Last updated on February 20th, 2026 at 05:02 pm

Knowing anti-money laundering stages is crucial for finance individuals involved in compliance, fintech, banking, or the prevention of financial crimes. These stages outline the process of how illegal funds infiltrate the system, transit through complicated transactions and lead to surface as legitimate money. Let’s dive into anti-money laundering stages and understand their importance and how it will help in the AML KYC career.

Why understanding the AML stages matters (for students & professionals)

The three stages of anti-money laundering form the core of understanding how financial crimes are conducted and how institutions are required to recognize and prevent them. For students, this understanding serves as basics for passing AML/KYC certifications, going through interview processes, understanding in case studies, and completing assessment examinations. For professionals, it enhances the capability to interpret warning signs, assess customer behavior, and detect unusual transaction patterns before they escalate into regulatory issues.

From a practical daily operations perspective, being aware of the AML stages allows you to pinpoint where the risk of money laundering is greatest and how criminals try to obscure the original source of illegal funds. The placement stage equips you to spot initial entry risks such as cash deposits, crypto-fiat exchanges, and mule accounts. The layering phase enhances your skills in recognizing structuring, swift movements, international transfers, and convoluted financial trails. The integration stage aids you in identifying when illicit funds re-enter the legitimate economy through avenues like real estate, shell companies, securities, or high-value purchases. With a grasp of these patterns, you can proactively anticipate the methods of financial criminals rather than merely responding to alerts.

From a regulatory perspective, AML stages are integrated into every significant compliance framework: FATF recommendations, RBI KYC Master Directions, FIU-IND reporting regulations, SEBI intermediaries guidelines, FinCEN (US), FCA (UK), MAS (Singapore), and the EU AMLD framework. Both global and Indian employers look for candidates who demonstrate a solid understanding of AML stages, as misinterpretations can result in overlooked Suspicious Transaction Reports (STRs), fines, or risks to the institution. Whether your career aspirations lie in banking, fintech, insurance, payments, crypto exchanges, or consulting, mastering the AML stages is an essential requirement for advancing in the field of financial crime compliance.

Abbreviations

FATF – Financial Action Task Force

RBI – Reserve Bank of India

KYC Master Directions = RBI’s regulatory framework for Know Your Customer compliance in India

FIU-IND – Financial Intelligence Unit – India

SEBI – Securities and Exchange Board of India

FinCEN – Financial Crimes Enforcement Network (United States Department of the Treasury)

FCA – Financial Conduct Authority (United Kingdom)

MAS – Monetary Authority of Singapore

EU AMLD – European Union Anti-Money Laundering Directive

Anti money laundering stage 1: Placement

This process entails transforming “dirty money” into seemingly legitimate deposits, purchases, or transactions to evade detection.

Common placement techniques

1. Smurfing / Structuring

Breaking large amounts of illegal cash into many small deposits below reporting thresholds (e.g., under ₹50,000 or ₹10,000 cash deposits repeatedly) to avoid detection.

2. Cash-Intensive Businesses

Using restaurants, bars, salons, petrol pumps, or small shops to mix illegal cash with legitimate daily cash collections, making dirty money appear like normal business revenue.

3. Casino & Gaming Transactions

Criminals buy chips with illegal cash, play minimally, then cash out as a “casino payout,” which appears as legitimate winnings.

4. Fake Invoices & Over-Invoicing

Shell companies generate fake invoices for goods/services that did not occur, allowing illegal money to enter business accounts as “payments.”

5. Cross-Border Cash Smuggling

Physically transporting cash to another country with weaker AML controls, then depositing it into financial institutions or using money remitters.

6. Cash Purchase of High-Value Assets

Buying real estate, gold, vehicles, or luxury items with illicit cash and then selling them later to convert illegal funds into legitimate sale proceeds.

7. Use of Money Mules

Depositing illegal cash into accounts of individuals who agree to move funds for a commission, creating distance between the criminal and the transaction trail.

8. Bank Drafts & Money Orders

Purchasing bank drafts, demand drafts, prepaid cards, or money orders with cash to break audit trails and convert cash into more traceable instruments.

Red flags and detection tips for placement

The placement stage represents the most riskiest aspect of the money-laundering cycle since criminals attempt to move illegal cash funds into the financial system. Identifying placement quickly can stop the entire laundering process. Presented below is a concise yet effective compilation of warning signs and detection strategies essential for compliance teams, auditors, and those pursuing careers in AML.

