Last updated on February 19th, 2026 at 06:19 pm

Interviews for investment banking may initially seem daunting. But if you know what to expect from the procedure and the questions, you’ll see that it follows a set path. Even though getting chosen, getting an internship, and passing interviews can be difficult, your chances can be significantly better with the correct Investment Banking Interview Prep.

Investment banking is a competitive field where firms hire not just for knowledge but skills which include analytics, excel and adapt under pressure. While accounting, valuations and excel are technical aspects of interviews, behavioural responses are equally important. Add in industry familiarity, corporate-fit, and a polished presentation of your background and you’re not just answering questions you’re positioning yourself as the ideal hire.

In the sections that follow, we explore the most important aspects of investment banking interview prep in detail. You’ll get concrete frameworks, checklists and tactics to elevate your readiness all aimed at helping you walk into your interview room with confidence and credibility. Let’s begin. Here, we will mention some important aspects that you should know to ace your interviews and land banking jobs:

What Do Investment Banks Test in Interviews? (quick checklist)

Investment banks don’t just want textbook knowledge. Their interview process is designed to identify candidates who can think clear, communicate, think analytically and work under pressure. All this while maintaining professionalism and motivation.

- Grasp on accounting, valuation and financial modelling is tested

- Can you break down complex business situations logically?

- Investment banking is team-intensive and high pressure

- Your understanding of what’s happening in the markets and why it matters to us.

- Investment banking interviews are fast paced. Confidence and clarity is the priority for most of the recruiters.

| Category | What It Tests | Examples |

| Technical Knowledge | Understanding of core finance concepts and valuation methods | 3 Financial Statements (Income, Balance Sheet, Cash Flow) | Excel & Financial Modelling Skills |

| Analytical & Problem-Solving Skills | Ability to apply logic and structured thinking to financial or business situations | Ratio Analysis – Interpreting Market Data | Quantitative Reasoning & Forecasting |

| Behavioural & Cultural Fit | Tests attitude, teamwork, motivation, and alignment with company culture | Fit Questions – Leadership, Teamwork | Ethics Scenarios |

| Commercial & Market Awareness | Evaluates understanding of global and local market trends | Knowledge of Recent M&A or IPO Deals | Sector Awareness |

| Poise Under Pressure | Checks confidence, composure, and clarity during high-stress moments | Speed & Accuracy in Responses | Body Language |

What Are the Most Important Aspects of Investment Banking Interview Prep?

The industry of investment banking is extremely competitive. Also, it requires not only technical proficiency but also exceptional problem-solving and communication abilities. Therefore, it takes a lot of investment banking interview prep to acquire a job in investment banking, especially for the demanding interview procedure. Whether you’re a professional trying to make a move into investment banking or a recent graduate, success in the interview process is critical. So, let’s explore the following aspects of investment banking interview prep:

Knowledge of the Sector:

The field of investment banking is intricate, with its own patterns and obstacles. The industry landscape, including recent buying and selling businesses, regulatory changes, and important players, must be thoroughly understood by candidates. So, it is essential to stay up-to-date on industry news by using reliable websites, financial magazines, and reports.

Technical Knowledge:

To gauge a candidate’s comprehension of accounting principles and financial ideas, investment banking interview prep frequently contains technical questions. Financial modeling, discounted cash flow analysis, valuation multiples, and acquisition modeling should all be areas of expertise for candidates. Therefore, technical abilities can improve by going over textbooks again, taking online Advance Excel Course, and practicing with mock interviews.

Company Research:

It’s critical to conduct an extensive study on the investment banks recent transactions, also on the industry priorities, corporate culture, and position in the market. As a result, an applicant’s candidacy can be greatly improved by exhibiting a sincere interest in the company. In addition, it also helps to match its aims and abilities with its objectives. Gaining relevant insights can be achieved by making use of resources. Afterward, it includes the corporate website, yearly reports, employee reviews, and networking with current or former employees.

Behavioral Interviews:

In addition, to evaluating a candidate’s interpersonal skills, problem-solving abilities, and cultural fit, investment banks significantly emphasize behavioral interviews. It’s crucial to practice answering typical behavioral questions and to prepare answers that demonstrate resilience, teamwork, and moral judgment. So, making use of the STAR (Situation, Task, Action, Result) technique can aid in the creation of gripping stories.

