Last updated on December 16th, 2025 at 12:01 pm

Bachelor degree is just the beginning of career. B.com provides knowledge of finance, accounting principles. This is a strong base for any student to enter into the market. You will get a job after doing B.com but basic skill is not enough. Upskilling is always important. Trying for better career opportunities will open new doors for you. Pursuing additional qualifications can significantly enhance your career prospects and earning potential. No matter what your passion is in like management, accounting or entrepreneurship there are many courses and certifications which will help you reach your goal and build your career. Courses After Graduation in Commerce will upskill you and increase your chances of getting a job.

The modern business world demands specialized skills, knowledge and also management skills to handle unexpected situations. Let you be passionate about anything upskilling opens numerous paths. Let’s explore courses and qualifications after graduation in commerce!

Why pursue further courses after B.com?

Landscape of professional fields is changing quickly, with new technologies coming up and market dynamic reshaping itself is crucial for students to upskill themselves and be relevant in the market. Additional qualification provides you competitive edge needed to stand out. Why upskilling is important you may ask?

Enhanced Job prospects

Specialized courses make you more employable by implementing the skill and expertise in specific areas. Employers seek more and more skilled candidates whom they won’t have to train extra for a job position. Industry recognized certifications rather than just theoretical knowledge. Studies also show there are 3-5 times more chances for you to get placed than only by basic degree.

Salary potential

A bachelor degree with extra qualification or certifications typically with the skill level can expect high level of salary.

For example: B.com graduate will get 2-4 LPA job, if with this bachelor degree have a additional qualification like CA, CS, or CFA definitely can earn 6-8LPA. With a bachelor degree in commerce your mid-career growth won’t be much but with a qualification and additional skills your salary will increase exponentially.

Knowledge gap

Fields like financial modelling, investment banking also data analytics are some skills that go beyond basic commerce education. Professional qualifications and courses provide hands on training in these high demand areas.

Career flexibility

Adding more skills in list allow more diverse paths across industries. Gives a liberty to select and experiment talent and passion. Professionally the need to continuously update yourself and remain relevant is essential.

