FRM vs CFA: FRM is a specialist risk-management credential focused on market, credit and operational risk models and controls; CFA is a broad investment credential covering equity, fixed income, portfolio management and financial analysis. For India: choose FRM if you want a fast track into bank risk, treasury or ALM; choose CFA if you aim for buy-side/sell-side roles like equity research, portfolio management or investment banking. FRM focuses on practical, quantitative risk skills and is awarded by GARP. CFA is a comprehensive investment credential awarded by the CFA Institute.

What is FRM?

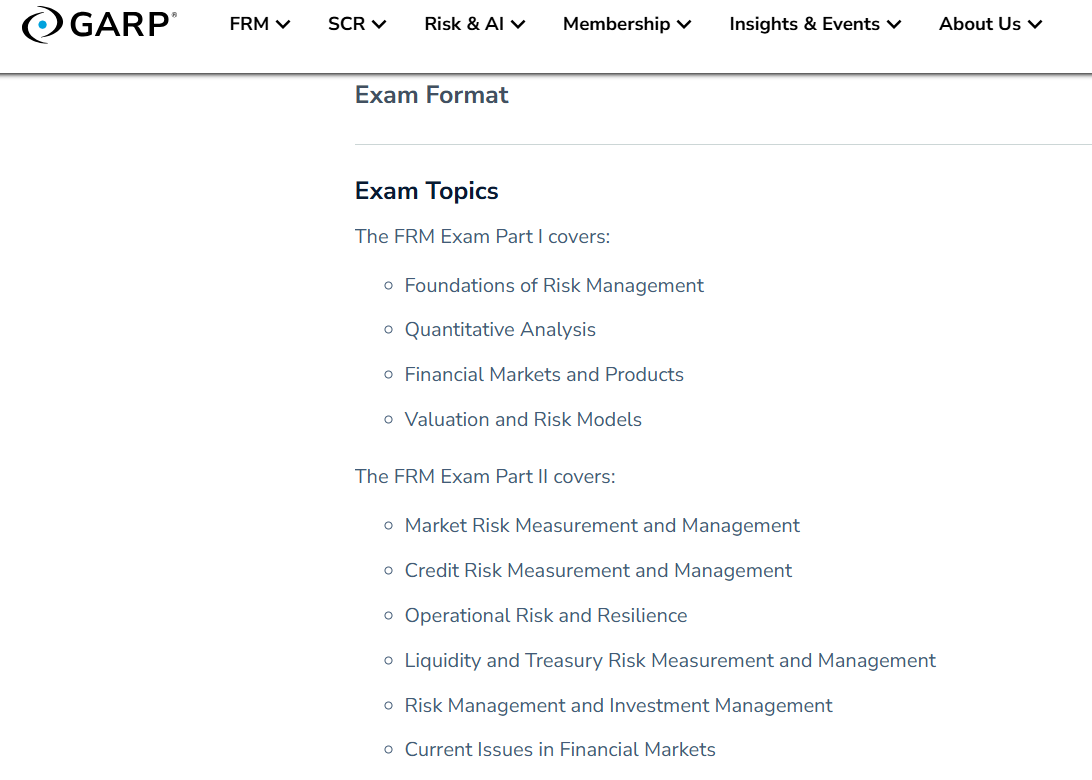

FRM is professional certification for risk management practitioners that concentrates on identifying, managing also measuring financial risk across markets. FRM is awarded by GARP, the global association of risk professionals. And is widely recognised by banks. FRM has two exam parts: One part includes tools and foundation also quantitative methods, valuation. Second part includes application and strategies- risk governance etc. Candidates need to study mix of everything quantitative and qualitative. After passing both exams, candidates also need two years of experience in risk related roles to get the FRM designation.

Planning to do FRM? You will need to have hands on skill with risk and quality control. In India, banks do hire FRM qualified candidates for internal risk management and everyday risk operations.

What is CFA?

CFA (Chartered financial analyst) is widely recognised professional credential awarded by CFA institute. Designed to get into investment banking and finance where you get work into portfolio management, equity also financial analysis. CFA has a huge curriculum it is unlike any other qualification this is also one of the reason for CFA being alittle tough to handle and pass. CFA covers financial reporting and analysis, equity valuation and professional ethics.