Mock Interviews:

You can imitate actual interview situations and get helpful feedback by holding mock interviews with colleagues, mentors, or professional interview coaches. These interviews aid in pinpointing problem areas, honing communication abilities, and boosting self-assurance. Furthermore, mock interviews can also record for self-evaluation, which can provide insightful information on articulation and body language.

Connections:

Within the investment banking sector, establishing strong professional connections can lead to opportunities and offer useful insider knowledge. Important actions include attending industry events, alumni get-togethers, informational interviews, and using websites like LinkedIn for networking. After all, making a lasting impression on prospective employers can achieve by exhibiting genuine interest and curiosity.

Optimizing Your CV and Cover Letter:

It’s critical to create a strong, organized CV and cover letter specifically for the investment banking sector. So, recruiters can be drawn in by succinctly highlighting relevant experiences, academic successes, leadership positions, and technical skills. Also, the quality of application materials can be improved by checking for faults and asking mentors or career counselors for their input.

Market Sizing and Case Studies:

To assess analytical and problem-solving abilities, certain investment banking interviews may incorporate market sizing questions or case studies. Therefore, applicants can acquire a methodical approach and critical thinking under pressure by having them practice market sizing activities, industry research, and case study solving under time limitations. So, responses can be better organized by making use of frameworks.

Current Events and Market Trends:

Being up to date on macroeconomic data, current events, and market trends is essential for showcasing your intellectual curiosity. Applicants must be ready to talk about current events in the market, current events in geopolitics, changes in regulations, and their possible effects on the investment banking sector. Additionally, keeping up to date can be made easier by subscribing to reliable news sources, economic reports, and industry blogs.

Confidence and Genuineness:

Lastly, interviewers may be influenced if candidates convey conviction, genuineness, and professionalism. Additionally, building rapport and making a good impression can be got by using active listening techniques and having meaningful talks. Authenticity, energy, and a sincere enthusiasm for investment banking and finance can set applicants apart from their competitors.

