Last updated on November 17th, 2025 at 03:56 pm

According to IBEF(Indian brand equity foundation), the HNI population is expected to grow by 75% 3.5 Lakh to 6.11 Lakh by 2025. That kind of growth will generate some significant development for the financial consultant salary in India! A career as a financial advisor is gaining massive popularity in India as more individuals seek expert help with investments, retirement planning, insurance, and wealth creation.

With the rise of mutual funds, fintech platforms, and digital financial services, the demand for skilled advisors has never been higher. Naturally, one of the most common questions is: How much does a financial advisor earn in India? Salaries can vary widely based on experience, qualifications, client base, and earnings from commissions or AUM fees.

If you are wondering things like: What’s the financial advisor salary in India? What is the financial consultant’s salary? What is the investment advisor’s salary? And how much is the CFP salary in India?

Then this post is for you.

Key Takeaways

1: Entry Level salaries in wealth management ranges between 3.5 to 5 LPA

2:Senior level salaries in wealth management can reach upwards of 40 LPA

3:Senior roles in wealth management ecompass more than client acuqistion,but also products, compliance etc

4: Adding professional qualification at the entry level, can help you find niche jobs

5: Free lancing in this field is recommended after 4-5 years of industry expereince

What is financial advisory?

Just to put things in perspective!

And Before you understand how much we get paid for various roles, hence we need to get the hang of our value in the industry.

Therfore Simply put there are providers of fund management and clients on the other hand.

There are 1479 schemes provided by 44 AMC(Asset Management companies)

SEBI

- On the clients side, he/she may not have the necessary time and resources to study each scheme.

- On the fund side, they don’t have the resources to advise you individually

Let me take an example here: Mr A has a salary of $70,000 Annually, who is recently married and is 32 years old.

Given that,He plans to create an emergency fund, and save for house purchase in 3 years, whilst plan for retirement with the current lifestyle.

In addition, Mr A doesn’t have any experience in investment, and he is a straight arrow( risk-averse).

Nevertheless,would any mutual fund have the time to create a plan for him?

While The answer is No, the financial advisor plays a pivotal role in creating a customised solution tailored to the client-specific needs.

Financial Advisory Salary in India

The financial advisor salary in India (2025) varies widely depending on experience, certifications, employer type, and the client segment. On average, a financial advisor in India earns ₹4.5 lakh to ₹10 lakh per year, with freshers starting lower and experienced wealth advisors earning significantly more. According to recent salary data from major platforms, the entry-level salary begins around ₹2–3 LPA, while mid-career advisors earn ₹5–10 LPA, and senior advisors managing large AUMs can make ₹12–25 LPA or more. In premium roles such as private banking or HNI wealth advisory, total compensation may reach ₹25–40 LPA, depending on performance-based incentives.

| Experience Level | Monthly Salary (₹) | Annual Salary (₹ LPA) | Role Examples |

| 0–1 Years (Fresher) | 20,000 – 35,000 | 2.4 – 4.2 LPA | Junior Financial Advisor, Relationship Executive |

| 1–3 Years (Early Career) | 30,000 – 50,000 | 3.6 – 6 LPA | Financial Advisor, Client Advisor |

| 3–5 Years (Mid-Level) | 45,000 – 80,000 | 5 – 10 LPA | Senior Advisor, Wealth Advisor, Mutual Fund Specialist |

| 5–8 Years (Upper Mid-Level) | 75,000 – 1,50,000 | 9 – 18 LPA | Senior Wealth Manager, Portfolio Consultant |

| 8–12 Years (Senior Level) | 1,20,000 – 2,50,000 | 14 – 30 LPA | Senior RM, HNI Wealth Manager, Private Banker |

| 12+ Years (Top Tier/HNI Segment) | 2,00,000 – 4,00,000+ | 25 – 40+ LPA | Private Banker, Senior Portfolio Advisor, AUM-Based Independent Advisor |

Relationship Manager

Who is a Relationship Manager?

The average salary of a Relationship Manager (RM) in India ranges from ₹3.5 lakh to ₹9 lakh per year, depending on the industry, location, experience, and company size. Freshers typically start between ₹3–5 LPA, while experienced RMs working in banking, wealth management, insurance, or corporate client roles can earn ₹8–15 LPA. Senior Relationship Managers and Key Account Managers with 7–10+ years of experience often earn ₹15–25 LPA, especially in top banks, fintechs, and investment firms where incentives and performance bonuses significantly increase total compensation. Cities like Mumbai, Bengaluru, Delhi-NCR, and Pune offer the highest salary packages due to strong BFSI and corporate demand.

