Last updated on February 14th, 2026 at 04:02 pm

If you’ve ever wondered how to become a CFA charterholder, what the CFA exam structure looks like, or how long the CFA journey takes, this article breaks it all down using the latest 2025 updates. You’ll also learn about practical skills modules (PSMs), CFA Institute membership, salary expectations in India, and how the CFA designation compares to other finance qualifications.

Whether you’re a student, a working professional, or someone considering a transition into finance, this CFA guide gives you everything you need to make an informed decision. This guide explains CFA eligibility, exam levels, fees, work experience requirements, career opportunities, and charterholder status in a simple and practical way.

How to Become a CFA (Chartered Financial Analyst)

The CFA designation is one of the most recognizable professional qualifications among people in the field of investment analysis, portfolio management, equity research, and financial strategy. This charter designation is bestowed by the CFA Institute.

Candidates need to pass a very stringent, 3-part examination process consisting of Level I, Level II, and Level III tests. In addition, candidates must satisfy particular work experience demands as well.

The CFA charter is viewed as a benchmark in finance, representative of a deep level of knowledge in valuation, ethics, financial modeling, portfolio management, and global markets.

This is undoubtedly one of the most sought-after qualifications globally for professionals desiring improved credentials within the fields of investment banking, asset management, wealth management, credit analysis, and research.

CFA Program Overview

What Is a CFA Charter?

The CFA Charter is a professional designation awarded by the CFA Institute to individuals who successfully complete all three levels of the CFA exam, satisfy the work experience requirement, and commit to upholding the CFA Institute’s Code of Ethics and Standards of Professional Conduct.

The CFA qualification is considered one of the highest qualifications in investment analysis, equity research, asset management, portfolio management, wealth advisory, and financial strategy.

To get the CFA Charter, a candidate must:

Pass Level I, Level II, and Level III of the CFA Program, which enjoys worldwide recognition.

Obtain a minimum of 4,000 hours in relevant work experience.

-Become a regular member of the CFA Institute.

Undertake and commit to strict ethical and professional standards. The CFA Charterholder designation demonstrates profound knowledge in finance, strong analytical skills, and a commitment to ethical investment practices. Employers globally regard CFA charterholders as highly qualified professionals who are well-suited for various career positions related to portfolio management, equity and credit research, investment banking, risk management, and wealth management.

Why Become a CFA?

The CFA Charter is a prestigious designation within the financial industry. The acquisition of the CFA designation has numerous advantages in the financial domain around the world. It is globally recognized for its high standards, comprehensive curriculum, and robust credibility. It is valued in investment analysis, asset management, equity research, portfolio management, and wealth advisory professions.

The CFA designation is taken to mean that you are well-versed in finance, have a strong ethical base, and can analyze complex investment opportunities. These attributes are highly sought after by banks, asset management companies, hedge funds, consultancy companies, and international finance institutions.

Main Benefits of Becoming a CFA Charterholder

Worldwide Recognition: Recognized in more than 160 countries, hence making it one of the most transferable finance qualifications globally.

High Professional Credibility: It has been regarded as the “gold standard” among investment professionals because of its strict curriculum and ethical requirements.

It opens up opportunities for a career in equity research, portfolio management, risk management, investment banking, corporate finance, and wealth management.

High Earning Potential: CFA charter holders often have the highest earnings due to their superior analytical capabilities and skills in dealing with intricate investment tasks.

Ethics and Professional Standards: The emphasis on ethics within the CFA program helps to create trust and differentiates professionals throughout the sensitive risk fields of finance.

No particular courses or degree is required initially: this makes it much more accessible to students, working professionals, and career changers.

Eligibility & Prerequisites

Educational Requirements

Applicants for the CFA Program in 2025 must fulfill one of the set educational or work experience criteria by the CFA Institute. This ensures that candidates have an academic background that prepares them well for investment analysis, ethics, and financial decision-making.

Bachelor’s Degree:

Applicants must have a bachelor’s degree in any field from an accredited university.

Final-Year Students:

Final-year undergraduates can sign up for the CFA Level I exam, but they have to graduate prior to taking Level II.