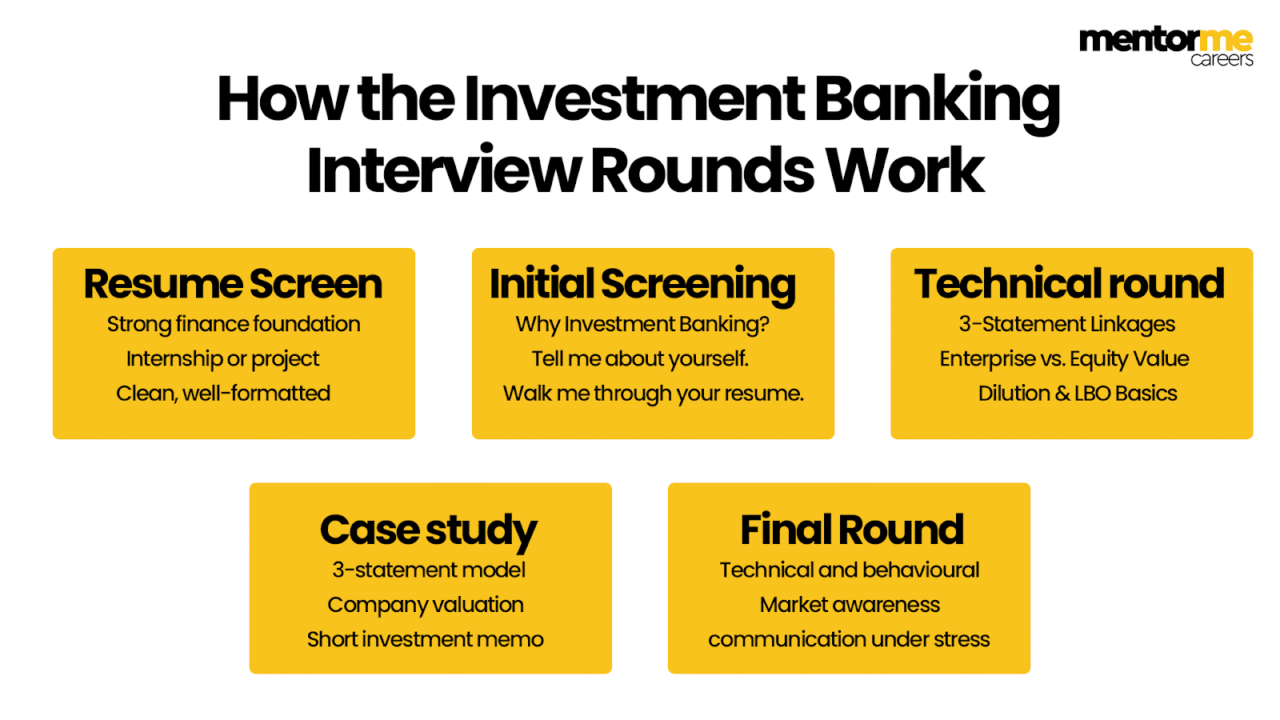

How the Interview Rounds Work

The investment banking interview process is structured to test your technical knowledge, analytical thinking, and cultural fit across multiple rounds. Each stage gets progressively more rigorous, filtering candidates who can think fast, work under pressure, and communicate with confidence.

- Resume screening: Recruiters shortlist candidates based on academic performance, relevant coursework, internships, and certifications.

- Initial screening interview: Usually conducted by HR or a junior banker via phone or video call, purpose of this is to assess your communication, motivation and fit for the firm.

- Technical round: Interviewers will evaluate your finance and analytical skills. Expect deep dives into skills like accounting and financial modelling.

- Case study: This round tests your ability to apply technical skills to real business scenarios

- Final round: Intense, multi-interviewer session held in one day.You will meet senior analysts, associates, and VPs, each testing different aspects.

Core Technical Topics to Master

- Accounting Fundamentals & Financial Statements

- Excel and analytics

- Leverage buyout basics

- M&A

- Financial modelling

- Valuation techniques

- Enterprise value and equity value

Investment Banking questions and answers

Accounting & 3-Statement Walkthrough

Walk me through the three financial statements.

The three main financial statements the Income Statement, Balance Sheet, and Cash Flow Statement provide a complete picture of a company’s financial health.

1.The Income Statement shows a company’s revenues, expenses, and profits over a period ending with Net Income.

2.The Balance Sheet captures assets, liabilities, and shareholders’ equity at a specific point in time showing what the company owns and owes.

3.The Cash Flow Statement adjusts net income for non-cash items and changes in working capital, showing how cash moves through operations, investing, and financing activities.

How do the three statements link together?

The three statements are interconnected changes in one affect the others.

Here’s how they link:

1.Net Income from the Income Statement flows into Retained Earnings on the Balance Sheet and becomes the starting point of the Cash Flow Statement.

2.Depreciation and other non-cash items adjust Net Income to calculate Operating Cash Flow.

3.Changes in assets and liabilities (working capital) affect cash flow, while capital expenditures and debt changes alter the Balance Sheet.

4.The ending cash balance from the Cash Flow Statement appears as Cash on the Balance Sheet.

Think of it as:

Income → Equity → Cash → Assets.

What happens to all three statements when depreciation increases by ₹10?

Let’s assume a 30% tax rate for simplicity.

1.Income Statement: Depreciation expense rises by ₹10, reducing pre-tax income by ₹10. Net income falls by ₹7 (after tax).

2.Cash Flow Statement: The ₹10 depreciation is added back as a non-cash expense, so cash flow increases by ₹3 (the ₹7 drop in net income offset by ₹10 add-back).

3.Balance Sheet:

a.PP&E (assets) decreases by ₹10 due to depreciation.

b.Cash increases by ₹3 from the cash flow gain.

c.Retained Earnings decrease by ₹7 (reflecting lower net income).

Assets down ₹7, Equity down ₹7, Balance Sheet stays balanced.

What is working capital and why is it important?

Working capital = Current Assets – Current Liabilities.

It measures a company’s short-term liquidity and operational efficiency showing whether it can cover short-term obligations with short-term assets.

1.Positive working capital means the company can easily pay bills and run daily operations.

2.Negative working capital may signal cash flow stress or aggressive growth.

Example: A company with ₹100 in current assets and ₹70 in current liabilities has ₹30 in working capital enough to sustain operations smoothly.

What’s the difference between operating income and net income?

1.Operating Income (or EBIT) represents profits from core operations it excludes interest and taxes but includes operating expenses like depreciation and SG&A.

2.Net Income is the bottom line profit after interest, taxes, and non-operating items.

Example:

If revenue is ₹1,000 and operating costs are ₹700 → Operating Income = ₹300.

After ₹50 interest and ₹60 tax → Net Income = ₹190.

