Last updated on October 23rd, 2024 at 02:36 pm

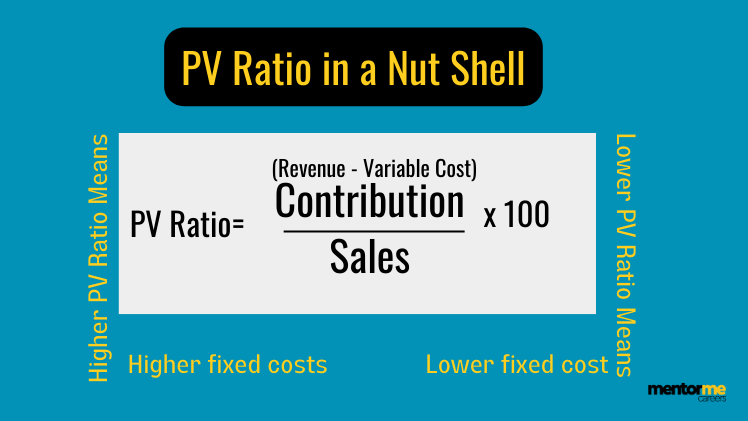

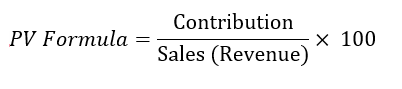

Did you know that understanding the profit volume ratio formula (PV ratio) can mean survival or death? pv ratio formula is (Contribution/ Sales ) x 100 expressed in percentage, a Higher PV means lower variable cost due to higher fixed cost.

Also, Have you ever thought about why a particular business goes bankrupt?

While some flourish and can stand the test of time?

pv ratio formula Implications

-Higher PV means lower variable cost due to higher fixed cost

-PV Ratio Formula= (Contribution/ Sales ) x 100 expressed in percentage

– Higher PV can be achived with higher investment in fixed cost

Moreover, I can assure you that knowing this concept in the right way can help you analyse business correctly.

So let’s get started!

How do profit and volume work?

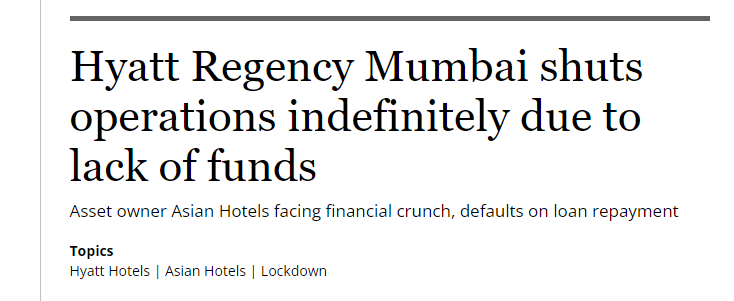

Do you remember the closure of Hyatt Hotels in Mumbai in 2021?

In addition to Hyatt, many such large businesses have become serious trouble.

Conversely, think about Infosys or the likes of Infosys, which have an ocean of cash to withstand any storm.

So, what’s the difference?

First, understand this from your personal expenses perspective.

Let’s say you get a monthly salary of (INR) 1 Lac with the following two scenarios:

- First, you have an EMI of INR 50 K, and your lifestyle expenses are fixed at INR 20K

- Second, you have the same EMI, while your lifestyle expenses are lower by fifty per cent at INR 10K

In the event of a situation like COVID-19, who has a better chance of survival?

Scenario 1, under the circumstances, will be complex.

Why do I say so? By all means, you cannot change your lifestyle overnight.

Scenario 2, indeed, will survive better or at least have a better chance because the lifestyle expense is low.

Now, if you also remember that, during the same time, banks in India momentarily allowed customers to delay their EMI payments.

So, my question to you is, what creates bankruptcy?

Every so often, it’s the lifestyle or the fixed expenses( excluding debt), which make people and companies go bankrupt.

However, what is this got to do with PV Ratio?

In essence, everything!

What is the PV Ratio formula?

The Price Volume ratio is one of the important that measures the rate of safety for the business, which establishes the relationship between contribution, i.e. profit or loss minus costs in connection to sales multiplied by 100

Now, of course, you know what sales are and what 100 is, but what the heck is contribution?

Essentially if we understand the rati

Well, that’s the only tricky part of this formula, whereas everything else is easy to understand.

First, let’s understand the relationship between price and volume.

Alongside the effect of fixed costs.

