Choosing between a CFA and an MBA has become one of the biggest dilemmas for finance career aspirants in India. Students, fresh graduates, and working professionals often struggle to decide which path offers better career growth, higher return on investment, and long-term stability. The confusion is growing as more candidates compare CFA vs MBA difficulty, exam commitment, placement outcomes, and salary potential before investing time and money.

While an MBA promises broad management exposure and campus placements, the CFA program focuses deeply on investment analysis, valuation, and portfolio management with global recognition. Both options lead to strong finance careers but in very different ways.

In this article, we break down CFA vs MBA across the factors that matter most: cost, difficulty level, duration, career roles, salary outcomes, and ROI in India. By the end, you’ll have a clear framework to choose the option that aligns best with your skills, goals, and career timeline.

What is CFA?

The Chartered Financial Analyst (CFA) is a globally recognized professional certification focused on investment analysis, equity valuation, portfolio management, and ethical financial decision-making.

Curriculum overview:

The CFA program has three levels. Level I builds core knowledge in ethics, financial reporting, economics, and equity basics. II deepens valuation skills across equity, fixed income, and derivatives. III focuses on portfolio management, wealth planning, and risk management, with ethics emphasized at every stage.

Who is it for?

CFA is for anyone who wants a career in finance. The background doesn’t matter, CFA qualification is enough for the companies to understand that you have the skill to work in finance. CFA suits candidates aiming for finance-first careers such as investment management, equity research, portfolio management, risk analysis, and asset management.

Eligibility & time commitment:

Candidates need a bachelor’s degree (or equivalent work experience) and should plan for 300–400 study hours per level. Most complete the CFA program in 2.5–4 years, depending on preparation and exam attempts. To get the charter you need to have experience, you won’t be a member of the CFA club if you don’t have a charter. 300 to 400 hours is just a baseline study plan with which you should do mock up’s, training and practice complex concepts.

What is an MBA (with Finance specialization)?

An MBA (Master of Business Administration) is a globally recognized postgraduate degree that develops leadership, management, and strategic decision-making skills. In India, an MBA holds strong value across corporate, consulting, banking, and entrepreneurial roles, while globally it serves as a gateway to senior management and leadership positions.MBA from Tier-1 and Tier-2 will definitely benefit you if you want to get into finance with business and management knowledge but it achieve the goal of getting a core finance job you need to have technical skills needed in finance.

MBA Finance curriculum:

MBA Finance combines core business subjects such as strategy, marketing, operations, and organizational behavior with finance specializations like corporate finance, investment banking, financial markets, risk management, and valuation. This broad curriculum prepares candidates to manage businesses while making informed financial decisions. MBA finance includes chapters of business case studies and research mostly. Some college curriculum might include the technical knowledge required to get a core finance job.

Who is it for?

An MBA suits candidates targeting leadership and management roles, including consulting, corporate finance, investment banking, strategy, and general management. It works well for professionals who want career acceleration, role switches, or people-management responsibilities. Most professionals or students in India choose MBA to switch their careers or get a good level of promotion. As a professional who knows the technical skills needed to do the job, the next people to choose are management and leadership skills to get managerial positions.

Types of MBA programs:

In India, full-time MBAs from institutes like IIMs and ISB focus on campus placements and immersive learning. Executive and part-time MBAs cater to working professionals seeking career growth without a full career break.

CFA vs MBA – Key Differences (Table)

The CFA vs MBA finance decision depends on your career goals, learning style, and budget. The table below highlights the key differences clearly and helps you compare both paths at a glance.

| Feature | CFA | MBA (Finance) |

| Type | Professional certification | Postgraduate degree |

| Duration | 2–4 years (flexible, self-paced) | 1–2 years (full-time) |

| Cost (India) | ₹2–3.5 lakh (total) | ₹10–30 lakh |

| Focus | Finance-only, deep specialization | Broad business + finance |

| Exam / Entry | Level-based exams (I, II, III) | CAT/GMAT + GD/PI |

| Recognition | Global, especially strong in finance | Global, multi-industry |

| Career Orientation | Investment, research, asset management | Leadership, management, consulting, IB |

| Criteria | CFA (Chartered Financial Analyst) | MBA (Finance) |

|---|---|---|

| Syllabus | Deep, finance-only curriculum covering equity & fixed income valuation, portfolio management, risk, derivatives, ethics, and economics across 3 levels. | Broad business curriculum with finance specialization corporate finance, markets, valuation plus strategy, operations, leadership, and analytics. |

| Jobs | Equity Research Analyst, Investment Analyst, Portfolio Manager, Risk Analyst, Buy-side roles (AMCs, funds). | Investment Banking Associate, Strategy Consultant, Corporate Finance Manager, Business Analyst, Leadership roles across industries. |

| Salary (India) | Entry: ₹6–10 LPA; Mid: ₹15–30 LPA; Senior roles can go higher with experience and performance. | Entry (top schools): ₹10–25 LPA; Mid–Senior: ₹20–40+ LPA depending on school, role, and firm. |

| Global Recognition | Very high within finance and investment roles worldwide. | High global recognition across multiple industries and management roles. |

