objective should be placements itself.

Course coverage

Now the claimed training of the investment banking course by the wall street school is around 60 Hrs. Which covers the following;

- Excel

- Basic finance concepts

- Feasibility study

- Comparable company analysis

- Precedent transaction analysis

- Discounted cash flow application

- Merger model

- LBO Model

IMS Proschool- Investment Banking Course Fees

Moving on to some other institutes in investment banking. Firstly, lets cover the investment banking course fee of IMS Proschool. The investment banking course fee of IMS Proschool is Rs. 120,000 for the classroom version.

Let me take you through the broad coverage of the course;

The broad coverage of this course includes the following topics;

- Excel

- Equity and debt market

- Forex and derivatives

- IB Operations

- Settlement and risk

- OTC Products

Now my only review here is that given, that the program is for 9 months. Why would the course cover so less content.

Edupristine Investment Banking Course Fees

So, edupristine which is managed by Neev knowledge management, used to be a stalwart in finance. However, over the years the institute has been very silent . What is the reason?, is probably a mystery. However let me look at their major investment banking course fee, which is their financial modeling course;

The program fee is not readily displayed in the website. However my guess is that the course fee should be around 30,000 + GST. Also, as per edupristine’s website, Edupristine gives training now only in Mumbai and live online.

Brief Coverage of the course

- Excel

- Mergers and acqusitions

- Project finance

- Macros

- Valuation

- Power BI

Other Popular List of Investment Banking Course fees & Duration.

Apart from the above very narrow list of filtered institutes, below is the entire list of investment banking course fees and duration list.

| Top Investment Banking Courses/Certification | Mode of Learning | Investment Banking Course Fees and Duration | ||

| Provided By | ||||

| Certificate in Investment Banking Operations Course (CIBO) | Mentor Me Career | Self-Paced and Live Online | 200+ Hours | Rs.5,499 to Rs.27,499 + (GST) |

| Investment Banking Training Udemy | Mentormecareers | Online | ||

| The Complete Investment Banking Course 2023 | Udemy | Online | 13.5 Hours | Rs.3,399 |

| Investment Banking: Financial Analysis and Valuation | Coursera | Online | 13 Hours | Enroll for Free |

| Investment Banking Course | Intellipaat | Online | 5 Months | Rs.98,040 |

| Essential Skills for Investment and Finance | EdX | Online | 2 Weeks | Free |

| Investment Banking Course | The Wall Street School | Online | 6 Weeks | Rs.45,000 + GST |

| PG Program in Investment Banking and Financial Modeling | Data Trained | Online | 6 Months | Rs.90,000 + GST |

| Certificate in Investment Banking and Equity Research | Career Bulls | Online | 3.5 Months | Rs.37,999 |

Intellipaat Investment Banking Course Fees in Mumbai

Intellipat is a leading platform that provides many courses and certification programs, with over 1.2 million learners worldwide. It is the fourth ranked course for investment banking in Mumbai, offering flexible learning options for all working professionals.

This program has been developed keeping in mind an interactive approach towards learning by doing which would help candidates build their theoretical as well as practical knowledge about investment banking. The curriculum also focuses on developing skills required in this field such as those related to different areas of finance like corporate finance, financial modeling etcetera along with industry-specific skillsets needed to thrive amidst competition within investment banks.

In collaboration with IIT Guwahati and E&ICT Academy, Intellipat’s course content is designed around the needs of the industry where it covers all major topics under investment banking thus providing hands-on experience coupled with strong theoretical foundation enabling students gain real-world applicable skills besides bookish understanding alone.

Course Curriculum

- Introduction to Excel

- Excel for Data Analytics

- Data Visualization Techniques with Excel

- Fundamentals of Investment Banking

- Overview of the Financial System

- Understanding Financial Markets

- Shares & Depository Receipts

- Cash Equities & Fixed Income

- Introduction to Foreign Exchange & Money Markets

- Derivatives Market Concepts

- Reference Data Management

- Corporate Actions

- Trade Life Cycle

- ISDA Basics

- Borrowing Fundamentals

- Mergers & Acquisitions

- Risk Management

- Anti-Money Laundering Practices

- KYC Norms

Highlights

- Live Sessions with Industry Professionals

- Industry Capstone Project

- One-on-One Interaction with Investors

- 24/7 Support

- Mock Interview Preparation

- Career Support Services

- Soft-Skill Development Program

- Placement Assistance

- Peer Learning Opportunities

Investment Banking Course Fees:

