What is AML in Banking? Anti-Money Laundering (AML) in banking refers to a system of laws, regulations, and internal controls used by financial institutions to prevent and detect activities that disguise illegally obtained money as legitimate. In simpler terms, AML is how banks identify, monitor, and report suspicious financial transactions that may be linked to crime, corruption, or terrorism financing.

For countries like India, with a fast-growing fintech and banking sector, effective AML compliance is vital. It helps protect the integrity of the financial system, supports international cooperation, and ensures that institutions remain in good standing with global regulatory bodies like the FATF (Financial Action Task Force).

In This Guide, You’ll Learn:

- What AML means in the context of Indian and global banking

- Why AML matters for banks, regulators, and society

- How banks in India implement AML programs and comply with the Prevention of Money Laundering Act (PMLA)

- Key differences between AML and KYC

- Common AML procedures and reporting requirements

- FAQs about AML jobs, tools, and certifications

Whether you’re a finance student, compliance professional, or curious reader, this guide will help you understand how AML shapes the backbone of safe and legal banking.

What is AML in banking

AML stands for Anti-Money Laundering. In the banking industry, AML refers to a broad framework of laws, policies, and operational procedures that financial institutions must follow to detect, prevent, and report money laundering and other financial crimes. AML compliance is not a single step it’s an ongoing system of checks that helps banks protect themselves and the economy from illegal activities.

What is money laundering?

Money laundering is the process of taking money earned through illegal means like fraud, drug trafficking, corruption, or cybercrime and passing it through the banking system to make it appear “clean” and legitimate.

Think of it like laundering dirty clothes: criminals try to “wash” dirty money so it blends in with lawful funds.

The Role of Banks in AML

Banks are the first line of defense against money laundering. They are legally obligated to:

- Verify customer identities – through Know Your Customer (KYC) procedures

- Monitor financial transactions – for patterns of suspicious activity

- Report unusual or large cash transactions – to regulators like FIU-IND (in India)

These measures help ensure that banks do not become unwitting accomplices to financial crime and uphold trust in the financial system.

Why choose AML in banking?

Anti-Money Laundering (AML) is more than a regulatory requirement it’s a critical tool for safeguarding the economy and protecting society from the hidden consequences of financial crime.

AML Helps Prevent Crime and Terrorism

By implementing robust AML measures, banks make it significantly harder for these individuals to move, conceal, or reinvest their “dirty” money.

This is why AML frameworks are tightly integrated with CFT (Combating the Financing of Terrorism) initiatives.

The Economic Cost of Money Laundering

According to global reports, an estimated $800 billion to $2 trillion or 2–5% of global GDP is laundered annually through legitimate financial institutions

Unchecked money laundering can:

- Destabilize economies

- Inflate real estate and asset prices through illicit investments

- Undermine public confidence in the financial system

AML Preserves a Bank’s Reputation and Customer Trust

For banks, AML failures can result in public scandals, regulatory investigations, and massive financial losses.

In today’s transparent digital environment, reputation is currency and effective AML practices help preserve that trust.

AML Compliance Is a Legal Obligation

In India, under the Prevention of Money Laundering Act (PMLA), and globally through laws like the Bank Secrecy Act (USA) and the EU AML Directives, financial institutions are legally required to maintain AML programs. Non-compliance can result in:

- Regulatory sanctions

- Withdrawal of licenses

- Even criminal prosecution of responsible officers

A Safer Financial System for Everyone

Ultimately, AML in banking contributes to a safer, more stable global economy.

Whether you’re a student entering the finance sector or a professional aiming to move into compliance, learning AML is a valuable investment in your career and society.

How do banks implement AML?

To effectively combat money laundering, banks don’t just rely on policy they implement a robust compliance system involving customer checks, transaction monitoring, reporting obligations, and continuous staff training. Let’s break down the key components of an AML program in banking.