Overall, Relationship Management is a high-growth, client-facing career with excellent incentives, rapid salary progression, and strong job stability in India’s expanding banking and financial services sector.

The first and single point of contact for a retail,as well as institutional client for all the clients needs.

Relationship Manager Job Description

- Sourcing new clients

- Understanding needs of customers

- Retaining clients

- Problem solving for clients in an ongoing basis

- Tracking clients investment performance

- Liasoning between various departments for the client

Education: Any

What to expect: Quick promotions possible, Good incentives, Lots of learning.

Challenges: Sales visits, inter-personal skills, handlign clients during bad performance

| Experience Level | Job Title / Role | Average Salary (INR per year) | Notes |

| 0–1 years | Junior RM / Sales RM / Associate RM | ₹3,00,000 – ₹5,00,000 | Entry-level roles in banks, NBFCs, insurance, fintech. |

| 1–3 years | Relationship Manager | ₹5,00,000 – ₹8,00,000 | Higher incentives based on client acquisition & portfolio quality. |

| 3–5 years | Senior Relationship Manager | ₹8,00,000 – ₹12,00,000 | Handles large portfolios, HNI clients, and key accounts. |

| 5–8 years | Key Account Manager / Wealth RM | ₹12,00,000 – ₹18,00,000 | Roles in private banks, wealth firms, and corporate banking. |

| 8–12+ years | Senior RM / AVP / VP – Client Relations | ₹18,00,000 – ₹25,00,000+ | Senior roles, large revenue targets, leadership positions. |

Senior Relationship Manager

Who is a Sr.Relationship Manager?

Manages multiple relationship managers under him/her and responsible for business and handling escalation from other relationship managers

Sr. Relationship Manager Job Description

- Responsible for overall revenue targets of the team

- Hiring and monitoring team performance

- Providing solutions to escalated problems from clients

- Advising products and planning team on new avenues of revenue generation

- Training junior relationship managers

Education: MBA(Finance),CA,CFP,M.Com

What to expect: Performance incentives on team performance, more team management and problem solving work

Challenges: Identifying good performers and retaining them, firing poor performers & creating revenue plans.

| Industry | Average Salary Range (LPA) | Earning Potential |

| Retail Banking | ₹4 – ₹8 LPA | Moderate salary, high incentives |

| Private / HNI Banking | ₹8 – ₹20 LPA | High incentives for portfolio growth |

| Wealth Management | ₹10 – ₹25 LPA | Strongest earning potential |

| Fintech (Lending/Payments) | ₹5 – ₹12 LPA | Fast-growing sector; performance-based bonuses |

| Insurance (Life/General) | ₹3 – ₹7 LPA | Incentive-heavy structure |

| Corporate Banking | ₹12 – ₹25 LPA | Highest base salaries among RM roles |

| City | Salary Range (LPA) |

| Mumbai | ₹6 – ₹20 LPA |

| Bengaluru | ₹6 – ₹18 LPA |

| Delhi NCR | ₹5 – ₹16 LPA |

| Pune | ₹5 – ₹14 LPA |

| Hyderabad | ₹4.5 – ₹12 LPA |

| Chennai / Kolkata | ₹4 – ₹10 LPA |

Financial Planner & Investment Counselor

Who is a financial planner?

The technical financial planning executive, who creates the actual financial plan for a client after the client is onboarded

Financial Planner Job Description

- Responsible for providing holistic financial planning to clients

- Setting up meetings/ calls with prospective clients

- Creating flexible financial plan and helping the client to follow the plan

- Doing asset allocation across long-term and short-term goals

- Comprehensively document interactions and the advice being provided

- Help these clients understand the financial circumstances and how to reach their short term and long term financial objectives.

Education:

CFP,CFA,MBA (Tier I)

Expereince: Minimum 3 Years in BFSI

Skills:

Communication skills,presentation & Analysis

What to expect: A Lot investment policy statements, technical queries,presentations & being upto date with regulations.

Challenges:adaptive to new changes in the industry, deep research

Assistant Vice President- Distribution

Who is a AVP- Distribution?

The head of business operations for a wealth management firm or vertifical.