In short:

Operating Income = Profit from business operations

Net Income = Profit available to shareholders

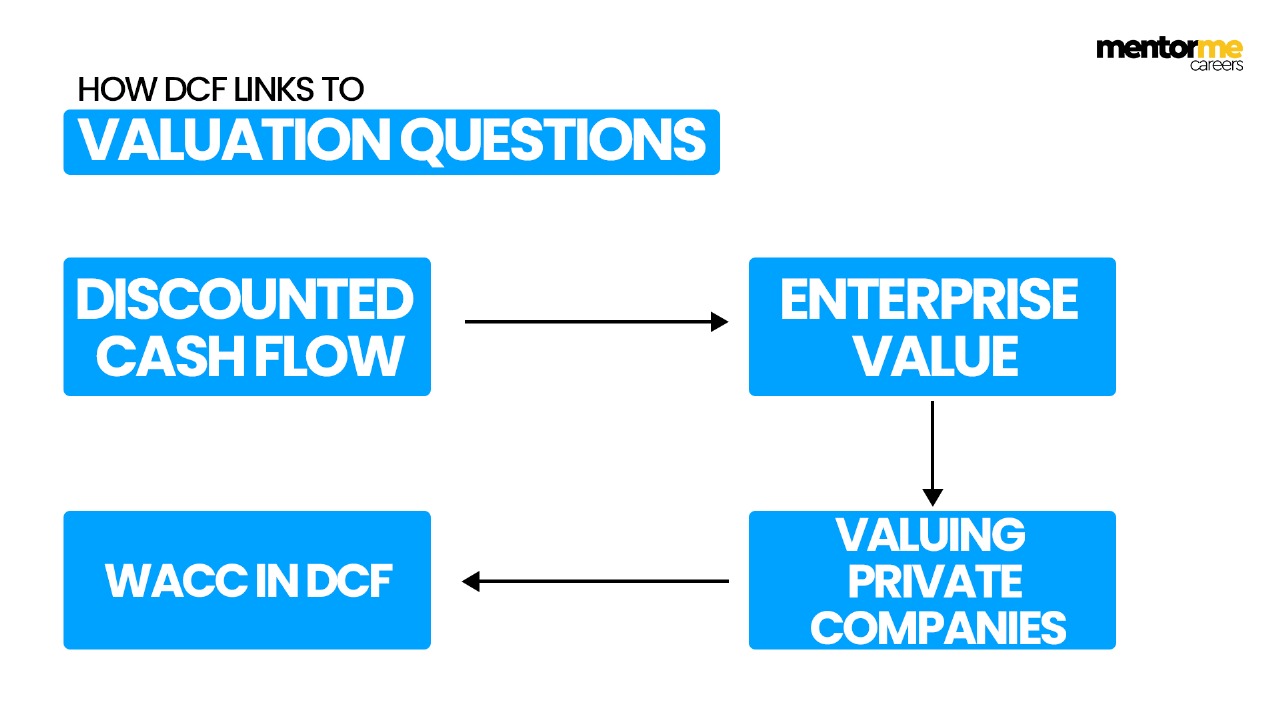

Valuation Fundamentals (Multiples, DCF)

What are the three main valuation methods?

The three primary valuation methods used in investment banking are:

1.Discounted Cash Flow (DCF) Analysis – calculates intrinsic value based on a company’s future free cash flows discounted at the Weighted Average Cost of Capital (WACC).

2.Comparable Company Analysis (Comps) – values a firm using market multiples like EV/EBITDA, P/E, or P/B of similar listed peers.

3.Precedent Transactions Analysis – determines value using M&A deal multiples paid for similar companies in the past.

Walk me through a DCF (Discounted Cash Flow) model.

Step-by-Step:

- Project free cash flows (typically for 5–10 years).

- Calculate terminal value (using Gordon Growth or Exit Multiple).

- Discount all cash flows and terminal value to present using the WACC.

- Sum these values to get Enterprise Value.

- Subtract debt and add cash to arrive at Equity Value, then divide by shares outstanding for implied share price.

Which is higher equity value or enterprise value?

Usually, Enterprise Value (EV) is higher than Equity Value because:

Enterprise Value = Equity Value + Debt + Minority Interest + Preferred Stock – Cash.

Since most companies carry some debt, EV generally exceeds Equity Value.

However, if a company has zero debt and large cash reserves, Equity Value could be higher.

Example:

If Equity = ₹500, Debt = ₹200, Cash = ₹50 →

EV = ₹500 + ₹200 – ₹50 = ₹650 (EV > Equity).

