Financial Modeling Course in Jaipur with Placements

India’s most Comprehensive Financial Modeling Program

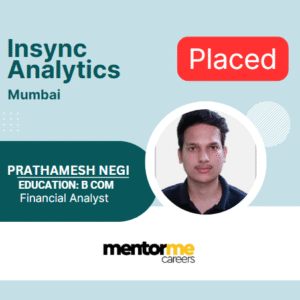

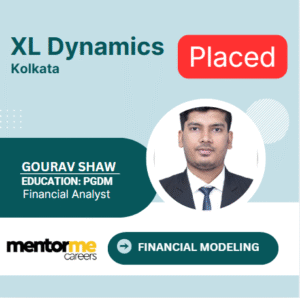

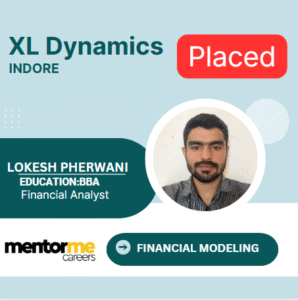

Placements Highlights

Service 2026verified by TrustindexTrustindex verifies that the company has a review score above 4.5, based on reviews collected on Google over the past 12 months, qualifying it to receive the Top Rated Certificate.

Course Learning Options

Financial Modeling Course

₹39999 + GST

- 200 Hrs offline training

- Guaranteed Interviews

- 12 Specializations

- Lifetime Portal Access

Financial Modelling Course in Jaipur Overview

Master Financial Modelling with Mentor Me Careers in Jaipur

At Mentor Me Careers, we know that finance is the lifeblood of any business. The Financial Modelling Course in Pune offered by us is designed to help you learn those practical skills that will make you a great financier. Taught by experienced professionals from top investment banks, our curriculum includes Corporate Finance, Capital Budgeting, Risk Management and Portfolio Management using tools like Excel among others.

What sets us apart?

• Hands-on Training: Real-world case studies and discussions.

• Flexible Payment: Easy installments

• Proven Success: Over 50,000 students trained worldwide.

• Flexible Formats: Live, offline or recorded sessions available in weekend or weekday format

• High Placement Rates: verifiable placements with contact details of placed students.

Course Features:

• 200 hours of intensive finance training.

• Suitable for full-time as well as weekend students

• Average salary for financial modellers in India ranges between ₹6-25 Lakhs.

Enroll today to power your career in finance at Mentor Me Careers!

How will your training work?

Learn Live Online or Offline

Learn concepts with industry led experts.

1:1 doubt solving

Get your doubts solved by experts through Q&A forum within 24 hours.

Test yourself

Test your knowledge through quizzes & module tests at regular intervals.

Hands-on practice

Work on assignments and projects.

Take final exam

Complete your training by taking the final exam.

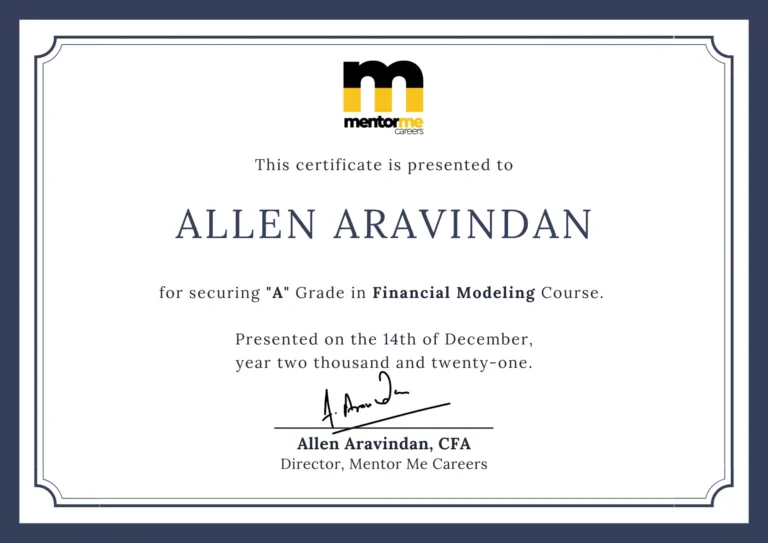

Get certified

Get certified in Financial Modelling and Valuation upon successful completion of training.

Expert Faculties

Nikhil Jain, CFA

Expertise: Credit Analysis, Financial Statement Analysis, Risk Management

Financial modelling course in Jaipur Curriculum

The investment banking course training by Mentor Me Careers is carefully crafted by ex investment bankers, credit analysts and fund managers who have spent decades in the industry. This course curriculum was designed for bridging the gap between what the industry requires and what the students know as a part of their academics qualifications. The core objective of this program is to make students and working professionals job ready for investment banking and equity research profiles.

