Last updated on July 18th, 2025 at 01:48 pm

Although it’s like comparing baseball with soccer, but I can understand why students get into this golden question. Which is ca vs Mba which is better?

I have seen this that,time and again qualification combinations are mistakenly taken as “one fits for all solution”. How can it be? Unless all the jobs, all solutions are same in the industry. Quite not the case.

The broad difference – MBA Finance vs CA

Master’s in business administration has become a popular, default choice for many graduates in every field. But there is a big difference between what students perceive MBA qualification as a regulatory requirement for a job.

Precisely for the same reason 93% of the MBA’s are unemployed. Did you know that? I did and it’s obvious, MBA gets pursued as if it’s a ticket to a successful stable Career. However, if you realise the question is, you need to know which career first. Which will then answer whether ca or Mba which is better for you?

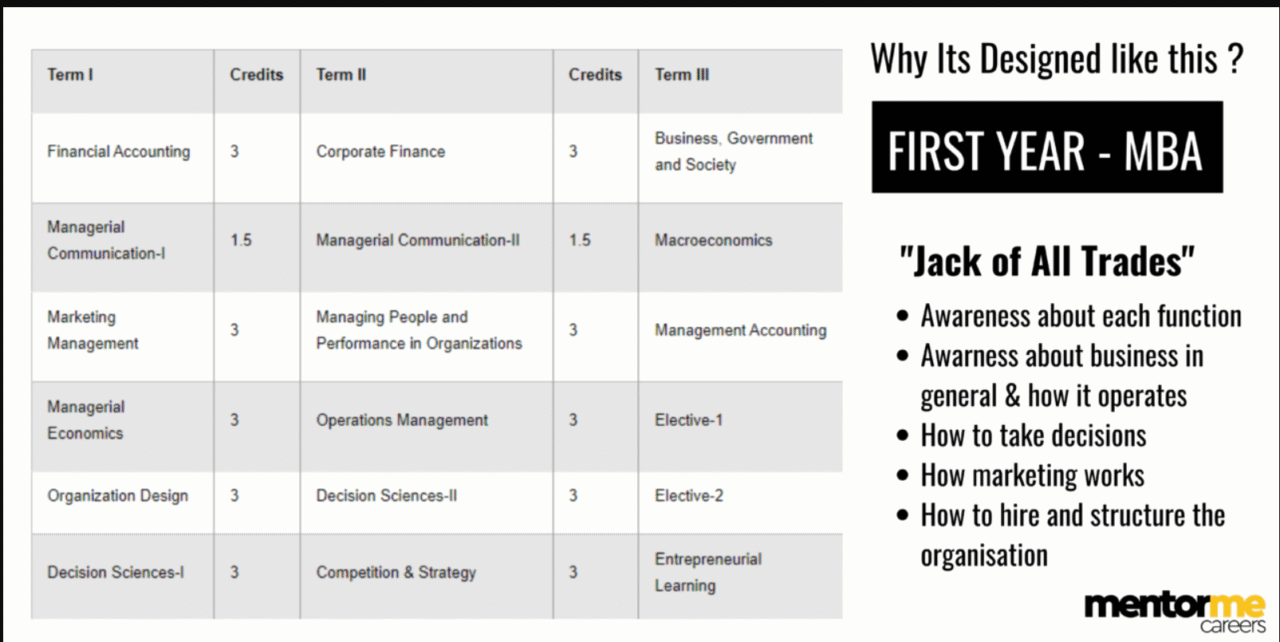

- MBA teaches you to be jack of all trades

- While CA is a regulatory qualification authorised by statute to audit, prepare and reconcile books of accounts for all.

And to be put it simply, “You can be great at business without an MBA but without CA you can’t be a bad chartered accountant ca

| Qualification | Industry | Specialisation |

| MBA | Any | Defining process, Problem solving, Finding new opportunities |

| CA | Taxation, Regulation, Auditing, GST | Auditing financial statements, interpreting and advising on tax laws, Advising on GST etc |

The Need of Jack of All Trades

Before you disregard the “Jack”, you need to understand that Business have too many functions. Imagine it for a second! You need to solve marketing issues, you need to plan for expansion, you need to solve product technical issues and more.

The MBA program is designed for a candidate to take any problem, whether its technical or non technical.

- Simplify the problem

- Find assistance from technical expert on options to solve the problem

- Create process or matrix for process so that this problem gets solved forever

- Identify new problems

- Keep listening to customers and listening to specialists(technical) people in the company and act as a bridge

Hence now you would appreciate why the MBA syllabus has everything. Trust me as a product manager myself for 6-7 years and going through various business transitions.

“There is a need for that neutral guy in the system, who can use his broader understanding of functions and come up with a solution”

You might be interested In watching this unscripted interview I had with the BNY Mellon director who happened to be both an MBA as well as a CFA charter holder.

