Learning how to build a financial model isn’t just about entering numbers into Excel — it’s about structuring information so you can make better business and investment decisions.A financial model turns business drivers and assumptions into a logical framework that helps you forecast outcomes and evaluate choices. Whether you’re an investor, entrepreneur, or finance professional, this guide breaks down the essentials in a way that’s actionable and easy to follow.

What It Really Means to Build a Financial Model

At its core, learning how to build a financial model means translating real business mechanics into a set of logical relationships and numbers. A model supports better decisions — not just prettier spreadsheets.

A good model helps you forecast performance, evaluate risks, and communicate insights clearly. It’s the foundation for budgeting, valuation, and strategic planning.

When You Need to Build a Financial Model

Financial models are widely used in capital allocation and investment analysis to assess risk and expected returns.

1. For Investment Decisions

Whenever you’re assessing whether to invest capital — in a stock, startup, or project — a financial model helps quantify expected returns and risk.

2. For Business Planning & Strategy

If your organization is considering launching a product, entering a new market, or optimizing operations, a model turns high‑level ideas into measurable scenarios and financial outcomes.

3. For Internal Forecasting and Budgeting

Companies use financial models to align budgeting, cash flow planning, and resource allocation with strategic goals.

Step‑by‑Step Framework: How to Build a Financial Model

Follow this structured sequence so your model is both logical and useful.

Step 1 — Define Your Objective

A clear objective — like forecasting growth, valuing a business, or planning capital structure — keeps your model focused. Without it, models quickly become confusing and less actionable.

Step 2 — Understand the Business and Industry

Before building numbers, understand how revenue is generated, cost behavior, and industry norms.

For example, subscription‑based businesses behave differently from transactional ones, and recognizing these differences makes your projections more realistic and defensible.

Step 3 — Collect and Prepare Historical Data

Good models rest on solid historical data. Gather three to five years of income statements, balance sheets, and cash flow statements.

Then clean the data by removing one‑time events and normalizing margins. Consistent data ensures your assumptions start from a reliable baseline.

Step 4 — Build Assumptions

Assumptions are the heart of your model. They’re where judgment and business insight meet quantitative forecasting.

Most beginners struggle here because they haven’t yet developed strong Excel‑based modeling workflows, which are essential for translating assumptions into structured forecasts.

Financial Modeling Jobs Related to Building Models

Assumptions should connect directly to business drivers — not arbitrary percentages.

Step 5 — Design Your Model Structure

Before you build formulas, design a clean structure that separates:

- Inputs and assumptions

- Calculations

- Outputs and summaries

A well‑organized structure makes it easier to audit your model, troubleshoot errors, and update assumptions.

Step 6 — Forecast Financial Statements

With assumptions in place, project:

- Income Statement — revenue, expenses, and profitability

- Balance Sheet — assets, liabilities, and equity

- Cash Flow Statement — operating, investing, and financing activities

Linkages between statements are critical — growth affects working capital; CapEx affects fixed assets and depreciation; debt changes interest expenses.

At this stage, many candidates are tested on these exact linkages during financial modeling interviews, especially in equity research and investment banking roles.

Financial modeling Interview Questions

Sanity‑check your forecasts: do projections reflect realistic expectations for the business?

Step 7 — Analyze Results & Support Decisions

Your model should illuminate answers to key questions:

- What are expected returns?

- How sensitive are outcomes to key assumptions?

- What risks and trade‑offs emerge?

Models support judgment — they don’t make decisions for you. Use scenario and sensitivity analysis to see how outcomes shift under different assumptions.

Common Mistakes to Avoid

❌ Overcomplication

More formulas and sheets don’t mean better insight. Complexity can hide errors and make models difficult to update.

❌ Unrealistic Assumptions

If assumptions aren’t grounded in business reality, the model won’t be reliable — no matter how polished.

❌ Forgetting the Objective

Always keep your original question at the forefront so your model stays decision‑focused.