Customer due diligence (KYC)

The AML process starts with Know Your Customer (KYC) procedures. Before opening an account, banks are legally required to verify the customer’s identity, collect proof of address, and understand the nature of the customer’s activities.

- KYC ensures the customer is who they claim to be, and not using a fake identity to launder illicit funds.

- Banks request PAN, Aadhaar, utility bills, or official business documentation based on the type of account.

Customer Profiling is part of the KYC process. Banks assign each customer a risk rating low, medium, or high based on factors like occupation, source of funds, location, and transaction patterns. For instance, a Politically Exposed Person (PEP) or someone operating in a high-risk country may undergo additional scrutiny.

Enhanced Due Diligence (EDD) applies to high-risk individuals or entities. This involves:

- Verifying source of funds/wealth

- Conducting more frequent reviews

- Ongoing monitoring of financial activity

AML vs. KYC: KYC is one part of AML it’s the step where banks “know their customer” to prevent misuse of accounts for money laundering.

Transaction monitoring and reporting

Once the account is opened, the AML process doesn’t stop. Banks must continuously monitor transactions for suspicious activity using advanced compliance software.

Common Monitoring Triggers Include:

- Sudden large cash deposits not aligned with a customer’s profile

- Repeated transactions just below ₹10 lakh (structuring)

- Rapid movement of funds between multiple accounts (layering)

- Transfers to or from high-risk jurisdictions

Red Flags of Money Laundering:

- Unexplained international wire transfers

- Sudden activity in a dormant account

- Customers reluctant to provide source of income or identity documents

Key Reports Banks Must File:

- Suspicious Transaction Reports (STRs): Filed with FIU-IND when unusual activity is detected. Customers are not notified to avoid tipping off potential criminals.

- Cash Transaction Reports (CTRs): Automatically filed for all cash transactions over ₹10 lakh, whether suspicious or not.

Use of Technology in AML:

Banks leverage AI-powered monitoring systems (e.g., as noted by SAS and Intellicheck) that scan thousands of transactions in real time to identify patterns, anomalies, or connections between entities. These systems improve detection speed and reduce false positives.

Stages of money laundering

Understanding the three stages of money laundering helps clarify what banks are trying to detect:

- Placement: Criminal funds are introduced into the system (e.g., deposits, purchase of assets)

- Layering: Funds are moved between accounts or jurisdictions to obscure their origin

- Integration: Money re-enters the legitimate economy appearing clean (e.g., business revenue)

Banks design AML controls to catch money laundering at any stage especially through KYC, monitoring, and reporting.

Compliance and staff training

Behind the scenes, every bank has a dedicated AML compliance program designed and managed by professionals like AML Officers or BSA Officers (as termed in the US).

Key Components Include:

- Internal AML Policy Manuals: Detailing due diligence, escalation steps, reporting protocols

- Employee Training: Staff are regularly trained to detect red flags such as fake documents, unusual account behavior, or complex structures designed to hide beneficiaries

- Audits and Inspections: Internal teams and regulators routinely assess AML systems to identify gaps

- Customer Education: Some banks provide alerts and awareness campaigns to help customers avoid scams or unknowingly aiding laundering

Through a combination of KYC checks, transaction monitoring, suspicious activity reporting, and continuous staff education, banks create a layered defense system against money laundering. These AML practices are not only essential for regulatory compliance but also for maintaining the integrity, trust, and security of the financial system.

What is AML in India?

In India, Anti-Money Laundering (AML) refers to a comprehensive framework of laws, regulations, and processes that banks and financial institutions adhere to in order to detect, prevent, and report money laundering activities. Under the Prevention of Money Laundering Act, 2002 (PMLA), banks are legally required to establish and maintain AML systems not just as a best practice, but as a critical legal obligation .

Why It Matters in India

India’s regulatory landscape is shaped by bodies like the Enforcement Directorate (ED) and Financial Intelligence Unit India (FIU-IND), which enforce AML laws and collect suspicious transaction reports .

