Last updated on February 16th, 2026 at 06:19 pm

Aml analyst or kyc aml analyst are much needed in finance sector. As technology advances, so do the methods used by criminals. This makes the work of AML and KYC analysts even more vital. They must stay updated on the latest trends in financial crime and utilize advanced tools and software to detect anomalies in financial transactions. Their expertise not only helps in preventing losses but also protects the reputation of the organizations they work for.

Moreover, the demand for aml analysts is growing across various sectors, including banks, investment firms, and insurance companies. Organizations are increasingly investing in training and resources to build strong compliance teams. This trend highlights the importance of having skilled professionals who can navigate the complex landscape of financial regulations and ensure that organizations operate within the law. If you are passionate about Legal and Finance this might be the best job for you!

Finance is the sector where there is maximum chance of frauds and money laundering. Money is a important asset for organizations and also individuals working for the organizations. Organizations need team to handle the situations of frauds and money laundering. As financial crimes are increasing and getting more sophisticated. Need for individuals who can analyze and solve these issues is increasing.

Who is AML Analyst?

Aml analysts professionals play a crucial role in safeguarding the integrity of financial institutions. An AML (Anti-Money Laundering) analyst is responsible for monitoring transactions, identifying suspicious activities, and ensuring compliance with regulations designed to prevent financial crimes. Similarly, a KYC (Know Your Customer) AML analyst focuses on verifying the identities of clients and assessing their risk levels to prevent potential fraud. Why aml analyst are important is because they safeguard any risky financial activity happening around.

The main tasks of aml analyst includes:

Monitoring:

Analyzing large volume of data, financial data to detect any weird activity patterns like layering, smurfing, structuring. Tracking the account movement including location, amount, time and date. Basically analyzing any out of line activities.

Verification:

Proper kyc (know your customer) steps taken is verified by aml kyc analyst. Verifying customer’s identity, going by the rules and regulations of kyc is the main role, also performing the due diligence on high risk clients. Every customer has to go through kyc for any account.

Suspicious Activity Reporting (SAR):

Investigating red flags like changed patterns in the transactions and escalate it by filing suspicious transaction report (SARS). Reporting fraud and any anti-terrorist financing. This is also one of the types of anti-money laundering.

Compliance documentation:

Drawing and maintaining the documentation for internal and external teams. Keeping a check on new regulations and implementing them. Managing audit ready documentations.

Risk Assessment:

Evaluate the AML risk associated with certain clients, geographies, or transaction types. Investigating and assessing the financial risks posed by a company’s operations. Mitigating money laundering risk.

Essential skills & qualifications an aml analyst needs

Generally, these roles don’t need much advanced level skills that we speak of. The skill level is basic easy to learn, most of skills include soft skills which maximum candidates already have.

Critical Thinking

To make the right decisions in any situation critical thinking is important for any role in the industry. An ability to think from all of the perspectives, brainstorming is essential part of being a aml analyst.

Interpersonal skills

Interpersonal skills are needed in day-to-day role of kyc aml analyst as they have to work with teams and understand the problem, effective find a solution. They build relationship which help professionals in difficult situations, this also increase productivity at work.

Technology skills

Knowing the tools and software to be used for the activites also having basic computer knowledge to maintain documents, file reports and utilize tools effectively. An AML analyst relies heavily on advanced technology and specialized tools to detect suspicious financial activity, monitor transactions, and ensure compliance with global regulatory standards. Whether working in a bank, fintech firm, or financial services company, mastering the right tools is essential for any aspiring AML KYC analyst.

Communication skills

Kyc aml analyst must have good communication skills to explain the issues and writing the reports. Maintain relationships, work with teams for coming up with right solutions and strategies. To clear any doubts and problem while working on report.

Aml Analyst Certifications

There are national aml certifications and also global certifications for aml. The certifications given below are for training and placement. These certifications will enable you to enter into anti-money laundering field easily.