AVP- Distribution Job Description

- Serve as a lead point of contact for a small group of Advisory Firms, developing strong, long-lasting trusted advisor relationships

- Execute on a long term business plan strategy with your assigned advisory firms.

- Engage in regularly scheduled strategic discussions on the execution of the business goals and initiatives outlined in that plan.

- Ensure timely and coordinated delivery of services by orchestrating with Business Solutions and Customer Care partners

- Examine trends and develop insights at the firm level and across the Strategic Wealth Services firms

- Identify opportunities to increase client satisfaction

- Manage attrition risk by proactively partnering with internal stakeholders

- Internally, this position interacts with middle and senior management at LPL

Education & Work Expereince:

- Bachelor’s degree in Finance, Business, Economics or related field; MBA preferred

- Minimum of 5 years’ experience in financial services preferable in sales, consulting and/or client service/relationship management

- Knowledge of the client segment, organization, product, industry, and end customer

What to expect: Everything under the sun related to business problems including revenue

Challenges: Shifting through one problem to another

Vice President- Wealth Management

Who is a AVP- Distribution?

The head of business operations for a wealth management firm or vertifical.

VP- Wealth Management Job Description

- Working on improving and developing service, capabilities and products to high net worth and ultra-high net worth individuals and families around the world

- Manage investment management and brokerage, tax and estate planning, banking and credit, capital raising, and specialty wealth advisory services.

- Work in conjunction with numerous wealth management investment solutions teams to develop and deliver products for use in the lines of business.

- Experience analyzing, communicating and executing against complex business initiatives withpreparation and structure

- Ability to influence and partner effectively across a global organization

- Demonstrated track record of adapting to a rapidly changing business environment, ability toquickly assess situations, act decisively and capitalize on change

- Industry involvement – staying abreast of industry trends and issues

- Highly collaborative – history of delivering results with and through organizationalpartnership

- Proficiency with MS Office, particularly Excel, Word, and PowerPoint

- Background in Product Development and Product Management preferred

Education & Expereince Required:

- 5+ years of

- Exposure to Investment Products (MFs, SMAs, ETFs, Equities, Fixed Income) preferred

- Proven ability to distill complex ideas into consumable and actionable materials

What to expect: Lots of interaction with senior industry professionals,constant traveling, team management

Wealth manager salary in India

| Experience Level | Monthly Salary (₹) | Annual Salary (₹ LPA) | Role Examples |

|---|---|---|---|

| 0–1 Years (Entry Level) | 30,000 – 45,000 | 3.5 – 6 LPA | Junior RM, Assistant Wealth Manager |

| 1–3 Years (Early Career) | 45,000 – 80,000 | 5 – 10 LPA | Wealth Manager, Relationship Manager |

| 3–5 Years (Mid-Level) | 75,000 – 1,25,000 | 9 – 15 LPA | Senior RM, Investment Advisor |

| 5–8 Years (Senior Level) | 1,20,000 – 2,00,000 | 15 – 25 LPA | Senior Wealth Manager, HNI Advisor |

| 8–12 Years (VP Level) | 2,00,000 – 3,50,000 | 25 – 42 LPA | Private Banker, Portfolio Advisor |

| 12+ Years (Top Tier / Ultra-HNI Segment) | 3,50,000 – 6,00,000+ | 45 LPA – ₹1 Cr+ | Senior Private Banker, Principal RM |

Wealth manager salary by Industry in India

| Industry Segment | Salary Range (₹ LPA) | Notes |

|---|---|---|

| Private Banks (HDFC/ICICI/Axis) | 8 – 18 LPA | Stable clients, AUM targets, steady incentives |

| Wealth Management Firms (IIFL, Motilal, 360One) | 12 – 30 LPA | Highest incentives, strong HNI books |

| Fintech Wealth Platforms (Groww, Upstox, Paytm Money) | 6 – 15 LPA | Younger clients, digital-first, rapid growth |

| Asset Management Companies (AMCs) | 10 – 20 LPA | More product-focused roles |

| Boutique / Family Offices | 20 – 45 LPA | Manage very high-value portfolios |

| Private Banking (Top Tier) | 30 LPA – ₹1 Cr+ | Ultra-HNI clients, personalised advisory |