MBA-More Generalised Qualification (Not Just Investments)

An MBA (Master of Business Administration) is a broad management qualification that goes far beyond investments. While an MBA in Finance covers corporate finance, markets, and valuation, it also includes strategy, marketing, operations, leadership, human resources, and business analytics. This breadth makes MBA graduates suitable for multi-functional and leadership roles, not only finance-specific jobs.

MBA programs prepare candidates for careers in consulting, corporate finance, investment banking, product management, strategy, operations, and general management. In India, top MBA institutes offer campus placements, which is a major advantage for students seeking structured entry into large organizations.

An MBA works well for candidates who want to manage teams, lead projects, interact with clients, or switch industries. It also benefits professionals planning to move into CXO or business leadership roles later in their careers.

Best fit:

Choose an MBA if you want career flexibility, faster role transitions, leadership exposure, and opportunities beyond pure finance, especially through top-tier business schools.

CFA & the Main Industry It Targets

The Chartered Financial Analyst (CFA) program targets the investment and capital markets industry. It prepares candidates for roles where financial analysis, valuation, portfolio construction, and risk management sit at the core of daily work. Employers that actively value CFA skills include asset management companies (AMCs), mutual funds, hedge funds, private wealth firms, equity research houses, investment banks, and institutional investors.

CFA focuses deeply on public markets and investment decision-making. The curriculum builds expertise in equity and fixed income analysis, derivatives, alternative investments (introductory), ethics, economics, and portfolio management. This makes CFA especially relevant for finance-first careers such as equity research analyst, portfolio manager, investment analyst, risk analyst, and buy-side roles.

In India, CFA demand is strong in Mumbai, Bengaluru, Gurugram, and Hyderabad, where AMCs, global banks, and research firms operate. The certification suits candidates who prefer technical depth over management breadth and are comfortable with self-study and long exam preparation cycles.

Best fit:

Choose CFA if you want to build a long-term career in investments, work closely with markets, and gain global credibility in finance rather than general business leadership exposure.

CFA vs MBA Difficulty – Which is Harder?

When students compare CFA vs MBA difficulty, the truth is that both paths are challenging but in very different ways.

The CFA program tests your ability to master highly technical finance concepts through self-study. Each level requires 300–400 hours+ of preparation, and pass rates remain low. Historically, CFA Level I pass rates hover around 40–45%, which shows how demanding the curriculum is. You must clear three levels covering ethics, equity valuation, fixed income, portfolio management, and risk often while working full time.

An MBA (Finance) is academically broader but extremely competitive to enter. Top institutes like the IIMs admit less than 1% of applicants, and cracking exams such as CAT often requires a 99+ percentile. Once admitted, MBA programs involve intense schedules, group projects, case studies, presentations, internships, and placement pressure, making time management critical.

We can’t actually compare which is more difficult, both have their own difficulties. MBA might be slightly easier because of its non technical curriculum but it includes indepth case study and research. MBA is best for the people who are not good in maths but want to go into finance but it is important to know that technical and non technical both are very important to have a very successful career in any field that we talk about.

Career Paths – Where Can Each Take You?