Like FRM, CFA also consist of levels. CFA has three levels, each level includes different subjects. Level 1: Foundation | Level 2: asset valuation and application) | Level 3: Portfolio management and wealth planning). Candidates must have 3 years of minimum experience in core finance and should pass all three levels to earn charter. CFA institute have Charterholder community, where they share information and help each other anytime needed. For Indian students and early career professionals, CFA is attractive because it helps finance career growth exponentially. It open doors to corporate finance roles also portfolio management etc.

Exam structure and difficulty

FRM has two parts, exam is conducted twice yearly where as CFA has three levels each with specific focus and exam schedule. Level 1 is 3-4 times a year, level 2 varies. FRM includes test concepts and quantitative application; CFA exams test broader view into finance as compared to FRM. CFA includes topics like valuation, accounting and portfolio also asset allocation.

The recommended hours of study for Chartered financial analyst by CFA institute is 300 hours per level but 300 hours is not enough if you analyse. Everyone has different grasping power so candidates have to know their flaws and strengths before you dive in. Make your own timetable and follow it depending on your power. While for FRM the recommended study time is 150-250 hours per part which again depends on your grasping speed and practice.

So far, we do know that FRM passing percentage is almost 60% percentage but for CGA this percent is almost 45. CFA covers broader range of topics and candidates are expected to master all the given subjects to provide their best answers in case-study.

FRM is deeper in quant model and risk modelling. If you are inclined towards statistics and credit risk you might enjoy doing FRM. If you prefer valuation, financial statement analysis and portfolio concepts. CFA is better option for candidates. Both of the qualifications require discipline and study plans, but the nature of practice differs.

Career paths roles that hire FRM vs CFA

Banks and risk teams prefer FRM’s for risk in credit and market risk. Asset managers, asset management companies hire CFA’s for portfolio and asset management. Fintech companies need FRM’s and CFA’s fir risk and investment related roles.

FRM career paths

Financial risk manager graduates commonly enter into market risk, credit risk and quantitative risk modelling and asset-liability management teams. Large public and private companies in India actively hire for FRM graduates. Typical job roles in India for FRM are credit analyst, chief risk officer also market risk associate. Financial risk manager get into regulatory and compliance levels for stress testing and capital adequacy framework implemented.

CFA career paths

CFA charterholders or even level 1 CFA passed candidates can enter into equity research, portfolio management roles in AMC (Asset management companies), CFA’s also enter in investment banking and wealth management. The typical job titles in India for CFA’s are Equity research analyst, portfolio analyst also Private equity analyst.

Salary FRM vs CFA (India Specific)

Ranges are broad which depends on pay varies by city and firm types.

| Role | FRM (Entry / Mid / Senior) INR | CFA (Entry / Mid / Senior) INR | |

| Risk Analyst / Market Risk | ₹4–8 LPA / ₹10–18 LPA / ₹18–35 LPA+ | ₹5–9 LPA / ₹10–20 LPA / ₹18–35 LPA+ | |

| Credit Risk / Credit Analyst | ₹4–7 LPA / ₹8–16 LPA / ₹15–30 LPA | ₹4–8 LPA / ₹8–16 LPA / ₹15–30 LPA | |

| Treasury / ALM Analyst | ₹5–9 LPA / ₹10–18 LPA / ₹18–35 LPA+ | ₹5–10 LPA / ₹10–20 LPA / ₹18–35 LPA+ | |

| Equity Research Analyst | ₹5–10 LPA / ₹10–22 LPA / ₹20–45 LPA+ | ₹6–12 LPA / ₹12–30 LPA / ₹30–60 LPA+ | |

| Portfolio Analyst / Manager | ₹6–10 LPA / ₹12–25 LPA / ₹25–50+ LPA | ₹6–12 LPA / ₹15–35 LPA / ₹30–75+ LPA | |

| Investment Banking Analyst | ₹6–12 LPA / ₹12–30 LPA / ₹25–80+ LPA | ₹6–12 LPA / ₹15–35 LPA / ₹30–100+ LPA |

Salary Varies

- Experience

- Firm type

- City

- Position

Why it differs?

CFA’s who become portfolio managers or senior analysts often obtain revenue linked pay.

FRM vs CFA cost and ROI

FRM includes exam registration + two exam fees + study material + coaching (if opted for). The total ranges from 40,000 to 1,50,000 depending on prep choices and currency fluctuations.

