Last updated on February 14th, 2026 at 04:07 pm

Money laundering is one of the biggest threats to the global financial system which leads terrorism, drug supplying, corruption, cybercrime, and large-scale financial fraud. As financial institutions going digital and customer onboarding moves online, criminals are using techniques, synthetic identities, crypto mixers, mule accounts (bank accounts used by scammers to transfer money), AI-generated documents, and high-speed layering to evade detection. This is why Anti–Money Laundering (AML) frameworks have become very important to financial crime prevention in 2025.

Governments and regulators such as FATF, FIU-IND, RBI, SEBI, FinCEN, FCA, MAS and global banking supervisors now demand stronger due diligence, real-time transaction monitoring, sanctions screening, and enhanced reporting standards. Modern AML teams rely on analytics, machine learning, and risk-based controls to identify suspicious transactions early and prevent funds from entering the financial ecosystem.

This guide is AML for students, job seekers, and working professionals. You’ll learn the stages of money laundering, top AML controls used today, emerging 2025 trends and concepts for interviews.

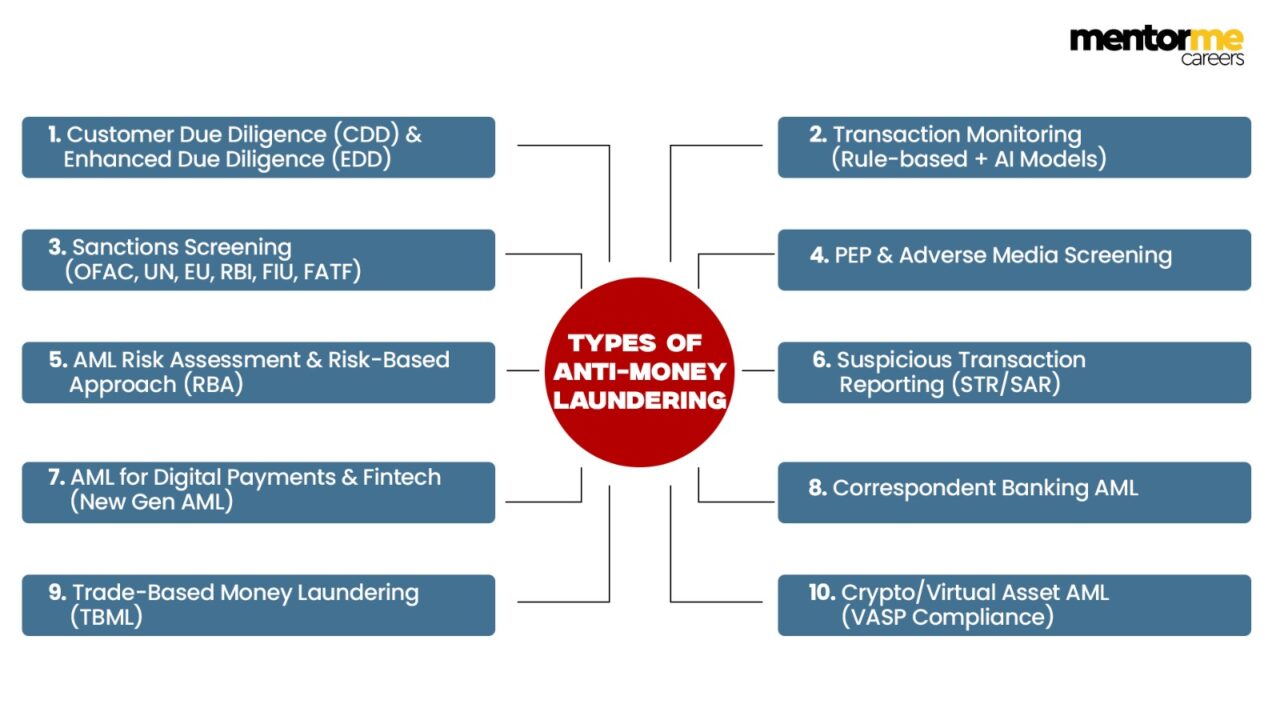

Top 10 types of anti money laundering (AML)

Money laundering continues to evolve in both scale which is increasing by digital finance, international payments, high-risk industries, and organised crime networks. As a result, AML frameworks in 2025 now combine traditional controls, AI-driven monitoring, behavioural analytics. Below is a comprehensive guide to the 10 major types of AML initiatives used globally today.