Work Experience Pathway: Candidates without a degree can qualify by completing 4,000 hours of professional work experience within at least 36 months. The work should develop relevant skills like analytical thinking, problem-solving, or business decision-making. Why This Is Important: These are educational requirements that ensure CFA candidates enter the program with the appropriate academic or professional preparation. Whether you are a student, a professional, or making a transition to a finance career, the CFA Program is open to you. It is recognized internationally and meets the skill needs of today’s investment roles.

Work Experience Requirement

To get the CFA charter, candidates need to gain relevant professional work experience of 4,000 hours, usually over at least 36 months. This experience can be obtained before, during, or after passing the CFA exams, giving candidates maximum flexibility.

The CFA Institute recognizes a wide range of investment-related roles that include equity research, portfolio management, risk analysis, private banking, corporate finance, and certain analytics or trading jobs, so long as the work involves decision-making, investment analysis, or adds value to the investment process.

Into 2025, the CFA Institute will continue to put emphasis on a curriculum of practical, real-world experience. This ensures that charterholders not only understand the curriculum but also demonstrate their professional skills before earning the respected CFA designation.

Other Pre-requisites

To be eligible for enrolling in the CFA Program, candidates have to fulfill certain educational and work experience requirements, among a few key prerequisites. Proficiency in English is required because all CFA study materials, exams, and communications from the institute are provided only in English. This will also make sure that you can clearly comprehend complex financial concepts, exam questions, and ethical case studies.

You also require a valid internationally recognized passport for CFA registration and identification on the test date. In fact, the CFA Institute accepts only passport identifications at the testing centers and during online check-ins, so it is an absolute requirement for them.

These requirements help make sure that any candidate entering the CFA Program meets certain minimum global standards for communication, identification, and examination integrity. This enhances the international credibility of the CFA designation.

CFA Exam Levels & Curriculum

The CFA Program consists of three levels of exams, each testing a deeper understanding of investment analysis, valuation, and portfolio management. The curriculum is regularly updated to meet the standards of the global financial industry, which is why the CFA is seen as one of the most respected qualifications in finance.

Level I: Foundations of Finance

Level I focuses on basic investment tools and key concepts. It tests your knowledge of:

– Ethics and professional conduct

– Quantitative techniques

– Economic principles

– Financial statement analysis

– Corporate finance

– Basics of equity, fixed income, derivatives, and alternative investments

Goal: Build foundational knowledge and assess your ability to recall and understand essential finance concepts.

Level II: Asset Valuation & Application

Level II delves deeper into asset valuation and the use of analytical techniques. This exam emphasizes:

– Equity valuation

– Valuation of fixed income securities

– Derivatives pricing

– Analysis of alternative investments

– Advanced financial statement analysis (FSA)

Goal: Assess your ability to use financial models, analyze data, and perform practical valuation tasks, which are crucial skills for analysts.

Level III: Portfolio Management & Wealth Planning

Level III focuses on portfolio development, wealth management, and investment strategy, covering:

– Portfolio management for individuals and institutions

– Strategies for asset allocation

– Risk management

– Principles of behavioral finance

– Ethical and professional standards

Goal: Prepare candidates to combine valuation expertise with portfolio management choices, vital for roles such as Portfolio Manager, Wealth Manager, and Investment Strategist.

Practical Skills Modules (PSMs)

As part of the updated 2025 CFA Program, candidates must participate in Practical Skills Modules (PSMs) that link theory in finance with real-world skills. These modules focus on hands-on learning and practical tools, helping candidates prepare for jobs in areas like investment analysis, equity research, risk management, and portfolio management.

PSMs include practical instruction in subjects such as:

– Financial modeling

– Python programming for finance

– Fundamentals of AI and Machine Learning

– Data analytics and visualization

– Valuation modeling

– Tools for portfolio analytics

Candidates must complete at least one PSM at each exam level. These modules feature interactive lessons, real-world datasets, assignments, and simulations used by modern investment firms.

Step-by-Step Path to the CFA Charter

Register and Enroll in the CFA Program

To start your CFA journey, the first step is to register and enroll on the official CFA Institute website. Candidates need to create an online CFA account, confirm their eligibility, and select their preferred exam window. During the enrollment process, you must pay the one-time CFA Program Enrollment Fee, which is about USD 350. This fee is only needed before taking Level I.

