Last updated on October 23rd, 2024 at 03:51 pm

International Financial Reporting standards or popularly known as IFRS is an accounting standard recognised globally, for which the DIP IFRS & Cert IFRS are certifications. In this article we will discuss the various options of IFRS Training in Chennai.

What is IFRS?

International Financial Reporting Standards (IFRS) are a set of global accounting standards developed and issued by the International Accounting Standards Board (IASB) to provide a common framework for companies to prepare and present their financial statements. IFRS aims to enhance the comparability, transparency, and reliability of financial reporting across different countries and industries.

The introduction of IFRS began in 2001, with the goal of harmonizing accounting practices around the world and improving the quality of financial reporting. Before the introduction of IFRS, different countries had their own accounting standards, which made it challenging for investors, analysts, and other stakeholders to compare financial information across borders.

Key features of IFRS include:

- Global Applicability: IFRS is designed to be applicable across various industries and countries, enabling multinational companies to present their financial information using a common set of standards.

- Principle-Based Approach: IFRS is principles-based rather than rules-based, emphasizing the underlying economic substance of transactions rather than rigid rules. This allows for more flexibility in applying the standards to different situations.

- Fair Value Emphasis: IFRS places significant emphasis on fair value measurement, requiring companies to report certain assets and liabilities at their current market value.

- Disclosure Requirements: IFRS mandates comprehensive and transparent disclosures to provide users of financial statements with sufficient information to make informed decisions.

- Consolidation and Group Accounting: IFRS provides detailed guidance on how to consolidate the financial statements of a group of companies, helping to accurately represent the financial position and performance of the entire group.

- Complex Financial Instruments: IFRS provides guidance on accounting for complex financial instruments, such as derivatives and hedging activities, to ensure accurate and consistent reporting.

- Revenue Recognition: IFRS has specific requirements for recognizing revenue from contracts with customers, aiming to reflect the transfer of goods or services to customers at an appropriate value.

- Leases: IFRS 16, a standard related to leases, requires lessees to recognize most lease agreements on their balance sheets, resulting in increased transparency and comparability.

Course Curriculum:

The IFRS course structure is divided into various modules and sections. The syllabus includes:

- International Sources of Authority.

- Preparation of Financial Statements and Additional Disclosures.

- Elements of Financial Statements

- Preparation of Extend financial reports for Combined Entities, Associates, and joint Arrangements.

| Topic |

| Introduction to IASB and IFRS. |

| Presentation and Profit |

| Accounting for Assets & Liabilities – Part 1 |

| Accounting for Assets & Liabilities – Part 2 |

| Group Accounting |

| Disclosure Standards |

| Principal Differences Between UK/US GAAP, IFRS and Ind AS |

IFRS Adoption Globally

Some countries have fully adopted IFRS for both domestic and listed companies, while others have converged their national accounting standards with IFRS or allowed the use of IFRS for certain companies or industries.

IFRS continues to evolve as the IASB issues new standards and amendments to existing ones to address emerging accounting issues and align with changes in the global business environment. It is important for companies, investors, and other stakeholders to stay updated on these developments to ensure compliance and accurate financial reporting. This post will help you decipher the right place to train for your IFRS and getting it done with all features provided by the institute which rightly suits you and your needs.

On successful completion, the students will be able to apply the appropriate financial reporting standards to elements of financial reports and also prepare group financial statements. They will also be able to identify and apply disclosure requirements for companies in financial reports and notes.

Benefits of ifrs training in chennai

- In-depth training on the new revenue and leasing standards (IFRS 15 and IFRS 16) with industry-specific illustrations.

- Overview of differences between IFRS and Ind AS.

- A deep understanding of the principles and rules of IFRS.

- Experience in the formation of professional judgment on the practical application of IFRS.

Assessment Structure of IFRS

- The Diploma in IFRS is a 3 hours 15 minutes single paper exam.

- A pass percentage of 50% and above are required to complete the paper.

- Students can take up their exams twice a year– June and December.

The paper contains:

| Section | Type of Question | Marks | Total |

| A | Groups Question | 1 x 25 | 25 |

| B | Scenario Question | 3 x 25 | 75 |

| 100 | |||

IFRS Course Eligibility:

Who can choose the course?

- Qualified Chartered Accountants

- CA students

- Management accountants and analysts

- Professionals working in finance and accounts

- Graduates and Post Graduates specialized in Finance.

Eligibility:

The course helps the students to be well versed with all the relevant and detailed IFRS knowledge. To qualify for a Diploma in IFRS any one of the following requirements have to be met:

- Be a professional auditor or an accountant qualified by the National Accounting Standards

- Accounting experience of 2 years and a certificate in International Financial Reporting by ACCA

- 3 years of relevant accounting experience

- ACCA affiliate status

Top institutions For IFRS Training in Chennai

SOE Global: IFRS Training in Chennai

SOE Global is a top ACCA institute in Chennai which aims to recognize the needs of the students and help them excel in their carrier with its quality and intensive ACCA coaching. They also offer other courses like BBA, B.Com, MBA, M.Com, B.Sc and M.Sc (ACCA). Also SOE Global provides ifrs training in Chennai.

Key highlights of IFRS Training in Chennai

With the provision of 24/7 online access to resources, they provide two modes of study:

Classroom Program

- 3 Months of Training Program

- Books & Learning Resources

- Taught by Expert Faculty

- Peer Group Learning Process

Live Online Training

- 55+ Hours of a training program on IFRS

- Live and Interactive

- Study Material and Recorded Sessions

- Additional 15 Hours Online Tutorials

- Face-to-Face sessions with experts

A participation certificate is provided for students with above 80% attendance.