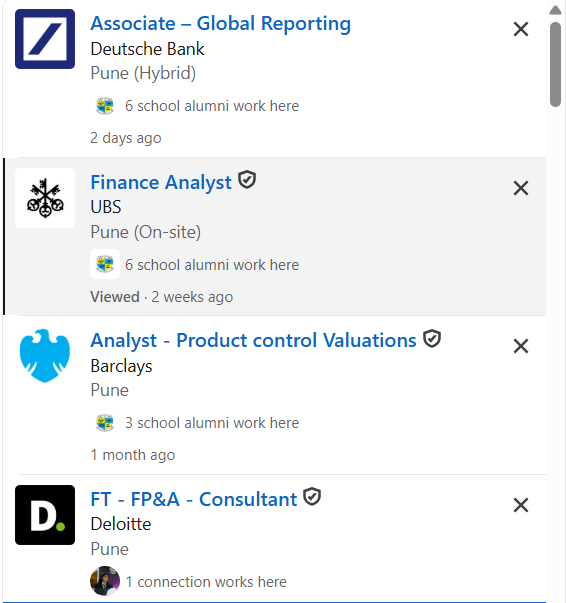

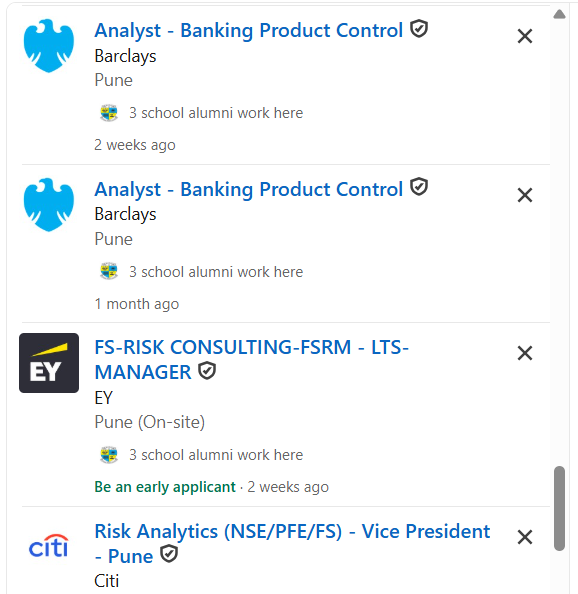

CFA prepares you for technical, finance-first roles that demand deep analytical expertise. Common career paths include Financial Analyst, Investment Banking Analyst, Equity Research Analyst, Portfolio Manager, and Risk Analyst. Employers value the CFA for roles focused on valuation, investments, and portfolio decision-making, especially in asset management, investment banking, and research firms.

Source: LinkedIn

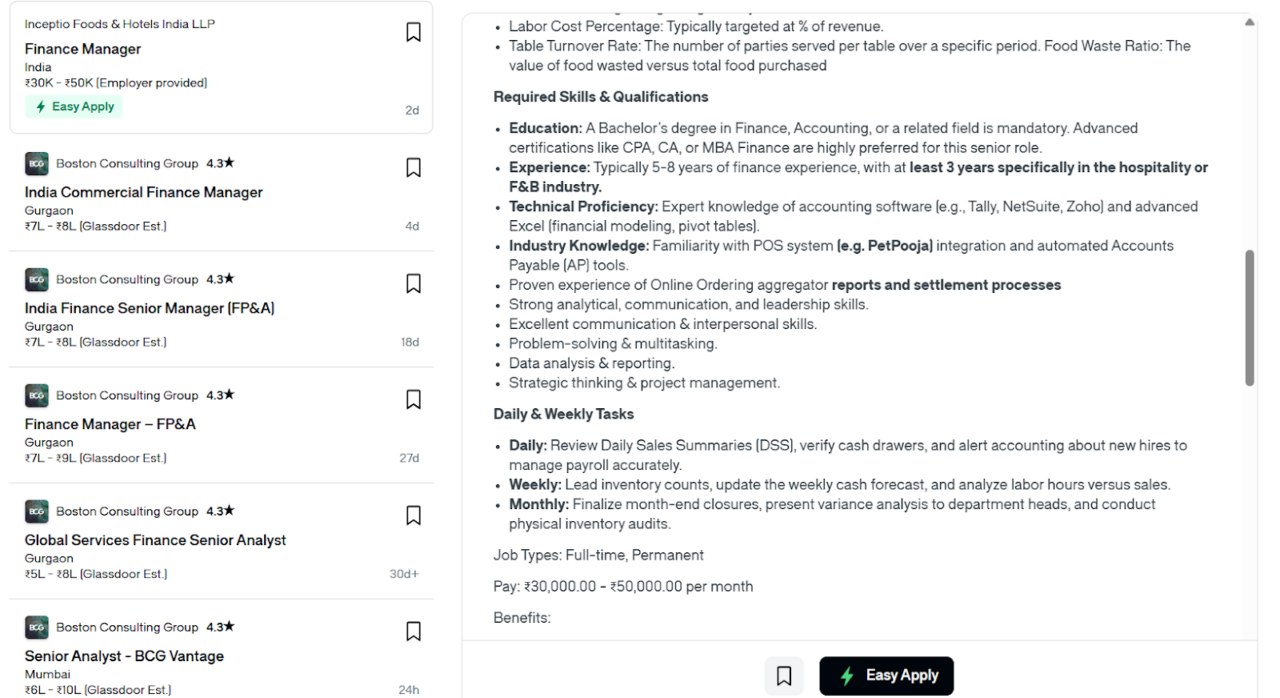

MBA (Finance) opens doors to broader management and leadership roles with a strong finance foundation. Graduates often work as Strategy Consultants, Investment Banking Associates, Corporate Finance Managers, Business Analysts, and Leadership-track professionals. The MBA suits candidates who want people management, strategic decision-making, and cross-functional exposure alongside finance.