After you enroll, candidates must pay the exam registration fee for their chosen level and exam window, either early or standard pricing. Enrollment also provides access to the official CFA Learning Ecosystem, which includes curriculum e-books and practice exams. It is important to complete the enrollment correctly. Exam scheduling, identity verification, and Practical Skills Modules (PSMs) depend on the right registration information. This step marks the official start of your CFA Program journey.

Pass All Three Exam Levels

To earn the CFA charter, candidates must pass all three levels of exams: Level I, Level II, and Level III. The CFA Institute recommends that each level requires 300 to 400 hours of study and assesses increasingly complex investment knowledge. Starting early, practicing consistently, and following a structured study plan significantly increases the chances of passing on the first attempt.

Level I – Foundations (What to Expect)

Level I focuses on basic investment tools and covers topics like ethics, quantitative methods, economics, and financial reporting. The exam consists of multiple-choice questions and requires a strong grasp of formulas, concepts, and the applications of the time-value-of-money.

Level II – Asset Valuation (What to Expect)

Level II emphasizes practical application, particularly in equity valuation, fixed income, derivatives, and financial analysis. The question format changes to item sets (mini-cases), which demand more in-depth analytical skills.

Level III – Portfolio Management (What to Expect)

Level III covers portfolio construction, private wealth, institutional management, and decision-making in various situations. It includes constructed-response questions (in essay format), which are considered the most challenging part of the program.

Complete Work Experience (4,000 hours)

Apply for CFA Institute Membership

After successfully completing all three levels of the CFA exam and acquiring the necessary 4,000 hours of relevant work experience, the next step is to apply for membership with the CFA Institute. Applicants must fill out a membership application on the official CFA Institute website, providing information about their work experience and professional conduct. Additionally, you will need to provide two professional references if one of them is a CFA charterholder, or three references if none are.

Once your application has been reviewed and accepted by the CFA Institute and your local society, you will officially receive the CFA charter, which grants you worldwide recognition as a qualified investment professional.

CFA timeline, Fees & Duration

Exam Registration and Fees

The CFA Program has two major cost components: a one-time enrollment fee and per-exam registration fees for Levels I, II, and III. Below is the updated fee structure based on the latest CFA Institute guidance.

1. One-Time Enrollment Fee (Paid Only Once)

1.USD 350 (approx. ₹29,000 – ₹31,000 in India)

2.Paid only when you register for your first CFA exam (usually Level I).

3.Not charged again for Level II or Level III.

2. Exam Registration Fees (Per Level)

| Fee Type (CFA Institute 2025) | Amount (USD) | Approx. Cost in India (INR) |

| Early Registration Fee | USD 940 | ₹78,000 – ₹82,000 |

| Standard Registration Fee | USD 1,250 | ₹1,03,000 – ₹1,07,000 |

Key Notes

1.You must pay this fee for each exam level (Level I, II, III).

2.Early registration is the best way to reduce CFA exam cost.

3. Other Possible Costs (Additional Expenses)

These are not charged by CFA Institute but are important for budgeting:

Study Materials

1.CFA curriculum e-books: Included in exam fee

2.Optional physical books: USD 299 (₹25,000 approx.)

3.Third-party prep providers: USD 300–800 (₹25,000 – ₹65,000)

Travel & Exam Center Costs

1.Travel to exam city (if required): ₹2,000 – ₹15,000

2.Accommodation (if needed): varies

Professional Membership Fees (Optional for Charter)

1.CFA Institute annual membership: USD 299 (~₹25,000)

2.Local society membership (varies): ₹2,000 – ₹6,000

Total Estimated Cost to Complete CFA (India, 2025)

Assuming early registration each time:

Total Fees per Level: ~₹1.07–₹1.15 lakh

Total for all 3 Levels: ~₹3.2–₹3.4 lakh

(plus optional study materials & travel)

CFA in India – Careers & Outcomes

Demand and Recognition in India

The CFA charter is well respected in India and is seen as a leading credential for investment professionals. Employers at banks, AMCs (asset management companies), mutual funds, PMS firms, brokerages, fintechs, and consulting firms prefer or highly value CFA charterholders for roles in equity research, portfolio management, risk, treasury, and corporate finance.