Remember the lifestyle perspective?

Now, let’s take an example:

- Let’s say you start a small hotel, with ten rooms, with an average vacancy rate of 70%.

- Your total employee salary is INR 1.5 Lacs.

- Additional costs include marketing cost of INR 50K & contractual hourly basis labour at 100K

- You have taken place on rent, summing up to INR 1 Lac

- You charge INR 1500 per day to your customers for 24 hrs stay period.

Calculation

- Selling Price per unit = (70% x 10 x 30 x1500)/(30 x10)= 1050 ruppe of sales

- Variable cost= INR 333 Per room per night, ( (Marketing Cost + Contractual labour) / 30 days x 10 rooms.

- Essentially the ratio improves if the ratio sales variable cost reduces.

- So, ratio contribution per unit= Selling Price per unit – VC Per unit= 1050-500= INR 550

- PV Ratio= 550/ 1050 X (100)= 52.38%

Factors Affecting PV Ratio formula?

Now, don’t just stop there! Why?

There is no inference to be made, presently with only calculating it.

52.38%, what’s that supposed to mean?

The magic starts when we start playing with the sales and price numbers.

When we start playing with the sales and price numbers, the magic starts!

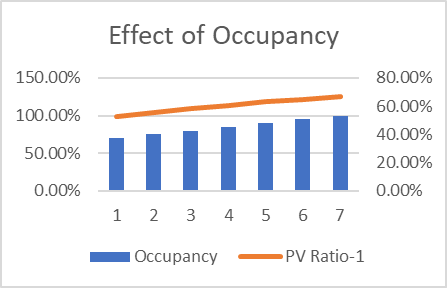

Effect of Occupancy on Price volume ratio

Above is the chart showing how the PV increases, alongside an increase in occupancy.

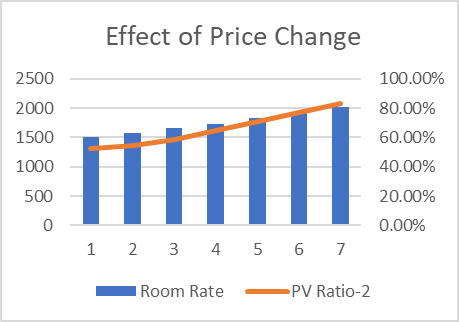

Effect of Price on PV:

Look at the exponential increase in the ratio as a result of price change due to the rise in profitability of each product.

I have attached the excel template in case you plan to try this out yourself.

Applications of PV Ratio formula in Business

What good is the PV ratio, if we can’t use it to our advantage, hence here are some of the close applications? It’s usually considered a calculation of the marginal cost of a business. A high PV ratio establishes that the business has high margins in each sale it makes.

- First, we could use the PV ratio table to understand the optimum level of fixed cost versus variable cost.

- Second, we could use subparts to calculate the volume of sales for the break even point(BEP)

- Third, we could use its subpart to calculate the degree of total leverage.

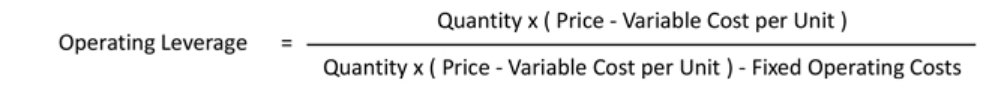

Operating Leverage

Companies with higher operating leverage generally are lower in risk. Essentially due to the managed nature of such expenses.

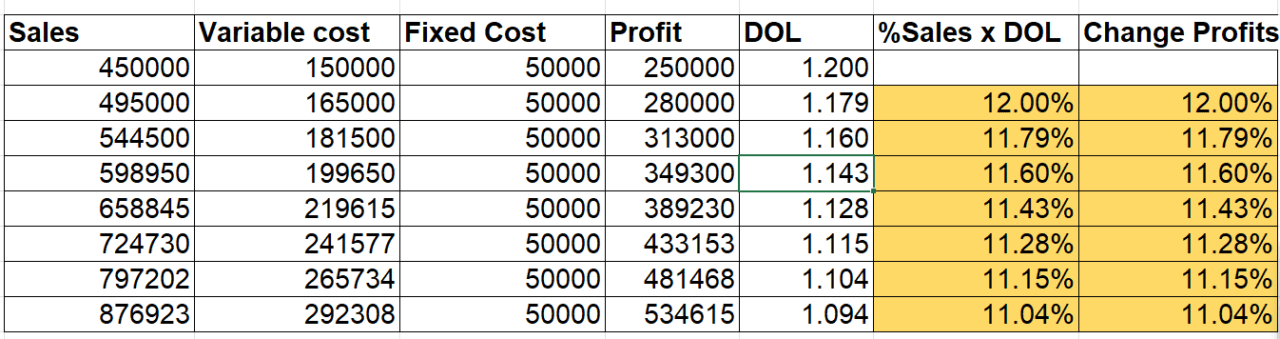

Let’s continue with our previous example, to calculate and understand this in detail.

