Certificate in Investment Banking Operations Analyst

- 3–6 months program

- 100% Interview Guaranteed

Accelerate your CFA preparation With expert trainers and structured learning

Service 2026verified by TrustindexTrustindex verifies that the company has a review score above 4.5, based on reviews collected on Google over the past 12 months, qualifying it to receive the Top Rated Certificate.

Fast facts for graduates & career switchers — MentorMeCareers edition.

New to the CFA program? What is CFA? Get a clear overview of the syllabus, eligibility, exams, and career scope.

Ethics, FRA, Equity & Fixed Income, Quant basics — job-relevant foundations.

Self-paced content + weekend live doubt clinics + structured weekly plans.

Level I typically 6–8 months with consistent prep.

Daily QOTD, mocks, 1:1 mentor calls, and exam-strategy workshops.

B.Com, Engineering-to-Finance switchers, MBA freshers, early professionals.

CFA Institute fee + MMC coaching. Early-bird offers & scholarship guidance.

Roles: Equity Research, IB Ops, Risk. Alumni at Deutsche Bank, Kroll, Titan.

Watch a free preview of our teaching style and course delivery.

Trying to understand how tough the CFA exams really are? CFA Exam Structure & Difficulty explains the exam format, topic weightage, pass rates, and why each level is challenging.

Evaluating the total cost of the CFA program? CFA Fees & Scholarships details exam fees in India, early-bird registration benefits, and available scholarship options.

Open doors to equity research, portfolio & risk, deal teams, and wealth with a globally trusted credential.

Curious about compensation and job roles after CFA? CFA Salary & Career Outcomes covers realistic salary ranges, finance roles, and long-term career growth in India.

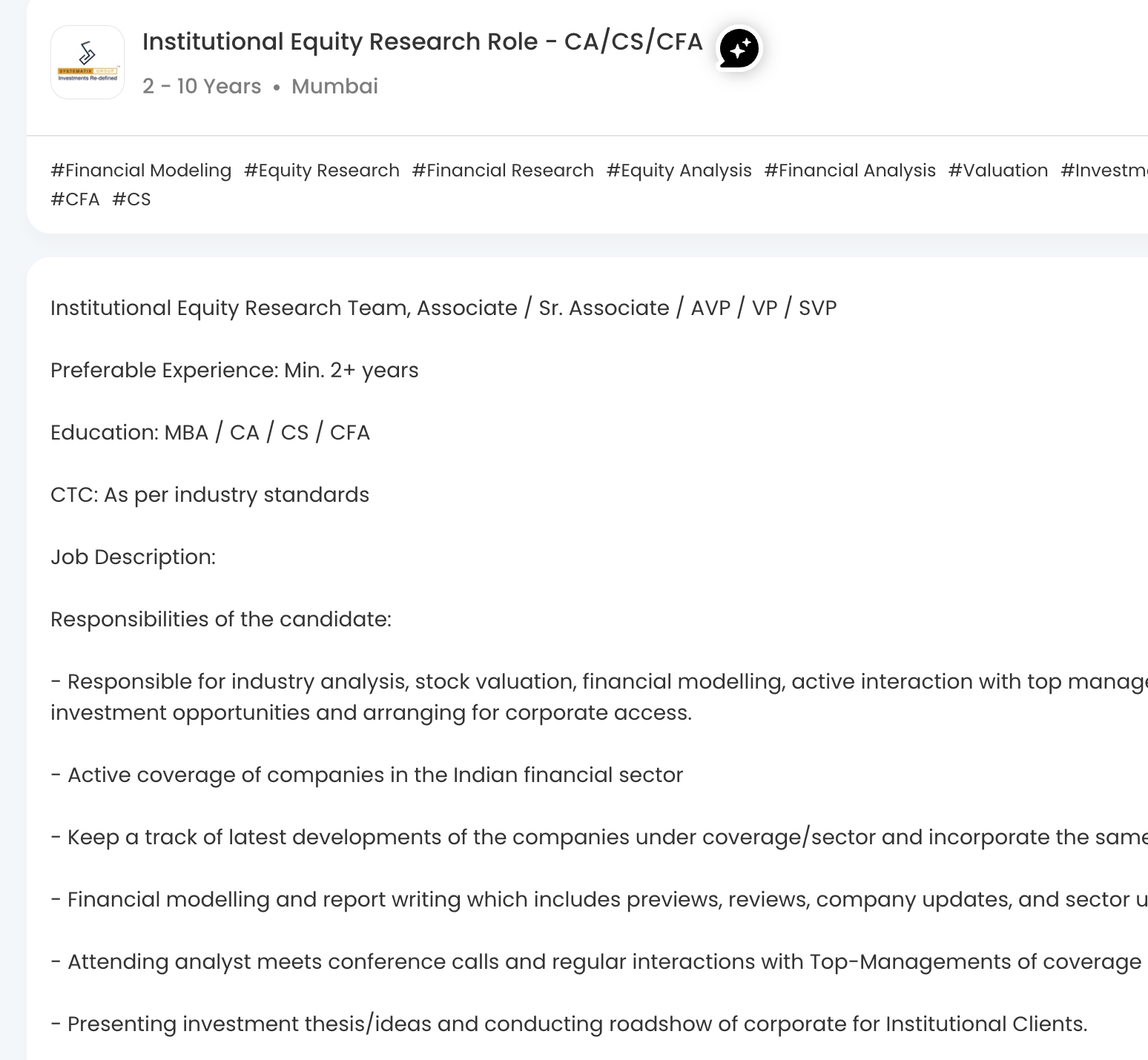

Build models, write coverage notes, track earnings, and present catalysts to buy-side/sell-side stakeholders.

Deal screening, CIM analysis, LBO support, industry mapping, and investment memos for IC review.

Create project cash-flow models, assess bankability, review covenants, and support lender presentations.

Pitchbooks, comps, DCF/merger models, due diligence support, and data-room coordination for live deals.

Portfolio proposals, IPS setup, rebalancing, client reviews, and product due diligence.

Market/credit risk reporting, VaR/stress analysis, model validation, and policy governance.

A concise view of all ten topics with key learning objectives.

Trying to understand how tough the CFA exams really are? CFA Exam Structure & Difficulty explains the exam format, topic weightage, pass rates, and why each level is challenging.

6 months of Live Training with expert faculties and Doubt Solving

Yes. CFA is open to all types of candidates, whether it is Enginnering, Science or Arts.

It takes anywhere between 1.5 years to 3 years to complete the course.

At mentor me we are serious on the quality of content you read, use and learn with.

We have high quality pre – recorded videos, recorded by experts

We have reading slides as summary

Class Recordings for staying updated (Applicable for Online Instructor Led)

Cheat Sheets- Get small pocket mind maps to remember formulas and logic

Excel Templates- Get high quality templates to learn

Interview question bank- we have compiled over the years question banks for interviews for top 50 companies in India. You will get to practice these from day 1.

A valid internet connection that can handle online meetings , a laptop with a working Microsoft Excel account

The pass rates for CFA is