Why do we subtract cash when calculating enterprise value?

We subtract cash because Enterprise Value represents the value of the core operating business not excess cash that can be used to pay down debt or distribute to shareholders.

Cash is a non-operating asset, so removing it ensures EV reflects the value investors pay for operations, independent of how the business is financed.

Think of it as:

If you buy a company with ₹100 in cash, you can immediately use that ₹100, so you effectively pay less for the operations.

How would you value a private company?

Valuing a private company requires adapting traditional valuation methods because there’s no market price or publicly traded multiples.

Common Approaches:

1.Use Comparable Company Analysis and apply a discount (10–30%) for lack of liquidity.

2.Apply DCF Analysis using estimated cash flows and industry WACC.

3.For transactions, use Precedent Deal Multiples in the same sector.

4.Sometimes, use Net Asset Value or Book Value for smaller, asset-heavy firms.

Tip: Always explain assumptions private valuations rely on judgment and comparables, not exact data.

How does WACC affect a DCF?

WACC (Weighted Average Cost of Capital) is the discount rate used in DCF analysis it represents the company’s required return based on its cost of equity and debt.

1.If WACC increases, future cash flows are discounted more → lower present value → lower valuation.

2.If WACC decreases, discounting effect weakens → higher valuation.

In short:

Higher WACC = riskier business → lower value

Lower WACC = safer business → higher value

LBO & M&A Concepts (basic LBO flow)

What makes a deal accretive or dilutive?

A deal is accretive if the acquirer’s Earnings Per Share (EPS) increases after the acquisition, and dilutive if the EPS decreases.

Formula:

Accretion/Dilution = (Pro Forma EPS – Acquirer’s Standalone EPS)

Key Factors:

1.Purchase price vs. target’s earnings yield

2.Financing structure (cash, debt, stock)

3.Synergies achieved post-merger

Example: If Company A’s EPS is ₹10 and the merged EPS becomes ₹11 → it’s accretive. If EPS drops to ₹9 → it’s dilutive.

What are synergies in M&A?

Synergies are the benefits or cost savings that occur when two companies merge — making the combined company more valuable than the sum of its parts.

Types of Synergies:

1.Revenue Synergies: Cross-selling, expanded market access, pricing power.

2.Cost Synergies: Reduced overhead, shared resources, economies of scale.

Example: If each company earns ₹100M separately but together they earn ₹220M → ₹20M represents synergy value.

Walk me through the process of an acquisition.

Here’s how a typical M&A deal process works:

- Strategy & Target Identification: The buyer defines acquisition goals and screens potential targets.

- Initial Contact & NDA: Confidentiality agreements are signed before data sharing.

- Due Diligence: The buyer reviews the target’s financials, legal, and operational details.

- Valuation & Deal Structuring: Using DCF, Comps, or Precedents, the buyer negotiates price and financing (cash, debt, or stock).

- Negotiation & Signing: Final terms are agreed upon in a purchase agreement.

- Regulatory Approval: Approvals from bodies like SEBI, CCI, or FTC are obtained.

- Closing & Integration: Funds are transferred, and the buyer integrates operations, achieving synergies.

Tip: Use real-life examples like the HDFC–HDFC Bank merger when explaining this in interviews.

What is an LBO and why do private equity firms use it?

An LBO (Leveraged Buyout) is when a company is acquired primarily using borrowed funds (debt), with the target’s cash flows and assets used as collateral.

Why PE firms use LBOs:

1.To maximize returns by using leverage.

2.To acquire companies with limited equity investment.

3.To improve operational efficiency and sell at a higher valuation later.

Example: A PE firm buys a company for ₹1,000 using ₹700 debt and ₹300 equity. If they later sell for ₹1,500, the return on equity is amplified because debt covered most of the cost.

How does leverage increase returns in an LBO?

Leverage magnifies returns by allowing investors to use less equity and more debt to fund the deal.

Example:

1.Purchase price = ₹1,000

2.Debt = ₹700, Equity = ₹300

3.Sell after 5 years for ₹1,500 → Gain = ₹500

Return on equity = ₹500 / ₹300 = 166%, instead of 50% if no debt was used.

But caution: Leverage also amplifies risk, if the company underperforms, losses on equity are larger.

What is IRR (Internal Rate of Return) and how is it calculated?

IRR (Internal Rate of Return) is the annualized rate of return earned on an investment over time, considering all cash inflows and outflows.