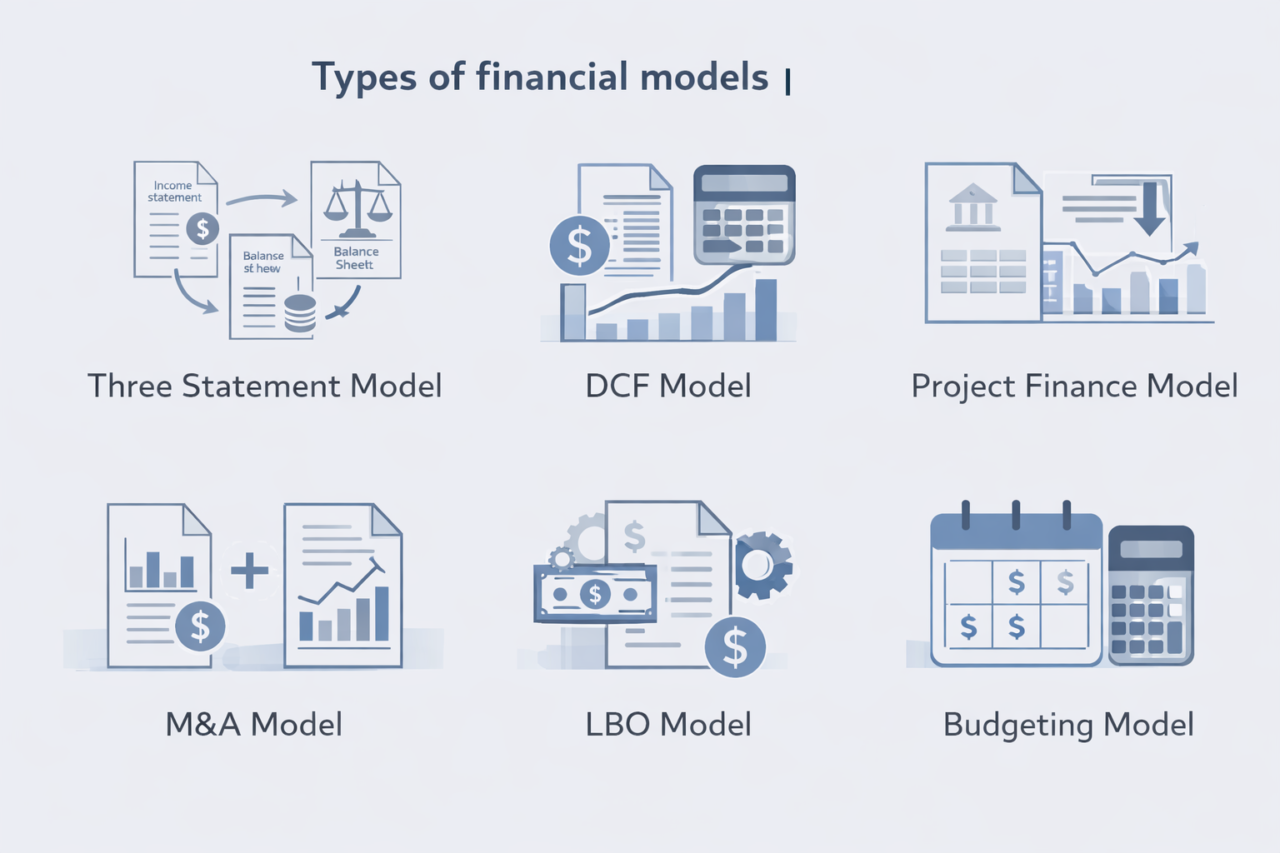

Types of Financial Models

Here’s a quick way to think about common models and when to use each one:

- Three‑Statement Model – Used to understand how operating decisions affect profitability, liquidity, and solvency over time. It’s the foundation for most other financial models because it connects all core financial statements.

- Discounted Cash Flow (DCF) Model – Used primarily for valuation, especially when your objective is to estimate intrinsic value by forecasting free cash flows and discounting them to today.

- Project Finance Model – Applied when evaluating specific initiatives or investments whose cash flows are ring‑fenced, such as infrastructure projects, large CapEx investments, or joint ventures.

- M&A & LBO Models – Used in scenarios involving acquisitions or leveraged buyouts. These models evaluate transaction impacts, debt capacity, and return metrics over time.

- Budgeting & Forecasting Models – Used internally for operational planning, resource allocation, and performance tracking on a regular cadence (monthly, quarterly).

These models differ in purpose — so choose based on your primary objective (valuation vs operations vs transaction analysis).

Skills That Help You Build Better Financial Models

To become proficient in financial modeling, you need a mix of technical and business skills:

- Accounting Knowledge – Understand how financial statements interact.

- Excel Proficiency – Master formulas, logic flow, and error‑control methods.

- Business Acumen – Great models reflect not just numbers, but real business behavior.

As you practice more models, your intuition will improve — helping you build faster and more accurately.

FAQ: How to Build a Financial Model

How long does it take to build a financial model?

It depends on complexity — simple models might take a few hours; detailed, multi‑scenario models can take days.

Can beginners build financial models?

Yes! Start with a simple structure, focus on logic, and refine as you go.

Is Excel enough?

For most purposes, yes — Excel remains the industry standard in financial modeling.

Do I need advanced finance credentials to learn?

No. Skills develop through practice — the more real models you build, the better you become.

If you want to apply this framework across real‑world valuation and decision‑making scenarios, a structured learning path helps accelerate the process.

Structured learning path in financial modeling

How to Build A Financial Model Tutorial

We have detailed step by step tutorial on how to create a financial model from scratch in this tutorial. The templates and spreadsheets are available in the description of the video.

Conclusion

Learning how to build a financial model is about more than spreadsheets — it’s about structuring assumptions, linking financial statements, and using logic to make smarter decisions.

Whether you’re planning your next strategic move or preparing for a professional finance role, mastering this framework equips you with a powerful analytical tool.