IIFB E-learning

Indian Institute of banking & finance provides aml kyc certification is available which is remote. They provide virtual or live 2-3 days of workshop on kyc aml certifications. IIBF has exam and also preparatory training which is optional. The exam is of 2 hours and doesn’t need much of preparation within 3-4 days you will be done preparing for the exam. IIBF kyc aml certification is recognized by RBI, FIU-IND, test is MCQ based.

Mentor me careers

Mentor me careers provides proper guided course which is for 1.5 months. In this course syllabus starts from basic to advance where mentor me careers also cover the core topics needed to understand in kyc aml analyst role. This course can be done self paced as students get login to their individual portal for the study material and videos. This course is more practical application driven than theory which helps students understand the application of the role they are aiming. In future thus helps getting a good job role in this field which mentor me career also help with. This is the course you need to reach your goal to be a kyc aml analyst.

Click here to know more about this course!

AML career Path

Getting into aml kyc doesn’t need a specific degree or background. This is a skill which be mastered as you learn more about finance and security. AML don’t have a specific anti money laundering career path but here is a common path you can refer to know the future in aml.

Stage 1: Entry level (0-2 years)

Roles

KYC Executive

AML Analyst (Junior)

Client Due Diligence (CDD) Analyst

Key Responsibilities

Customer identity verification (KYC)

Document checks (PAN, Aadhaar, Passport, etc.)

Basic customer risk profiling

Reviewing low-risk alerts

Updating compliance records

Skills Required

Basic AML & KYC knowledge

Attention to detail

Documentation & reporting

Communication skills

Certifications (Helpful)

IIBF AML/KYC

Entry-level AML certifications

Salary (India)

₹3–6 LPA

Stage 2: Transaction Monitoring Analyst (2–4 Years)

Roles

Transaction Monitoring Analyst

AML Operations Analyst

Key Responsibilities

Monitoring large volumes of transactions

Identifying suspicious patterns:

Structuring

Smurfing

Layering

Escalating alerts

Writing investigation summaries

Skills Required

Analytical thinking

Understanding of AML typologies

Excel, dashboards, AML tools

Salary (India)

₹5–8 LPA

Stage 3: AML Investigator / Senior AML Analyst (4–6 Years)

Roles

AML Investigator

Senior AML Analyst

Key Responsibilities

End-to-end investigations

Drafting & filing SAR / STR reports

Handling high-risk customers (EDD)

Interacting with regulators & auditors

Mentoring junior analysts

Skills Required

Risk assessment

Strong report writing

Regulatory understanding

Case management systems

Salary (India)

₹7–12 LPA

Stage 4: AML Manager / Compliance Manager (6–10 Years)

Roles

AML Manager

Compliance Manager

Risk & Compliance Lead

Key Responsibilities

Managing AML teams

Designing AML frameworks

Ensuring regulatory compliance

Audit & inspection handling

Training internal teams

Skills Required

Leadership

Regulatory expertise

Stakeholder management

Strategic decision-making

Certifications (Recommended)

CAMS (Certified Anti-Money Laundering Specialist)

Advanced compliance certifications

Salary (India)

₹12–20+ LPA

Stage 5: Leadership / Specialist Roles (10+ Years)

Roles

MLRO (Money Laundering Reporting Officer)

Head of AML

Chief Compliance Officer (CCO)

Financial Crime Risk Head

Key Responsibilities

Enterprise-wide AML strategy

Regulatory reporting

Risk governance

Policy design

Board-level reporting

Salary (India)

₹20–40+ LPA (can go higher in MNCs & global banks)

