The demand for finance certifications in India is rising fast as students and professionals look for specialized, global credentials to stand out in competitive finance roles. This growth has increased comparisons between CFA and CAIA, especially among candidates targeting investment-focused careers. Reason being certifications and qualifications can be a benchmark to get higher salary in India or getting a job outside India, as qualifications like CFA have global recognition. CFA charter get numerous opportunities globally especially in US and UK.

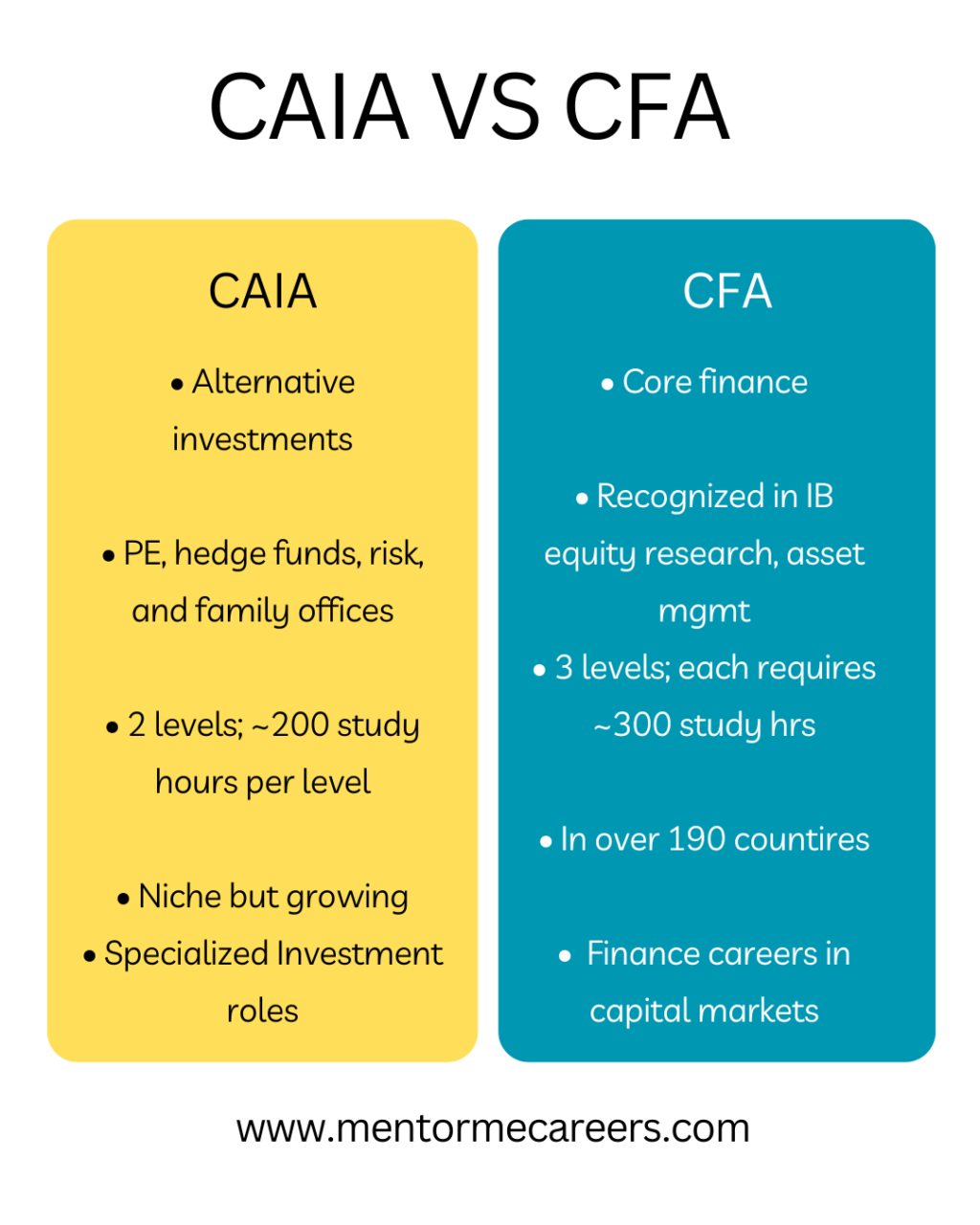

Many professionals now ask CFA vs CAIA. Which is better? The confusion comes from overlapping areas like investments, portfolio management, and global recognition, but each certification serves a different career purpose. While CFA focuses on traditional finance and public markets, CAIA specializes in alternative investments such as private equity, hedge funds, and real assets.

