Last updated on October 23rd, 2024 at 04:59 pm

Financial management plays a crucial role in ensuring the long-term success of any organization. It involves making strategic decisions to optimize financial resources and achieve specific goals. In this article, we will explore two key long-run objectives of financial management: maximizing shareholder wealth and ensuring financial sustainability.

You are free to use this image on your site, template etc. Just provide us the attribution link

Top 5 Long Run Objectives of financial management

-Approving Financial decisions

-Business Financial Plan

-Creating Financial Statements

-Strategic Planning for business

-Risk Management

Long-Run Objectives Of Financial Management

One primary objective of financial management is to maximize shareholder wealth. This means that financial decisions should aim to increase the value of the company and generate a higher return for its shareholders. Several strategies can be employed to achieve this objective.

Firstly, effective capital budgeting is vital for maximizing shareholder wealth. It involves identifying and evaluating investment opportunities that generate positive net present value (NPV). For instance, a manufacturing company may consider investing in new machinery that improves production efficiency and reduces costs, leading to increased profitability and higher shareholder value.

Additionally, prudent financial management includes optimizing capital structure. This involves determining the appropriate mix of debt and equity financing to maximize the return to shareholders. For example, a company may choose to issue bonds to raise funds for expansion rather than issuing new shares, which could dilute the ownership and potentially decrease shareholder value.

Furthermore, efficient working capital management is essential in maximizing shareholder wealth. Maintaining appropriate levels of inventory, managing receivables and payables, and optimizing cash flows contribute to improved profitability and higher shareholder returns. For instance, a retail company that efficiently manages its inventory can reduce holding costs and minimize stockouts, resulting in enhanced profitability and increased shareholder wealth.

Ensuring Financial Sustainability

Another crucial long-run objective of financial management is ensuring the financial sustainability of the organization. This objective focuses on maintaining a strong financial position and the ability to meet future obligations and challenges. Several strategies can be employed to achieve financial sustainability.

Firstly, effective financial planning and budgeting are essential for ensuring financial sustainability. By forecasting and projecting future revenues, expenses, and cash flows, organizations can better prepare for potential challenges and allocate resources accordingly. For instance, a non-profit organization may develop a budget that ensures it can continue delivering its services even during periods of reduced funding.

Additionally, risk management plays a vital role in financial sustainability. Identifying and mitigating potential risks, such as market volatility, regulatory changes, or natural disasters, helps organizations protect their financial health. For example, a multinational company may use hedging strategies to manage foreign exchange risks, ensuring stability in cash flows and safeguarding against financial instability.

Furthermore, maintaining adequate liquidity is crucial for financial sustainability. Having sufficient cash reserves and access to credit facilities allows organizations to meet their short-term obligations and seize growth opportunities. For instance, a construction company with a strong liquidity position can bid for new projects and execute them promptly, enhancing its long-term sustainability.

Effective Financial Management: Balancing Debt and Equity Capital

Effective financial management requires balancing debt and equity capital to maintain a sound capital structure. This balance ensures that the company can leverage debt to fuel growth while maintaining equity to absorb shocks. Sound capital structure decisions involve choosing the right mix of debt and equity to minimize the cost of capital and maximize shareholder value. For instance, a company might issue bonds to take advantage of low-interest rates while retaining enough equity to maintain control and flexibility.

Short Term and Long Term Goals of Financial Management

Financial management must balance both short-term and long-term objectives to ensure overall success. Short-term goals often include maintaining liquidity and managing day-to-day operations efficiently. Long-term goals focus on sustainable growth, such as strategic investments and profit maximization. This dual focus helps businesses navigate immediate challenges while preparing for future opportunities.

Important Objectives of Financial Management

Among the important objectives of financial management, profit maximization and ensuring financial sustainability stand out. Profit maximization ensures that the company remains competitive and provides higher returns to shareholders. At the same time, financial sustainability ensures that the company can weather economic downturns and continue operations without significant disruptions.

Financial Management in a Nut Shell

A very simple way of imagining about financial management, is to related with your mother! Yes!

You heard it right!

Similarly, just how a mother in an Indian household is responsible for making sure everything runs as per the monthly budget.

Also, financial managers can be thought of as the mothers of business.

So lets think of the practical activities that are a expected of you, which also becomes the functions of financial management.