Essentially, if we manage to calculate the degree of operating leverage for a business, then we could comment on the improvement.

Now, that formula might look like a lot, but essentially all we are trying to do is;

- Divide EBITDA, which is, in reality, contribution as per the financial statements, by EBIT.

However, operating leverage communicates how much it would affect the profit due if the volume of sales increases by 10%.

But, we have to multiply the DOL with the percentage change in sales to arrive at the expected increase in profit due.

Lets’s have a look at the simulated results:

I would highly recommend you to try this, in the template provided.

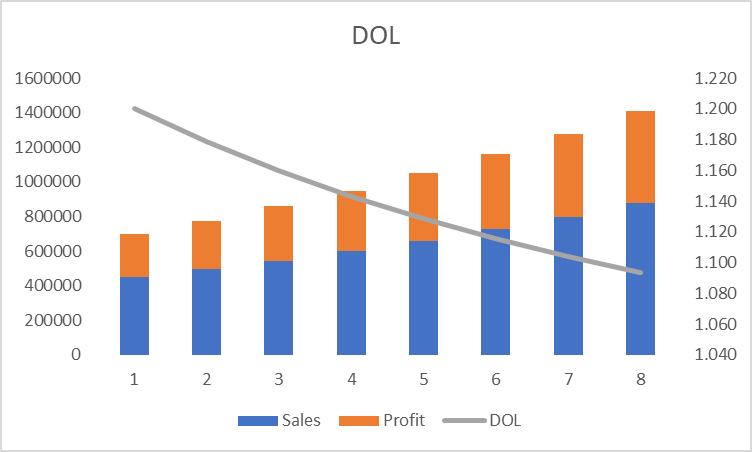

Above the chart, the orange section is the profits, the blue is the sales, and the grey line is the operating leverage.

I want you to notice that initially, the operating leverage is high, which causes the profit to jump significantly.

However, in the later part operating leverage starts reducing with its benefits.

The Impact of Sales Revenue and Cost-Volume-Profit Analysis

Understanding the relationship between sales revenue and cost-volume-profit (CVP) analysis is essential for accurate business analysis. Sales revenue, generated from the sale of goods or services, is directly linked to the PV ratio formula. By analyzing sales volumes and the number of units sold, businesses can better manage their fixed and variable costs. The PV ratio, part of CVP analysis, helps in determining the break-even sales point, which is the level of sales at which total revenues equal total costs. This analysis aids in optimizing pricing strategies and cost management.

Contribution Margin and Fixed vs. Variable Costs

The contribution margin ratio, which is the ratio of unit contribution margin to sales revenue, is crucial for understanding profitability. By dividing the contribution margin by fixed costs, businesses can determine their break-even sales point. This highlights the importance of managing both unit variable costs and total variable costs effectively. Fixed costs remain constant regardless of sales volume, while variable costs fluctuate with production levels. Therefore, businesses with a higher contribution margin ratio can achieve better financial stability and profitability.

Drawbacks of PV Ratio formula

Of course, there are!

No analysis comes without flaws, and this calculation is not full proof either.

One biggest limitation of relying on operating leverage calculation while analysing companies can be.

- First, the business cannot keep increasing sales at the same exact fixed cost.

- Second, for the same reason as the first limitation, the method only assumes an increase in volume not price

So, how do you overcome this limitation?

Well! The easiest yet most difficult thing is to research a company’s capacity.

This means how far the company can stretch the same capacity without an increase in fixed cost.

Conclusion

These are concepts which have to be learnt by aspiring professionals and entrepreneurs likewise.

You see, business understanding requires some skills and means getting your hands dirty.

If you do want to learn things like this, do care to learn about the financial modelling skill with mentor me careers.

Also if you want to know what is financial modeling then read the article on it.

ciao!