salary by AUM

| AUM Managed | Expected Annual Variable Pay (₹) | Insight |

|---|---|---|

| ₹5–10 Cr AUM | 1 – 2 Lakh | Entry-level Wealth Managers |

| ₹10–25 Cr AUM | 3 – 5 Lakh | Established RMs |

| ₹25–50 Cr AUM | 6 – 12 Lakh | Senior Wealth Managers |

| ₹50–100 Cr AUM | 15 – 25 Lakh | Private Bankers |

| ₹100 Cr+ AUM | 30 Lakh – ₹1 Cr+ | Ultra-HNI Private Banking |

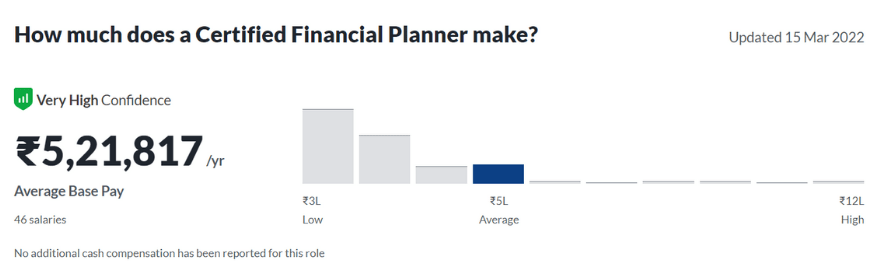

Certified Financial Planner(CFP) salary in India

Certified Financial Planner or CFP is a popular professional qualification pursued by wealth management professional across the world & is award by Financial Planning Standards Board in the U.S, whichis recognised across 60 countries.

Now the real question here, is whether CFP actually helps?

To be honest Just CFP, no! However it does give you a lot of knowledge, which can help you leap through the heirarchy faster.

Moreover it may help you in doing more technical work like financial planning or may be work in product development for wealth management firms.

The program helps you get a deeper understanding of :

Investment Planning Specialist

FPSB® Retirement and Tax Planning Specialist

Risk and Estate Planning Specialist

FPSB® Integrated Financial Planning Course

But now lets look at some real data, to see if there is any value in terms of growth.

I do believe that data if you have completed the entire CFP program, along with atleast 2 years of experience!

| Stage | Without CFP | With CFP | Salary Uplift |

|---|---|---|---|

| Entry Level (0–2 yrs) | ₹2.5 – ₹4.5 LPA | ₹4 – ₹7 LPA | 40% – 60% |

| Early Career (2–5 yrs) | ₹4 – ₹7 LPA | ₹7 – ₹12 LPA | 35% – 55% |

| Mid-Level Wealth Advisor (5–8 yrs) | ₹7 – ₹12 LPA | ₹12 – ₹20 LPA | 40%+ |

| Senior Wealth Manager (8–12 yrs) | ₹12 – ₹20 LPA | ₹18 – ₹30 LPA | 30% – 50% |

| Private Banker / HNI Advisor | ₹18 – ₹35 LPA | ₹25 LPA – ₹50 LPA+ | 30% – 40% |

| Independent CFP (Own Practice) | ₹10 – ₹25 LPA | ₹20 LPA – ₹1 Cr+ | 100%+ |

So upwards of around +2 LPA premium, compared to a non CFP candidate. However do note, that CFP program is not an easy feat to complete and requires some good effort and focus.

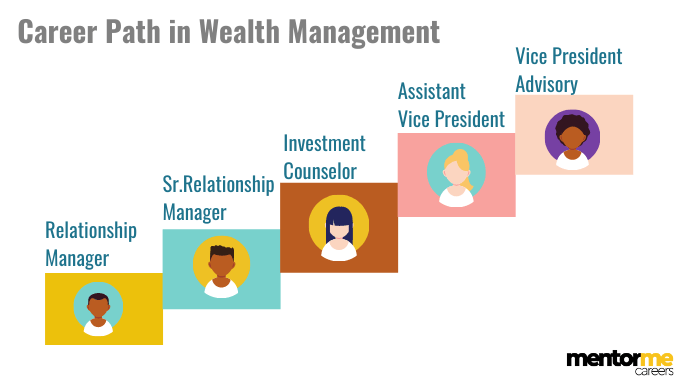

Career Growth Path for Financial Advisors (0–10 Years)

| Career Stage | Experience (Years) | Job Title / Role | Key Responsibilities | Expected Salary Range (₹ LPA) |

| Stage 1 | 0–1 Years | Junior Financial Advisor / Relationship Executive | Client onboarding, basic financial planning, product awareness, lead support | 2.4 – 4.2 LPA |