Local community and support, CFA Society India

The CFA Society India, along with its regional chapters, plays an important role in recognition and networking. It organizes conferences, employer panels, mentoring, continuing education, and job fairs that connect candidates with top recruiters in Mumbai, Bengaluru, Delhi, and other major cities.

Career Paths

CFA charterholders create opportunities in investment management, banking, and risk management. Frequent career paths include:

Equity / Sell-side Analyst – Conducting research on companies and sectors, performing financial modeling, and producing investment reports; this is often a natural starting point for CFA candidates.

Portfolio Manager / Buy-Side Analyst – Building and overseeing portfolios (such as mutual funds, PMS, hedge funds); this role involves greater decision-making authority and revenue accountability.

Fixed-Income / Credit Analyst – Assessing bond values, performing credit research, providing support for credit ratings, and analyzing corporate lending.

Investment Banking / Corporate Finance – Conducting valuations, performing M&A due diligence, executing deals, and creating pitchbooks (the CFA enhances technical credibility).

Risk Manager (Market / Credit / Liquidity) – Measuring and mitigating financial risks, conducting stress tests, calculating Value at Risk (VaR), and ensuring regulatory compliance.

Wealth / Private Banker – Providing advisory services to clients, constructing portfolios for high-net-worth individuals (HNWIs), integrating technical expertise with client management.

Compliance & ESG / Sustainable Investing Specialist – Involved in ESG integration, reporting, and fulfilling regulatory compliance duties (demand for these roles is on the rise).

Each path prioritizes distinct strengths: research and modeling for buy-side/sell-side roles, coding and statistical analysis for quant positions, and client engagement abilities for wealth management.

Preparation Resources & Study Aids

CFA Institute provides an interactive online platform called the Learning Ecosystem, which includes:

1.Personalized study planner

2.Adaptive learning tools

3.Mock exams and quizzes

4.Flashcards and topic summaries

5.Performance analytics to track weak areas

This system is now central to CFA preparation and is optimized for mobile and desktop.

Practice Tests & Mock Exams

Candidates get multiple mock exams and practice question banks directly from CFA Institute. These mimic the exam format closely and are critical for exam readiness. Third-party providers also offer supplementary practice tests, but the official ones are the most accurate.

