Last updated on January 2nd, 2026 at 06:55 pm

The CFA exam is one of the most misunderstood professional exams in the world—not because the content is impossible, but because candidates prepare for the wrong type of questions.

Every year, thousands of students rely heavily on third-party question banks and summaries. Yet according to the CFA Institute Candidate Survey, over 91% of candidates reported that the exam was as difficult or more difficult than expected.

Why?

Because the questions they practiced were not aligned with the actual CFA exam questions.

This article breaks down exactly how CFA exam questions work, why they feel harder than mock questions from prep providers, and the study strategy you must use to master them. At the end, you will also find a Priority LOS List—a data-driven set of learning outcomes with the highest probability of being tested.

🔍 What Makes CFA Exam Questions So Different?

Unlike simple textbook or coaching institute questions, CFA exam questions test interpretation—not memorization.

A CFA exam question typically:

- Is built around a real-world scenario

- Tests multiple concepts in a single prompt

- Requires judgment, not formula plugging

- Uses subtle wording to check conceptual clarity

- Looks completely different from the examples in prep provider books

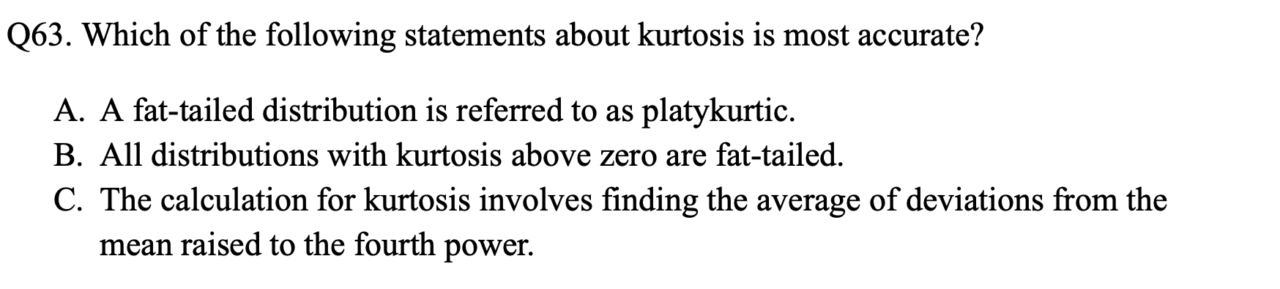

A third-party (Schweser-style) question might ask:

“Calculate the duration of a bond with the following data…”

But a true CFA-style question might ask:

“Given a shift in the yield curve, which bond experiences the largest price decrease?”

The second question tests:

- Duration

- Convexity

- Yield curve behavior

- Interpretation of sensitivity

This is why a candidate who memorizes formulas often struggles on exam day.

⚠️ My Own Mistake: Preparing for the Wrong Questions

As a CFA candidate, I made the same mistake most students make today.

During my Level 2 prep, I relied entirely on summary notes and prep provider question banks. I solved hundreds of questions and felt confident.

But when I attempted my first CFA-style mock, I froze.

The questions didn’t resemble anything I had been practicing. They were deeper, layered, and scenario-based. In panic, I shifted back to the core CFA curriculum—just two months before the exam.

That decision changed everything.

It taught me one important truth:

👉 The CFA exam doesn’t test your memory. It tests your understanding.

📈 CFA Institute Survey: Why 91% Find the Exam Harder

The CFA Institute’s own survey reveals:

- Most candidates use prep providers

- 91% found the exam as difficult or more difficult than expected

This gap exists because the question style is fundamentally different from traditional coaching materials.

Comparison- Left Side Shows CFA type question versus a third party Question

Both are from the same chapter but CFA tests on inference rather than just plug and play

You must prepare for the actual CFA exam questions, not simplified substitutes.

📊 The 75% Rule: How Subject Weightage Affects Questions

Another reason candidates struggle is poor prioritization.

Some subjects contribute massively to the exam questions you receive, while others contribute very little.