The first module is designed for a comprehensive start with spreadsheet skills and awareness on various sections and features of excel ribbons which is required for a financial analyst , equity analyst or investment banker

Excel layout and structure

Sheet vs Book

Home ribbon

Insert Ribbon

Data Ribbon

Page layout

Formula Ribbon

Review Ribbon

View Ribbon

Cell freeze and referencing

Logical operators

Nest if Function

Module 2: Excel Part 2

The second module gets into new functions required for financial model making .

Vlook up/ Hlook up/ Xlook up

Index and Match

Sum, Average, Count, Max, Min, Counta

Sumproduct

Conditional operators, Sumif, Countif, Average if

Pivot Table, Pivot Chart, Slicer

Financial analysis and template

Data Look up case study on stock market data

Charts- Waterfall, Radar, Clustered column, Histogram

Data Analysis tool pack

Sales Data case study

Module 3: Financial Mathematics

What is time value of money

What is compounding

What is discounting

Definitions of rate

Frequency of compounding

Continuous compounding

Series of cashflow

TVM Excel functions

Beginning and ending cashflow

IRR and NPV. Problems with IRR

Module 4: Statistics for Finance

Financial modeling is incomplete without learning the statistics required to make forecasting , and creating insights on the business risks

Need of statistics

Central tendency

Presentation and analysis of data

Risk Calculation

Risk adjusted calculations- Sharpe, MAR, Sortio

Fund selection Case study

No one can become a financial analyst without knowing accounting and financial statement analysis required for investment finance field. The investment banking course offered by Mentor Me will teach you financial accounting from the basics.

Introduction to Financial Statement Analysis Framework- Annual report reading, Con Call reports, Quarterly reports, statement of change in equity, Supplementary information

Financial statement linkages and creating financial statement in excel

Income statement– Revenue recognition principles, Expense recognition principles, Diluted EPS, EPS, LIFO, FIFIO,AVCO

Balance Sheet– Format of balance sheet, current assets, current liabilities, Fixed assets, Non current liabilities

Cash flow statement– Format of cash flow statement, Direct method , Indirect method, FCFF, FCFEE

Ratio analysis– Solvency Ratios, Profitability ratios, Activity Ratios.

Ratio Analysis Case Study- Analyse persistent systems annual report

How to Read an annual Report step by step

Franchisee Business Model Valuation- NPV , IRR, Sensitivity analysis

Minority Interest, Impairment, Good will analysis

Once the finance fundamentals are set now its time to dig into creating financial models in practice. We will start applying all the concepts learnt into practical real life financial decision making

Start-Up Model Travel agency Business

You will learn how to think of the template of the business model. How a three statement financial model is made . Also you will learn how small business assumptions can make the decision making difficult

Manufacturing Plant Business Modeling

In this financial model you will learn how funding complications affect the model. Interest capitalisation, Construction phasing , Soft cost and hard cost of projects will be taught in this section

Tax Modeling

Tax is an important part of investment decision making calculation. Taxation is much more complicated than calculating 30% of the PBT. Here you will learn tax loss carry forwards, Carry forward loss set off, Minimum alternate tax, MAT Credits, MAT Set off,Deffered tax liability & Deffered Tax Asset. All of this practically using excel

Manufacturing Plant Set Up Model

This is a real model of the industry made from scratch using real world assumptions and calculations. You will learn what it means to work in a industry level financial model from zero. All the complications thrown into one project finance case.

This is the final section before the specialization kicks in. In this section we will take a publicly listed company from NSE stock exchange and create a DCF Valuation Model and Relative /Comparable analysis financial model. This is one of the other applications of financial modeling in decision making. This model is specifically useful for people who want to pursue to join equity research and Investment banking

Valuation Basics- DCF, Gordon growth, WACC, Cost of equity , Levered, Un levered Beta, Terminal Value

Creating a model template

Data collection and data feeding in financial model

Revenue Driver- breaking the business into Price and quantity metrics, so that you can forecast those metrics

Cost Driver

Debt Schedule , Asset schedule Forecast

Free Cash flow calculation

Valuation Calculation

Sensitivity Analysis

Report Writing

This is our major success metric at Mentor Me, your placement. With over a decade of experience in this field, we have developed resources and process which will make you polished for the interview and job in investment banking and research. This module will include

Employability quizzes for each skill tested in the interview

Case studies practice for interview

Written test question bank

Mock Interviews- Face to face

Stress Interviews

CV Edits and recommendation

Soft Questions practice for HR Rounds

Our 12 Specializations in Financial Modeling Online Course

Financial Modelling course in Jaipur Job Roles

| Role | Experience Level | Salary Range (INR) |

|---|---|---|

| Equity Research Analyst | Fresher | 6 - 7 LPA |

| Private Equity Analyst | Fresher | 10 - 12 LPA |

| Project Finance Analyst | Fresher | 7 - 8 LPA |

| Investment Banking Analyst | Fresher | 10 - 12 LPA |

| Wealth Management Analyst | Fresher | 5 - 6 LPA |

| Risk Management Analyst | 2-5 Years | 12 - 15 LPA |