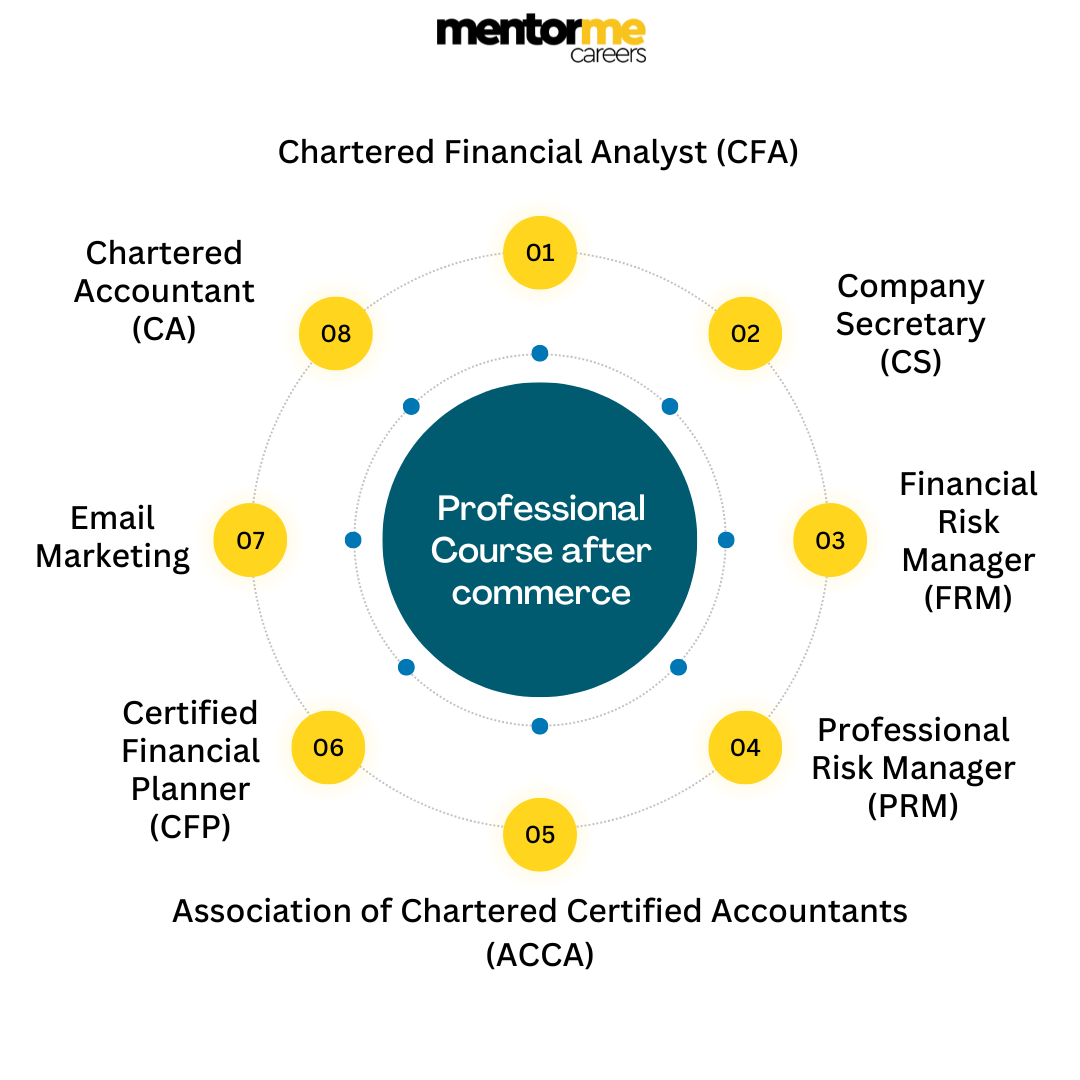

Top Professional courses after graduation in commerce (B.com)

Below are some qualifications students can start studying for in their bachelor or after bachelor.

Chartered Accountancy (CA)

CA is most prestigious professional qualification for accountant. They have expertise in accounting, auditing, taxation and financial management. There are 3 levels in CA. First is foundation second is intermediate level and third is final.

First is entry level covering accounting, quantitative aptitude and business economics which includes in 4 papers. Intermediate and final have 6 papers across two groups. You can give 1 group at a time.

Course details:

Duration: 3-5 years

Cost: 50,000- 1 lakh (coaching fees excluded)

Difficulty: High

Pass rate: Level 1- 15.09% Intermediate- 14.67% Final: 18.75%

Career opportunities:

Audit Manager

Chief Financial officer (CFO) (Potential)

Tax consultant

Internal Auditor

Salary Range:

Entry Level: 6-12 LPA

Mid-Career: 15-30 LPA

Senior Level: 40 LPA

Top employers: Deloitte, PwC, EY, KPMG and major corporations

Chartered Financial Analyst (CFA)

Chartered financial analyst Globally recognized certification for investment and financial analysis professionals. CFA is highly valued in International markets.

Course Details:

Duration: 2-4 years

Three levels

Cost: 3-4 Lakh total without coaching Globally recognized

Opportunities:

Financial Analyst

Investment Analyst

Portfolio Manager

Research analyst Risk manager

Salary Range:

Entry level: 6-12 LPA

Mid-Career: 14-18 LPA

Senior Level: 40-50 LPA

Top employers: Goldman Sachs, Morgan Stanley, JP Morgan, BlackRock.

Company Secretary (CS)

CS specialization in compliance and legal affairs of companies.

Course details:

Duration: 3-4 Years

Cost: 30,000-80,000

Difficulty: High

Regulatory Focus: Yes

Career opportunities:

Company secretary

Corporate Legal Advisor

Compliance officer

Salary Range:

Entry Level- 5-8 LPA

Mid-Career- 12-20 LPA

Senior Level- 25 LPA

Top employers: Tata Group, Reliance, ICICI Bank, Hindustan Unilever.