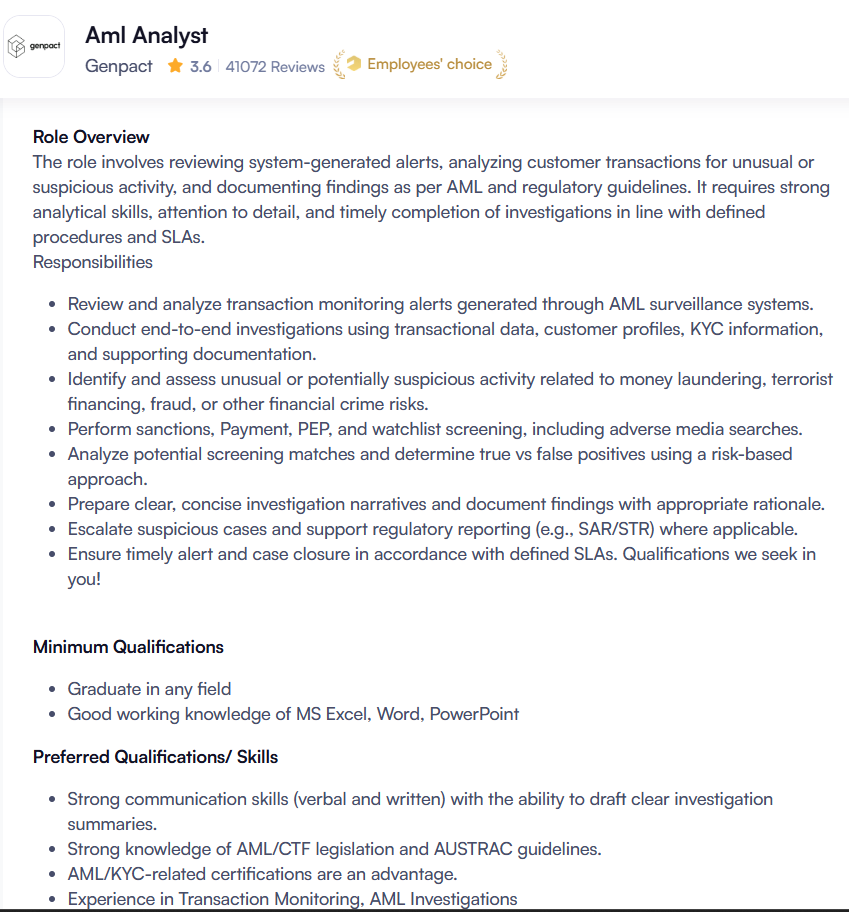

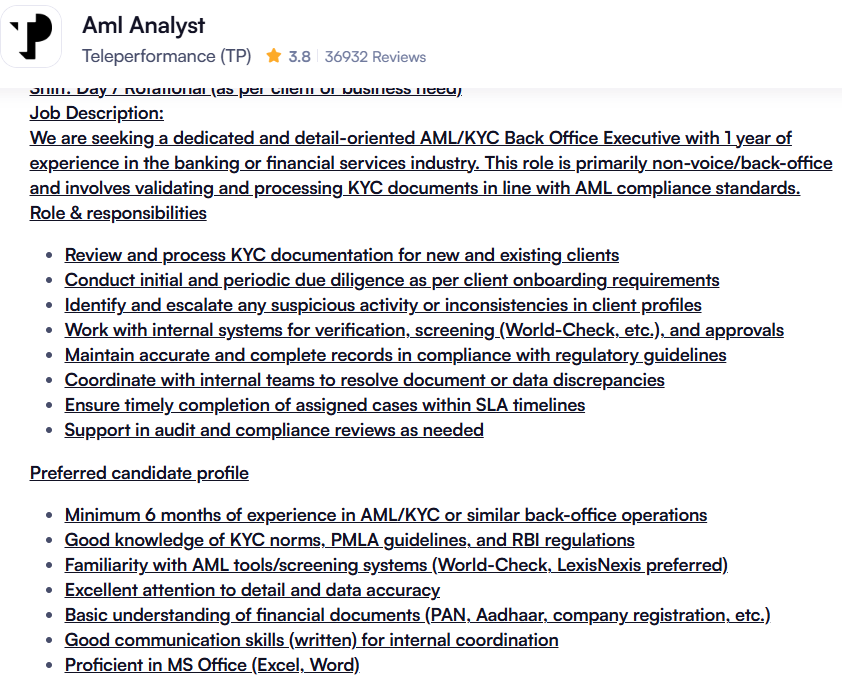

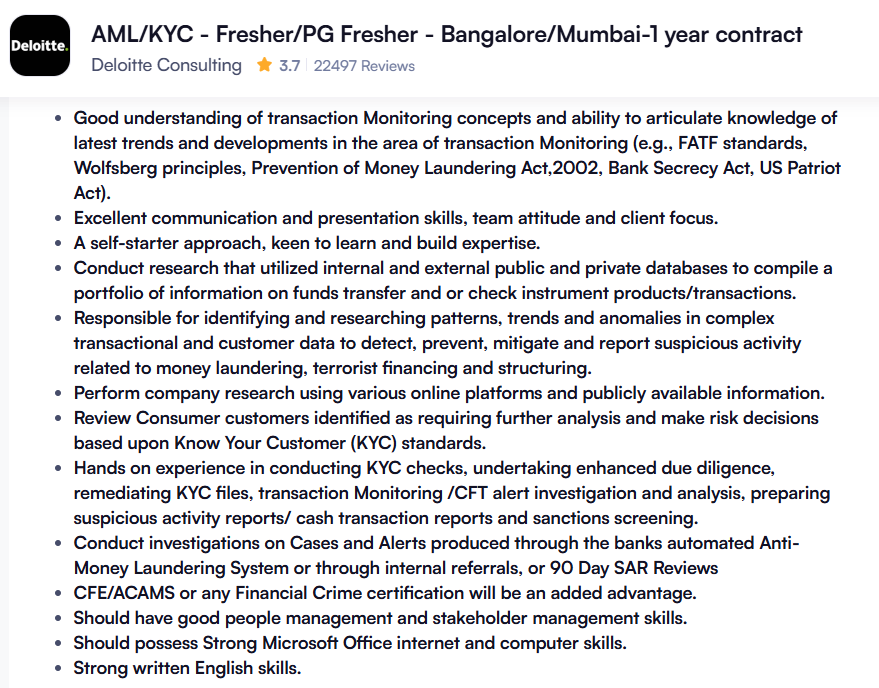

AML analyst job descriptions

Mainly as a fresher you are expected to know basics of aml kyc and be good with communication also if you know any tools related to aml kyc then its a add on.

Naukri.com

Source: Naukri.com

Naukri.com

Tools used by AML Analyst

One of the most important categories is Transaction Monitoring Systems (TMS). Tools like Actimize (by NICE), SAS AML, and Oracle FCCM help AML analysts automatically detect red flags in large volumes of financial data. These systems are rule-based or AI-driven and are designed to flag potential money laundering behaviours such as structuring, layering, and circular transactions.

In addition to monitoring, AML KYC analysts also rely on KYC and customer screening tools. Platforms like World-Check, LexisNexis, and are used to screen individuals against global watchlists, politically exposed persons (PEPs), and negative media. For real-time ID verification, tools such as Trulioo, Jumio, and offer facial recognition and document verification capabilities.

Another key area is case and workflow management. AML professionals use platforms like Actimize Case Manager, and custom-built CRM tools such as Salesforce to track the progress of investigations, manage alerts, and maintain documentation for regulatory audits.

To analyze large datasets, AML analysts frequently turn to Excel, SQL, and increasingly, Python for automation and risk scoring. Visualization tools like Power BI and Tableau are also used to create dashboards and identify trends in suspicious activity.

In short, a successful AML analyst or AML KYC analyst must be proficient in a mix of compliance platforms, data tools, and investigative software to effectively safeguard financial systems from illicit activity.