It’s the discount rate that makes the Net Present Value (NPV) of all future cash flows equal to zero.

Simplified Formula:

NPV = 0 = Σ (Cash Flow_t / (1 + IRR)^t)

Example:

If you invest ₹100 today and receive ₹150 in 3 years, IRR ≈ 14.5%.

In LBOs: IRR helps PE firms measure profitability, most target 20–25%+ IRR for successful exits.

Excel sample questions

| Question Type | Sample Question / Task | Skill Tested | Expected Answer / Function |

|---|---|---|---|

| Basic Formulas | Write a formula to calculate the total sales (Quantity × Price). | Formula Application | =B2*C2 |

| Functions | Find the average revenue for all months. | Statistical Function | =AVERAGE(B2:B13) |

| Conditional Logic | Display “Pass” if score ≥ 50, else “Fail”. | Logical Function | =IF(B2>=50,"Pass","Fail") |

| Lookup Function | Fetch the department name from another sheet based on Employee ID. | Lookup & Reference | =VLOOKUP(A2,Sheet2!A:B,2,FALSE) |

| Dynamic Lookup | Replace VLOOKUP with a more flexible formula. | Advanced Lookup | =XLOOKUP(A2,Sheet2!A:A,Sheet2!B:B,"Not Found") |

| Text Function | Combine first and last name with a space in between. | Text Manipulation | =CONCATENATE(A2," ",B2) or =A2&" "&B2 |

| Date Function | Calculate number of days between invoice date and payment date. | Date & Time | =DATEDIF(A2,B2,"d") |

| Summarization | Sum total sales only for “East” region. | Conditional Summing | =SUMIFS(C2:C100,A2:A100,"East") |

| Data Cleaning | Remove extra spaces from a customer name. | Data Cleaning | =TRIM(A2) |

| Error Handling | Prevent errors when lookup value not found. | Error Management | =IFERROR(VLOOKUP(A2,Data!A:B,2,FALSE),"Not Found") |

| Pivot Table | Create a Pivot Table showing average revenue per region. | Data Summarization | Use Insert → Pivot Table |

| Charting | Plot monthly sales trend with a line chart. | Data Visualization | Insert → Line Chart |

| Financial Function | Calculate compound interest for 5 years at 8% rate. | Financial Modelling | =FV(8%,5,0,-100000) |

| Ratio Analysis (Excel) | Calculate Gross Margin % from Revenue and COGS. | Finance Application | =(Revenue - COGS)/Revenue |

| What-If Analysis | Test impact of 10% increase in sales price on profit. | Scenario Analysis | Use Data Table or Goal Seek |

Fit & Behavioral Questions

Why investment banking?

Investment banking combines analytical rigour, business strategy, and high-impact decision-making.

It’s the ideal career for professionals who enjoy solving complex financial problems, valuing companies, and working on deals that shape industries.

“I’m drawn to investment banking because it offers exposure to real business decisions early in my career. The idea of helping companies raise capital, structure acquisitions, and drive growth excites me. It’s demanding, but the learning curve and teamwork make it deeply rewarding.”

Tip: Highlight curiosity, analytical mindset, and desire to learn, not just money or prestige.

Why our firm?

This question tests how well you’ve researched the company and whether you’re genuinely aligned with its culture and deal focus.

“I’m particularly drawn to your firm because of its strong reputation in mid-market M&A and its focus on client-first advisory. I admire your recent role in the [XYZ merger/deal], which demonstrates both expertise and integrity. I believe the firm’s culture of collaboration and its training programs make it an ideal environment for me to grow as an analyst.”

Tip: Always reference one specific deal, value, or initiative from the firm’s website or news.

Tell me about a time you worked under pressure.

Investment banking is deadline-driven, recruiters want proof you can handle stress without compromising quality.

“During my internship, our team had to complete a client presentation overnight due to a sudden deadline change. I reorganized our task list, prioritized the valuation updates, and stayed late to ensure accuracy. We submitted it on time, and the client approved the model without any revision. That experience taught me to stay calm and methodical under pressure.”

Tip: Use the STAR framework (Situation, Task, Action, Result).

Show structure and a positive takeaway.

What’s your greatest strength and weakness?

Strength:

“My biggest strength is attention to detail and persistence. Whether it’s reconciling financial data or reviewing presentations, I make sure numbers align perfectly. This accuracy has helped me deliver high-quality work consistently under tight deadlines.”