- Firstly, Business financial plan for a period.

- Secondly, making sure we have an optimum mix of funding.

- Thirdly, making sure we have something to take away, or profit maximisation

- Finally, make sure that we don’t cross the limit and live beyond our means.

Roles in Financial Management

Now, lets explore what kind of roles are availble for you?

After all, there is no such role as financial management eh?

However, lets spend a minute first understanding the broad category of financial management activities

Strategic Financial Management

So,Without boring you to death! In street language, these are synonumus to big boys work.

So this includes activities like;

- Defining business objective and visions

- Finding new avenues for investing

- Taking financial decisions

- Mitigating risks

and you get the point right?

Tactical Financial Management

Alternativly,tactical financial management relates to short term activities.

So what does this include?

- Managing operations

- Making sure we execute the long term plans

- Taxes and regulation

- Consistent reporting and communication

All right! So now that we understand the broad classification lets look at some jobs in the real world, that exists.

| Role | Activity |

| Finance Controller | Financial Decisions including fixed assets purchases. Including cash management, raw material, working capital |

| Financial Planning | Analysing Financial data for decisions, including ratio analysis, capital budgeting |

| Treasury | Managing surplus capital or financial resources out of profits. Investment of funds |

| Financial Reporting | Creating financial statements |

| Financial Risk management | Forecastign business risk |

Hence, you can see how it does sound like motherly activities after all.

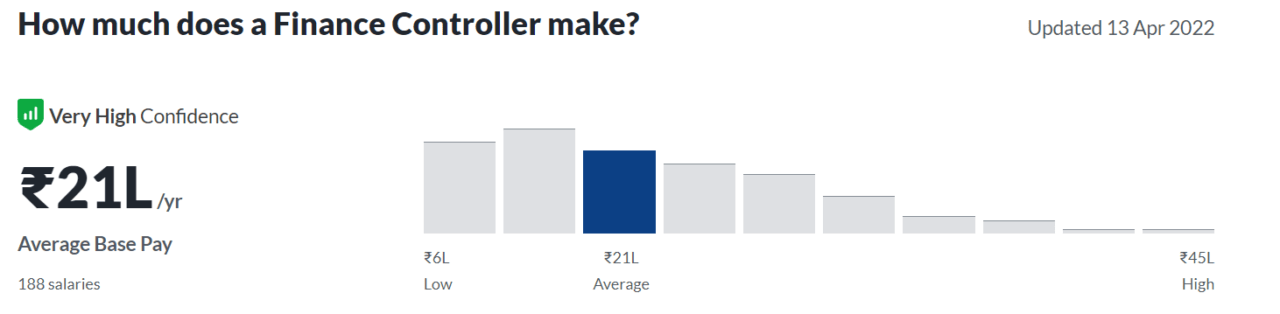

Salary in Financial Management

I know, you have been waiting for this!

However, financial management is infact a rewarding career, but lets look at some data anyways.

Now, don’t get to excited! Financial controller is very senior position in the department.

Also,reaching here generally takes about 10-12 years of expereince.

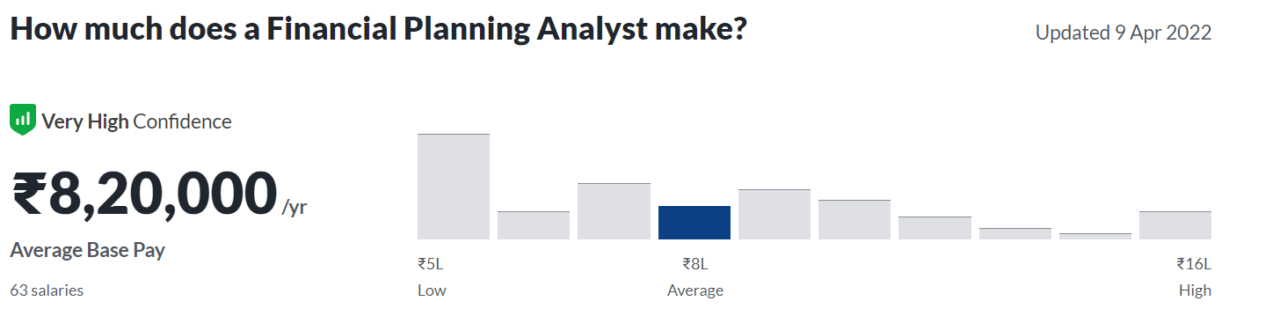

Alright! You can get excited here, because this would be the most common entry point in financial managent career path.

