Last updated on October 23rd, 2024 at 04:50 pm

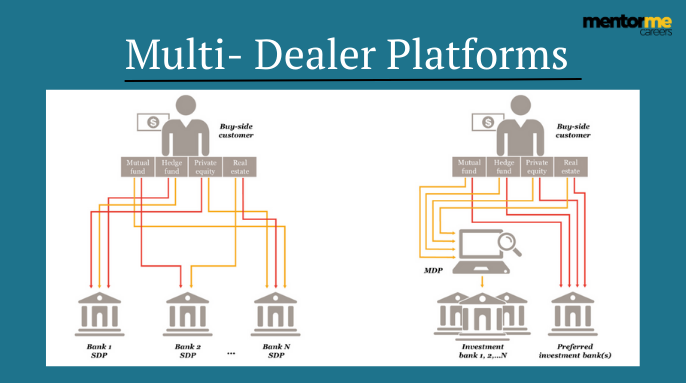

Multi-Dealer Platforms (MDPs) have reshaped the landscape of investment banking, akin to how travel websites revolutionized booking processes. Unlike Single-Dealer Platforms (SDPs) that limit choices to proprietary services, MDPs aggregate offerings from multiple investment banks. This approach enhances service diversity and optimizes customer allocation, paralleling the efficiency of selecting from various airlines on a travel booking site rather than being restricted to a single carrier.

In the realm of asset classes such as equities, FX trading, and fixed income, MDPs have gained prominence. They facilitate streamlined trading processes and reduce costs by consolidating liquidity across market participants. This shift has prompted banks to explore hybrid SDP/MDP strategies, aiming to balance cost efficiencies with the need for specialized services. By leveraging shared technology in trading, post-trade processing, and client onboarding, banks can focus their proprietary investments on high-value areas like research, analytics, and client relationship management.

This strategic alignment not only enhances a firm’s digital cost-to-income ratio but also supports its ability to cater to diverse client demands effectively. As institutions navigate the complexities of evolving market dynamics, a hybrid approach allows them to capitalize on their unique strengths while adapting to the efficiencies offered by collaborative platforms like MDPs.

To naturally integrate these paragraphs into your updated article, consider placing them after the initial introduction or where you discuss the historical context of MDPs versus SDPs. This expansion not only increases the word count but also enhances readability and clarity, incorporating relevant keywords such as “management development program” and “general management” seamlessly into the discussion of strategic implications in investment banking.

A simple way to understand an MDP is, a travel website which allows you to purchase air tickets from multiple airlines in one go. On the other hand a single platform provider is like going to a specific airline website and purchasing air tickets from a single airline. So, in this article I will discuss mdp full form and the various details of MDP Versus SDP.

MDP Full Form-( Multi Dealer Platform)

MDP stands for multi-dealer platforms, where a bank provides access to multiple investment banks services rather than its own proprietary technology. So, you can understand this in the same way, a travel website gives you option to take services from various airlines rather than one airline itself. Which then leads to the best service provider and optimum customer allocation.

Factors that Lead to MDP In Investment Banking

Just like the airline anology, the same can be understood in investment banking services too. While, you may look for a commercial flight on makemytrip, but for charter flights you need to contact a single service provider. Hence, there is a need for specialised as well as general options.

- Equity Trading

Now, consider the most popular segment of asset, equities. Many banks, had invested heavily on their own technology. However, since there have come up so many options which are more efficient and have more flexibility. Hence an SDP solution has failed big time in this regard. However, many banks have come together to create their own network of MDP.

- FX Trading

Now, the same trend can be seen in forex trading. Where, major giants have emerged in providing better services, and market particpants like Banks have become less active in this space.

- Fixed Income

Fixed income or bonds segment has also seen high electronicfication, led by software companies. Most banks have seen a steep decline in revenue generated from their platforms, as MDP becomes more popular in this space too.

Hybrid MDP Strategy

Dealers have long complained that margins have been eroded by the cost of doing business on MDPs, which aggregate liquidity by bringing together market participants.

We believe it is no longer logical to think of SDPs and MDPs as being mutually exclusive. We believe a hybrid SDP/MDP strategy can increase a firm’s digital cost-to-income ratio by as much as 45%, based on our work with clients and other internal research. This is a result of

Reduced price: driven by the adoption of shared technology in fields where functions like trading, post-trade processing, collateral management, reference data management, and client onboarding do not require differentiation.

Increased income: Driven by improvements targeted at areas where they can yield the greatest rewards. For the majority of businesses, these will include investments in exclusive technology that supports unique functions, especially in the fields of research and analytics, sales, prime financing, client servicing, and pricing/trading of structured products.

We recognize that these changes are neither quick nor straightforward. Ageing technology architecture and complex operating models may present challenges for businesses.

We also recognize that investing more in platforms at a time when margins are contracting can be challenging. The default response is to wait and see, but this can be a dangerous course of action. Firms are likely to continue overspending on proprietary technology rather than creating a platform based on a thorough understanding of what makes their bank unique. For instance, a bank’s sophisticated SDP may assist clients in gaining investment insights from customized research and analytics, but this may not be sufficient to alter clients’ habits of checking prices on lean MDPs and trading with the bank that has the lowest price.

We advise businesses to use a hybrid SDP/MDP model because buy-side clients are increasingly choosing among different sell-side providers.

In order to accomplish this, CIOs and CTOs will want to share technology using an MDP that forbids their organizations from contributing anything original to the platform. By using an SDP, this strategy will allow banks to concentrate on the areas where they actually add real value. Additionally, it maximizes their technological investments in a cutthroat market.

Functional Areas and Management Development Programme (MDP)

Incorporating a Management Development Programme (MDP) is crucial for the growth and efficiency of financial institutions. These programs, often offered by prestigious institutions like the Indian Institute of Management, are designed to enhance skills in key functional areas such as leadership, strategic management, and operational efficiency. By aligning the objectives of a Management Development Programme with the strategic goals of implementing MDPs in investment banking, institutions can achieve a more integrated approach to cost management and service optimization. This not only improves the overall performance of the firm but also ensures that the staff is well-equipped to navigate the complexities of modern financial markets.

Conclusion

Multi-Dealer Platforms have revolutionized investment banking by offering a more diversified and efficient approach compared to Single-Dealer Platforms. By leveraging the benefits of both MDPs and SDPs through a hybrid strategy, financial institutions can significantly enhance their digital cost-to-income ratio and overall performance. Incorporating a Management Development Programme (MDP) from institutions like the Indian Institute of Management can further strengthen the capabilities of these institutions, ensuring they remain competitive in an ever-evolving market.