In today’s complex financial landscape both in India and globally fighting money laundering has become a top priority for governments, banks, and financial institutions. With billions of dollars in funds moving through the global financial system each year, the demand for qualified professionals who understand Anti-Money Laundering (AML) laws, risks. Especially in India’s expanding banking and fintech ecosystem, having AML expertise isn’t just a value-add it’s a necessity.

This is where the International Compliance Association (ICA) plays a leading role. Recognized globally, the ICA is a premier provider of professional qualifications in compliance, risk, and financial crime prevention.

The ICA Certification in Anti-Money Laundering is well-regarded credential that equips professionals with the core knowledge needed to detect, prevent, and manage money laundering risks.

Whether you are a analyst, or a banking professional looking to transition into compliance, this certification could be your gateway to a high-impact career. But what exactly is the ICA Certificate in AML, and why is it so highly regarded?

In this comprehensive guide, we’ll break down everything you need to know:

- Why pursue ICA AML certification

- Who should pursue compliance

- Course syllabus and structure

- Enrollment process, fees, and eligibility

- How it compares to other AML credentials

Why pursue ICA certification in anti-money laundering

Pursuing the ICA Certificate in Anti-Money Laundering (AML) is a strategic step toward building a credible, future-proof career in compliance, risk management, and financial crime prevention. Why does it stand out?

Global recognition & credibility

The ICA Certificate in AML is recognized worldwide by banks, regulators, and financial institutions. It is accredited by the University of Manchester and aligned with global compliance frameworks like FATF (Financial Action Task Force).

This certification demonstrates that you meet international standards of AML knowledge and integrity. Employers value ICA-certified candidates as committed professionals who uphold the highest compliance standards. Whether you’re in India or aspiring to work globally, this credential significantly enhances your professional credibility.

Skill Set

You will gain strong foundation in:

- Understanding AML laws and regulations

- Customer Due Diligence (CDD)

- Risk-based approaches to compliance

- Identifying and reporting suspicious transactions

- Sanctions, terrorist financing

You will develop a well-rounded understanding of the AML landscape, bridging theory with practical skills used in real-world compliance environments.

Career Advancement

Looking to enter AML/KYC roles or aiming to move into compliance analyst or risk officer positions, this certification adds measurable value.

In India, top employers including international banks, Big 4 consulting firms, fintechs, increasingly prefer candidates with globally recognized AML certifications.

While ACAMS’ CAMS remains a popular option, the ICA Certificate is academically accredited, foundational.

Enrollment includes 1-year ICA membership, granting access to a thriving network of over 30,000 compliance professionals worldwide.

You also receive:

- Access to the ICA Learning Hub

- Weekly webinars and learning resources

- Exclusive industry insights

This community and knowledge base can be invaluable, especially for those building a long-term career in AML and compliance.

This certification isn’t just academic, it is designed for real-world impact.

While the Certificate exam is usually a 1-hour multiple-choice assessment, the course prepares learners through realistic case studies and compliance simulations, making the knowledge stick.

Who should pursue ICA certification in anti-money laundering

Looking at the data we have on the internet also the reviews on reddit we see a pattern. ICA certification position of acceptance differ by country to country. This certification is UK based, candidates based in UK claimed that they got a good level of job with average package as a fresher. If we see in other countries than UK, Europe accepts candidates with experience and ICA certification for a higher package, position. So we if talk about India here, its better to pursue a training course in AML rather than directly jumping onto ICA certification. To enter the industry this is necessary. Fresh graduates with a finance job who wants to switch to AML can opt for this certification but recommended is to have atleast 1 year of experience in finance sector so that the certificates relevancy will increase.

Fresh graduates or career switchers who want to enter the AML/compliance field.

Banking/Finance professionals (front-line staff, operations, or customer service) who want to understand AML.

Compliance Officers and Analysts who may already be working in related areas but need formal training in AML.

Risk Management and Financial Crime Prevention staff those working in fraud detection, risk departments, etc.

Legal and Audit professionals in financial services, who want a credential to solidify their expertise.

Syllabus of ICA certification in anti-money laundering

Key concepts of AML: What is money laundering, why it happens, terrorist financing and sanctions.

Legal and Regulatory Frameworks: How different countries implement AML laws. Like India has PMLA (Prevention of Money Laundering Act). This module teaches about compliance requirements, vulnerabilities.

Customer Due diligence (KYC/CDD):

Identify customers, verify identity, understanding ownership, monitor ongoing transactions. KYC is a part of AML compliance.

Risk management: Accessing AML risk in an institution, Allocating resources to higher risk areas.

Recognizing and reporting suspicious activities (SARs).

Requirements and fees of ICA certification in anti-money laundering

If you’re considering enrolling in the ICA Certificate in Anti-Money Laundering (AML), understanding how the course is structured can help you plan effectively.