Management and Leadership Tracks

Master of Business Administration (MBA)

Management education with specialization in various domains

Course details:

Duration: 2 years

Cost: Varies by Institutes

Difficulty: Moderate

Specialization: Finance, Marketing, HR, Operations, Pharma, Agriculture.

Career opportunities:

Manager

Associate

Executive levels in the specified specialization

Salary Range:

Tier 1 B-school: 15-20 LPA

Tier 2 B-school: 8-20 LPA

MBA is generally preferred for management or knowledge of business and not technical roles of finance. A masters degree does help on resume for existing position promotion.

Master of commerce (M.com)

Advanced in commerce roles and knowledge.

Course details:

Duration: 2 years

Cost: varies by college

Difficulty: Moderate

Focus: Academic and research oriented

Career opportunities:

Professor

Research

Salary Range:

Entry Level: 3-5 LPA

Academic sector: 5 LPA & more with experience

Association of chartered certified Accountants (ACCA)

ACCA Globally recognized professional accounting qualification valued highly in international markets.

Course details:

Duration: 2-3 years

Cost: 3-5 lakh

Difficulty: High

Globally recognized 180+ Countries

Career opportunities:

Internal accountant

Audit manager

Tax consultant

Financial Manager

Salary Range:

India: 6-18 LPA

International: 40LPA to Cr

There is also Certified Management Accountant (CMA-USA) and Certified Public Accountant (CPA-USA) both are globally recognized and good for accounting and financial management related profession.

Data science and analytics

This is a high demand field at this point on extracting insights from data to derive conclusions.

Course duration goes from 3 to 6 month or even 1 year. The duration actually depends on your learning pace and practice.

Cost: 50,000 to 3 Lakh

Difficulty: Moderate to high

Technology Focus: Python, SQL, Machine Learning

Career opportunities:

Data analyst

Business analyst

Data scientist

Salary Range:

Entry level: 6-12 LPA

Mid-career: 15-25 LPA

Top employers: Google, Amazon, Microsoft and also consulting firms.

Financial modelling and valuation (FMVA)

FMVA specialized skill set for Investment banking, corporate finance and equity research.

Course details:

Duration: 3-6 months

Cost: 40,000 to 1 lakh

Difficulty: Moderate to High

Industry Application: High

Career opportunities:

Financial Analyst

Equity Research analyst

Valuation Specialist

Salary Range:

Entry Level: 4-6 LPA

Mid-Career: 12-18 LPA

Senior Level: 20-25 LPA

Like financial modelling there is also certified financial planner (CFP) and Professional Risk Manager (PRM) also Chartered Institute of Management Accountants (CIMA) which is UK based management accounting certification with global recognition.

| Course | Duration | Approximate Cost | Difficulty Level | Average Starting Salary | Career Demand |

|---|---|---|---|---|---|

| CA | 4–5 years | ₹50,000 – 1 lakh | Very High | ₹7–12 LPA | Very High |

| MBA | 2 years | ₹2–20 lakh | High | ₹6–15 LPA | Very High |

| CFA | 2–4 years | ₹2–3 lakh | High | ₹8–12 LPA | High |

| CS | 3–4 years | ₹30,000 – 80,000 | High | ₹5–8 LPA | High |

| Data Science | 6–12 months | ₹50,000 – 2 lakh | Medium | ₹6–10 LPA | Very High |

| Digital Marketing | 3–6 months | ₹20,000 – 1 lakh | Medium | ₹4–6 LPA | High |

| CFP | 1–2 years | ₹1–2 lakh | Medium | ₹5–8 LPA | Medium |

| M.Com | 2 years | ₹20,000 – 1 lakh | Low | ₹3–5 LPA | Medium |

Emerging Niche Specialization

Fintech and Blockchain Certification is a cutting-edge field with combination of finance and technology innovation. The course difficulty is moderate and it is innovation focused. Positions you can expect after completing fintech and blockchain certification are fintech analyst, blockchain developer, cryptocurrency analyst etc. This is emerging field, demand is high and supply is less. The package you get is usually high than other because of the skill and demand supply inbalance.