Choose according to your convenience. The fee structure varies for both modes.

IFRS Course Fees: ifrs training in chennai

- Classroom Program

- Live Online Training

The course fees will include:

- 80 hours of classes

- The detailed and comprehensive study material

- Solved Question Banks

- Mock Tests

- Support from teachers and for Exam registration

The IFRS Examination fee for a single attempt is $185 equivalent to Rs.14000. They provide all the necessary support for document collection for exam registration.

IFRS Course Certificate:

A Diploma in IFRS can be completed in 4 to 6 months by just completing 1 exam and can help you be prepared for various sectors in the industry. Upon successful completion of the course, students are awarded a Diploma in International Financial Reporting Standards by ACCA, opening up brand new global opportunities for candidates.

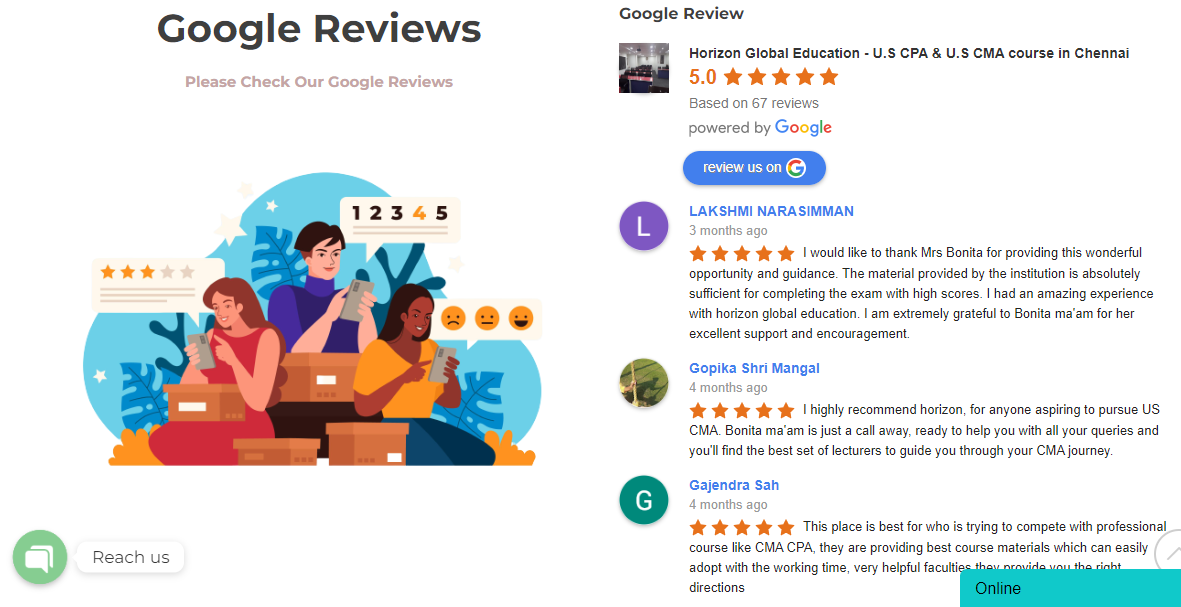

Horizon Global Education: IFRS Training in Chennai

Horizon global education, a trailblazing coaching institute based in Chennai gives exclusive coaching on ifrs training in Chennai. Strategic coaching, high qualified teaching faculty, ultramodern classrooms & 20 years of professional experience are the cardinal drivers of the institute.

Key Highlights: of IFRS Training in Chennai

The ifrs training in Chennai covers:

- 80 Academic hours of Classes

- Comprehensive Proprietary Study Materials developed by Global Methodologists.

- Comprehensive Question bank with Solutions.

- Mock Tests

- Interactive Support From the teacher.

- Administrative Support for Exam Registration.

Course Fees:ifrs training in chennai

INR 22000 (Duration:12 Weeks)

Henry Havin: IFRS Training in Chennai

Henry Harvin® is one of the leading providers of training & advisory services. Also it has been operational since July 2013 having offices across 11+ cities in US, India & UAE . While Henry harvin also provides ifrs training in Chennai.

Key Highlights:

- 75 Hours Online Training: A virtual tour of IFRS strategies, principles, and implications.

- 1 Year Gold Membership of Henry Harvin® Finance Academy

- Free Monthly Masterclass Sessions

- Access to the Learning Management System (LMS)

- Recorded Videos of the Session.

- 100% Placement, Internship, and Project Support exclusively entitled to IFRS Professionals.

- Digital Badge of ACCA Dip. IFRS Training Certified professional

- Excellent knowledge of Global Accounting Standards

- Opportunity to work with renowned companies

Course Fees:

INR 15000/- for the live online classroom and INR 13500/- for the self-paced course.

Conclusion on IFRS Training in Chennai

As we conclude this course, it’s evident that a solid grasp of IFRS is indispensable for professionals in the accounting and finance fields. Whether you’re an accountant, auditor, analyst, or manager, the knowledge gained from this course equips you to navigate the complex landscape of international financial reporting. Remember, accurate and transparent financial reporting is not only a legal requirement but also a means to build trust and credibility in the global business arena.

In our rapidly changing financial landscape, where economies and markets are interconnected like never before, a strong foundation in IFRS will empower you to contribute meaningfully to your organization’s success. I encourage you to continue exploring new developments in IFRS and to remain vigilant in upholding the highest standards of financial reporting integrity. Before you choose any institute to complete your Diploma in IFRS, keep in mind all the features they have to offer, time duration, costs and other additional assistance provided by the institute. This would help you to complete the course smoothly without any worries.