What Banks Must Do

Under PMLA and related rules, Indian banks must:

- Verify customer identities and maintain Know Your Customer (KYC) records

- Monitor all transactions and raise Suspicious Transaction Reports (STRs) for unusual behavior

- File Cash Transaction Reports (CTRs) for amounts exceeding ₹10 lakh ($12,000), storing records for up to 10 years

- Cooperate with FIU-IND, RBI, SEBI, and ED during investigations

Banks also apply risk-based approaches, adjusting their scrutiny based on customer risk profiles, and continually upgrade AML systems to address emerging threats like fintech innovations and crypto.

AML in Indian banking is more than compliance it’s a guardrail that preserves the integrity of the financial system. By preventing the integration of illegally sourced funds, AML efforts help curb corruption, terrorist financing, and financial fraud. For India’s rapidly growing economy, a strong AML regime is crucial not just for regulatory compliance, but to maintain trust and global credibility.

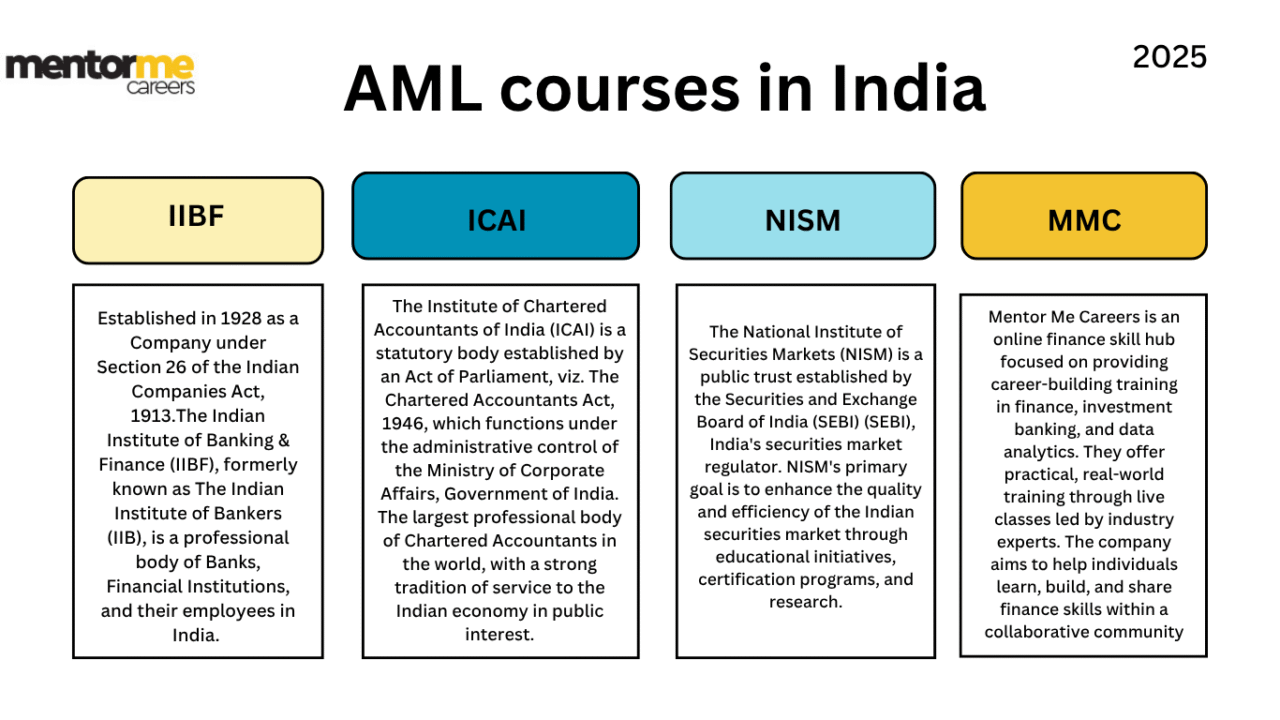

Mentor Me Careers AML KYC course

Certified AML & Regulatory KYC Course – Launch Your Career in Financial Crime Compliance

The Certified AML & Regulatory KYC Course by Mentor Me Careers is a career-focused certification program designed to help graduates and early professionals step into high-demand roles in Anti-Money Laundering (AML) and Know Your Customer (KYC) operations. With India becoming a growing hub for global AML/KYC processes, the demand for skilled professionals in this domain is skyrocketing.