Global AML KYC Regulatory Bodies

1. Financial Action Task Force (FATF)

Role: Global standard-setter for AML & Counter-Terrorist Financing (CTF)

Key Functions:

Issues 40 AML recommendations

Evaluates countries via mutual evaluations

Maintains:

Grey List (increased monitoring)

Black List (high-risk jurisdictions)

Why It Matters for AML Analysts:

National AML laws are aligned with FATF standards

AML risk assessments and SAR filings are FATF-driven

2. International Monetary Fund (IMF)

Role: Financial stability & AML capacity building

Key Functions:

Helps countries implement AML frameworks

Conducts AML/CFT assessments

Works closely with FATF

3. World Bank

Role: AML implementation & governance support

Key Functions:

Supports developing countries in AML compliance

Provides technical assistance & risk frameworks

Focus on corruption & illicit financial flows

4. Egmont Group

Role: Global network of Financial Intelligence Units (FIUs)

Key Functions:

Secure information sharing between FIUs

Supports cross-border AML investigations

Why Important:

India’s FIU is a member

SAR/STR data sharing internationally

5. United Nations Office on Drugs and Crime (UNODC)

Role: AML laws, terrorism financing & drug crime prevention

Key Functions:

Drafts AML model laws

Assists countries in AML legal frameworks

Focus on terror financing & organized crime

AML & KYC Regulatory Bodies In India

India follows FATF-aligned AML laws, enforced by national regulators.

1. Reserve Bank of India (RBI)

Role: AML/KYC regulator for banks & NBFCs

Regulates:

Banks

NBFCs

Payment system operators

Responsibilities:

Issues KYC Master Directions

Conducts inspections & audits

Penalizes non-compliance

For AML Analysts:

Most KYC rules come from RBI circulars

2. Financial Intelligence Unit – India (FIU-IND)

Role: Central agency for receiving & analyzing STRs/SARs

Key Functions:

Receives:

Suspicious Transaction Reports (STR)

Cash Transaction Reports (CTR)

Shares intelligence with enforcement agencies

Why Important:

AML analysts file STRs to FIU-IND

Core reporting authority in India

3. Securities and Exchange Board of India (SEBI)

Role: AML regulator for capital markets

Regulates:

Stock brokers

Mutual funds

Portfolio managers

Investment advisors

AML Focus:

Investor KYC

Market manipulation

Insider trading

4. Insurance Regulatory and Development Authority of India (IRDAI)

Role: AML/KYC regulator for insurance sector

Regulates:

Life insurance

General insurance

Health insurance companies

AML Focus:

Policyholder KYC

High-risk insurance products

Premium payment monitoring

5. Ministry of Finance

Role: Policy-making authority for AML laws

Key Functions:

Oversees AML legislation

Supervises FIU-IND

Coordinates FATF compliance

6. Enforcement Directorate (ED)

Role: Enforcement of money laundering laws

Key Functions:

Investigates money laundering cases

Attaches assets under PMLA

Prosecutes offenders

For AML Analysts:

STRs may trigger ED investigations

7. Central Board of Direct Taxes (CBDT)

Role: Tax-related financial crime oversight

AML Link:

High-value transaction reporting

Black money & tax evasion tracking

Core AML low in India

Prevention of Money La undering Act (PMLA, 2002)

Defines:

Money laundering offences

Reporting obligations

Punishments & penalties

Role of FIU, ED, regulators

AML KYC Trends (2025-2026)

AI & Machine Learning Integration

Why It Matters

As financial crime becomes more sophisticated, traditional rule-based monitoring isn’t enough.

AI/ML is being used for:

anomaly detection

pattern recognition

link analysis

predictive investigations

What Recruiters Want

Experience with AI-driven AML tools

Understanding of how models reduce false positives

Ability to interpret AI alerts for investigators

Tools / Concepts to Learn

SAS AML with AI modules

NICE Actimize ML capabilities

Python for ML-driven risk scoring

Analysts who can blend compliance + AI literacy are in demand everywhere.

Robotic Process Automation (RPA) & Workflow Automation

Why It Matters

Repetitive tasks (KYB/KYC checks, SAR preparation, data extraction) are being automated.