Here’s the truth:

The majority of exam questions come from just

five subjects

- Ethics

- Quantitative Methods

- Financial Statement Analysis (FSA)

- Fixed Income

- Equity Investments

These subjects alone make up nearly 75% of the exam.

This means:

- Scoring 100% in Alternative Investments but 30% in FRA will NOT help you clear.

- A strong performance in the Big Five dramatically increases your chances of passing.

Understanding how question weightage works is key to building the correct study strategy.

🧠 How to Study for CFA Exam Questions: The F.B.E.P.R Method

Based on years of teaching and analyzing CFA exam questions, I use the F.B.E.P.R Method—a structured framework that mirrors how the CFA exam is designed.

F — First Read

Understand the intuition. Don’t focus on memorization.

B — Blue Box Questions

These are directly from the CFA curriculum and often resemble the logic used in exam questions.

E — End-of-Chapter Questions (EOCs)

If you score <60% here, you haven’t mastered the concepts.

P — Practice 5 CFA-style Questions Daily

Not 100 in a single day.

Just 5 questions—but consistently.

This activates spaced repetition, which aligns perfectly with how CFA exam questions test conceptual recall.

R — Revision Cycle (Every 2–3 Weeks)

Revisit key topics regularly or your retention will drop dramatically.

This method ensures that you not only learn the material but also think the way CFA exam questions require you to think.

🔗 How to Identify High-Probability CFA Exam Questions

Not all Learning Outcome Statements (LOS) are equal.

Some LOS are “domino concepts” that connect to many question types.

Examples:

Inventory (FSA)

Impacts:

- Ratios

- Cash flows

- Profitability

- Balance sheet

- Comparability

- Analytical adjustments

📌

Linear Regression (Quant)

connects to:

- Hypothesis testing

- Confidence intervals

- Forecasting

- Distributions

- Interpretation of coefficients

Exam questions often link multiple concepts from these high-impact LOS.

This is why you must identify and master them early.

⭐ Priority LOS List — High-Probability CFA Exam Questions for 2026

Based on:

- Curriculum density

- LOS complexity

- Cross-topic linkages

- Mock exam patterns

- Historical frequency

I’ve created a Priority LOS List that highlights the most likely areas for exam questions in 2026.

👉 You can View the full list here

CFA High Priority Learning Outcomes Tool

Click a subject to view its Anchor LOS and Rotating LOS. Use this as a smart map for your CFA study plan.

- Distinguish between the Code of Ethics and Standards of Professional Conduct.

- Evaluate whether a scenario violates the CFA Institute Standards of Professional Conduct.

- Recommend procedures to prevent violations of the Code and Standards.

- Identify and manage conflicts of interest in research and recommendations.

- Evaluate conduct as a CFA candidate and member of CFA Institute.