This guide is for freshers exploring finance careers, working professionals planning specialization, and career switchers entering investment roles. It breaks down the key differences, career outcomes, difficulty level, and suitability of CAIA vs CFA so you can choose the certification that fits your long-term goals.

What is CFA?

The Chartered Financial Analyst (CFA) program is one of the most respected global certifications in finance, designed for professionals who want deep expertise in investment analysis and portfolio management. Employers across investment banking, asset management, equity research, and risk management value the CFA for its strong focus on ethics, valuation, and real-world financial decision-making.

The CFA program emphasizes practical finance skills rather than general management theory. Candidates learn how to analyze companies, value securities, manage portfolios, and assess risk using globally accepted standards. Because of its rigorous curriculum and selective pass rates, the CFA charter signals technical credibility, discipline, and commitment in the finance industry.

For students, working professionals, and career switchers aiming for investment-focused roles, the CFA serves as a powerful credential that opens doors to both Indian and global finance careers.

Full form & recognition:

CFA stands for Chartered Financial Analyst. It is a globally recognized finance certification awarded by the CFA Institute and is widely respected across investment banks, asset managers, research firms, and regulators.

Core topics covered:

The CFA curriculum builds deep expertise in ethics, financial reporting, equity and fixed-income valuation, derivatives, portfolio management, risk management, and economics. Ethics runs through all levels and carries high weight, reflecting real-world decision-making standards.

Who it’s best suited for:

CFA fits candidates targeting finance-first roles such as equity research, investment management, portfolio management, risk analysis, and institutional investing. It suits students and professionals who prefer technical depth over general management.

Structure, duration & pass rates:

The CFA program has three levels (I, II, III). Most candidates study 300–400 hours per level and complete the program in 2.5–4 years while working. Pass rates are selective Level I ~40–45%, Level II ~45%, and Level III ~50% (varies by exam window). CFA fees goes around 2-4 lakhs for all of the 3 levels.

What is CAIA?

CAIA stands for Chartered Alternative Investment Analyst. It is a globally recognized finance certification that focuses on alternative investments, such as private equity, hedge funds, real estate, infrastructure, commodities, and private credit. The CAIA Association awards this designation to professionals who want specialized expertise beyond traditional stocks and bonds.

The CAIA program trains candidates to analyze, evaluate, and manage alternative asset classes using practical investment frameworks. It emphasizes portfolio construction, risk management, due diligence, and ethical decision-making in private and institutional investing.

Full form & purpose:

CAIA stands for Chartered Alternative Investment Analyst. The CAIA Association awards this globally recognized certification to professionals who specialize in alternative investments beyond traditional stocks and bonds.

Focus on alternative investments:

The CAIA program concentrates on private equity, hedge funds, real assets (real estate, infrastructure), commodities, structured products, and private credit. It also covers risk management, due diligence, portfolio construction, and ethics within alternative asset classes.

Structure, duration & pass rates:

CAIA has two exam levels (Level I and Level II). Most candidates complete the program in 12–18 months, with 200–250 study hours per level. Pass rates are generally higher than CFA, averaging 50–65%, depending on the exam window.

Growing global relevance:

As global portfolios shift toward private markets and alternative assets, CAIA is gaining strong relevance among asset managers, family offices, private equity funds, hedge funds, and institutional investors worldwide.

CAIA vs CFA: Key Differences at a Glance

Comparison Table:

| Feature | CFA (Chartered Financial Analyst) | CAIA (Chartered Alternative Investment Analyst) |

| Primary Focus | Traditional finance & public markets | Alternative investments |

| Key Asset Classes | Equity, fixed income, derivatives, portfolio management | Private equity, hedge funds, real estate, infrastructure, private credit |

| Type | Broad, core finance certification | Specialized niche certification |

| Levels | 3 levels (Level I, II, III) | 2 levels (Level I, II) |

| Typical Duration | 2.5–4 years | 12–18 months |

| Study Hours | ~300–400+ hours per level | ~200–250 hours per level |

| Pass Rates (avg.) | Level I ~40–45% | ~50–65% |

| Career Fit | Equity research, asset management, investment banking, risk | Private equity, hedge funds, real assets, family offices |

| Best For | Deep finance fundamentals & valuation | Specialization in private/alternative assets |

| Global Recognition | Very high across finance roles | High within alternative investment space |

| Overlap | Covers alternatives briefly | Builds on finance basics, goes deep into alternatives |

Choose CFA if you want a strong, all-round finance foundation. Choose CAIA if you want to specialize in alternative investments or already work with private markets.