INR 98,040 + 18% GST

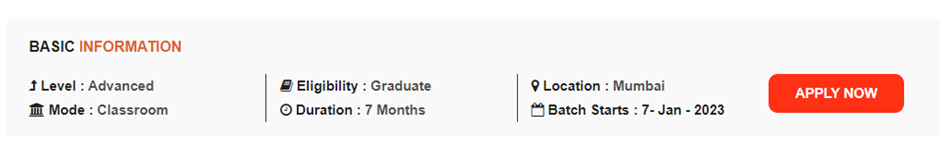

BSE Institute Mumbai

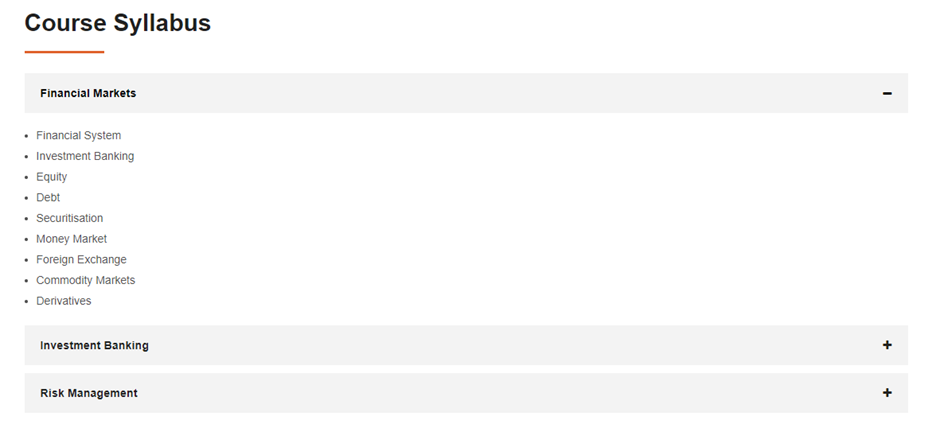

The Bombay stock exchange, also has a training institute which offers courses related to finance and one of the courses is related to investment banking operations. So, let’s review the program further, to see the suitability.

Course Content:

Now, first of all lets check the syllabus coverage. So, the syllabus covers three major areas of investment banking operations, financial markets, Investment Banking & Risk management.

However, in my honest opinion the course coverage is shallow and unnecessary time is being spent on risk management. Which, is not that useful for placements.

Investment banking Courses Fees & Duration

The institute website mentions that the course is for 7 months, and the lectures are conducted online. Although the main website says its classroom.

Confusion with the mode?- Information is not clear on their

Also the investment banking course fees from the program is: INR 87,150/-

Location:

Address: 19th Floor, Phiroze Jeejeebhoy Towers, Dalal St, Kala Ghoda, Fort, Mumbai, Maharashtra 400001

Placements & Reviews: Investment Banking course Mumbai

Now, lets try to understand how the placements. So at the first glimpse, the website doesn’t show any specific page where the placed students profiles are shown. Also, the names of the companies mentioned as recruitment partners are very limited.

Which, is also limited because the non MNC’s in Mumbai don’t pay that high a salary.

BSE institute is rated as 4.2 on google with 181 reviews.

Expert Opinion:

In my opinion, the course lacks the depth and the coverage is too shallow for for considering this as a viable option. Plus the fees seems too high for a 7 months course, which lacks any clarity on placements.

The Wall Street School India

The Wall Street School India is a reputable internet learning platform, being one of the top six investment banking courses in Mumbai. It is highly recognized for its strong educational programs which are offered based on different needs of students who may opt for business valuation courses; financial modeling courses among others beside equity research and CFA training.

At The Wall Street School India they have designed this investment banking course with industry-experienced professionals who have gone through many real situations that require knowledge but also skills taught here can be applied practically too so as not just providing theoretical information. The whole idea behind crafting such a program is to ensure candidates understand what’s happening around them within the sector thus making it easier for them excel.

Instructors for this Investment Banking Course are well seasoned experts from various financial institutions having taught thousands over years helping learners shape their careers towards success in finance especially related fields like private equity or venture capital etcetera..