Short case/example:

A corrupt official receives ₹30 lakh in bribes and deposits the cash into several bank accounts under different names, each below the ₹10 lakh STR (suspicious transaction reporting) threshold. He later funnels the money into a small retail business to make it appear as daily cash sales, a classic case of placement and structuring.

Anti money laundering stage 2 layering

The layering stage in anti money laundering refers to the process where criminals move, transfer, or convert illegal funds through multiple complex transactions to hide their origin. During layering, money is intentionally routed across accounts, entities, countries or assets to break the audit trail and make detection difficult.

Layering methods

1.Shell Companies & Empty Corporate Structures

Criminals set up fake or inactive companies with no real operations to move illegal funds. These entities help mask ownership, create false invoices, and generate multiple layers of transactions.

2.Multiple Bank Transfers Across Jurisdictions

Funds are rapidly transferred between banks in different cities or countries, especially high-risk or secrecy jurisdictions to break audit trails and exploit weak AML regimes.

3.Trade-Based Money Laundering (TBML)

Criminals manipulate import/export documentation through over-invoicing, under-invoicing, misclassification, or fake trade transactions to disguise illegal proceeds within legitimate trade flows.

4.Crypto Mixers & Tumblers

illegal crypto assets are passed through mixing services to hide wallet trails. Funds are broken into smaller parts, routed through multiple wallets, and reassembled making on-chain tracing difficult.

5.Use of Securities, Derivatives & Investment Products

Criminals buy and sell stocks, bonds, mutual funds, or derivatives to create fast, layered transactions. Frequent trading, moving funds through brokers, and using multiple custodians adds further opacity.

How analysts trace layering in anti money laundering

Link analysis tools (e.g. graph networks) to trace relationships between accounts, entities, and counterparties.

Transaction graphing to identify circular flows, rapid movement patterns, or unusual fund routing.

Chain-hopping detection for crypto tracking movement across blockchains, mixers, and exchanges.

Behavioural analytics (AI/ML) to identify deviations from expected customer behavior.

KYC + beneficial ownership checks to uncover hidden relationships behind shell companies.

Cross-border payment pattern analysis using SWIFT (Society for Worldwide Interbank Financial Telecommunications) /UPI(Unified Payments Interface)/IMPS(Immediate Payment Service) metadata to detect high-risk jurisdictions.

Example scenario:

An unaccounted amount of ₹25 lakh was deposited into the account of a small textile export firm in India.

The company subsequently wired ₹20 lakh to a shell corporation in Dubai, marked as “consulting fees.”

The shell corporation then converted a portion of the funds into cryptocurrency (for instance, Bitcoin) and utilized a crypto mixer to obscure the transaction trail.

Following the mixing, part of the cryptocurrency was reconverted to fiat and distributed across various accounts in Singapore, Hong Kong, and Estonia.

One account acquired counterfeit trade invoices and funneled funds back into a third company in India as “export proceeds.”

Anti money laundering stage 3 integration

The integration stage in anti money laundering is the final phase where illegally obtained funds are reintroduced into the legitimate economy. At this stage, the laundered money appears fully clean, often through investments, business purchases, or luxury assets, making detection extremely difficult.

Integration routes and examples

Real estate acquisitions

Criminals utilize laundered funds to buy residential or commercial properties in order to quickly legitimize substantial amounts of money.

Business investments / SME ownership

Laundered money is funneled into restaurants, logistics companies, retail outlets, or service-sector businesses as “capital” or “profits.”

Luxury items

Purchases of high-value items such as gold, diamonds, cars, artwork, yachts, or antiques facilitate the conversion of illegal proceeds into seemingly legitimate wealth.

Loan-back arrangements

Criminals direct their illicit funds into offshore corporations, which then lend the money back as “loans,” creating the appearance of legitimate credit inflow.

Bank deposits & investment portfolios

Funds are funneled into mutual funds, stock trading accounts, government bonds, or fixed deposits, disguised as typical investments.

E-commerce & online marketplaces

Laundered money is blended with online business income or inflated sales figures to create the illusion of real revenue.

Charitable organizations and NGOs

Donations and grants are employed to reintroduce funds through intricate transfers and fabricated charitable expenditures.