Recruiters look for:

Knowledge of RPA tools (e.g., UiPath, Automation Anywhere)

Ability to optimize compliance workflows

Experience in reducing manual overhead

Impact

Faster alerts-responses

Lower operational cost

Higher analyst productivity

Blockchain & Crypto AML Compliance

Why It Matters

Crypto, digital assets, and DeFi are huge growth areas and weakly regulated yet highly targeted by criminals.

What employers want:

Understanding of blockchain analysis

Address clustering & transaction tracing

Crypto AML tools (Chainalysis, Elliptic, TRM Labs)

Very High Demand:

Crypto exchanges

FinTech firms

Global banks’ digital asset teams

API-Driven Risk & Data Integration

Why It Matters

Data used to be siloed (CRM, core banking, payment systems). Now real-time APIs allow:

instant KYC verification

automatic risk rule application

faster monitoring

Skills that help

Understanding API integrations

Using data from risk scores, PEP/sanction checks, watchlists

Building real-time alert dashboards

Cloud-Native AML Platforms

Why It Matters

Legacy on-prem AML systems are being replaced with cloud-hosted platforms.

Hiring managers want:

Familiarity with cloud setups (Azure, AWS)

Understanding how cloud improves scalability and monitoring

Knowledge of cloud-based data lakes for compliance

Global Sanctions & Geopolitical Risk Awareness

Why It Matters

Sanctions regimes change fast (Russia, Iran, Africa, East Asia, global finance).

Non-compliance is costly.

Skills employers prefer:

Up-to-date sanction lists

Ability to interpret sanction risk

Implementation of dynamic sanction rule sets

Compliance professionals who understand geopolitics = high edge

Cross-Border Payment Monitoring

Why It Matters

International transfers are prime avenues for money laundering.

Key skills:

SWIFT MT/MX formats knowledge

Technology that flags cross-border anomalies

Regulatory expectations for cross-border checks (FATF + national)

Integrated Risk Scoring Systems

Why It Matters

Instead of static risk categories, modern systems compute dynamic risk scores using ML + rule engine + behavior history.

Hireable capabilities:

Explaining risk models

Combining transaction risk + customer risk + watchlist risk

Building meaningful dashboards

Enhanced Due Diligence (EDD)

Why It Matters

EDD is not optional anymore especially for high-risk and cross-border customers.

What helps you stand out:

Performing EDD efficiently

Documenting investigations professionally

Escalating findings to compliance leadership

Investigative Storytelling for SARs

Why It Matters

A good SAR is not a checkbox. it’s a story demonstrating:

What happened

Why it’s suspicious

What evidence supports it

Strong communication + investigation skill = major advantage

Regtech & Compliance Platforms Mastery

Why It Matters

Regtech solutions are transforming AML workflows.

Recruiters value:

Expertise in tools (world-check, LexisNexis, AMLWatch, Trulioo)

Experience with data enrichment platforms

Ability to automate rule updates

ESG + AML Integration

Why It Matters

Environmental, Social & Governance risk factors are now considered in AML compliance.

Banks and regulators are connecting AML performance with ESG risk frameworks.

Understanding ESG + AML = future-ready skill.

High value AML roles in India

These jobs are growing in popularity:

| Role | Why It’s In Demand |

| Transaction Monitoring SME | Core compliance need |

| Crypto/Blockchain AML Analyst | Fastest-growing space |

| AML Tech & Automation Specialist | Reduces cost |

| AML Data Analyst with Python | Blends tech + compliance |

| AML Auditor | Quality & regulatory focus |

| Global Sanctions Analyst | Critical for multinational institutions |

Industries With Exploding AML/Hiring Needs

Banks & NBFCs

FinTech & Digital Payments

InsurTech

Investment Banking

Crypto & Digital Asset Exchanges

RegTech & Compliance Technology Companies

Consulting firms (Big 4 risk advisory)

India follows FATF-aligned AML laws, enforced by national regulators.