Weakness:

“Earlier, I focused too much on perfecting every detail, which affected efficiency. I’ve learned to balance precision with time management by setting realistic milestones and reviewing work in structured stages.”

Tip: Always choose a real but improvable weakness and explain how you’ve addressed it.

Describe a time you showed leadership.

Leadership in investment banking isn’t just about titles, it’s about taking initiative and guiding others toward a goal.

“In my college finance club, our team was struggling to meet deadlines for a valuation competition. I stepped up to divide tasks based on each member’s strength, handled the financial model personally, and mentored others on DCF logic. We completed the model a day early and won the competition. That experience taught me how clear communication and delegation drive team success.”

Tip: Show ownership, teamwork, and initiative, even if the example isn’t from a formal leadership role.

Summary

| Question Type | What They Test | Difficulty Level | Preparation Tips | Example Questions |

|---|---|---|---|---|

| Technical Questions | Test your finance, accounting, and valuation knowledge especially core concepts like DCF, financial statements, and multiples. | 4 (High) | – Master the 3 financial statements and how they link. – Practice DCF, LBO, and M&A questions. – Review valuation formulas and key Excel functions. | – Walk me through a DCF. – How do the 3 financial statements connect? – Why do we subtract cash from Enterprise Value? |

| Behavioral Questions | Assess fit, attitude, communication, teamwork, and leadership skills. Test if you’d align with firm culture and handle pressure well. | 2-3 (Moderate) | – Use STAR method (Situation, Task, Action, Result). – Prepare stories showing leadership, problem-solving, and teamwork. – Be authentic and concise. | – Tell me about a time you worked under pressure. – Why investment banking? – Describe a time you took initiative. |

| Market/Current Affairs Questions | Test your awareness of markets, recent deals, and economic trends. Judges your commercial thinking and interest in finance. | 3 (Medium to High) | – Read Financial Times, Bloomberg, or Economic Times daily. – Follow recent M&A deals, IPOs, and interest rate trends. – Be ready to discuss how macro events affect valuation. | – Tell me about a recent deal you found interesting. – How do rising interest rates affect equity markets? – What’s happening in the Indian IPO market right now? |

Market / Sector Awareness (What to read before interviews)