1. Customer Due Diligence (CDD) & Enhanced Due Diligence (EDD)

In CDD, customers identity is verified, customer risk, and prevention of onboarding of criminals.

Customer due diligence involves KYC, document verification, risk scoring, and profile building.

Enhanced due diligence applies to high-risk customers (PEPs, NRIs, high-value businesses, crypto users) and uses deeper checks like bank statements, business proof, adverse media, and source-of-funds verification.

Why it matters: CDD/EDD is the first line of defence and stops bad actors before they enter the financial system.

2. Transaction Monitoring (Rule-based + AI Models)

Financial institutions use automated AI models to detect unusual behaviour:

1.Rapid cash deposits (quick flow of money through accounts)

2.Round-tripping (fake flow of transactions to show legitimate activities)

3.High-risk cross-border payments (transactions between countries by parties)

4.Suspicious merchant categories (high fraud risk profile)

Modern 2025 systems integrate AI, behavioural analytics, anomaly detection, and machine learning to reduce false positives.

3. Sanctions Screening (OFAC, UN, EU, RBI, FIU, FATF)

Prevents dealings with banned individuals/entities. Screening includes:

1.Customer names

2.Beneficial owners

3.Counterparties

4.Transactions

5.SWIFT (global messaging system international banks use to do transactions)/UPI remittances

4. PEP & Adverse Media Screening

Detects Politically Exposed Persons, high-risk individuals, and negative news like fraud, bribery, corruption, terrorism links.

Advanced systems use natural language processing (NLP) to scan global media, court databases, leaks (Panama Papers/ICIJ), and regulatory notices.

5. AML Risk Assessment & Risk-Based Approach (RBA)

Every institution must build a risk model analysing:

1.Products

2.Geographies

3.Customer types

4.Delivery channels

5.Transaction volumes

6.Industry risk

6. Suspicious Transaction Reporting (STR/SAR)

Once a suspicious pattern is identified, the institution must file:

1.STR/SAR to FIU-IND or equivalent authority

2.Within strict timelines (typically within 7 days of suspicion)

3.Without tipping off the customer

7. AML for Digital Payments & Fintech (New Gen AML)

Covers UPI, wallets, buy-now-pay-later (BNPL), P2P apps, neobanks.1

1.Device fingerprinting

2.Geolocation risk

3.Behavioural biometrics

4.AI-based fraud scoring

5.Merchant onboarding checks

This is one of the fastest-growing AML categories due to India’s digital economy boom.

8. Correspondent Banking AML

High-risk area involving international transfers and cross-border banking flows. Includes:

1.Beneficial ownership checks

2.Nested relationships monitoring

3.SWIFT transaction screening

4.Country risk analysis

5.Enhanced due diligence for foreign banks

2025 rules have tightened due to FATF recommendations.

9. Trade-Based Money Laundering (TBML)

Criminals use trade documents to hide illegal funds. Includes:

1.Over/under-invoicing

2.Phantom shipments

3.Trade mispricing

4.Shell importer/exporter entities

Banks now use AI document comparison, customs data, blockchain trade finance systems to fight TBML.

10. Crypto/Virtual Asset AML (VASP Compliance)

A rapidly expanding AML domain. Controls include:

1.Wallet screening

2.On-chain analytics (Chainalysis, TRM Labs, Elliptic)

3.Travel rule compliance

4.Exchange KYC

5.AML for DeFi, stablecoins, P2P marketplaces

2025 standards require exchanges and VASPs to follow full AML/KYC obligations.

| Factor | Customer Due Diligence (CDD) | Enhanced Due Diligence (EDD) |

| Purpose | Basic identity verification & customer risk assessment | Deep investigation of high-risk customers |

| Who It Applies To | Regular/low-risk customers | PEPs, NRIs, high-value businesses, crypto users, high-risk geographies |

| Documents Checked | PAN, Aadhaar, ID proof, address proof | Bank statements, source of funds, business proof, ownership structure |

| Risk Scoring | Standard risk scoring based on KYC data | Detailed multi-layer risk scoring + continuous monitoring |

| Verification Depth | Basic verification + sanctions screening | Adverse media check, deeper background checks, transactional behaviour analysis |

| Objective | Prevent onboarding of criminals & ensure compliance | Detect complex risks, corruption, fraud, terrorist financing exposure |

| Why It Matters | First line of defence in AML/KYC | Protects institution from high-impact financial crime and regulatory penalties |