According to a report by Grand View Research, the AML KYC market in India is projected to grow at a CAGR of over 20%, reflecting rapid job creation in compliance operations across banks, fintechs, and consulting firms.

Course Delivery Modes:

This course is available in two flexible formats:

- Live online classes with industry experts in AML/KYC

- Self-paced video modules for independent learning

Whether you’re a recent graduate or transitioning into finance from another domain, this course helps you gain the skills, certification, and placement support you need to break into AML/KYC roles.

What Makes This Course Unique?

- Certification + Job Assistance: You don’t just earn a certificate—you get real placement support in top Indian metros

- Recognized Credentials: Prepares you for both MentorMe Careers’ in-house AML/KYC certification and IIBF’s AML-KYC exam

- Real-World Case Studies: Learn from practical, real-time compliance scenarios used in banks and financial institutions

- Employability-Focused: Course curriculum is aligned with NISM and IIBF standards, giving you the flexibility to pursue additional external certifications (IIBF/NISM fees not included)

Career Opportunities

Upon completion, students are eligible for entry-level roles such as:

- AML Analyst

- KYC Executive

- Transaction Monitoring Associate

- Compliance Analyst

This program is ideal for graduates looking to enter the finance and compliance sector, especially in cities like Mumbai, Pune, Bangalore, and Hyderabad where compliance roles are rapidly expanding.

| Comparison Point | MentorMe Careers | Other Institutes |

|---|---|---|

| Format & Delivery | Live online + self-paced videos (flexible) | Self-study or coaching (no live training) |

| Curriculum Focus | Regulatory compliance, CDD, law, tools | Focus on AML theory and regulations |

| Certification Type | MentorMe certificate + exam prep | Certification from respective institute |

| Industry Recognition | Growing recognition + industry-aligned | Recognized in specific industry niches |

| Placement Support | ✔ 100% placement assistance | ✖ No direct placement support |

| Exam Mode & Flexibility | Online assessment or project | Online proctored exams or on-demand |

| Cost | Moderate (training + support) EMI available | Varies (typically lower cost for exam-only options) |

Conclusion

In summary, Anti-Money Laundering (AML) in banking is all about safeguarding the financial system from misuse by criminals. Through policies like Know Your Customer (KYC), transaction monitoring, and suspicious activity reporting, banks play a vital role in protecting economies, maintaining global trust, and preventing financial crime.

For finance students, fresh graduates, and aspiring banking professionals, understanding AML is not just an academic requirement it’s a real-world skill that employers value. Whether you’re aiming for roles in operations, risk, front-office sales, or compliance, a strong grasp of AML principles will help you long way in your career.

As global AML regulations grow more stringent and financial institutions expand their compliance teams, there’s never been a better time to upskill in this domain.

Take the next step: Whether you’re just starting out or looking to specialize, investing in an AML certification such as the one offered by Mentor Me Careers can boost your credibility and open doors to high-growth job opportunities in banking and fintech.

FAQ

What are three stages in Anti-money laundering?

Placement, layering, and integration. These stages represent the process criminals use to disguise the origins of illegally obtained money and make it appear legal.

What is suspicious transaction activities?

Financial activity in the account which has an unusual pattern than before.

What is CFT and AML in banking?

Countering the finances of terrorist is CFT where the goal is to prevent terrorist organizations from accessing and utilizing financial resources. Anti-money laundering is AML where professionals work towards stopping criminals from disguising illegally obtained funds.