CFA has three exams + optional tuition fee which commonly range from 1.5 lakh to 5 lakh. CFA exam fees are higher but there is also opportunity for scholarship in CFA depending on your family income and also college.

Timeline:

FRM includes 1-2 years to complete because of two levels and this is comfortable timeline also depending on if you work or a student and how much time for studying.

CFA includes 2.5-5 years to complete, it is mostly preferred to take breaks in between the levels also after level 2 it is required for you to have minimum three year of experience to become a charterholder after you pass level 1. If we talk about ROI, total spent on FRM is 1.5 lakhs in 2 years. After completing FRM minimum package offered is 6 LPA. Your ROI will be just within a year. In CFA case you will actually get paid more but it took more money to complete CFA so the ROI will depend on your basic pay and will be close to 1.5-2 years which is very reasonable for qualifications like CFA.

After these qualifications your career will be set and there won’t be any need to worry about stuff.

FRM vs CFA Skills and Syllabus

Both FRM and CFA cover derivatives, fixed-income instruments, quantitative methods and some risk concepts. Candidates need strong attention to detail and an ability to translate theory into numerical analysis. Both credentials expect familiarity with probability, statistics and financial instruments, which creates some synergy if you later choose both paths.

FRM syllabus

CFA Level 1 syllabus

CFA level 2 syllabus:

CFA level 3 syllabus

Implications:

If you enjoy risk management also legal compliance, hands on risk tools and programming statistics FRM will suit you very well.

If you love analyzing companies, managing portfolio also perform valuation then CFA is better option for you.

Decision framework (FRM vs CFA)

1.Clarify your career goal

- If you want risk, treasury, regulatory, or model validation → FRM is the primary choice.

- If you want equity research, portfolio management, investment banking, or private equity → CFA is the stronger fit.

2. Assess your strengths & interests

- Strong maths/statistics & enjoyment of modelling → lean FRM.

- Interest in companies, valuation, and asset allocation → lean CFA.

3. Check current job & near-term opportunities

- If your current role is risk-centric, FRM gives fast signalling and immediate on-job application.

- If you are in finance/analysis with valuation tasks, CFA supports career growth in investment roles.

4. Time horizon & ROI

- Want quick credentialing and faster payback? FRM (2 parts) often quicker.

- Willing to invest 2–4 years for broader options? CFA may provide higher long-term upside.

5. Consider doing both (strategically)

- If you want a hybrid role: map a 3–5 year plan: start FRM (fast), then pursue CFA while gaining investment experience. Or start CFA Level I if early-career and add FRM later if moving into risk.

If you still can’t choose, use this checklist:

- Choose FRM if: You enjoy statistics, coding for models, and want to work in banking risk or regulatory roles.

- Choose CFA if: You like company analysis, valuation, portfolio construction and aspire to be a buy-side/sell-side analyst or fund manager.

- Choose both if: You want to build a rare hybrid skillset for senior quant/investment roles.

FAQ

Which pays more FRM or CFA in India?

Senior compensation overlaps; CFAs can earn higher upside in buy-side roles (bonuses/AUM linked), while FRMs command premium in specialised risk leadership roles. Entry ranges are similar; long-term pay depends on role and performance.

Is FRM easier than CFA?

They’re different: FRM is narrower and more quantitative; CFA is broader and requires three levels. “Easier” depends on your background maths/statistics favors FRM; accounting/valuation favors CFA.

Can FRM get me a job in investment banking?

FRM can help for risk or structuring roles in banks, but front-office IB analyst roles typically prefer CFA, accounting degrees or investment experience.

How long does it take to complete FRM vs CFA?

FRM: many finish in 6–18 months; CFA: typically 2.5–5 years depending on pace and retakes.

Should I do FRM after CFA or vice versa?

Do whichever aligns with your current job first. Many do FRM first for quick domain entry, then CFA for broader mobility.

Do Indian employers value FRM?

Yes, banks, NBFCs and corporate treasuries value FRM for risk roles; demand has grown with regulatory complexity.

Do I need programming skills for FRM/CFA?

FRM benefits from Python/R or VBA for modelling; CFA candidates benefit from Excel and modelling skills; programming is increasingly advantageous for both.

Can I study while working?

Yes, both are designed for working professionals, but expect significant study hours. Plan realistic schedules and use employer support if available.