Course Name:

Duration of Course:

Weekday Batch: 6 Weeks (180+ hours), Monday to Friday, 9 A.M to 3 P.M

Weekend Batch: 2.5 Months

Mode of Study: Live Online Classes

Course Curriculum:

- Basic & Intermediate Excel

- Excel Functions

- Introduction to Advanced Excel & PowerPoint

- Basic Finance Concepts

- Understanding Financial Statements

- Assessing Financial Health

- Business Modeling

- Comparable Company Analysis

- Precedent Transaction Analysis

- Discounted Cash Flow Valuation (DCF)

- Merger Models

- Leveraged Buyout Models (LBO)

Course Highlights:

- Training by Industry Experts

- Real Case Studies and In-depth Discussions

- Flexible Weekday and Weekend Batch Options

- Online Self-paced Recorded Videos

- Placement Assistance Support

- Flexible Payment Plan: 40% at Enrollment, 60% After Placement

This course of investment banking by The Wall Street School India is designed to be flexible and comprehensive. Students can learn through the internet or attend weekend programs in person; with this variety candidates are left with no option but having all knowledge regarding finance at their fingertips. More so they teach using real life examples thereby making it easier for people to understand what happens around them within financial sector hence becoming successful professionals later in future especially when dealing with private equity firms or venture capitals etcetera..

Location

1st floor, Business Square, M.A Road, Railway Colony, Andheri West, Mumbai, Maharashtra 400058

User Reviews:

5 reviews10 months ago

Very bad experience as I call for the enquiry of courses then their phone representative said why you calling again and very unprofessional behaviour not acceptable.Shame on you and my doubts regarding the course are not resolved. Poor service.

Frequently Asked Questions: Investment Banking Course Fees

What are the qualification criteria for doing investment banking certification Mumbai?

In order to join an investment banking course in Mumbai, candidates must meet certain qualifications as stated by most institutes. A degree at undergraduate level is usually required where B.Com forms most part of commerce related courses. Additionally, it is mandatory for students to have a basic understanding about finance and they should also take keen interest in this sector. Some programs may require work experience or skills like financial analysis or wealth management before one can be admitted.

How does taking up finance course from Mumbai help me kick-start my career in financial services industry?

These training programs combine theoretical knowledge with practical skills so that their trainees could become well equipped professionals having both strong academic foundation and hands-on experience necessary for entry into finance service sector. This involves teaching various topics such as financial management; corporate finance; capital markets among others but not limited to risk management which are very critical areas when it comes down into working within this field.

Why are certificate programs important in investment banks?

Investment banking certificates like Certified Investment Banking Operations Professional (CIBOP) or any other recognized investment banking certifications carry high value across different industries especially those related with money matters because they act as proof of competence gained through relevant job experiences along side educational qualifications attained over time thus making candidates more competitive during recruitment processes particularly within organizations such as Goldman Sachs, JP Morgan Chase & Co., Deutsche Bank AG etcetera.

How much should I expect investing on learning investment banking skills through attending classes at Mumbai Institute i.e cost wise?

The cost incurred when someone wants learn about investments banks’ operations either by enrolling into a school located within Mumbai city limits varies depending on many factors like which institution one choose to study from, duration taken by course among others. For instance; top rated colleges may charge between INR 30000-150000+ for their programs inclusive of reading materials and hands-on training provided during placements but some colleges have discounts or can allow payment in installments.

What kind of jobs can I get after taking an investment banking course from Mumbai?

There are numerous career opportunities available for individuals who have completed courses on financial services offered by different institutes within this city ranging from being an Investment Banking Analyst; Financial Advisor or working with Assets Management Companies/Equity Research Firms/Private Equity houses etcetera. Additionally most schools offer placement assistance services which help students secure positions at top banks and other financial institutions.

What are the benefits of studying investment banking in Mumbai?

Mumbai is known as the financial capital of India, which makes it an ideal location for anyone interested in taking up a course on investment banking. It is home to several financial organizations such as Morgan Stanley and Deutsche Bank among others; this means that there will be many chances for networking with professionals working in these institutions or even gaining insights from them about what they do best. Moreover, most of these courses usually come packaged with things like hands-on training opportunities, live virtual classes where students can ask questions directly from experts over video calls, and case studies based on real-life situations that challenge people’s skills within finance industry.

Related Articles

- How to become investment banker in India?

- Career Paths in investment banking

- Interview Preparation for investment banking

- Financial Modelling skills for investment banking

- Investment banking operations for placements