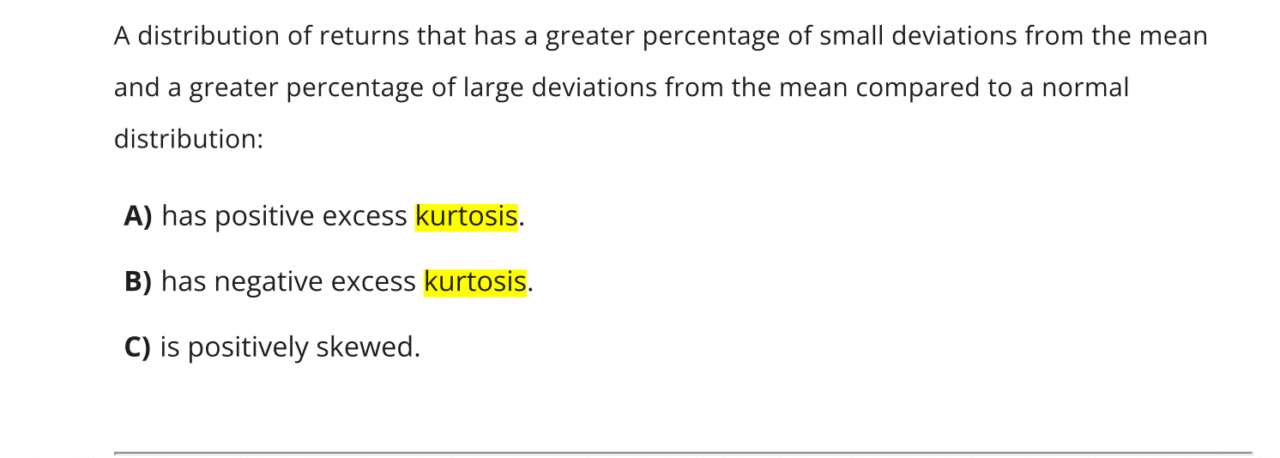

- Interpret p-values and test statistics in hypothesis testing.

- Calculate and interpret confidence intervals for population means.

- Compute and interpret time value of money for single and multiple cash flows.

- Interpret correlation and covariance in the context of investment returns.

- Explain the assumptions of simple linear regression and their implications.

- Explain how monetary and fiscal policies affect inflation, growth, and employment.

- Interpret currency quotations and calculate cross-currency rates.

- Analyze the impact of trade restrictions and capital flows.

- Describe business cycles and their characteristics.

- Analyze the effects of different inventory valuation methods on financial statements and ratios.

- Evaluate the impact of capitalizing vs expensing expenditures on profitability and leverage ratios.

- Assess financial reporting quality and identify red flags in earnings.

- Analyze deferred tax assets and liabilities and their implications.

- Evaluate lease classification and its effect on financial statements.

- Calculate and interpret the weighted average cost of capital (WACC).

- Evaluate the effects of leverage on earnings, risk, and capital structure decisions.

- Compare different dividend and share repurchase policies.

- Analyze working capital management policies and their impact on liquidity.

- Explain and apply the Dividend Discount Model (DDM) to value equity.

- Estimate a company’s value using free cash flow to the firm (FCFF) and free cash flow to equity (FCFE).

- Analyze industry structure using Porter’s Five Forces framework.

- Explain market efficiency and its implications for active vs passive management.

- Interpret price multiples and their use in relative valuation.

- Calculate a bond’s price given yield or spot rates.

- Compute and interpret Macaulay duration, modified duration, and price sensitivity.

- Explain the relationship between yields, prices, and credit spreads.

- Describe yield curve shapes and what they imply about future rates.

- Explain basic features of mortgage-backed and asset-backed securities.

- Construct and interpret payoff diagrams for long and short call and put options.

- Explain and apply put–call parity for European options.

- Describe the characteristics of forward and futures contracts.

- Explain the basic structure of swaps and how they are used to manage risk.

- Explain key features of private equity, including stages and exit strategies.

- Calculate and interpret net operating income (NOI) and capitalization rates for real estate.

- Describe hedge fund strategies and typical fee structures.

- Explain the risk–return tradeoff and the role of diversification.

- Interpret the Capital Market Line (CML) and Security Market Line (SML).

- Calculate and interpret portfolio expected return and variance for two-asset portfolios.

- Explain systematic vs unsystematic risk and their implications for portfolios.

- Describe the steps in the portfolio management process.

This resource alone can sharpen your preparation and help you focus on what actually matters.

✔️ Final Takeaway

The CFA exam is not about solving thousands of easy questions.

It’s about practicing the right type of questions—those that match the CFA exam’s logic, structure, and conceptual depth.

When you focus on:

- curriculum-based questions,

- high-weight subjects,

- high-probability LOS, and

- interpretation over memorization…

Your performance increases dramatically.

If you want structured CFA coaching—with daily practice, doubt solving, and mock exam analysis—you can join us at MentorMeCareers.

📞 Want More Help?

Get in touch with us for CFA Level 1 preparation and we would happy to help you with the preparation for CFA Level 1 to clear the exam