Stages of Money Laundering

Money laundering typically occurs in three major stages, though modern schemes may blend or repeat steps to avoid detection:

1. Placement

This is the first stage where illegal money enters the financial system. Criminals try to distance the funds from the source by:

1.Depositing cash in small amounts is also called smurfing or structuring.

2.Using cash-intensive businesses like salons, restaurants, gaming centers.

3.Purchasing foreign exchange, gift cards, or insurance policies

4.Routing funds through mule accounts (fake accounts)

5.Using online payment apps to break traceability

Placement is risky for criminals because it creates the first digital footprint.

2. Layering

Layering makes transactions harder to trace by creating multiple, complex financial movements. Common techniques:

1.Rapid transfers across multiple accounts

2.Crypto mixers and privacy coins

3.Using shell companies and offshore jurisdictions

4.Converting funds into assets (gold, crypto, securities)

5.Circular trading or fake invoice schemes

6.High-value purchases followed by resale (like paintings and luxury goods)

The goal is to blur the audit trail and confuse investigators through layers of transactions.

3. Integration

At this stage, the laundered money re-enters the legitimate economy. Criminals make funds appear clean and unconnected to the original crime. Examples:

1.Investment into legitimate businesses

2.Real estate purchases

3.Import/export companies

4.Luxury goods, cars, art

5.Salary payments through fake employment contracts

Once integrated, the funds become extremely difficult to detect unless red flags trigger a deeper investigation.

Modern criminals mix placement, layering, and integration simultaneously, making anti money laundering controls more crucial than ever.

Top AML Controls Used in 2025

Financial institutions use a risk-based, multi-layered AML framework in 2025. The following controls form the backbone of modern AML programs:

1. Customer Due Diligence (CDD)

Banks verify customer identity, collect documents, and assess initial risk levels. CDD includes:

1.KYC verification

2.PAN/Aadhaar checks

3.Address and ID validation

4.Basic occupation and income review

2. Enhanced Due Diligence (EDD)

Applied to high-risk customers such as PEPs, NRIs, high-value traders, offshore entities, crypto users, and unusual business models. Includes:

1.Deep profile checks

2. Source of funds verification

3. Adverse media screening

4. Additional documents and periodic reviews

3. Sanctions & PEP Screening

Every customer and transaction must be screened against: (Meaning at the start of the article)

1.OFAC

2.UN Sanctions

3.EU Sanctions

4.FATF high-risk jurisdictions

5.PEP database

6. Adverse media lists

Tools like ComplyAdvantage, LexisNexis, and Refinitiv WorldCheck support screening.

4. Transaction Monitoring

AI/ML systems detect unusual patterns such as:

1.Rapid deposits and withdrawals

2.Large international transfers

3. Smurfing

4. Inactive account spikes

5. Crypto-linked transactions

6. Unusual high-value purchases

Alerts are sent to analysts for review.

5. STR/SAR Reporting

When suspicious activity is detected, banks must file a Suspicious Transaction Report (STR) with FIU within a set timeline (7 days in India).

No customer is informed, prevention laws apply.

6. Periodic KYC Reviews

Banks refresh customer data based on risk category:

1. Low-risk: Every 8–10 years

2. Medium-risk: 2 years

3. High-risk: Annually

7. Training & Governance Controls

Regular AML training for staff to detect red flags, update regulatory knowledge, and ensure compliance.

8. Audit & Quality Assurance

Internal and external audits test AML effectiveness, data accuracy, backlog management, and policy compliance.

These controls form a strong AML defense against financial crime.

Emerging anti money laundering Techniques

1. AI-Generated Synthetic Identities

Criminals create digital identities using:

1.AI face generation

2.Fake addresses

3.Stolen/merged data

Hard to detect using traditional KYC.