| Stage 2 | 1–3 Years | Financial Advisor / Client Advisor | Goal planning, recommending mutual funds & insurance, initial AUM building | 3.6 – 6 LPA |

| Stage 3 | 3–5 Years | Senior Financial Advisor / Wealth Advisor | Managing 50–150 clients, building AUM, advanced planning, cross-selling | 6 – 10 LPA |

| Stage 4 | 5–7 Years | Senior Wealth Manager / Portfolio Consultant | Handling HNI clients, asset allocation, portfolio reviews, revenue targets | 9 – 18 LPA |

| Stage 5 | 7–10 Years | Private Banker / Senior RM / Portfolio Manager | Managing ₹20–50+ crore AUM, HNI/Ultra-HNI advisory, investment strategy | 14 – 30 LPA |

| Stage 6 (Optional) | 10+ Years | Independent Financial Planner / Principal Advisor | Running own practice, fee-based advisory, AUM-based income | ₹30 LPA – ₹1 Cr+ (depends on AUM) |

Top Investment Advisor Jobs in India

There are tonnes of jobs in investment advisory, but I am going to highlight some great opportunties that this industry has to offer. Also to make you aware that investment advisory, although has a big componenet related to targets, revenue and sales but has the potential to be a big pay master

Salary : 17 -27 LPA

Salary: 13 LPA

Salary:5.5 LPA

Salary: 9 LPA

Salary: 9.5 LPA

Hopefully the idea is clear? Wealth Management can pay and be attractive just like any other niche field,if you have the personality fit for this kind of job.

Freelance Financial advisor jobs

Another beautifull thing about financial advisory, is the opportunity to call your own shots!

Yes!

All it takes is 4-5 Years of industry expereince, wherin you have created some reputation and network. Remember wealth managemnet deals with money, and money means trust! You will not be so trusted, if you start your own practice as a fresher. Just like any other field or sport, career, wealth management has got its own slangs, tricks and recipies for runnign the show.

However once you have it, then wealth management can be a great stay for runnign your own private wealth management services.

There are two ways by which you can structure your business

- Fee Based

- Commission based

Fee based is still very new in India, and clients usually don’t feel comfortable paying the advisor for the services, but happy taking a cut on their returns with the management fees that the mutual fund charges.

However in the longer run, I feel that fee based is going to the place for innovation and the standard.

Conclusion

Summing up! I feel wealth management, financial advisor, investment advisor all are great opportunties for aspiring candidates who wish to take the adventure.

Its not easy and its not for everyone but my advice is not to discount this field as a sales job, after all everything is sales. You can’t sell, you can’t survive.

FAQ

Yes. Financial advisory can be a high-paying career in India, especially for those with strong credentials like CFP/CFA and a solid client portfolio. Entry salaries are modest, but experienced advisors and wealth professionals can earn high incomes through fees, commissions, and AUM-based earnings. The more clients and assets you manage, the higher your income potential.

A Certified Financial Planner (CFP) in India typically earns ₹3–6 LPA at the entry level, ₹6–12 LPA at mid-level, and ₹12–30 LPA+ at senior levels. Independent CFPs managing large HNI portfolios can earn significantly more through advisory fees, trail commissions, and performance-linked payouts.

Earnings per client depend on the advisor’s model:

1.Fee-based: ₹1,000–20,000+ per client/year.

2.AUM-based: 0.5%–2% of assets under management annually.

3.Commission-based: Varies by insurance/mutual fund product.

Advisors serving HNI clients earn substantially higher revenue per client due to larger AUM and premium advisory services.

Commission income varies across financial products:

1.Mutual funds/PMS: low commissions or trail fees (0.1%–0.75%).

2.Insurance: higher upfront commissions + annual renewals.

3.Advisory/AUM fees: 0.5%–2% annually on managed assets.

Regulatory trends favour transparency, so many advisors now combine modest commissions with advisory fees.

Yes. Many experienced advisors, wealth managers, and independent CFPs earn ₹1 lakh+ per month through a mix of advisory fees, AUM charges, commissions, and client retainers. Achieving this typically requires either a large AUM base or a strong pipeline of high-value clients.

Both careers are strong, but they differ in scope. A financial advisor mainly serves retail and mass-affluent clients with planning and investment advice, while a wealth manager handles HNI/UHNI clients with advanced services like estate planning, alternative investments, tax structuring, and family office support. Wealth management generally offers higher income potential, but financial advisory provides broader reach and easier entry.