Exam Difficulty: CAIA vs CFA

When comparing CAIA vs CFA exam difficulty, both certifications are rigorous and often described as master’s-level programs, but the nature of difficulty differs.

Required Study Time & Pass Rates

The CFA program requires 300–400 study hours per level across three levels, with historically lower pass rates. Level I around 40–45%, Level II near the mid-40s, and Level III close to 50%. This makes CFA a long, endurance-based challenge.

The CAIA program has two levels, typically requiring 200–250 hours per level, with higher pass rates (about 50–65%), but it still demands focused preparation.

Difficulty Levels

Both exams test concepts at a master’s-equivalent level. CFA emphasizes breadth and depth across traditional finance, while CAIA emphasizes depth within alternative investments such as private equity, hedge funds, and real assets.

Realistic Challenges Candidates Face

CFA candidates often struggle with time management, exam stamina, and volume of material over multiple years. CAIA candidates find the challenge in specialized concepts, qualitative questions, and case-style application.

Who Finds Which Easier?

Candidates with accounting, equity, or public-market backgrounds usually find CFA easier to relate to.

Professionals already working in private equity, real estate, or hedge funds often find CAIA more intuitive.

Bottom line:

CFA tests endurance and breadth; CAIA tests specialization and depth.

Career Outcomes: Finance Roles After CFA vs CAIA

Both CFA and CAIA open doors to strong finance careers in India and globally, but the roles they lead to differ based on focus area and industry demand.