2. Crypto Laundering

1.Mixers & tumblers

2.Cross-chain swaps

3.Privacy coins (XMR)

4.Layering via DeFi platforms

5.NFTs for value transfer

3. Mule Networks via Social Media

Fraudsters recruit individuals on Instagram/Telegram to receive and move illegal funds.

4. Trade-Based Money Laundering (TBML)

1.Fake invoices

2.Over/under-invoicing

Used heavily in import-export companies.

5. Online Gaming & Micro-Payments

Digital tokens and gaming credits are used to layer funds.

6. BNPL (buy now pay later) & Digital Lending Abuse

Rapid account creation → fast funds movement → settlement via third parties.

7. AI Deepfake Documents

Fake Aadhaar, passports, and video KYC created using AI tools, harder for manual KYC teams to catch.

Regulators are responding with AI-detection tools, biometrics, device intelligence, and behavioural analytics, making AML roles highly technical and in-demand.

Anti money laundering for job seekers (2025)

To succeed in an AML/KYC job in 2025, candidates must master both core concepts and practical tools.

1. Core Knowledge Areas

1.KYC (POI/POA rules) (know your customer)

2.CDD, EDD, SDD

3.FATF recommendations

4.PMLA (India), RBI KYC Master Directions

5.Sanctions & PEP screening

6.Transaction monitoring fundamentals

7.Red flag indicators

8.STR/SAR reporting workflow

9.Customer risk profiling

2. Tools to Learn

1.Actimize

2.Mantas

3.SAS AML

4.FICO TONBELLER

5.Refinitiv WorldCheck

6.ComplyAdvantage

7.Fircosoft

3. Skills Recruiters Want

1. Analytical thinking

2. Pattern identification

3. Attention to detail

4. Regulation wise awareness

5. Strong writing skills (for STR)

6.Excel, SQL basics

7. Ability to work with large data

4. Certifications

1.CAMS (Most valued)

2.ICA AML Diploma

3.CFE (For forensic roles)

4.FinCrime Specialist (ACAMS)

5.FRM/CFA basics (For advanced roles)

5. Job Trends 2025

1.AML analysts

2.KYC onboarding analysts

3.Transactions screening specialists

4.FIU investigators

5.AML transaction monitoring associates

6.Audit roles

7.AML advisory & policy roles

8.Crypto compliance analyst

This field offers excellent growth because AML is regulatory-critical and cannot be automated fully.

Conclusion

Anti money laundering is no longer just a compliance function, it is a frontline defense against global financial crime. With increasing digital payments, cross-border transactions, crypto adoption, and regulatory scrutiny, AML professionals play a crucial role in protecting customers, financial institutions, and national security. As techniques become more complex, AML teams must evolve with new tools, advanced analytics, and deeper regulatory understanding. For students and professionals, AML offers long-term job stability, strong salaries, and rapid career growth in 2025 and beyond. Keep up with the daily news to explore more about this industry as it is growing rapidly and the demand is not going to stop soon.

FAQ

The three stages of money laundering are Placement, Layering, and Integration. Money first enters the system (placement), then is obscured through complex transactions (layering), and finally re-enters the economy as “clean” funds (integration)

Smurfing is a money-laundering technique where criminals break large transactions into many smaller ones to avoid detection and reporting thresholds. It’s commonly seen in cash deposits, e-wallet top-ups, and crypto transfers.

To become an AML specialist, gain a degree in finance/law/commerce, complete certifications like CAMS, ICA, or AML/KYC courses, develop skills in KYC, transaction monitoring, sanctions screening, STR filing, and apply for roles such as AML Analyst, KYC Analyst, or Compliance Associate.

AML refers to laws and processes that prevent criminals from hiding or moving illegal money. It is essential for preventing terrorism financing, fraud, corruption, and cybercrime.

Analytical thinking, regulatory knowledge, Excel/SQL basics, pattern recognition, report writing, and familiarity with AML tools like Actimize and WorldCheck.

Actimize, SAS AML, WorldCheck, ComplyAdvantage, Fircosoft, TCS BaNCS, and similar transaction monitoring or sanctions screening systems.

Yes. Entry-level salaries are ₹3–6 LPA, mid-level roles ₹8–15 LPA, and senior AML specialists earn ₹20–35+ LPA depending on domain and company.