Mode of Study

The ICA AML course is delivered entirely online via the ICA Learning Platform, allowing you to study at your own pace, anytime, anywhere. There are no physical classes, making it ideal for working professionals or international students including those based in India. Learning materials include interactive e-learning modules, digital textbooks, and case-based exercises designed to build practical understanding. 100% online and flexible

Duration

1-2 months on average

The course can be completed in as little as 4 weeks with intensive study. However, ICA provides up to 2 months of access to the learning platform. The total estimated study time is 20 hours.

Online

Multiple choice exam

1-hour online multiple-choice exam, which you can take from anywhere. Results are delivered immediately upon completion, and if you pass, your digital certificate is available for instant download. The exam is designed to test your practical understanding of AML concepts, not just memorization.

Entry Requirements: Open to All

No prior knowledge or experience in AML is required. As long as you’re 18+ with basic English proficiency, you can enroll.

How to Enroll

During the sign-up process, you’ll also need to purchase a 1-year ICA student membership, which is mandatory and unlocks access to ICA’s learning hub and global compliance community. ICA often runs the course on an on-demand basis, so you can start anytime.

Course Fees (With INR Conversion)

| Fee Component | Amount |

| Course Fee | GBP £700 ( ₹70,000) |

| ICA Membership (1 Year) | GBP £135 ( ₹13,000) |

| Total Estimated Cost | GBP £835 ( ₹83,000–₹85,000) |

Note: Pricing may vary slightly with exchange rates or applicable taxes. ICA occasionally offers group or early-bird discounts as well.

Certification & Designation

Once you pass the exam, you are awarded the “ICA Certificate in Anti Money Laundering”, a globally recognized qualification accredited by the University of Manchester. This credential signals your readiness for AML/KYC roles and shows recruiters that you meet global compliance standards.

How to pass AML ICA certification

Once you’ve enrolled in the ICA Certificate in AML, the next step is preparing effectively to pass the exam and gain maximum value from the course. Here are actionable tips to help you succeed:

1. Set a Weekly Study Schedule

Treat the course like a short online semester. Allocate 4–6 hours per week and break your study time into manageable sessions. Consistency is key studying regularly (instead of cramming) will help you better understand AML laws, frameworks, and practical application.

2. Use ICA Learning Resources to Your Advantage

As part of your ICA student membership, you’ll get access to valuable tools through the ICA Learning Hub, including:

- E-learning modules

- Webinars led by compliance experts

- Discussion forums (if applicable)

Leverage these resources to reinforce your learning. Many past students have praised ICA’s flexible format and high-quality content—especially beneficial for working professionals balancing study with jobs.

3. Relate Topics to Real-World Cases

When studying AML topics like Customer Due Diligence (CDD), suspicious transactions, or risk management, try connecting concepts with real-world events. Indian examples like the PNB scam or YES Bank investigations can make complex ideas more relatable and easier to remember.

4. Prepare for the Exam with Conceptual Clarity

The final exam is a 1-hour multiple-choice test, so focus on understanding concepts rather than rote memorization. Create flashcards or short notes for key terms like FATF Recommendations, PEPs, or SAR filing. If ICA provides sample questions, practice them to get familiar with the format.

Plan Your Next Career Move

Pursuing these advanced certifications not only enhances your knowledge but also opens doors to high-level roles in compliance, anti-financial crime, and risk management.