- Daily financial news

- Industry specific news

- Company research

- Technical & conceptual reading

- Market and economy outlook

- Newsletters

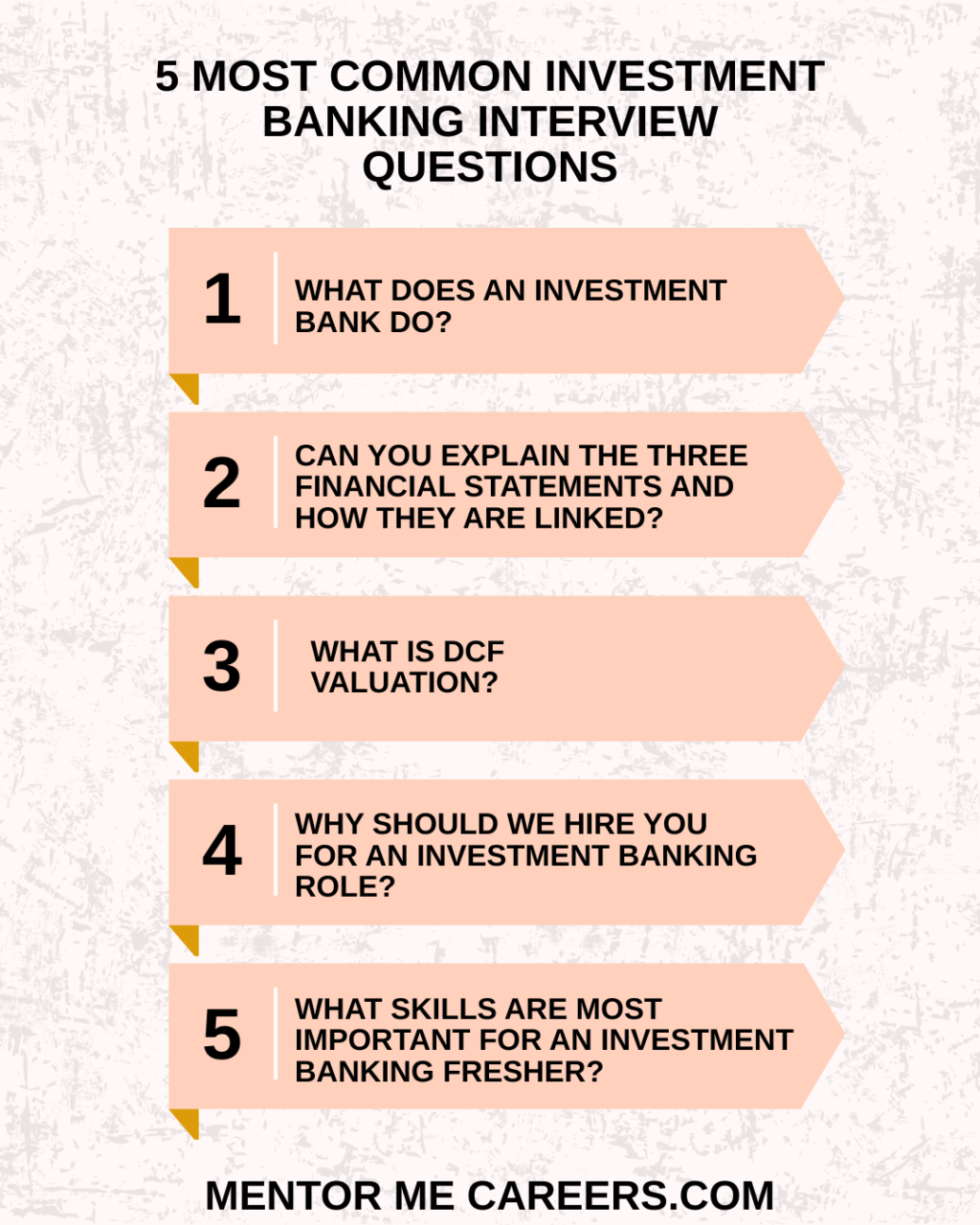

Common Interview Questions

Tell me about yourself

Why do you want to work here?

Why should we hire you?

What are your strengths are weaknesses?

What do you know about our company?

Do you have any questions for us?

How do you stay updated in your field?

How to prepare for investment banking interview in 7 days

| Day | Focus Area | Goal |

|---|---|---|

| Day 1–2 | Core Technicals | Build foundation in finance, valuation, and Excel |

| Day 3 | Behavioral | Refine personal stories and fit answers |

| Day 4 | Market Awareness | Develop commercial knowledge |

| Day 5 | Practice | Reinforce weak areas through mock questions |

| Day 6 | Mock Interview | Simulate the real interview |

| Day 7 | Final Review | Confidence and composure |

Get Prepared for Investment Banking Interviews!

With Mentor Me Career, get ready to ace your investment banking interviews! With the help of our extensive Investment Banking Interview Prep, you’ll be able to ace every part of the interview process. Moreover, we provide you with the direction and assistance you need to be successful. From developing technical abilities to creating solutions that are captivating and suitable for your target firms.

However, you may successfully prepare, highlight your advantages, and land the investment banking position of your dreams.

Summary

In summary, a comprehensive strategy that integrates technical expertise, industry insights, interpersonal abilities, and strategic planning is necessary. After all, to master the nuances of investment banking interview prep, these are all important. Aspiring candidates can improve their candidacies, go through the interview process with confidence, and set themselves up for success by concentrating on these ten essential elements. Therefore, to secure profitable employment chances in finance, always remember that preparation is the key.

FAQ

Investment banking interviews include technical finance questions, accounting concepts, valuation methods, financial modelling basics, and behavioral questions to assess analytical ability and cultural fit.

For freshers, investment banking interview questions are moderate in difficulty and mainly focus on concept clarity, fundamentals, and problem-solving skills, rather than advanced deal experience.

Key topics include financial statements, valuation techniques (DCF, comparables), accounting principles, financial modelling, and basic M&A concepts.

Yes, many investment banks include Excel-based financial modelling or valuation tests, especially for analyst roles, to evaluate practical skills.

Yes. Interviewers ask behavioral and motivation-based questions to assess work ethic, communication skills, and ability to handle pressure.

No, a finance background is not mandatory, but candidates must demonstrate strong understanding of finance fundamentals and valuation concepts.

Effective preparation includes revising finance concepts, practicing valuation problems, building basic financial models, and doing mock interviews.

Yes, some interviews include case studies or practical scenarios to test analytical thinking and real-world application of finance knowledge.