Payments for professional services

Funds are concealed through high-value invoices for consulting, IT projects, or legal services.

Why integration is the hardest to detect and what helps

Integration is the most challenging stage to identify because, at this point, the funds have already moved through various transactions, jurisdictions, and shell companies, making them seem entirely legitimate. The money typically enters through legal channels, supported by fraudulent documentation or seemingly genuine business transactions. Analysts depend on subtle indicators such as differences between reported income and asset growth, sudden changes in lifestyle, unverified “consulting” earnings, unexpectedly high-value acquisitions, and inconsistencies in the source of funds. Contemporary tools like behavioral analytics, network mapping, and AI-driven profiling aid in revealing these concealed patterns, yet integration still demands keen judgment and investigative expertise.

| Stage | Main Goal of the Criminal | Typical Indicators to Watch |

| Placement | Move illegal cash into the financial system | Large or structured cash deposits, use of shell firms, sudden account openings |

| Layering | Obscure the audit trail and disguise the origin | Multiple transfers, cross-border wires, use of crypto or shell entities |

| Integration | Reintroduce laundered money as legitimate assets | Real estate purchases, luxury goods, fake business revenues or loans |

How AML programs target each stage

AML teams use different tools and controls to detect suspicious activity at each of the three stages of money laundering, placement, layering, and integration. Below is a high-level explanation of how modern AML systems tackle risk throughout the laundering cycle.

Placement: Controls & Detection Techniques

Controls during the placement phase concentrate on identifying unusual cash inflows and early signs of suspicious activity before illegal money enters the financial system.

Key AML Controls:

Transaction Monitoring System (TMS): Identifies quick cash deposits, structuring, smurfing, atypical cash-heavy behavior, or activities in high-risk geographical areas.

Real-Time Notifications: The system generates alerts when customers deposit amounts below reporting thresholds or conduct transactions across multiple branches/accounts.

CTR/STR Reporting: Recognizes and elevates cash patterns for submission to the Financial Intelligence Unit (FIU).

Objective: Prevent illicit funds from fully integrating into the formal financial system.

Layering: Controls & Detection Techniques

The layering stage involves intricate movements to disguise the source of funds. Controls emphasize the identification of transaction patterns, connections, and networks.

Key AML Controls:

Link Analysis Software: Discovers relationships among accounts, counterparties, or shell companies.

Cross-Border Surveillance: Highlights transfers to high-risk regions or inadequately regulated tax havens.

Behavioral and Machine Learning Models: Machine-learning systems identify abnormal activities, the speed of transfers, or irregular behavior.

Crypto Analytics: Monitors chain-hopping, the use of mixers, and wallet-to-exchange transfers through blockchain forensic analysis (Chainalysis, TRM Labs, Elliptic).

Objective: Track the flow of funds and reveal concealed patterns or networks attempting to hide their origins.

Integration: Controls & Detection Techniques

Integration appears legitimate as funds re-enter the economy as lawful income. Controls focus on tracing assets and identifying discrepancies between lifestyle and income.

Key AML Controls:

Asset Tracing Software: Discovers real estate acquisitions, luxury goods, investments, and business ventures funded by illegal money.

STR/SAR Investigations: Search for inconsistencies between customer profiles and sudden increases in wealth.

Enhanced Monitoring: Ongoing behavior tracking and examination of high-value assets or corporate investments.