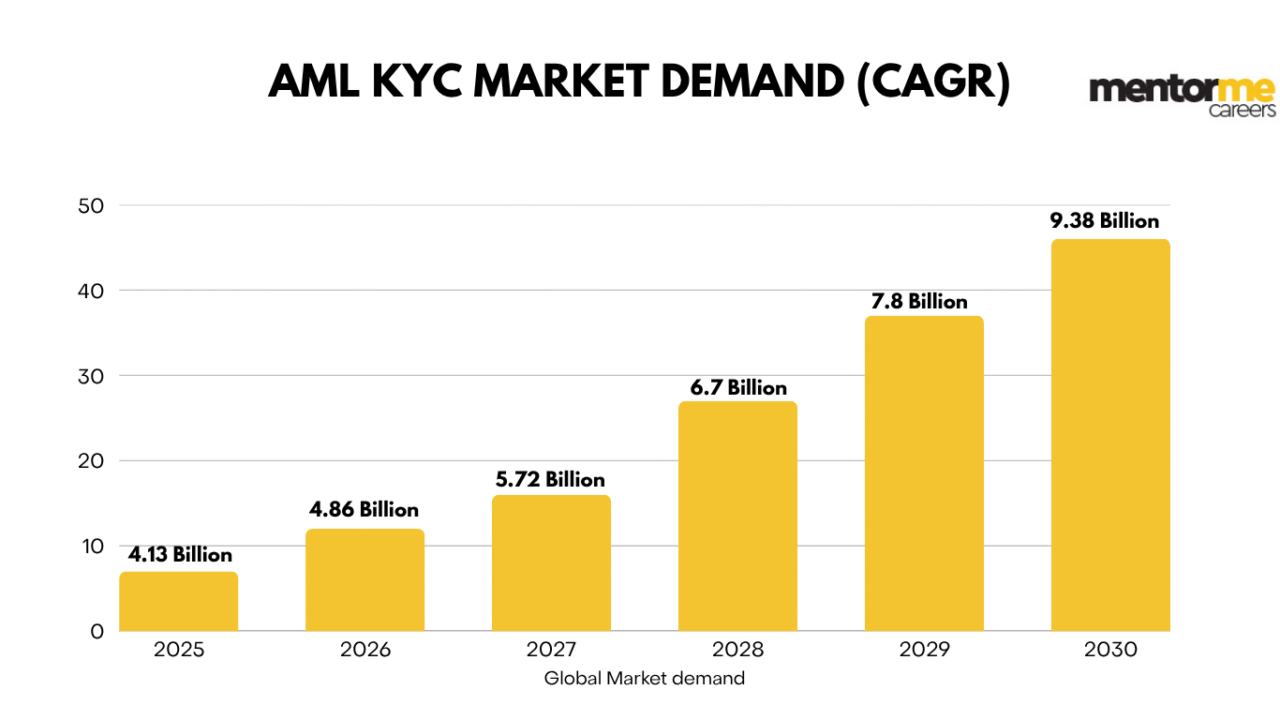

Market Demand

There is more need for professionals who want to pursue finance and especially kyc aml in finance. As the world is moving towards digital world and becoming more prone to frauds and money laundering. India or any country need professionals who can handle these situations save country’s money and keep the country safe from any crimes happening. Money is becoming more important for human kind than it ever has, more people are immigrating to urban cities in search of jobs and better life style. Money has increase and these have increased the chances of the digital crimes, frauds. If you go looking for jobs in this field and for these positions you will see many jobs, the demand never stops. Opportunity is there you just have to grab it and move forward for progression.

In conclusion, the finance sector is in dire need of AML and KYC analysts. Their work is essential in combating fraud and money laundering, ultimately contributing to a safer and more secure financial environment for everyone. As the industry continues to evolve, the role of these analysts will only become more significant, making it a promising career path for those interested in finance and compliance.

FAQ

With relevant skills and certifications, guidance not difficult at all to enter the industry.

Networking helps in times also try applying on LinkedIn and institutes like mentor me careers who help students get placed is too a great option.

Not much jobs in the market for work from home, the who are providing are international companies who need experienced individuals.