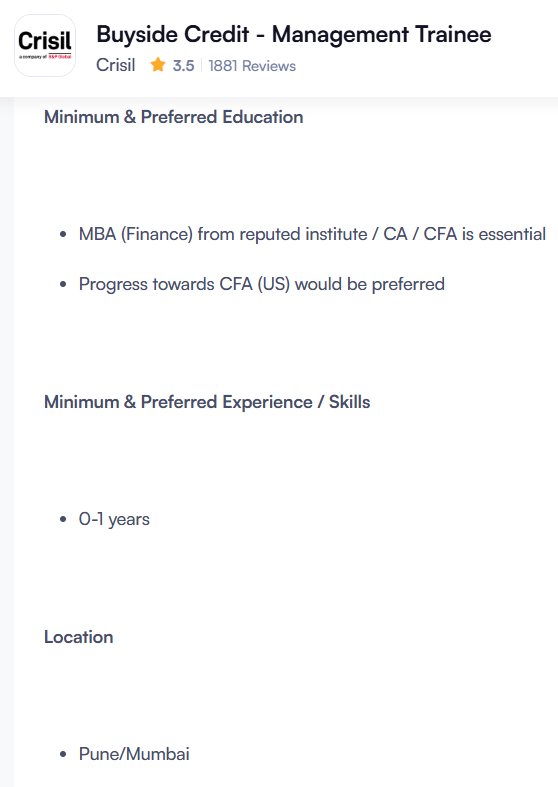

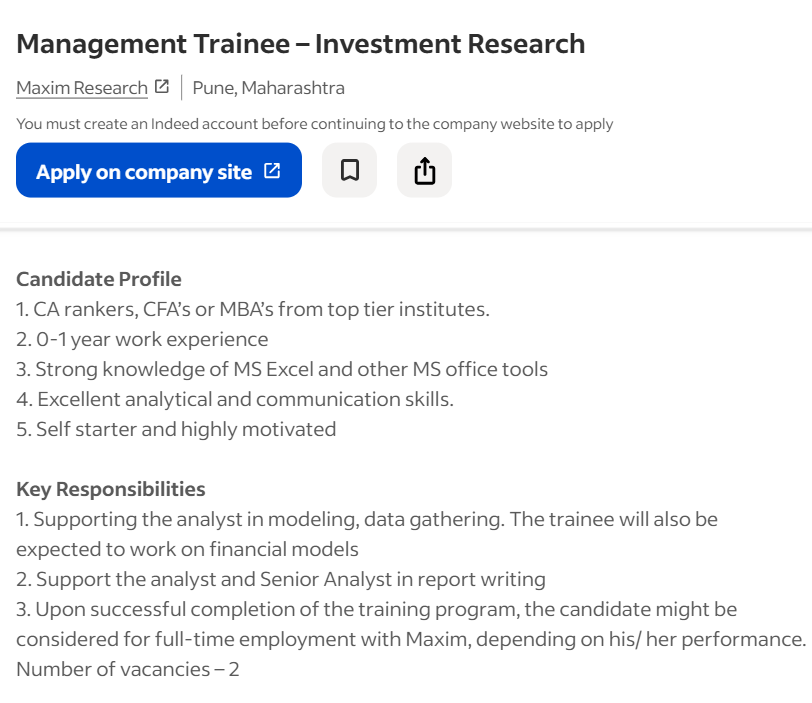

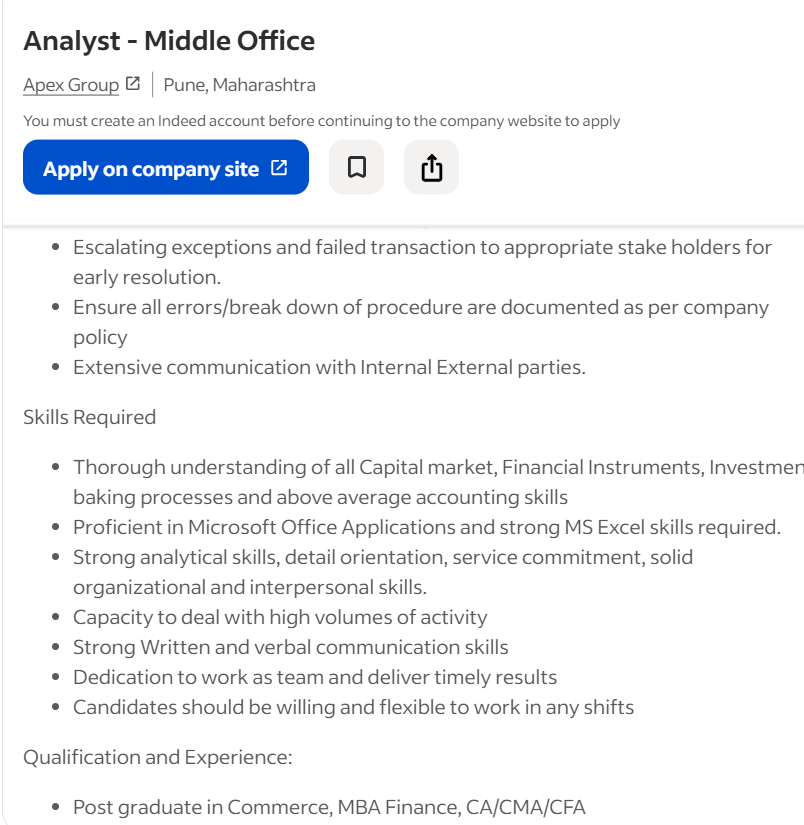

CFA Job Roles (Broad Finance & Investment Focus)

After completing the CFA program, professionals work in many high-impact finance roles, including:

Investment Banker – Advises companies on capital raising and M&A deals. CFA training in valuation and financial analysis adds strength here.

Portfolio Manager – Manages investment portfolios and asset allocation for clients or institutions. CFA’s deep portfolio management focus prepares you well.

Equity Research Analyst – Analyzes stocks and publishes investment recommendations for brokers and funds.

Risk Manager – Identifies and mitigates financial risks using models and analytics.

Financial Analyst / Corporate Finance – Supports budgeting, forecasting, and business planning within firms.

In India, entry-level CFAs can expect ₹6–10 LPA, mid-career professionals often reach ₹15–30 LPA, and senior roles can exceed ₹40–70+ LPA in cities like Mumbai, Bengaluru, and Gurugram. CFA salaries in finance hubs tend to be higher due to demand from asset managers, banks, and consultancies.

Source: Naukri.com

Source: Indeed.com

CAIA Job Roles (Alternative Investments & Specialized Roles)

CAIA focuses on alternative assets, leading to roles such as:

Hedge Fund Analyst – Supports portfolio analysis and trading strategies in hedge funds.

Private Equity Associate – Works on deal evaluation, due diligence, and portfolio company analysis.

Alternative Asset Manager – Manages investments across real estate, commodities, private credit, and other non-traditional assets.

Portfolio Strategist / Consultant – Advises institutions on diversifying into alternatives like private markets.

CAIA professionals in India typically see ₹8–12 LPA at entry level and ₹18–35 LPA or more mid-career, with senior specialists often earning over ₹50 LPA in top alternative investment firms or international roles.