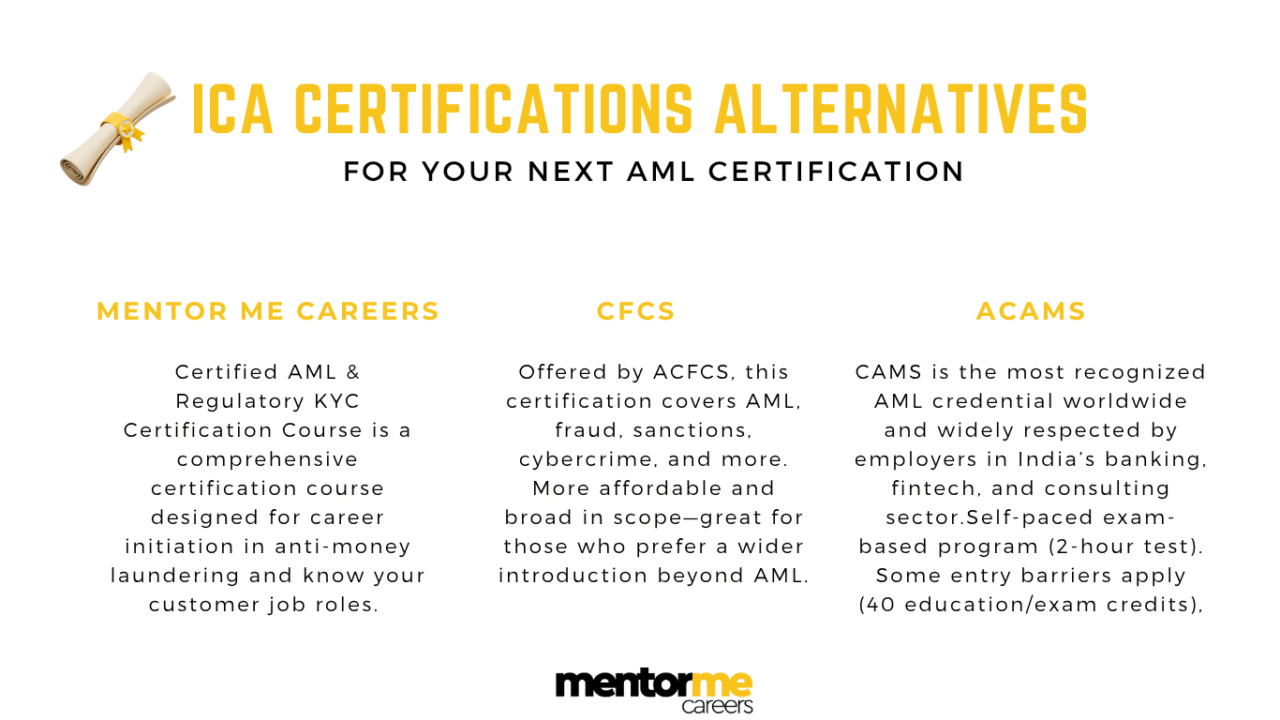

ICA certification in anti-money laundering alternatives

ACAMS

The ACAMS Certification, formally known as the Certified Anti-Money Laundering Specialist (CAMS) credential, is one of the most recognized and respected AML certifications in the world. Awarded by the Association of Certified Anti-Money Laundering Specialists (ACAMS) a global body headquartered in the U.S. this certification is considered the industry standard for professionals working in financial crime prevention, compliance, and anti-money laundering (AML).

The CAMS exam tests your understanding of key AML concepts including money laundering risks, regulatory frameworks, KYC procedures, sanctions screening, suspicious activity reporting (SARs), and risk-based approaches. It is ideal for bankers, KYC/AML analysts, compliance officers, auditors, and law enforcement professionals looking to demonstrate their expertise and commitment to AML regulations.

Globally recognized by banks, regulators, and financial institutions, the CAMS certification significantly boosts your credibility and career potential. Many employers in India’s BFSI and fintech sectors now list CAMS as a preferred qualification for roles such as AML Analyst, Compliance Officer, and Risk Manager.

To earn the CAMS credential, candidates must meet minimum experience criteria, complete training through ACAMS-approved materials, and pass a 2-hour online proctored exam. Maintaining the certification also requires continuing education credits (CAMS CPEs), ensuring that professionals stay up to date with changing regulations and AML practices.

In the Indian context, with increasing regulatory scrutiny from the RBI and the rise of fintech compliance challenges, CAMS certification can set candidates apart in both domestic and international job markets.

Whether you’re beginning your career or moving into leadership, ACAMS certification offers strong ROI, global recognition, and access to a network of tens of thousands of AML professionals worldwide.

Mentor me careers

Certified AML & Regulatory KYC Certification Course is a comprehensive certification course designed for career initiation in anti-money laundering and know your customer job roles. The program is available both in live classroom as well as self-paced versions. The course is designed around the huge influx of AML KYC related processes which are migrating towards India. According to grand view research AML KYC Market in India is expected to grow at a staggering 20% CAGR.

The CARK( Certified AML & Regulatory KYC) course is designed for entry level jobs in this field. Students with a graduate degree can purse this course to get employment opportunities in AML KYC Jobs. As with any of our courses, our benefits and features revolve around employability.

- Certification & Placement: With mentor me careers you just don’t certify but get employed

- Live Online Interactive Lectures with Industry experts in AML

- Placement Support for jobs in major metros in India

- Recognised Certification- The course prepares for IIBF exam, along with mentor me careers certification

- Practical Learning: The course is packed with real life case studies for relevant learning.

Mentor me careers provides its own internal AML KYC Certification, which is recognised by recruiters as a valid proof of up skilling various industry job roles. Other than the course certification, candidates can also give the IIBF or NISM Certification for which our AML Course is aligned from the preparation perspective.

Visit Mentor me careers for more info!

Conclusion

Looking at the data we have on the internet also the reviews on reddit we see a pattern. ICA certification position of acceptance differ by country to country. This certification is UK based, candidates based in UK claimed that they got a good level of job with average package as a fresher. If we see in other countries than UK, Europe accepts candidates with experience and ICA certification for a higher package, position. So we if talk about India here, its better to pursue a training course in AML rather than directly jumping onto ICA certification. To enter the industry this is necessary.

FAQ

What is ICA certification cost in India?

The cost can vary by location. As a guideline, the course fee is around 60,200, plus a 11,610 ICA membership fee (if you’re a new ICA member). In total, that’s roughly 75,300 (approximately ₹80,000 in India). Prices may be subject to local taxes or exchange rates. Price will also differ by the dollar conversion.

How long does it take to complete the certification?

The course is self-paced. It can be completed in as little as 4 weeks if you study intensively, since it requires roughly 20 hours of study. However, you have up to 2-3 months of access to finish at your own pace. Many working professionals complete it in about 6-8 weeks alongside their job. The final exam is a 1-hour online test.