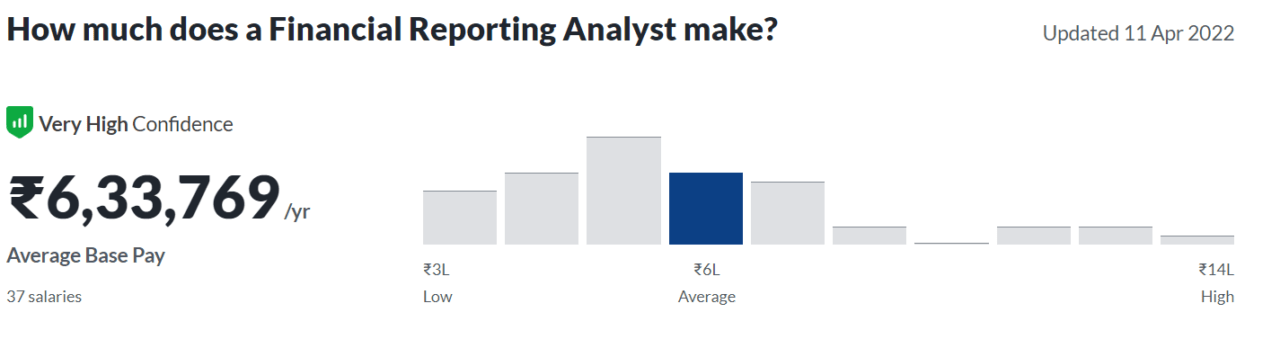

So, this is more of the accounting role and the salary mentioned here is for entry level positions in a medium size company.

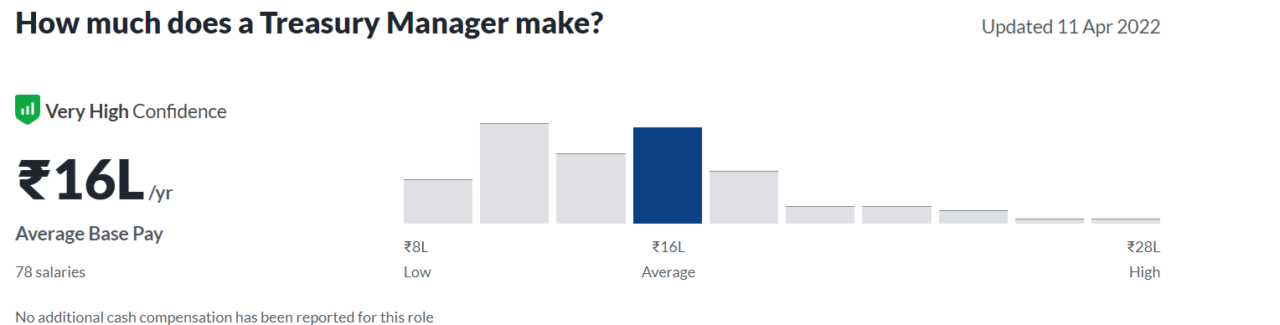

Treasury usually is like becoming the lead actor of a movie! Why? Because its fancy, pays high and generally with some solid expereince, you can join the senior ranks in strategy.

Skills Required in Financial Management

So by now, you must have got a fair idea on what happens in financial management! By no means, can we say that the work is generic and static. Since there are so many variables and business are evolving constantly.

Top 3 Skills Required to Thrive in Financial Management Functions are:

Accounting

No matter whether you are in treasury or controlling, you can’t surivive without accounting.

Financial Modeling

You have to get your hands on decision making skills and financial modeling is that skill.

You can read more about financial modeling- What is financial modeling

Presentation

You are going to working constantly on data.

Also analysing them but it doesn’t stop there does it?

What good is the analysis ?,if you aren’t able communicate the information to the management?

So, do spend considerable time learning this art.

Also,You can read about how to make powerfull charts in excel.

Recommended Qualifications

Now, I'll be honest with you here.

So technically speaking ,financial management is a part of every finance qualification.

However, if you do intent to expertise then my suggestion would be to consider the following additional qualifications