Source: GlassDoor

Should You Do Both? (CFA + MBA)

Doing both CFA and MBA makes sense if your goal is finance-heavy leadership roles positions where you must combine deep financial expertise with strategic and people-management skills. This path suits careers in investment banking leadership, private equity, asset management, consulting, and senior corporate finance.

When does it make sense?

Pursue both if you want to start in technical finance roles (analysis, valuation, investments) and later move into decision-making, client-facing, or leadership positions. The CFA builds credibility in finance, while the MBA accelerates growth into management.

What order should you follow?

Many candidates choose CFA first, then MBA. CFA strengthens finance fundamentals and improves profiles for top MBA programs. Others prefer MBA first, then CFA if they want quick role switching through campus placements before specializing further.

Indian examples:

Several Indian professionals in investment banking, asset management, and consulting hold both CFA and MBA, using CFA for technical depth and MBA for leadership progression.

Bottom line:

CFA + MBA is powerful but only when your long-term career truly needs both skills.

Real Student Scenarios

Quick story:

Ravishankar (Currently studying MBA + CFA in Pune)

“Ravishankar chose the most difficult way to get a deal in finance but hopefully it will get him the best outcome because both of the qualifications in your resume does make a really good impact on your overall career start. He is currently preparing for CFA and also pursuing MBA from Tier-3 college. From his opinion this will give him a very good initial platform to get into finance and have a successful career in finance”.

A lot of students come to mentor me careers and say they want a MBA to get a job or doing a MBA to get a better job. Some also choose to do MBA first to get the knowledge of business and then pursue CFA.

How to Choose Between CFA and MBA?

Choosing between CFA vs MBA depends on career goals, experience level, learning style, and time commitment.

If your goal is deep finance specialization equity research, asset management, or investment analysis CFA is the better choice.

If you aim for leadership, consulting, corporate roles, or investment banking with management exposure, an MBA fits better.

Use this decision framework:

Freshers focused on finance: CFA builds strong fundamentals at a lower cost.

Candidates seeking campus placements or career switches: MBA offers structured hiring.

Working professionals in finance: CFA adds technical credibility; MBA accelerates leadership growth.

Long-term investment leaders: Consider CFA + MBA for both depth and breadth.

Bottom line:

There is no universal winner. CFA suits investment-focused careers, while MBA suits leadership-driven paths. The right choice aligns with where you want to be in 5–10 years, not just your first job.

Conclusion

The CFA is harder academically and technically, while the MBA is harder in terms of competition, workload, and execution. Your choice should depend on whether you prefer deep finance specialization or structured leadership training.

There’s no one-size-fits-all answer when choosing between CFA and MBA. Your decision should align with your career goals and strengths CFA suits deep finance roles like equity research, investment analysis, and portfolio management, while an MBA fits leadership-focused paths with broader opportunities in consulting, management, and corporate finance.

If you’re still unsure, personalized guidance can help you choose confidently.

Still confused? Book a free 1:1 session with mentor me career’s finance career experts and get clarity on your next move.

FAQ

CFA and MBA both provide you an entry door into finance. The difference is CFA is technical and MBA provides you business, leadership knowledge. Both have their pros and cons before making a decision.

You can pursue both CFA and MBA at the same time. If the MBA is from a basic college and not top 20 then it is fine. CFA needs specific time to study and understand the concepts while MBA includes concepts of business which are case study based and you dont need to give specific study time to it.

CFA and MBA have separate levels of difficulties on their own. CFA includes technical concepts, MBA includes leadership and business concepts. Both are difficult are their levels. CFA but needs more time, attention as the syllabus is universal. For MBA the syllabus differs.

After CFA level 1, you can get a salary of 4-7LPA in India which is basic for finance. MBA from top 20 colleges will provide you higher pay than CFA level 1 candidates.

CFA is worth it in any way you see it. Doing it before MBA means you already have technical finance knowledge. Now you just need how to take help from that technical knowledge to get business or handle clients and do the business means MBA is needed there also MBA is needed for better promotion.