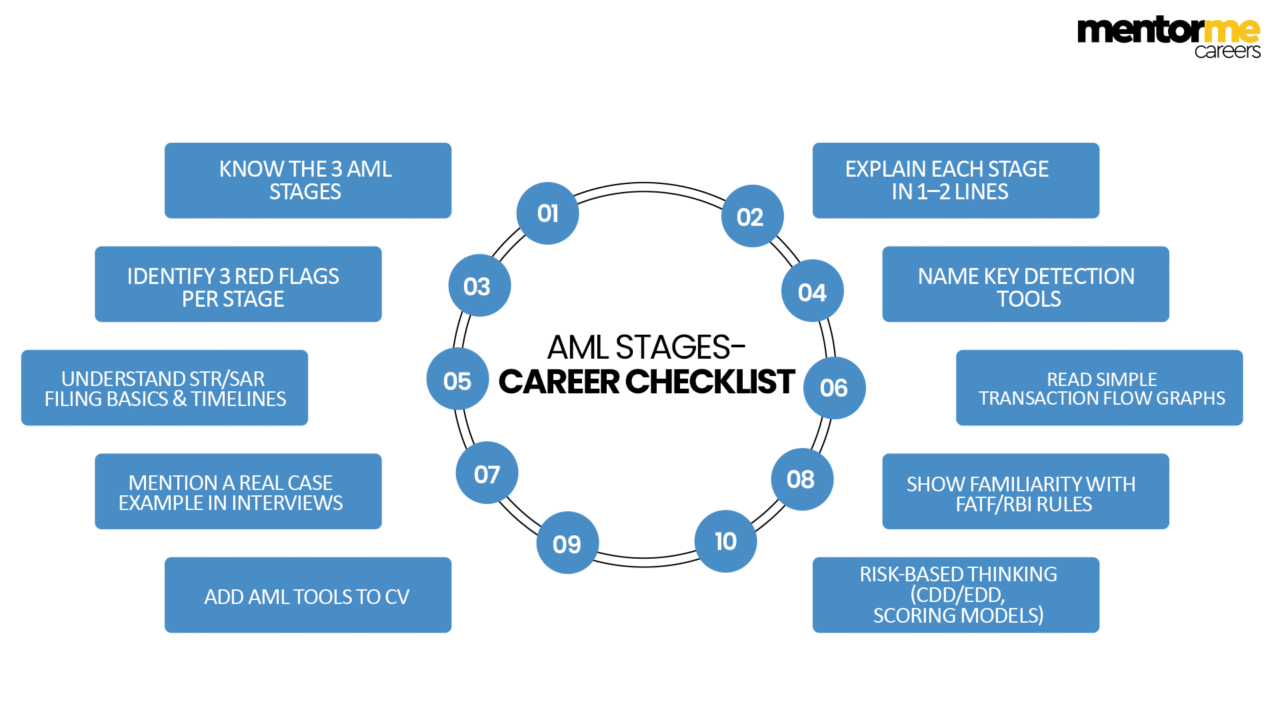

What employers expect you to know about AML stages

Be able to clearly define all 3 AML stages (placement, layering, integration).

Mention at least 3 detection techniques per stage in interviews.

Understand how STR/SAR filing works and timelines.

Know 1–2 real case examples (e.g., HSBC AML failures).

Show comfort reading simple transaction graphs or flow diagrams.

Add keywords like AML stages, transaction monitoring, EDD, STR filing to your CV.

Explain layering using shell companies, cross-border transfers, crypto.

Demonstrate familiarity with FATF guidance, RBI/SEBI rules, FIU reporting.

Conclusion

Understanding the three stages of money laundering Placement, Layering, and Integration is essential for anyone aiming to build a career in compliance, banking, finance, or risk management. Each stage represents a critical point where illicit funds attempt to enter, move through, and finally merge with the legitimate financial system. By learning how these stages work and recognizing their red flags, professionals can strengthen AML frameworks and support global efforts to combat financial crime.

Looking to build a career in Anti-Money Laundering, Compliance, or Risk Management?

Explore MentorMe Careers’ AML training programs, expert-led courses, and placement-focused guidance designed to help you gain practical skills and industry-ready knowledge.

FAQ

Money laundering typically occurs in three stages: placement, layering, and integration. In placement, illicit funds are introduced into the financial system. Layering involves moving and transforming those funds through complex transactions to hide their origin. Finally, in integration, the now-obscured funds are reintroduced into the legitimate economy and appear “clean.”

Understanding the stages helps financial institutions and regulators identify suspicious activity earlier and design better anti-money laundering controls. Each stage has distinct characteristics and risk indicators that compliance teams monitor to detect laundering attempts.

At the placement stage, criminals may break large amounts of money into smaller deposits (called smurfing), use cash-intensive businesses, buy financial instruments, or funnel funds through foreign exchange and other services to avoid detection.

Layering is the process of disguising the origin of illicit funds by moving money through multiple accounts, financial instruments, countries, or transactions. This creates a complex trail that makes it difficult for authorities to trace the true source.

Laundered money is reintroduced into the economy apparently as legitimate funds. This might involve investments in real estate, luxury assets, business ventures, or other transactions that make the money look lawful.

Some common warning signs include unusually high cash deposits, frequent transfers to offshore accounts, rapid movement of funds through multiple accounts, and transactions without clear business purposes.