Choosing among these diverse options, analyze your personal interests also financial capacity. These courses take up enough time, you have to commit time. If you are doing a job online course will be a good option. The demand for these specialized skills continues to grow as businesses increasingly rely on expert knowledge to navigate complex financial challenges.

Professional Certification courses in commerce

These industry-recognized credentials are specifically designed for commerce graduates who want to gain specialized expertise without committing to lengthy academic programs. These courses focus on broad theoretical, practical knowledge which are job-ready skills that employers actively seek.

What makes a Professional Certifications Valuable?

Global Recognition: Many of these certifications are internationally recognized, which help in more career opportunities and higher compensation.

Return on Investment: Professional Certification can be earned within 3-12 months allowing quicker advancement and salary increment.

Industry alignment: These courses are developed ensuring the curriculum current market needs and trends.

Choosing the right certification

Career alignment: Courses which directly connected to your career intent.

Market Demand: Research the demand and supply in the market according to your field and skills.

Time and cost: Lookout for what will be comfortable for you to achieve and afford as these courses cost more than normal certifications.

Highest Paying Jobs after B.com

Commerce is field of skill where financials knowledge and practical management of it is taught. Key to achieving high compensation lies in strategic career planning and skills also positioning yourself in high-growth industries.

| Career Path | Entry-Level Salary | Mid-Career Salary | Senior-Level Salary |

|---|---|---|---|

| Chartered Accountant (CA) | ₹7–10 LPA | ₹12–25 LPA | ₹30+ LPA |

| Investment Banker | ₹12–18 LPA | ₹25–40 LPA | ₹50+ LPA |

| Management Consultant | ₹8–15 LPA | ₹20–35 LPA | ₹40+ LPA |

| Financial Analyst (CFA) | ₹8–12 LPA | ₹15–25 LPA | ₹30+ LPA |

| Data Scientist | ₹8–12 LPA | ₹18–30 LPA | ₹35+ LPA |

| Company Secretary (CS) | ₹5–8 LPA | ₹10–18 LPA | ₹25+ LPA |

| Digital Marketing Manager | ₹6–10 LPA | ₹12–20 LPA | ₹25+ LPA |

Geographic and Industry salary Variations

Tier 1 Cities:

Higher packages are provided in tier 1 cities. Cost of living is also high but career opportunities are better. Access to multinational Companies.

Tier 2 Cities:

Competitive salaries and lower cost of living. There is a growing Opportunities in tier 2 more companies are coming to tier 2 cities.

International opportunities:

Middle East: 50-100% premium over Indian salaries

Singapore/ Hong Kong: 100-200% premium

USA/UK: 200-400% premium (but higher living costs)

Conclusion

The comprehensive analysis presented in this guide demonstrates that commerce graduates who strategically invest in additional qualifications and continuously develop their skills can achieve remarkable career success and financial prosperity.

The modern business landscape offers opportunities across traditional finance roles, emerging technology sectors, specialized consulting practices, and entrepreneurial ventures. Whether you’re drawn to the prestigious and challenging path of Chartered Accountancy, the globally recognized CFA program, the comprehensive leadership development of an MBA, or the dynamic world of data science and digital marketing, each path offers unique advantages and growth potential when approached with dedication and strategic thinking.

FAQ

Finance roles? CA, CFA, MBA (Finance)

Legal compliance? CS

Interested in Technology? Data science and analytics

Yes B.com degree skills are very much in demand it is base of accounting which is used in every industry and is growing YoY.

Chief Financial Officer is the biggest job in commerce/Finance. Second biggest is Chartered Accountant (CA).

Financial analyst, Tax consultant, Auditor and Banking officer are some of the in demand roles after B.com.