The Need of Master of One or CA

Don’t shoo away the master, as exciting the previous function might sound like. It’s not fun, when you don’t know what to do everyday. It’s tough when you need get a new idea everyday.

The masters are technically specialised resources or people, who are the boss of one domain and subject. You need that player in the team, who you can rely on when you ask him,

- “Hey so what kind of GST should we register for? Composite or general?

- You need that specialised person who can be sure of the way of saving taxes legally. Example can we use 44 AD, or should we not.

- You need that person who knows his specific trade

In my opinion,CA qualification is that “Master of One”, in an organisation. Hence the syllabus of CA, is all about making you specialised in everything related to a business or individuals – Accountant and taxation needs.

By now I am guessing you understand, how different these two qualifications are.

Areas of Work – Where MBA subjects help

Now lets try to dive into combining these two areas together

- Jack of All Trades + Master of One

Now this is my non marketed and pure analysis of the combination.

MBA can help a CA with experience to get into roles apart from accounting, period. That’s all!

There is no other benefit and will never be. Even if someone argues that, even to run a CA practice you need an MBA. That’s crap! There are big doctors, lawyers, hedge fund traders who run their practice without an MBA.

You might have to hire some MBA’s – The good ones. Yea sure! But doing MBA, on the pretext of running business better, absolutely not. Business teaches you what to learn, even as simple as watching a youtube video. Trust me, as a product manager in my previous job, I learned new things as was required .

For example: I remember once, I was supposed to make a marketing plan. So I download the book on Marketing Management and applied. Yeah and I did better than most of the MBA entry candidates.

So if you are a CA, and thinking about MBA then your perspective has to be switch out of accounting industry.

Employment Opportunities: Who earns more CA or MBA?

So to put it simply neither would earn better if they don’t work and both can earn great if they are hardworking. So there is no question about it. On an average a fresh chartered accountant would command on an average 7-8 LPA INR in India. Whereas the same would be pretty close when you are talking about the average salary of Top 10 MBA college pass outs.

Once you are an MBA, now it’s up to you. You can get into various industries

- Product Marketing- Join fintech companies, use your understanding of accounting and design new products for Fintech companies

- Operations Management- Join companies and lead in operations. May be investment banking

- Fund Management- Use your CA background to get into asset management industry

- Consulting- Get into strategic consulting in finance

- IT Business analyst- Use your solid finance and accounting knowledge to become a liaison between the customer and technical team

You open yourself to wider choices just like an other MBA candidate. But with a added advantage of the knowledge of a specific domain

So let me settle the ca vs Mba salary question and state that on an average they would both be competitive.

5 Reasons not to Pursue MBA

If you fall under any of the below scenarios, you should not do an MBA. You think MBA CA combination

- Will give you better salary- Absolutely not.

- gives you better chances in investment banking- not.

- will make you a better manager in your current profile in accounting- absolutely not.

- will add a masters at least- Absolutely not, CA qualification or any professional qualification done after graduation is treated at par with Masters.

Best MBA Business Schools for CAs

If you do decide to do MBA for reasons apart from the one we covered in the previous section. Then my serious advice is to go the hard way.

- If You are experienced: CA qualified candidates with at least 3 years or experience, should plan for MBA ( 1 Year) programs. Consider MBA institutes like ISB, INSEAD, IIM A,B,C ( Executive program) , designed for professionals

- If you area fresher: This needs be thought through well but lets say you have already done the thinking on why MBA? Then prepare fom the entrance exams , CAT & target Top 10 ivy league MBA programs.

Why do I say that?

Lets cover this in the next section.

3 Types of MBA programs never to pursue

- Online & Distance MBA Programs- There are many now a days. Why? Because MBA program is not about getting the degree, it’s about discussions. It’s about placements support, it’s about great professors. Its about alumni and connection with them post MBA

- Tier 2 MBA Colleges: Each city has an MBA college. Do you really want to think that, a professor with no industry experience can teach you business? Do you think that college can give you the placement support, apart from sales job selling insurance?

- Abroad MBA programs( Tier 2): Just because you pursue MBA program from France, doesn’t make you special. There is enough shift available outside India too, don’t pay for the vacation.

Alternate Options to MBA

My favourite in expense choice is

- read all MBA books, whenever required.- Marketing Management, Decision science, Operations management

- Look for a career you want to shift into and then read whats required. Then find the book

- Look for more advanced books on the subject once the basics are done

- Practice, look for ways of applying what you learn. For example after learning about copy writing, write a blog, design some infographics. Create a plan for your plan to grow

This way is simpler, more productive and can get you much more further in your career without having to take sabbaticals and invest large amount of capital.

Final Verdict ca vs mba which is better

In my opinion for a finance professional or a person who likes accounting, then CA should be the default choice. The reason why I say that is because even if you do not actually become a chartered accountant. But even with inter CA knowledge, you can get into many core finance jobs. So that answers the question ca vs mba which is better in the most unbiased way possible.