Indian Context & Job Cities

Both CFA and CAIA roles are well-paid in major financial centres like Mumbai, Bengaluru, and Delhi NCR, where global investment firms and international finance teams are located. CFA roles tend to be broader and more common across banks, consulting, and asset management, while CAIA roles are more niche and specialized, often in private equity, hedge funds, and institutional investment units.

CFA careers offer wider opportunities across traditional finance and investment roles.

CAIA careers focus on specialized alternative assets and niche investment teams.

Both can lead to high salaries in Indian finance markets, especially with experience and role progression.

Which One Should You Choose?: CAIA vs CFA

Choosing between CFA and CAIA depends on your career goal, experience level, and time–money commitment. Both certifications add strong value, but they serve different purposes.

Choose CFA if:

Your goal is general or core finance roles like equity research, investment banking, portfolio management, or risk management.

Fresher or early-career professional who needs strong finance fundamentals.

You want broad global recognition across banks, AMCs, consulting firms, and corporates.

You can commit 2–4 years and steady self-study time at a lower overall cost.

Choose CAIA if:

You want to specialize in niche alternative investments such as private equity, hedge funds, real estate, or private credit.

Already have some finance or investment experience and want faster specialization.

You prefer a shorter program (12–18 months) with focused content on alternatives.

Time & Money Commitment

CFA: Longer duration, lower total cost, higher academic intensity.

CAIA: Shorter duration, moderate cost, highly specialized curriculum.

Can You Do Both?

Yes. Many professionals follow a CFA + CAIA strategy. CFA builds strong finance fundamentals first, and CAIA adds deep expertise in alternative assets. CAIA also offers exam waivers for CFA charterholders, which reduces effort and time. There is no hard and fast rule about attempting both or not. It is individual choice to pursue the qualification needed for finance career depending on your goals.

Final takeaway:

Pick CFA for broad finance careers. Pick CAIA for alternative investments. Choose both only if your long-term goal requires deep finance knowledge plus specialization.

CAIA + CFA: Complement or Conflict?

CAIA and CFA complement each other, not conflict, when used with the right career strategy. CFA builds a strong foundation in traditional finance equity, fixed income, portfolio management, valuation, and ethics. CAIA then adds deep specialization in alternative investments such as private equity, hedge funds, real assets, and private credit.

How CFA + CAIA Work Together

Professionals often use CFA for breadth and CAIA for depth. CFA helps you enter core finance roles, while CAIA strengthens your profile for private markets and institutional investing. Together, they signal both technical credibility and niche expertise to employers.

When Pursuing Both Makes Sense

Doing both makes sense if you:

Aim for investment leadership roles that manage public and private assets

Work (or plan to work) in private equity, hedge funds, or multi-asset funds

Want to transition from public markets to alternatives

CAIA Exemption for CFA Charterholders

CFA charterholders receive an exemption from CAIA Level I, allowing them to start directly at CAIA Level II. This significantly reduces time, cost, and study effort, making the CFA + CAIA path efficient for experienced professionals.

Bottom line:

Use CFA to build your finance core and CAIA to specialize in alternatives—together, they create a powerful, future-ready finance profile.

Conclusion: CFA vs CAIA – Final Verdict

There’s no universal winner between CFA and CAIA the right choice depends on your career goals and experience. CFA suits candidates who want a strong, broad foundation in finance, with roles across equity research, portfolio management, investment banking, and risk. CAIA fits professionals aiming for specialization in alternative investments like private equity, hedge funds, real assets, and private credit.

Practical Recommendations

Freshers & early-career professionals: Start with CFA to build core finance skills and maximize job options.

Mid-career professionals in finance: Choose CAIA if you want faster specialization in alternatives.

Professionals targeting leadership in investments: Consider CFA + CAIA for breadth plus depth, especially in multi-asset or private markets roles.

Bottom line:

Choose CFA for breadth, CAIA for specialization, and both only if your long-term path truly needs it.

Need help with your preparation? Book your free finance career counseling session with mentor me careers now.

FAQ

CFA is generally tougher due to three exam levels, lower pass rates, and deeper technical coverage. CAIA is intensive but shorter and more focused.

CFA has wider recognition across Indian finance roles. CAIA is well-recognized in private equity, alternatives, and institutional investing.

Yes. You can pursue CAIA without CFA. Many candidates start CAIA directly if they target alternative investment roles.

Yes, CAIA is worth it in 2026 as demand for alternative assets like private equity and real assets continues to grow globally.

CFA typically costs ₹2–3.5 lakh total, while CAIA costs around ₹2–2.5 lakh, depending on registration timing and fees.