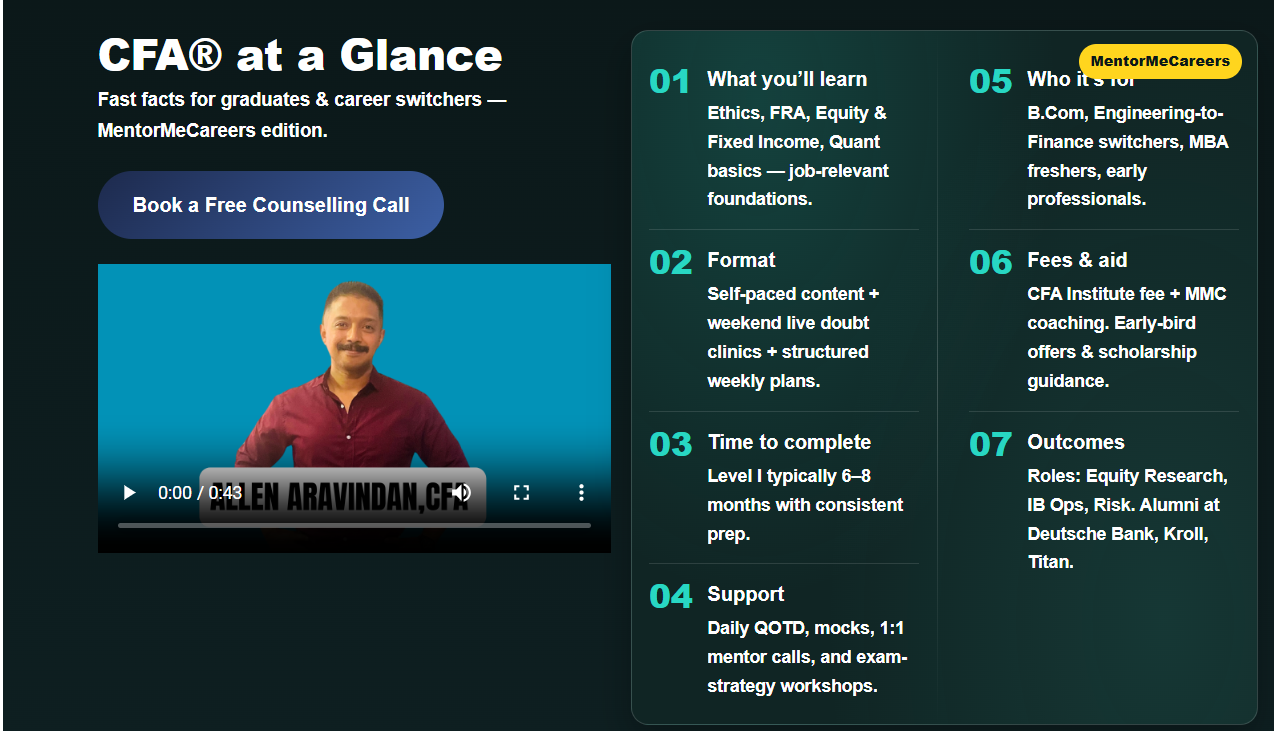

Coaching and Course

Mentor Me Careers offers one of the most comprehensive CFA coaching programs in India, designed to help you pass the CFA exams and accelerate your finance career. Mentor Me Careers doesn’t just help you study, they equip you with the discipline, strategy, and confidence needed to tackle CFA exams and build a successful career in investment analysis, portfolio management, risk management, or asset management.

Want a free demo or counseling?

Reach out to Mentor Me Careers to book your free CFA career counseling and understand the best study plan for you.

Study tips

Start early: At least 6 months before exam day

Use CFA Institute curriculum + mock tests (highest probability of exam alignment)

Practice > Reading: Spend 50% of study time solving problems

Master FRA + Ethics: These sections heavily impact passing outcomes

Simulate exam conditions: Take 4–6 full mock exams

Conclusion

The CFA Program remains one of the strongest pathways for building a global career in finance. From eligibility and fees to exam levels and work requirements, the CFA journey is demanding but the rewards are meaningful. CFA charterholders are highly valued in equity research, portfolio management and investment banking roles across India and abroad.

If you’re committed to learning, investing in your skills, and building a long-term finance career, the CFA designation can be a transformative stepping stone. With the right study plan, practical skills, and real-world experience, earning the CFA charter opens doors to some of the most respected roles in the investment profession. Now that you understand the complete path, you can confidently decide whether the CFA journey aligns with your career goals.

FAQ

Typically 3–5 years for most candidates: plan ~300–400 study hours per level plus the time to pass Levels I–III, and meet the 4,000 hours (3+ years) of qualifying work experience required for the charter. Many finish faster if they pass each level on the first attempt and already have relevant experience.

CFA candidate is enrolled in CFA Program and studying for the exam levels (I, II, III). CFA charterholder has passed all three levels also met the professional work-experience requirement, and accepted as a CFA Institute member, eligible to use the “CFA” designation.

Common roles: equity analyst, portfolio manager, investment analyst, risk manager, research analyst, corporate finance. Salary (ballpark): fresh charterholders ₹6–10 LPA, mid-level ₹10–25 LPA, senior/buy-side roles ₹25 LPA+. Actual pay varies by city, firm type (sell-side vs buy-side), and performance bonuses.

You must have: a bachelor’s degree (final undergraduate year), OR 4 years of qualifying professional work experience, OR a combination of work + education totaling 4 years. You also need a valid passport and must agree to the CFA Institute Code of Ethics.

Costs vary by registration window and extras. Typical components: one-time enrollment fee (USD 350) + exam registration fees per level (early vs standard USD 700–1,250) + study materials, prep courses, travel. Expect ~USD 2,000–4,000 (₹1.6–3.5 Lakh) total all-in for the full program depending on prep choices and exam fee timing. Check CFA Institute for current fees.

Related Articles

- CFA scholarship

- How to become a investment Banker in India

- FRM vs CFA

- CFA vs CPA

- Equity research analyst salary